Just a quick update, since its been awhile. Been away from markets and most things digital and just catching up on things.

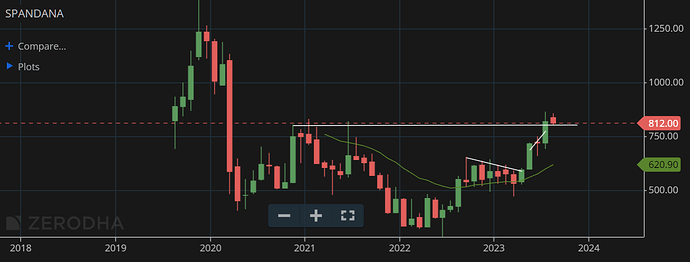

Spandana, discussed earlier in this thread and in the company thread. Playing out alright so far fundamentally with pretty good results last quarter. Q1 is seasonally weak for MFI so not much to read in general but pretty much everything is moving towards the Vision 2025 guidance. Lot of branch additions should drive growth strongly in H2. Padmaja’s stake sale is the only overhang here and that too seems to be getting underway with Goldman Sachs buying 1.2% earlier this week. I believe Spandana deserves a much better valuation so intend to hold for few more quarters and see where it goes.

Technically seems to be trading at 3 year highs. Taking out the ATH levels 1350 or so should happen in the next couple of quarters with continued execution

HOEC - Results not out yet but setting up nicely for taking out the highs made last year in anticipation for B-80 wells producing. Now with them producing and contributing to numbers well from last quarter, this should happen sooner, rather than later. I believe its still trading cheap as per my calculations earlier in this thread

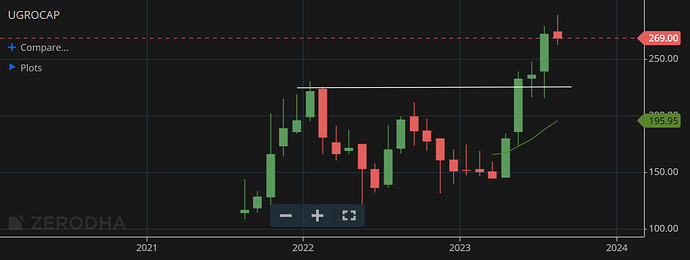

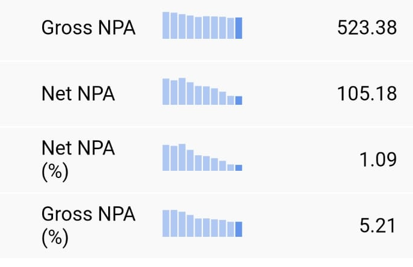

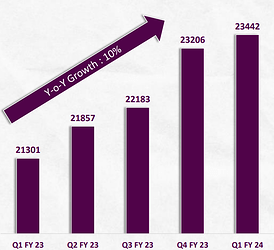

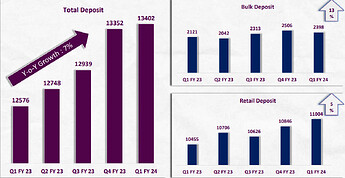

Ugro - Business momentum is strong and I see management delivering on past promises and moving towards the FY25 goal. If they do manage to deliver a 18-20k Cr AUM, 18% RoE and maintain asset quality as promised, hopefully this can re-rate over time further. To put things in perspective, Five-star business finance and Ugro both have an AUM of ~6500 Cr but the former is valued nearly 10x - the difference? Stellar execution, asset quality, class-leading 8% RoA (and low float). But Five-star perhaps has a lot priced in at current valuations (growth in new regions won’t be as easy + model not as scalable) where as Ugro can at least aspire to get better from here with some re-rating opportunity

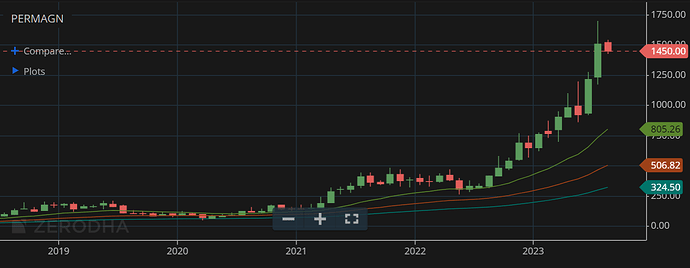

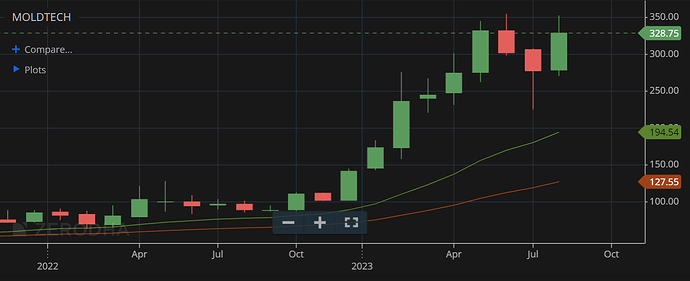

PML - I thought it was expensive at 1000 but it has got even more expensive. I think this is going to be a great business over time if they manage to execute the NdFeB magnets opportunity well with the base business growing at 20-25%. Growth in the smart meter opportunity as well could be a kicker. Results not yet out for the quarter and I dont think it is going to be stellar (maybe ~8 Cr PAT) for the valuation (and yet I couldn’t bring myself to sell). Technically I think it could consolidate between 1300-1500 for sometime perhaps

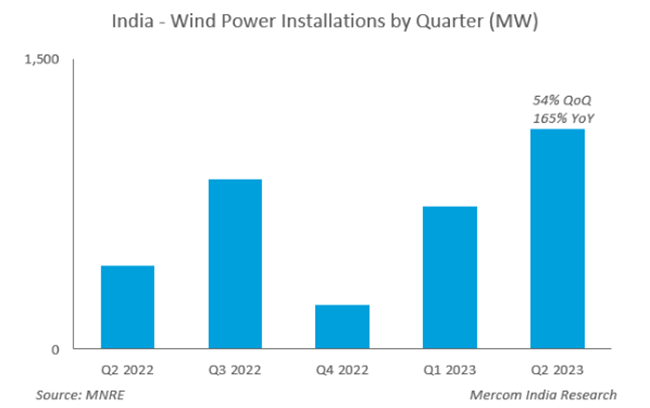

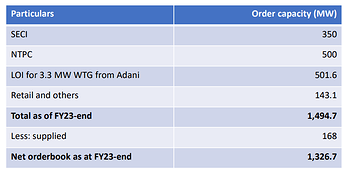

Welspun corp - Like the MFI space, this space as well is on fire with strong orderbooks, execution and results. Results tomorrow and I dont expect it to be great when compared to Q4 since Q1 is generally a very muted quarter and most of the execution happens in second half. Technically though discounting has already started and it has broken out of the 300 levels and is trading at a 15 year high.

I feel market in general is a bit overheated. I would have perhaps sold if the valuations weren’t in favour (except for PML which is expensive). Throwing darts and sitting tight has given excellent results since last week of March when the market bottomed out. I believe there’s more to go at least where valuation is in favour as overall economy seems to be in great health. But its definitely not a throw darts market now

Disc: No recent transactions and am just a novice sharing what I am doing as it helps build clarity for me. Not to be construed as advice