Hi all,

I am sharing my portfolio (also attached as an excel sheet) along with my rationale below, I will love to get your thoughts. The goal is to generate ~15% compounded returns over the long term with very low churn.

Thesis.xlsx (12.2 KB)

Entry strategy:

- Shares are acquired in 3 equal tranches with difference of atleast one month between two traches

- Single sector allocation < 25%, single stock allocation < 20%

Exit strategy:

- Shares are sold in 3 equal tranches, similar to the buying rule

Exit reasoning:

- Flawed thesis

- Better opportunity in another company (switching)

- Expensive valuation (>50 p/e considered normalised margins)

I have built this folio over the last 2 years, the IRR returns since 2018 are shown below:

2018 → 2.5% (absolute return was 1.4%)

2019 → 17.7% (absolute return was 10.2%)

2020 YTD (until 07.02.2020) → 27.9% (absoute return was 2.4%)

Cheers!

Harsh

37 Likes

With the FY20Q3 results for my companies, I am giving a brief snapshot of the portfolio results. There are not changes in position sizes.

- The way market is de-rating shemaroo says that market has lost all confidence in management. Either corporate governance problems will crop up soon (will exit if that happens) or it is a really undervalued stock

- Lupin continues to disappoint on US business, lots of write-offs taken against one time gain from Japanese generic pharma divestment. (Will give a couple more quarters to see if management can resolve FDA issues)

- Care rating results is in-line with my expectation. Whenever growth comes back there will be very strong operating leverage. For now, I keep reinvesting the dividends to buy more shares

Good results

Ajanta Pharma -> Strongly growing US business along with recovery in Africa business

Ashiana Housing -> 9M booking growth ~45%, will probably meet the booking target of 2M sq.ft in FY20, should contribute to sales in 2-3 years

HCL Tech -> Fastest growing large cap IT company (~15% revenue, ~16% profit growth) on back of acquisitions

Indigo -> 25% revenue growth with rapid expansion in higher margin international markets

Manappuram -> 30% NII growth on back of 35% AUM expansion, NPAs under control so far

NESCO -> 26% topline growth on back of leasing of new IT park

PI -> ~20% topline growth on back of strong domestic revival (~21% sales growth) and 19% export growth

Average results

Bajaj auto (exports saved the day), Cera (no real estate recovery), Divis (good FDA compliance, expanding capacity), HDFC (higher than industry growth, controlled NPA), IEX (slight degrowth on back of soft electricity demand), Infosys (SEC probe still an overhang), ITC (awesome hotel business performance, FMCG margins picking up), Kolte Patil, L&T, Natco (continues to invest in agro chemical and focus on diversification away from US), PowerGrid (lower CAPEX would mean higher freecashflow), Reliance, Nippon India life (drop in debt fund AUM continues to be a matter of concern)

Bad results

Care ratings -> 23% sales de-growth, valuation reflects this well.

Lupin -> 5 facilities under FDA scanner, US business still not doing well, India business doing well

Mahindra logistics -> Auto keeps top-line subdued (~8% degrowth). Continues to diversify out of auto. Very strong operating leverage play whenever growth comes back

Shemaroo -> 50% de-growth in traditional broadcasting a howler, continues investing in new business avenues with launch of a new free to air marathi channel.

2 Likes

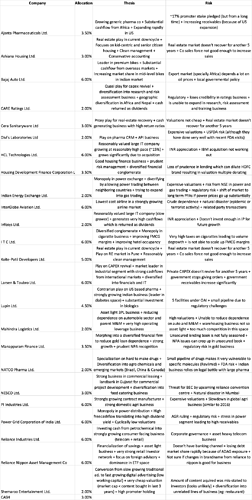

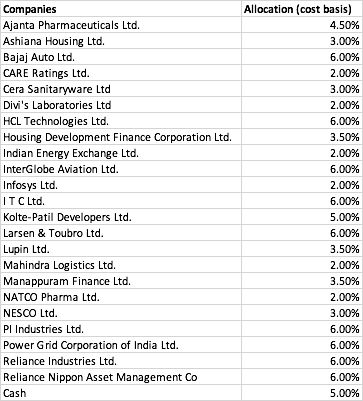

As of today, I sold Shemaroo. The degrowth in traditional business of 50% is too hard to digest. I continue maintaining a small tracking position. The updated portfolio is:

3 Likes

Hello Harsh,

Just wanted to know what made you take the decision to sell off shemaroo. I am also invested in shemaroo and confused about future course of action. Have you noticed some issue related to corporate governance.

Could you share your thought process in deciding to sell it off now.

Thanks

1 Like

Hi Sarthak,

I haven’t identified any corporate governance issue. The reason for my exit is my incorrect assessment of growth, the underlying thesis was digital business is going to be the growth driver (which is true so far) with nominal growth in traditional business. However, the traditional business degrowth of 50% shows that my underlying thesis was incorrect. This becomes much more evident when I compare the ad numbers with Zee and SunTV as they didn’t show such degrowth, which means either Shemaroo doesn’t have the right content or they don’t have pricing power. I hope management has not overstated the inventory numbers. I personally couldn’t find anything wrong with the management except that Raman Maroo was an independent director in Orbit Corp, which later was declared a wilful defaulter by RBI. There can be three things happening: (1) I am wrong in selling a seriously undervalued business run by a good management, (2) management is not as good as I thought, or (3) the business inherently is much more cyclical than I had thought.

To clarify my thought process, I am having losses on another position which is Care Ratings. The reason I hold Care is that I have more confidence that it will exist after 10 years and it has much better operating cash flows, which is returned as dividend. However the same is not true for Shemaroo. I will be tracking Shemaroo and if I realize I was wrong in selling, I will be happy adding it back to the portfolio. Hope this clarifies my thought process.

Harsh

4 Likes

Thanks for the detailed answer.

Taking a loss is the most difficult thing for me in investing. Haven’t managed to do it right even once. Anything that you do to make it easier to let go.

Thanks

1 Like

Hi,

In investing, we have to let our winners run and try to cut our losers. Losses suck but having a 50-60% hit rate is good enough for a long only portfolio. So, its important to learn to take losses.For me, I try not to defend my positions if the underlying logic is proven incorrect. There are two mental frameworks which I find useful:

- If you are not sure of a position, sell all of it and then re-evaluate. Having no position in a stock helps improve clarity of thought.

- Think of selling as switching from one company to another.

Maybe you can find them useful. Good luck!

Harsh

18 Likes

Just thinking aloud, given the content library will Shemaroo be an acquisition target for any of the larger players (Netflix, Prime, Jio, etc) who want to build local library ?

They might be an excellent acquistion candidate but its highly unlikely as promoter holding is 65%. Also at these valuations, it doesn’t make any sense for the promoters to sell out. They have invested >500 cr in content in the last 3 years, their current market capitalization is ~200 cr. Additionally, the promoters seem to be ambitious, given how much they are investing in different business lines.

Right, makes sense - promoters are likely to hold lions share. Thanks for answering!

I came across Shemaroo first through this Bloomberg video

My investment thesis was digital growth of regional content with Jio effect and was like worst case someone will acquire although not sure for how much!

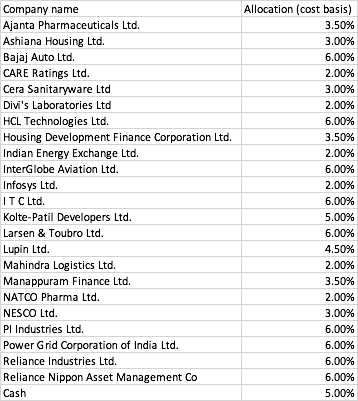

As of today, I reduced weightage of Lupin by 1% (from 4.5% to 3.5%) and increased weightage of Ajanta Pharma by 1% (from 3.5% to 4.5%). This is because Ajanta has near term earnings visibility (~20% upto FY22 due to expansion in US generic markets). Apart from this, I am closely tracking the following companies which are close to my buy range:

- Maithan alloys - Detailed thesis can be seen at this link Maithan Alloys Ltd - #232 by harsh.beria93

- Avanti feeds

- HDFC AMC

- INOX Leisure

- Vinati Organics

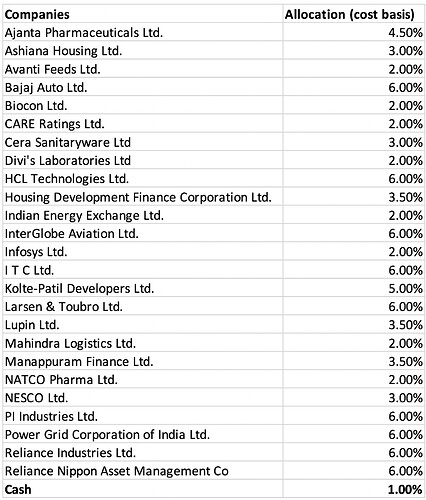

I will post the detailed thesis after creating a position in the specific company. The updated portfolio looks like this:

1 Like

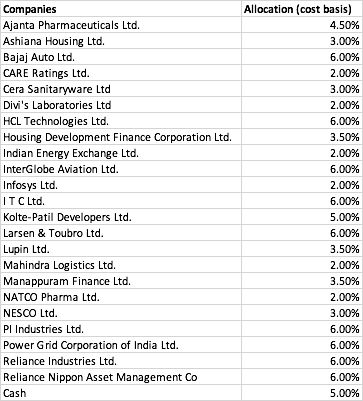

I have created a 2% position in Biocon in the model portfolio on Friday.

Pharma sector has done badly in the last few years, but its inherently a very good business (low debt, high ROE, reasonable growth). In order to take advantage of the fall in the past few years, I have taken a basket approach and allocated ~14% of my portfolio to this sector. My pharma picks are:

-

Ajanta Pharma (4.5%) - Rapidly expanding into US markets. Strong domestic market presence, good cashflows from Africa institutional and branded businesses.

-

Lupin (3.5%) - trying its hand on biosimilars. Doing well in Indian markets. De-leveraging by selling its Japanese generic unit. Problems with FDA compliance

-

Divis Lab. (2%) - Biggest Indian contract research manufacturer and API manufacturer. Strong revenue visibility in the next 2-3 years on back of capacity expansion. Valuations reflect this.

-

Biocon (2%) - Has the largest pipeline in biosimilars of all Indian pharma companies. If stage 3 trials and approvals go well, topline can become 2-3 times in the next 5-years. However, there are numerous risks (a) FDA compliance (Biocon has done well in this so far), (b) Biosimilars is a long gestation business (5-6 years to go through the three stages of approval in US, it is easier in Europe though), c) valuations reflect optimism in pipeline

-

Natco Pharma (2%) - Niche player specializing in hard-to-make drugs. Diversifying into foreign markets and agro-chemicals business

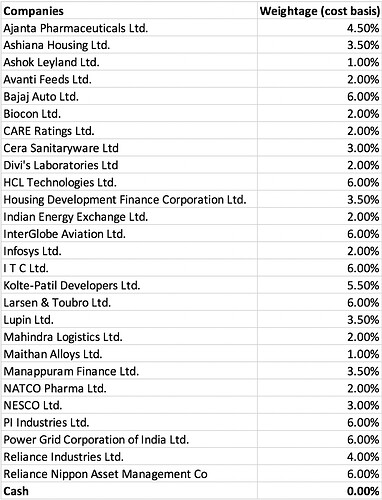

The updated portfolio is shown below:

Today, I initiated a 2% position on Avanti feeds.

Avanti feeds makes shrimp feeds and have a domestic market share of 45-50%, with industry growing at ~10%. The margins of the company is very volatile because of dependence on prices of fish meal and soyabean which are commodities. Long term average margins is ~12%, its current quarter margins are ~7%. They have passed out the raw material price increase to the shrimp farmers, so margins should come back to the long term mean in a couple of years. They have also foreyed into shrimp processing business which is a growth driver for them. The feeds business is well consolidated with three key players (Avanti, Waterbase, CP foods) accounting for > 80% market share. The sector has done very well in this cycle (starting 2012) with companies generating >30% ROCE. They have recently started selling their shrimps in China, and also want to sell their feeds in Bangladesh.

Key risks:

- Outbreak of disease (this killed the shrimp sector in 1998 and is a key monitorable)

- Dumping from Ecuador to US due to China slowdown can lead to temporary revenue hick-up.

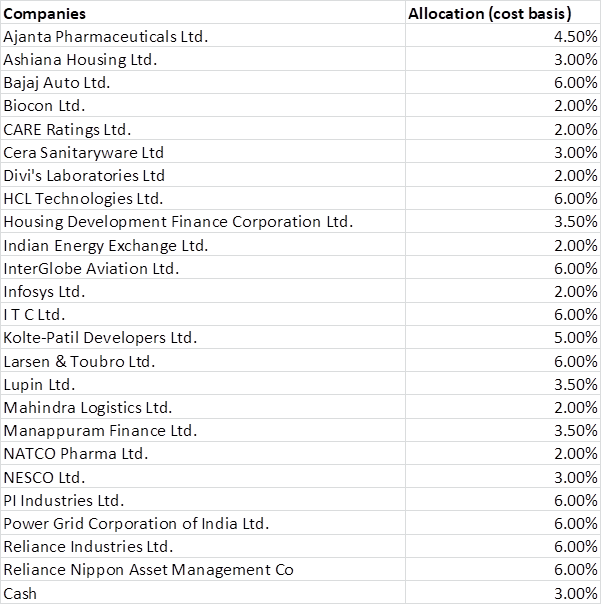

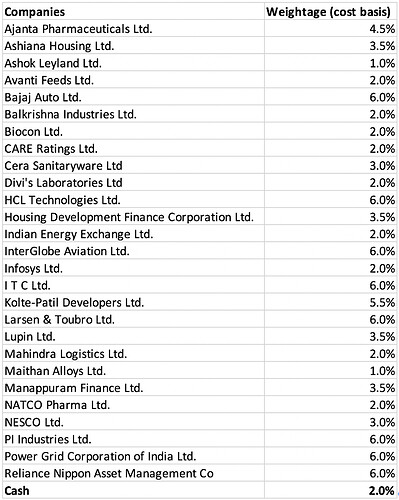

The updated model portfolio is below:

With the recent fall in prices, I am slowly increasing risk in my portfolio. A lot of commodity and cyclical businesses are trading at very low valuations. My thought process at this point is to increase my portfolio allocation to the more risky commodities/cyclicals. I am doing this by using 1% cash left in the portfolio and reducing the position size of Reliance Industries from 6% to 4%. The cyclical positions are shown below:

-

Shrimp exporter (2%): Avanti feeds

-

Airlines (6%): Indigo

-

Real estate (9%): Kolte Patil (5.5%), Ashiana Housing (3.5%)

-

Commerical vehicle (1%): Ashok Leyland

-

Steel (1%): Maithan alloys

Basically, I have added 1% position size in Real estate (0.5% increase in Kolte and Ashiana). I have created 1% position in Ashok Leyland and Maithan alloys. The rationale for them are:

-

Ashok Leyland - CV is a highly cyclical business, @amey153 explains this beautifully in his blogpost . Key risk for me is the capital allocation policy of Hinduja group, which is probably why the stock is down 24% today. Also, they lost their key man to Eicher last year. But its trading at low cyclical valuations and should do well when CV cycle turns (sometime in the next 3 years)

-

Maithan alloys - Detailed rationale is posted here Maithan Alloys Ltd - #232 by harsh.beria93

The updated portfolio is:

2 Likes

Among the real estate picks, have you considered Sobha Ltd? Would be great if you could share the rationale behind selecting Kpatil and ashiyana. Thanks!

I took a top-down approach, I wanted exposure to real estate players in markets with relatively low inventory (Hyderabad, Pune, Bangalore) and clean corporate governance.

-

Kolte is a play on Pune real estate market. They have done reasonably well during this downturn and have decent corporate governance. They undertake new projects by doing joint ventures with financial investors, hence not taking too much debt.

-

Ashiana caters to a niche space (senior citizen housing) and is responsible for property maintenance services which provides an annuity stream of revenue. Ashiana is one of those rare non-leveraged real-estate players (d/e < 0.2) with really good corporate governance (have a look at this playlist)

Both are available at ridiculous valuations and can give decent returns when sector turns and if they are able to execute their strategy.

3 Likes

I have been reshuffling my portfolio substantially during this market fall. The broad idea is to replace existing portfolio companies with other companies which in my assessment can generate higher returns in the future.

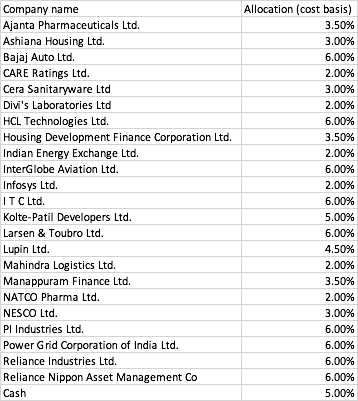

Today, I replaced Reliance Industries (4% position) with Balkrishna Industries (2% position) from the portfolio. This generates 2% cash which I am looking to deploy quickly. The model portfolio is shown below:

1 Like

I have added AIA Engineering in the model portfolio (position size: 2%). AIA makes grinding media which finds its application in cement and mining industry. It is a market leader along with Magotteaux (Belgium based). AIA is exposed to the mining and cement sectors, although the cyclicality of AIA is lower as it manufactures indutrial consumables. They are trying to move up the supply chain by offering integrated services to mines. They dont have much debt on their balance sheet (d/e < 0.1), have high ROCEs (>20%), and don’t have any obvious corporate governance issues. Its fairly priced at current prices, and I might increase the position size if prices or growth becomes more attractive.

2 Likes

As of today, I have done a switch from AIA Engineering to Wonderla Holidays in the model portfolio, maintaining a position size of 2%. The reason for this switch is below:

- I was earlier valuing AIA on their accrual profits without realizing that AIA only converts 70-75% of their accrual profits to cash profits. This required me to revalue the business and I realized that AIA was trading at slightly higher than fair valuations

- Wonderla on the other hand is definitely undervalued in my assessment (detailed post here).

I understand that this switch may not work out in the near term as Wonderla parks are currently closed. However, over the next 5 years, with a 12% growth rate (with stabilization of Hyderabad park and start of Chennai park), I expect share price returns to be in excess of 25%. This attractive risk reward is why I have made this switch. The model portfolio is shown below

2 Likes

In-line with past updates of increasing allocation to cyclical sectors, I have sold my position in Mahindra Logistics (2%) and added NALCO (1% position). This builds up 1% cash which I am looking to deploy very soon.

The reason for this switch is below:

-

NALCO has a normalized PBT margin ~ 18%. For the last 2 quarters, PBT margins have been negative due to pressure on aluminum prices. Aluminum prices like most commodities is cyclical. FY13, FY14 period was the last bear cycle, followed by a cyclical uptick in FY15, followed by cyclical downtick in FY16 & FY17 and a cyclical uptick in FY18 and FY19. Over long term, the company trades at P/sales ~ 2 and it goes below 1 during cyclical downticks. Currently, company is trading at P/sales ~ 0.6 (market cap ~ 5600 cr. with cash of ~2800 cr.) Valuations are reflecting poor future prospects. In the next five years (i.e. by FY25), a cyclical upturn in aluminum is likely. When that happens, sales will go beyond the last peak sales and is likely to cross 12’000 cr. I will consider selling at P/sales > 2 i.e. 24’000 cr. (~128 share price). Current stock price is ~30. This gives me a favorable risk reward. Plus, its a debt free balance sheet with 51.5% GOI stake (i.e. not too much scope for further equity dilution)

-

Mahindra Logistics: The growth is supposed to recover after corona stabilization. As company is rapidly expanding into new business (i.e. cold storage, warehousing), I am comfortable giving it a growth rate of ~15% for the next 5 years and a normalized PBT margin ~ 4% (Global leader C.H. Robinson has long term EBIT margins ~ 5.5%). Looking five years ahead (FY25), with 15% topline growth, revenues will go from ~3200 cr. (taking into account corona impact) to ~6500 cr. At 4% PBT margins, PAT ~ 195 cr. PE ~ 20 will give Mcap ~ 3900 cr. Current Mcap ~ 1800 cr.

In essence, I have a better risk reward in NALCO compared to Mahindra Logistics. Also, I have certain doubts about accounting in Mahindra Logistics (details here)

4 Likes