As of today, I have switched out of Shri Jagdamba Polymers and utilized the proceeds to buy more shares of Stylam. As a result, Stylam’s position size increases to 4% in the model portfolio.

The reason for exiting Shri Jagdamba is that they will likely be adversely impacted from the current US real estate downcycle. Also, their capex is still sometime away. On the other hand, Stylam has multiple earnings driver (export + domestic + margin improvement). I find the risk reward more interesting in Stylam, and hence the switch. Cash stays at zero.

Core compounder (40%)

| Companies | Weightage |

|---|---|

| I T C Ltd. | 4.00% |

| Housing Development Finance Corporation Ltd. | 4.00% |

| NESCO Ltd. | 4.00% |

| Eris Lifesciences Ltd. | 4.00% |

| Ajanta Pharmaceuticals Ltd. | 4.00% |

| HDFC Asset Management Company Ltd | 4.00% |

| Aegis Logistics Ltd. | 4.00% |

| Gufic Biosciences | 4.00% |

| HDFC Bank Ltd. | 2.00% |

| PI Industries Ltd. | 2.00% |

| LINCOLN PHARMACEUTICALS LTD. | 2.00% |

| Godfrey Phillips | 2.00% |

Cyclical (50%)

| Companies | Weightage |

|---|---|

| Kolte-Patil Developers Ltd. | 4.00% |

| Sharda Cropchem Ltd. | 4.00% |

| Avanti Feeds Ltd. | 4.00% |

| Aditya Birla Sun Life AMC Ltd | 4.00% |

| Alembic Pharmaceuticals Ltd. | 4.00% |

| Amara Raja Batteries Ltd. | 4.00% |

| Chaman Lal Setia Exp | 4.00% |

| Stylam Industries Limited | 4.00% |

| Ashiana Housing Ltd. | 2.00% |

| Ashok Leyland Ltd. | 2.00% |

| Heranba Industries | 2.00% |

| Kaveri Seed Company Ltd. | 2.00% |

| Control Print Limited | 2.00% |

| Sundaram Finance Ltd. | 2.00% |

| Time Technoplast Ltd. | 2.00% |

| RACL Geartech Ltd | 2.00% |

| Manappuram Finance Ltd. | 2.00% |

Turnaround (4%)

| Companies | Weightage |

|---|---|

| Punjab Chem. & Corp | 4.00% |

Deep value (6%)

| Companies | Weightage |

|---|---|

| Geekay Wires | 1.00% |

| Jagran Prakashan Ltd. | 1.00% |

| D.B.Corp Ltd. | 1.00% |

| Shemaroo Entertainment Ltd. | 1.00% |

| Modison Metals | 1.00% |

| Suyog Telematics | 1.00% |

These are valid points and I agree with most of them. However, the way I approach microcaps is slightly different. If there is anything attractive that I find available at a very small market cap, I do some basic work and build a small position if things look reasonable. The idea is not to have a rigorous checklist, otherwise it becomes very hard to buy anything at such a small market cap. In the past few years, this approach has worked out very well for me.

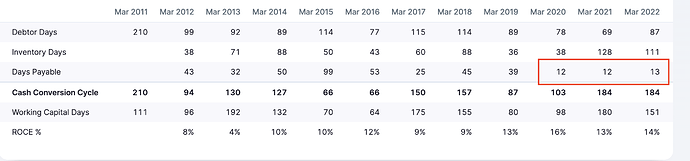

Coming to Geekay, I was attracted by growth and reasonable dividends. While the core business is not great as reflected in mid teens ROCEs, the high working capital and poor cashflow generation is due to very low payables (and not high receivable days). That means, sales are probably not fictitious. Also, we can verify their sales with export data.

Low payable days is generally a strategy to get cash discounts, resulting in higher margins. However, if they keep growing like this, they will need to do equity dilution. Lets see how this plays out.

All the records that I share is pre frictional costs and also pre dividends. Actually, my dividend yield is much higher than the index, as I keep 10-20% of my portfolio in high dividend yield cos. As a result, dividends more than pay the frictional costs.