The party got over sometime ago and things have gotten pretty weird. The liquidity driven rally post demonetisation in micro/small/midcaps is ending in a pretty dramatic fashion. Lot of reasons were being given for things going up last year from liquidity, momentum, phenomenal earnings growth (in the P/L at least) etc. Experts came on TV channels and gave buy calls by the dozen and everyone ended up looking like Nostradamus.

Now onto the weirdness. The reasons for the carnage again are many and varied - to paraphrase Tolstoy - Happy families are all alike but unhappy families are unhappy in their own way. Here are some of the reasons offered

- LTCG

- Mutual Funds rejig due to reclassification

- Liquidity!

- Crude/Rupee/Interest rates

- CFOs/Auditors resigning

- Cyclicals peaking

- Cooked books

- Overvalued IPOs

- Loss of momentum

- Bad corporate governance

- Karnataka Elections

- Banking scams

- Margin triggers due to ASM/GSM have brought other stocks down as traders sell other holdings to put up margin money (New reason updated as of 5th June, 2018)

This is how it has unravelled.

Probable Fraud

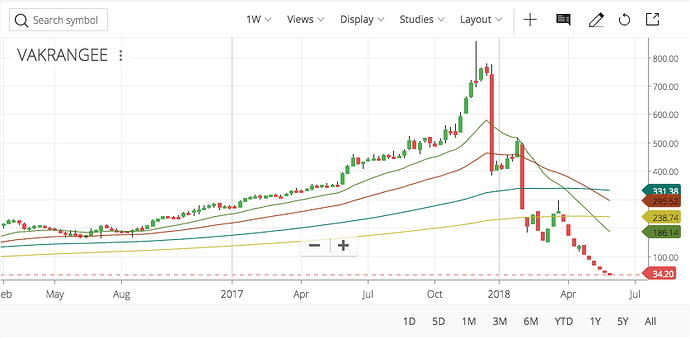

Vakrangee - The undisputed leader of the pack

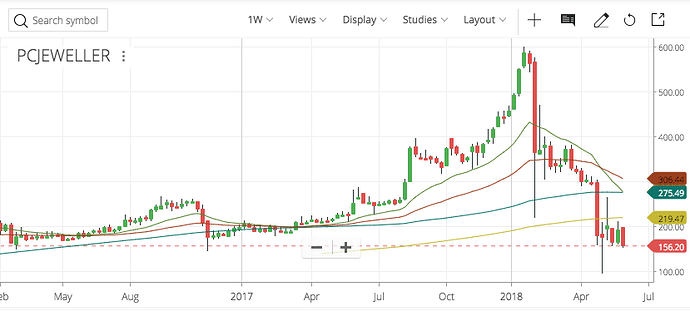

PC Jeweller - Partner in crime?

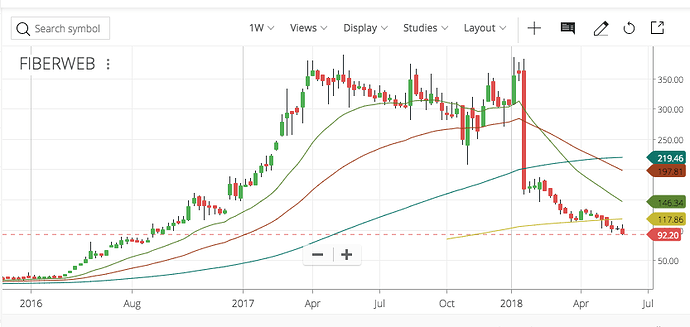

Fiberweb - This reeked a fair bit long before it unravelled. The fiberweb thread is a must visit

Demergers

Demergers and so-called value-unlocking

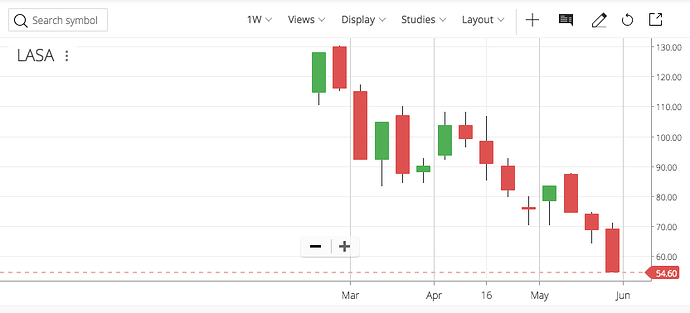

Lasa/OSCL - Hype and possibly seeded conversations. Enough rationale posted in the thread. Things could have turned up for the better at least somewhat had the last quarter numbers not been what it were. That changes everything. This was just an outright con.

Sintex Plastics - Looked way overvalued even at 80 levels in comparison with Nilkamal

Overvalued IPOs

Silly Monks - Was very, very expensive at 150 levels.

Vadivaarhe - The promoter definitely knew he lost a key customer when he went for the IPO. Oh well!

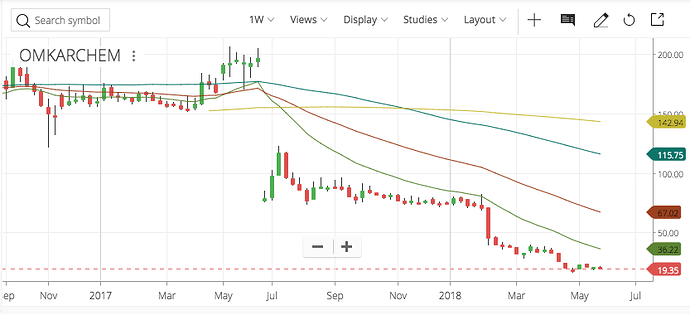

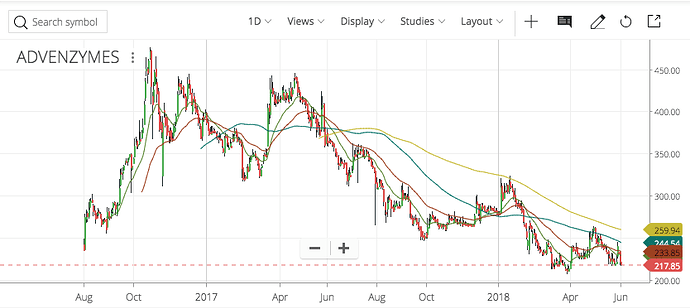

Advanced Enzymes - One of the earliest overvalued IPOs in the list. I liked this company but could never get past the valuations.

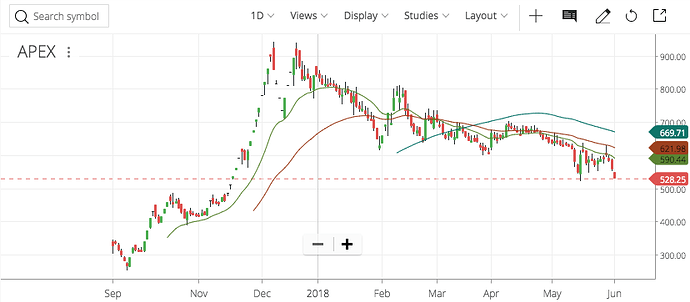

Apex - Right on time to cash in on liquidity and marine products exports peaking

Momentum stocks without momentum (aka Emperor has no clothes)

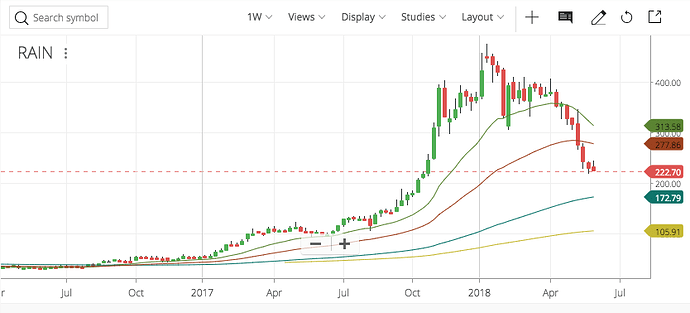

Rain - Down 50% almost

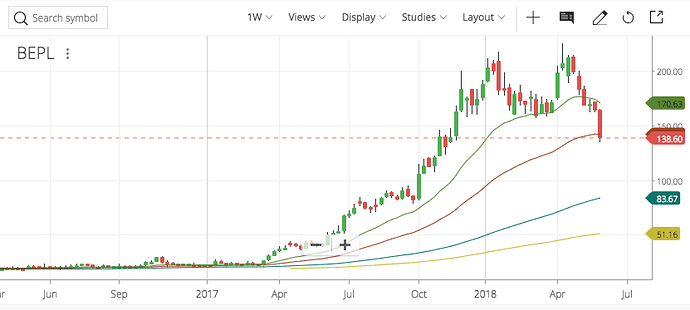

BEPL - Seeing this above 200 was strange

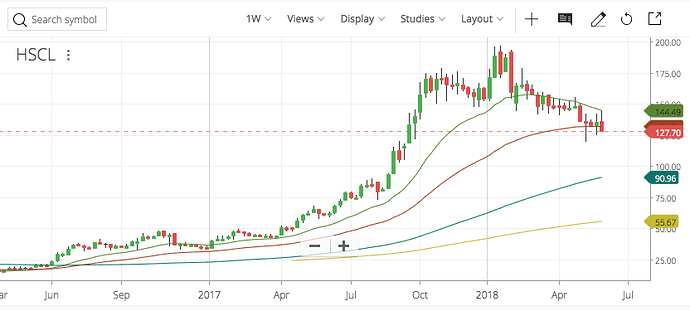

HSCL - This was expensive from the time it crossed 100-120 levels. Went all the way close to 200

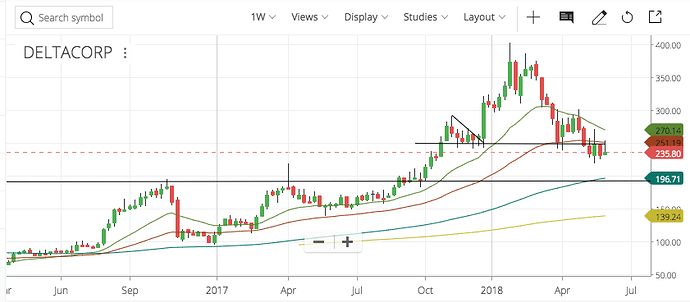

Delta Corp

Just plain pump-and-dump

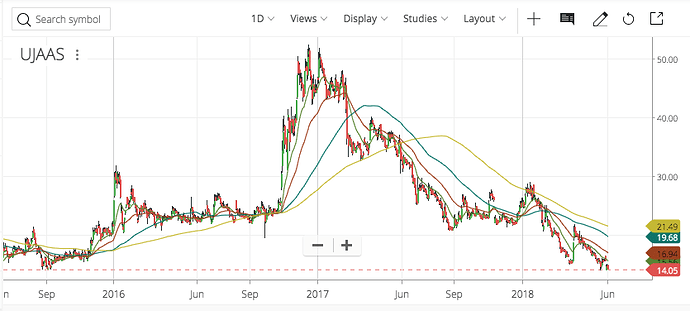

Ujaas Energy - Promoter cashed in nicely at 40 levels. Valuable lesson learned early.

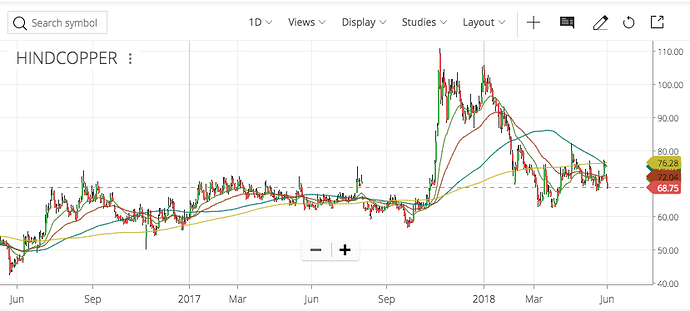

Hind Copper - This had no business riding to 100. Whoever planted media stories of Copper and EV demand and so on was a genius.

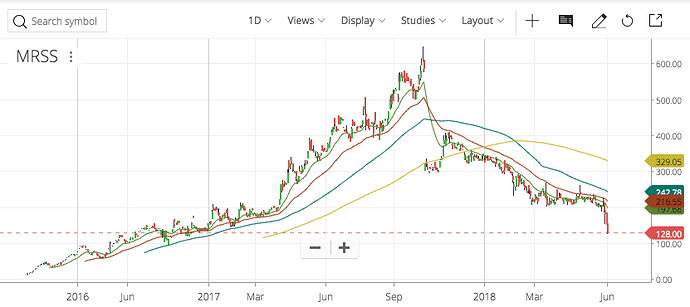

MRSS - Never understood this company. The dispatches in January were a clear red flag.

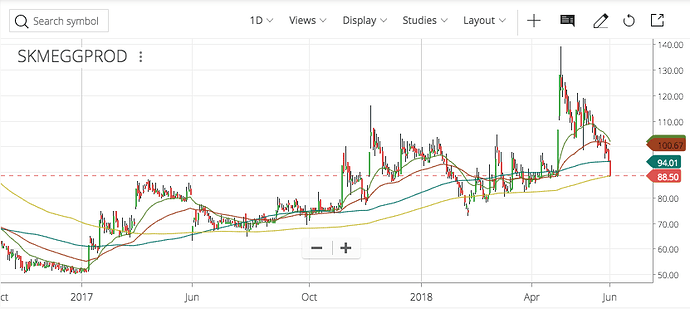

SKM Egg - Lot of reasons given from this turning into FMCG play and so on. Nothing in the numbers to substantiate and the overhang of the related-party promoter entity is yet to be clarified.

Sanwaria - Bizarre dispatches. Results within couple of days of quarters’ ending and shareholding pattern a whole two months later. This had everything.

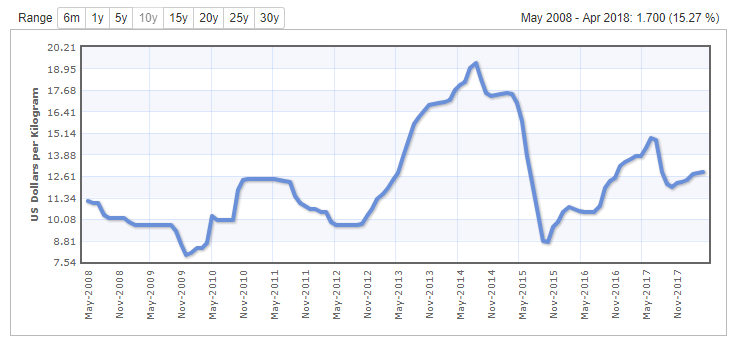

Cyclicals ending badly

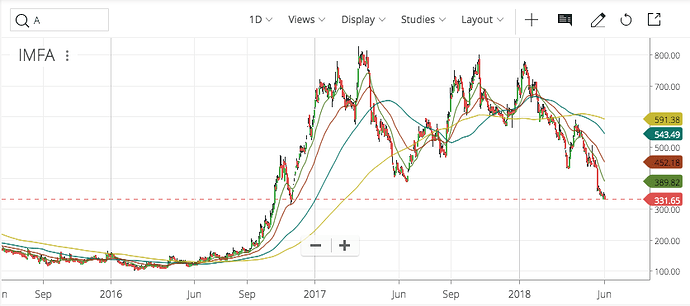

IMFA

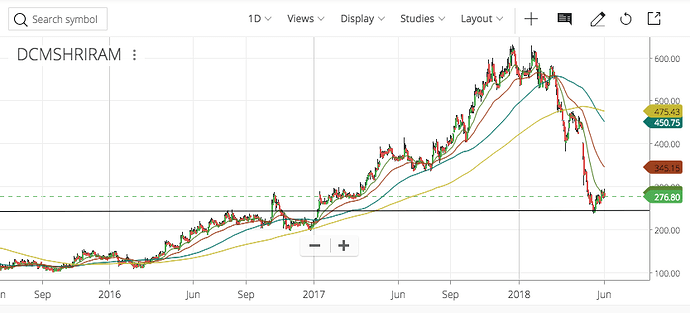

DCM Shriram (and every other Sugar stock)

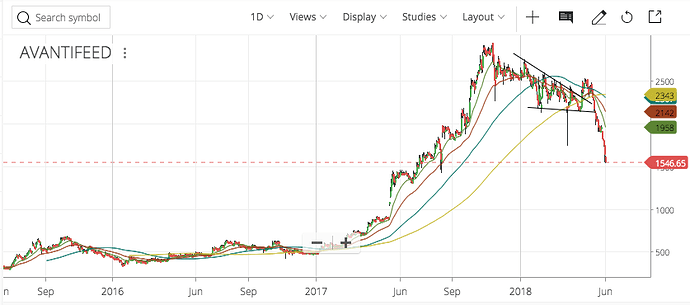

Avanti Feeds/Waterbase

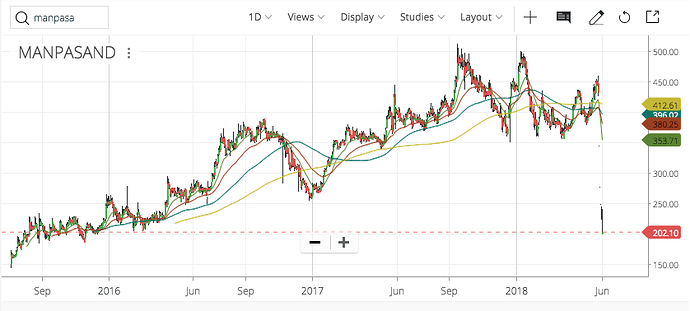

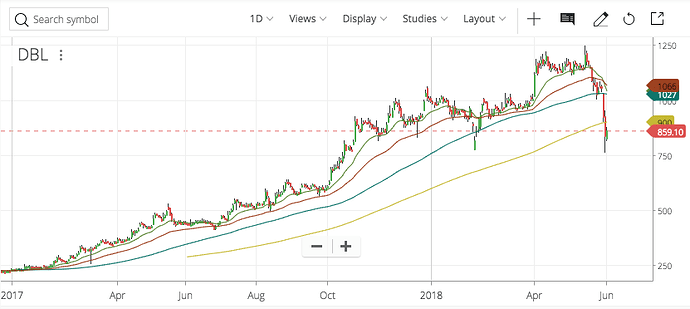

CFO/Auditors resigning

Manpasand

DBL

Miscellaneous

8k Miles

Vikas Ecotech

Nile

Daawat

Chamanlal

Kitex

Suzlon/Inox Wind

I have owned and exited some of these stocks with profits, thanks to trailing stops and some research (Avanti, DCM Shriram, Delta Corp, HSCL, BEPL). Some at a loss due to stop-loss (Ujaas Energy, Suzlon Energy), Some I still hold at a loss (Hind Copper) and some I have bought/buying in SIP post the fall because of attractive valuations (Advanced Enzymes, Inox Wind). I am not trying to paint all these stocks with a broad brush (as fraud or overvalued etc.) but it has been interesting observing what’s transpiring and I think there are big lessons to be learnt to not buy into euphoria as the hangover can be very, very bad. Micro/Small/Midcaps can be great wealth creators but it cuts both ways so it is very important to learn how not to lose money as well.

These are from the stocks I have followed closely. Do add more if I have missed any.