As of today, I have added 1% position in Modison Metals as part of the deep value portfolio which reduces cash to zero. I will look to increase the position and make it a core bet if quarterly numbers keep improving.

Modison Metals is a capital goods company making electrical contacts that goes into switchgear (Low, Medium, High and Extra High Voltage). This is a niche space with very few competitors (and consolidated profit pool).

Demand for low voltage switchgear comes majorly from residential sector (MCBs, DBs, RCCBs) and for medium/high voltage switchgear from industry and power utility sectors. In the past few years, there was significant growth in high voltage switchgear demand from utility companies due to expanding sub-station network (as can be seen in Powergrid’s growth). Since COVID pandemic, low voltage switchgear market has also witnessed significant demand increase from residential real estate segment and proliferation of manufacturing companies. On back of these tailwinds, company has managed to grow topline at 24-25% rates since FY20.

One trend in engineering goods space is that of increasing exports from India, which can be attributed to the government’s zero duty Export Promotion Capital Goods (EPCG) scheme. Modison Metal derives 15-20% sales from export markets and has also witnessed increase in demand from MNCs who are consolidating their suppliers (thus giving more business to more reliable suppliers).

If we look at breakup of domestic vs export sales, its clear that exports are more cyclical than domestic sales. In the last 2-years, most of the growth has come from domestic demand (I guess largely due to higher residential sales + more manufacturing cos being setup). Its to be seen how long domestic sales can keep growing. I am hoping that exports counter any slowdown in domestic demand or vice versa.

| Revenues (cr.) |

FY05 |

FY06 |

FY07 |

FY08 |

FY09 |

FY10 |

FY11 |

FY12 |

FY13 |

FY14 |

FY15 |

FY16 |

FY17 |

FY18 |

FY19 |

FY20 |

FY21 |

FY22 |

| India |

30.33 |

41.64 |

66.22 |

76.40 |

64.73 |

84.41 |

107.28 |

135.52 |

131.44 |

148.14 |

146.31 |

143.12 |

181.62 |

173.76 |

176.22 |

176.36 |

241.27 |

285.06 |

| Outside India |

6.78 |

11.17 |

15.57 |

28.68 |

12.42 |

12.10 |

19.64 |

27.08 |

28.34 |

36.71 |

25.51 |

26.09 |

26.90 |

32.93 |

44.77 |

45.83 |

52.38 |

56.14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| % of revenues outside India |

18.27% |

21.16% |

19.03% |

27.29% |

16.09% |

12.53% |

15.47% |

16.66% |

17.73% |

19.86% |

14.85% |

15.42% |

12.90% |

15.93% |

20.26% |

20.63% |

17.84% |

16.45% |

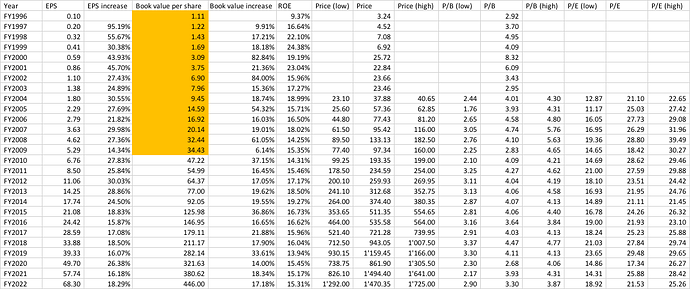

Currently, company margins have been severely hit due to increase in copper and silver prices, and are at cyclical lows. These margins should go back to long term averages with correction in copper and silver prices, thereby leading to higher profit growth, even if sales growth slows down.

There has also been a couple of company specific changes.

- In order to improve sales, company has changed employee incentive policy where some part of remuneration is linked to company performance

- Company has announced a 25 cr. capex plan towards building a new factory for HV segment assembly line (where company enjoys monopoly in India), upgradation of existing facilities through increased automation, etc. This type of capex implies that management might be seeing good growth opportunities

- Company is evaluating expansion plans in Battery Energy Storage System and EV charging Infrastructure, having signed an MoU with RENERA and LDrive (L-Charge)

Lets see how it works out. Detailed portfolio is below.

Core compounder (44%)

| Companies |

Weightage |

| I T C Ltd. |

8.00% |

| Housing Development Finance Corporation Ltd. |

4.00% |

| NESCO Ltd. |

4.00% |

| Eris Lifesciences Ltd. |

4.00% |

| Ajanta Pharmaceuticals Ltd. |

4.00% |

| HDFC Asset Management Company Ltd |

4.00% |

| Aegis Logistics Ltd. |

4.00% |

| Gufic Biosciences |

4.00% |

| HDFC Bank Ltd. |

2.00% |

| PI Industries Ltd. |

2.00% |

| Shri Jagdamba Poly |

2.00% |

| LINCOLN PHARMACEUTICALS LTD. |

2.00% |

Cyclical (42%)

| Companies |

Weightage |

| Kolte-Patil Developers Ltd. |

4.00% |

| Sharda Cropchem Ltd. |

4.00% |

| Avanti Feeds Ltd. |

4.00% |

| Aditya Birla Sun Life AMC Ltd |

4.00% |

| Manappuram Finance Ltd. |

4.00% |

| Alembic Pharmaceuticals Ltd. |

4.00% |

| Amara Raja Batteries Ltd. |

4.00% |

| Ashiana Housing Ltd. |

2.00% |

| Ashok Leyland Ltd. |

2.00% |

| Heranba Industries |

2.00% |

| Kaveri Seed Company Ltd. |

2.00% |

| Control Print Limited |

2.00% |

| Sundaram Finance Ltd. |

2.00% |

| Time Technoplast Ltd. |

2.00% |

Slow grower (4%)

| Companies |

Weightage |

| Cochin Shipyard Ltd. |

4.00% |

Turnaround (4%)

| Companies |

Weightage |

| CARE Ratings Ltd. |

2.00% |

| Punjab Chem. & Corp |

2.00% |

Deep value (6%)

| Companies |

Weightage |

| ATUL AUTO LTD. |

1.00% |

| Jagran Prakashan Ltd. |

1.00% |

| D.B.Corp Ltd. |

1.00% |

| RACL Geartech Ltd |

1.00% |

| Shemaroo Entertainment Ltd. |

1.00% |

| Modison Metals |

1.00% |