just search AMFI Monthly AUM data on google.

Hi Harsh I have followed quite a few of your posts from the Agrochemicals Industry and I do believe that you are one of the best SMEs on this forum with regards to AgroChemicals.

I was going through the Presentation and I would only like to point out one thing which is a view on Corporate Governance. I see that 2 of the companies Meghmani ( https://www.capitalmind.in/2019/05/guest-post-how-shady-corporate-governance-has-given-india-inc-a-bad-name/ ) and heranba ( Heranba Industries | IPO Analysis | SPTulsian.com ) having histories of their own which is never a good sign for retail investors according to me. Also I was pretty interested in Punjab Chemicals but the concall did not instill in me the quality plus its linkage and somewhat hidden nature of association with UPL seemed to be an rationale for not investing.

I know Meghmani personally having seen their IT landscape and their IT investments for the future but I guess its no easy to wipe off your past . Apparently the general public seem to forget these instances but its better to be brought up again and again so that some sense prevails in the market madness.

As a safer bet went ahead with position in Bharat Rasayan as it has proven to be delivering with its successful JVs with Nissan . PI was already a part of my portfolio and I need to look into Sharda CropChem again .

Hi Harsh…

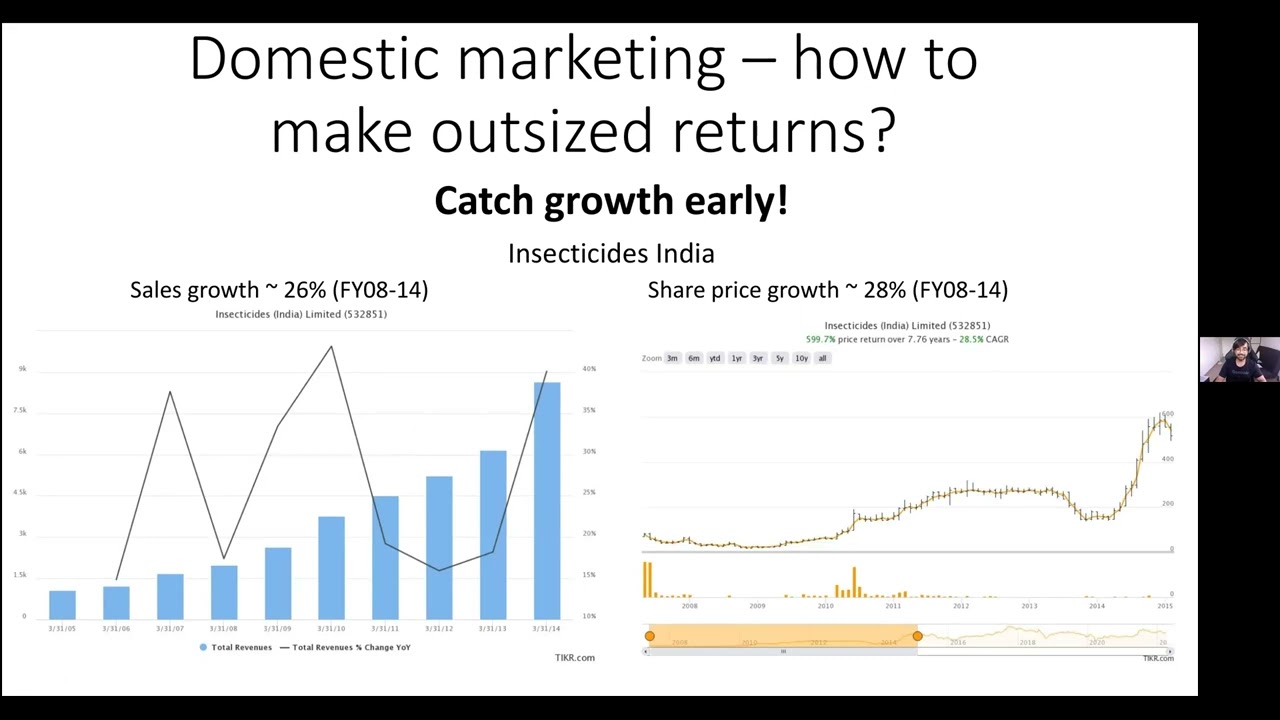

I am here sharing common interested . Pi , Astec and Insecticides are important holding .Pi and Astec are multibaggar .Insecticides overall has delivered decent return since I entered around 2013 . How ever I still feel insecticide can deliver super cagr . their sales growth will not be linear but exceptional and more than sales but profit and hence it can command 2x valuation from here.

Coming to Agrochemicals, was also interested to know why Coromandel International doesn’t feature in the assessment. Has good presence in South-Central India with retail outlets too. Has decent export percentage which could grow in future. Happens to be a midcap and bigger than quite a few companies mentioned herein lagging only UPL and PI Industries maybe.

Hey! I don’t track monthly AUMs for each individual company. I broadly track market share trends for the different AMCs and see how its evolving over the medium term (2-3 years).

@Nabendu Good to hear this ![]()

@rranjan Insecticides India had a rough year due to product ban, that was also the main reason why margins went back to 10-12% trajectory. The way their exports are growing, they can be a dark horse especially given the valuations they are trading at.

@Ameya_Warty The presentation focused on pesticide companies, I didn’t cover any fertilizer company. Coromandel is a well run company and have done very well, especially given the regulatory landscape they operate in. They are more in the UPL league and much larger than most pure play pesticide companies.

Hi Harsh,

I had a question regarding your valuation metric - the EV\Sales ratio. Don’t you think in inflationary environment, this ration won’t be a correct measure of under\overvaluation?

For majority of companies thr sales numbers might grow but cost pressures will lead to margins taking a hit and also reduce the free cash flows. In such a scenario, the EV\Sales multiple might not expand as expected in your calculations even though the top line growth might be there.

Before going into the utility of EV/sales as a valuation metric, its important to understand what drives true value of a business. There are four main variables which capture the scientific part of valuations:

- Amount of capital deployed (as reflected in book value)

- Return generated on deployed capital (return on equity)

- Amount of money that is reinvested in the busines (thereby giving the growth rate)

- Investor’s return expectation (cost of capital)

However, this ignores the human part in valuations i.e. the part where people become excited or depressed about a given business. To incorporate this, I need a metric which is mean reverting in nature i.e. during good sentiment it becomes high and during bad sentiment it becomes low. Of all the metrics I ever looked at, EV/sales and P/B were most mean reverting in nature and also had low anomalies. There are two distinct advantages of EV/sales over other metrics like P/E or EV/EBITDA:

- It ignores fluctuation in margins which is a function of business cycle

- It incorporates debt thereby highlighting a very important balance sheet aspect

What EV/sales doesn’t incorporate are:

- Cashflows

- Return on equity

- Growth period

In order to account for these, I manually ensure that sales are getting converted into cash flows and look at long term trends in ROE. Growth (which excites most people) is the hardest to model. Thus, I try to buy things when they are cheap on a cyclical basis, thus if growth doesn’t come I don’t lose a lot of money.

All this being said, its a shorthand metric and doesn’t really tell much about a business. But its very useful as it is mean reverting over long periods of time (like 15-20 year periods). These long timeframes incorporate all kinds of macroeconomic scenarios: inflationary, deflationary, stagflationary, etc. Any valuation metric that cannot stand the test of time doesn’t have much utility. Hope this clarifies my thought process.

The video of my presentation on agrichemical value chain can be seen at the link below. From now on, we will be posting presentations made at VP Europe meetings through the youtube channel whose link is also below ![]()

Hi, Good presentation, thanks for this.

I have a question – any idea how do bio-pesticides work out for the ultimate consumer i.e. the farmer in terms of price competitiveness vis-à-vis chemical pesticides? I think they will pick up speed only if they are cheaper as well, otherwise they will continue to remain a niche premium product which not every farmer will be interested in. What’s in it for the farmer to make the shift?

Now that we have results of all listed AMCs, its a good time to see what kind of numbers have been delivered. I am comparing FY22 numbers against FY18, both these years were cyclical highs in terms of capital market returns. This makes the comparison useful as we are connecting high-to-high.

Sales growth: UTI (3.85%) > HDFC (3.13%) > Aditya Birla (-0.6%) > Nippon (-6.8%)

Operating profit growth: HDFC (10.63%) > Aditya Birla (10.4%) > UTI (5.76%) > Nippon (4.9%)

In terms of sales, all listed companies have struggled to grow. This is partly because these cos passed on the full expense ratio cut in 2019 to distributors who are not fighting back by pushing other financial products. Additionally, AMC space is seeing hightened competition.

In terms of valuations currently, here is how the market is valuing them:

HDFC > Nippon > Aditya Birla ~ UTI.

Sectoral valuations are at cyclical lows (although we have very little historical data as Nippon was only listed in 2017). So we barely have 5-years of historical valuations.

In terms of valuation arbitrage, Aditya Birla should be valued at a premium to UTI and trade at similar multiples as a Nippon. Apart from a poor website, there is nothing inferior about Aditya Birla. Lets see what happens going forward.

Hi Harsh,

I came across fee things regarding Atul auto which I believe could be of use to u too…Please find below…Would appreciate ur thoughts on the same…

(1) Corp Gov alert - Atul auto ( holds 30% stake in nbfc) investing almost 40 cr plus in nbfc in the form of participative preference shares ( zero fixed interest and zero voting rights) for 5 yr period.Promoters plus other investors ( @VijayKedia1 ) not putting single rupee

(2) yet enjoying 70% voting rights is a RED FLAG. Using @atulauto1 's public shareholders money without any downside protection is not an ideal way to treat public shareholders . Its promoters and other share holders enrichment at the expense of public shareholders.

Cheers

I have written about it in detail here.

Uploaded the info from NBFC annual report above…As per that , 2.758 cr of participative pref shares shall be issued at 16.16 Rs each . The total amount shall be INR 44.5 crs. Whole thing is little bit confusing

Hey Harsh, With the Q4 results and guidance of 15-20% growth by Sharda Cropchem, would you be considering to shift it from 4% bucket to 8% bucket of your portfolio? For that matter, any of your 4% is stocks, are you finding worth getting the promotion ![]()

Hi!

I haven’t sold any shares of Sharda in the past months, so position size has gone up due to price appreciation (at CMP its around 8.4%). As I have stated previously, I am trying to be more measured in my selling. If I had to reinitiate the position, I will start at 4% (and not at 8%) because I am currently able to find lot more cos where risk reward is very favorable. Plus, Sharda’s performance should be looked from the backdrop of inventory positioning of the industry, which was quite low last year and benefitted Sharda. This can also reverse as we have seen in API cos in FY22.

If we look at Sharda’s agchem sales per registration, its the highest in their recorded history, so this might be a cyclical high. If we compare them against UPL, its still much lower (I think UPL does 2.5-3 cr. per registration). But I do not know if UPL is the appropriate benchmark as they also manufacture products.

| FY15 | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | |

|---|---|---|---|---|---|---|---|---|

| Agrochemicals revenue per registration (cr.) | 0.62 | 0.58 | 0.55 | 0.69 | 0.73 | 0.70 | 0.81 | 1.12 |

| Intangible assets per registration (cr.) | 0.06 | 0.07 | 0.10 | 0.10 | 0.16 | 0.16 | 0.21 | 0.21 |

All this being said, I still think Sharda is one of the best positioned company to gain market share due to their better supply chain capabilities and large number of registrations. Here are my revised projections for Sharda.

Revised projections as on 13.05.2022

FY22 sales ~ 3’580 cr., at 15% growth, FY25 sales ~ 5’445 cr., sell @2x EV/sales, EV ~ 10’890 cr., Assuming 310 cr. cash level, Mcap ~ 11’200 cr. (1242 share price)

| Companies | Ticker | Projection date | Price | 3 year fwd Price (FY25) | Price return % | Dividend yield % | Total returns % | FY25 EPS double over FY22 | Business | Promoter | Financial proj. | Valuation proj. | Cyclical? |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sharda Cropchem Ltd. | nse:shardacrop | 13.05.22 | 645.70 | 1,242.00 | 24.36% | 0.93% | 25.29% | No | Medium | Medium | High | Medium | Yes |

I feel very confident about a number of my 4% positions, especially those where margins are at cyclical lows, growth prospects look strong and valuations are towards the lower end. Some of these are:

Avanti Feeds: Has shown clear leadership traits, growing higher than industry and creating new cash pools. Avanti’s shrimp processing division is now bigger than Apex Frozen when 5-years before they were only half the size. If we look at quarterly margins, its reviving.

Amara Raja: Have maintained higher growth than exide with higher margins, growing topline when the whole auto sector was in downturn. The new generation has come in and are investing for the future. We are getting all this at valuations last seen in 2010-12 downcycle. And EV vehicles require an ancillary battery which is lead powered!

NESCO: Their exhibition business is coming back, on steady state it contributes 150+ cr. to topline and 120+ cr. to EBIT. Even without that contribution, they are trading at 21x P/E (if I remove cash at 17x P/E). On a normalized basis (assuming exhibition business comes back), they are trading at 10x P/E (ex-cash).

HDFC: This is probably the most misunderstood company, I hear people saying that HDFC is past its high ROE days. But then people dont see that HDFC’s leverage has come down to cyclical low levels impacting ROEs, their core profitability (ROAs) have stayed at 2-3% and growth is not a problem. The HDFC bank merger gives another return kicker.

Kolte Patil: With very clear real estate revival, stock prices are back to cyclical lows. I don’t think real estate is a 1-2 year cycle play as construction for a property itself takes 3+ years. Kolte is growing in a very capital efficient manner where a large part of incremental growth is coming from redevelopment projects. With the current worry about inflationary pressure on real estate demand, even prices of Ashiana Housing have become reasonable. So I might increase my exposure to residential real estate cos.

In short, I am reasonably confident in a number of my 4% bets, I am also happy to add more businesses in that weightage band. For an outsized bet (like 8%), downside has to be protected. So far, I have only made such outsized bets in HDFC and ITC, that too when absolute downside was low. Optionality plays can get to a higher weightage by their sheer performance (rather than me betting in an outsized manner). I want to stay in the game longer than trying to act as a hero.

What is your view on Reliance’s foray into the exhibition space in Mumbai? How is it going to challenge NESCO?

Hi Harsh,

always good to read your pointers on different companies.

I wanted to know your thoughts on Lupin. What so bad happened to this company that it is not turning around at all? What is the future ahead?

Thanks

I think there was some discussion about it on Nesco’s thread, Jio world centre is a convention centre whereas Nesco is an exhibition centre. I keep a tab on some industrial exhibitions and a number of them have resumed in Nesco’s centre. So I think exhibition business should come back over time (and should not be impacted due to Jio world centre). This division is very significant for Nesco, contributing 150-200 cr. during normal times.

Well its been a disappointing journey with Lupin, I have got this one wrong. Currently, they are struggling with their supply chain and on their HR front (retaining talent).

Lupin invested in a lot of very different things (acquisition of Gavis + biosimilar + inhaler + injectable + specialty women’s division) and they have executed poorly (so far) on everything except inhalers (where execution has been top notch). The FDA compliance issues meant that Lupin could never launch their very rich pipeline and now a number of such molecules has lost its economic value due to competitors launching them. Also, company was hit by things outside management’s control (like failed back to back flu seasons because of people wearing masks, where Lupin is the leader).

If we look at last 4-years, the number of products commercialized in US has stayed stagnant and revenue per ANDA has also come down (pricing pressure). This is the main reason for revenue stagnation.

| FY18 | FY19 | FY20 | FY21 | FY22 | |

|---|---|---|---|---|---|

| Cumulative ANDA filed | 398.00 | 422.00 | 430.00 | 437.00 | 457.00 |

| Cumulative ANDA approved | 235.00 | 265.00 | 272.00 | 288.00 | 297.00 |

| Products commercialized | 165.00 | 176.00 | 174.00 | 168.00 | 166.00 |

| US revenues (mn $) | 879.00 | 778.00 | 800.00 | 720.00 | 738.00 |

| US revenue (mn $) per launch | 5.33 | 4.42 | 4.60 | 4.29 | 4.45 |

This is further compounded by the fact that Lupin is losing market share in a number of their key molecules (data below).

| FY18 | FY19 | FY20 | FY21 | FY22 | |

|---|---|---|---|---|---|

| Us market leader (# products) | 51.00 | 65.00 | 63.00 | 53.00 | 44.00 |

| US top 3 (# products) | 109.00 | 129.00 | 123.00 | 122.00 | 113.00 |

About future: Lupin needs to fix their compliance issues and launch a lot of products. Hopefully, margins will revive once they are able to launch high value products (like spiriva, suprep). Lets see how it unfolds.

Hi Harsh.

Have you ever written about your selling framework. If yes, can you please point me to that link.

Was reading this post(The harsh portfolio! - #39 by harsh.beria93) of yours and got me interested as your thread has always been a source of learning for me.

Thanks.