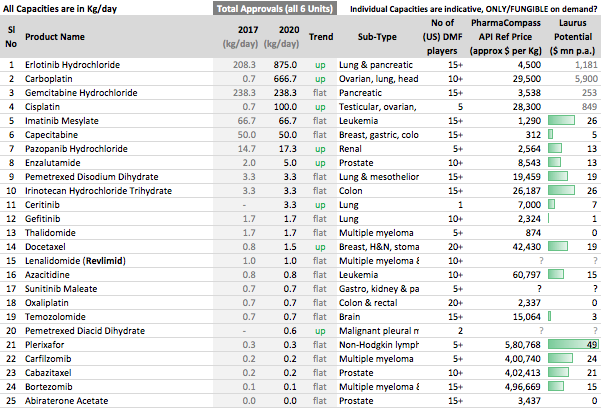

Plank 1: API Opportunities are again mainstream today . Industry opportunities are consolidating. API manufacturers with process/cost efficiencies and scale are taking away larger market share in their key products.

Product Selection philosophy: There are huge opportunities today. But we need to be cautious. Led completely by whether the Management believes they can get to a global leadership position. Global Leadership position implies >25% global market share (eventually)

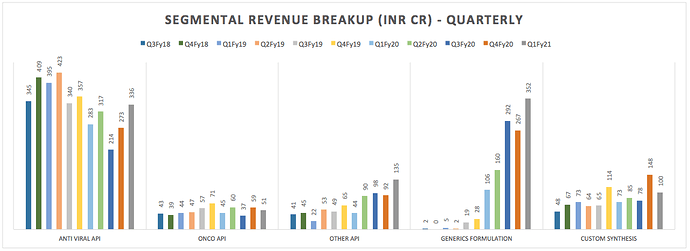

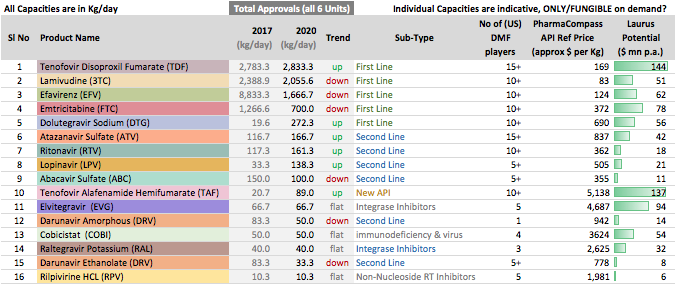

2020 API situation

- Currently, 7 Products enjoying more than 25% global market share

- Another 3 Products enjoying more than 15% global market share

- Working on more than 6 more APIs where Laurus can get to leadership position

-

Confident of at least 15 products > at least 25% global market share in 3-4 years

Source: Management Interview July 31 ET Watch 6:27 Min onward

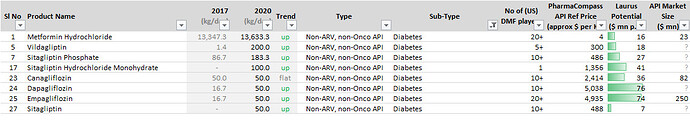

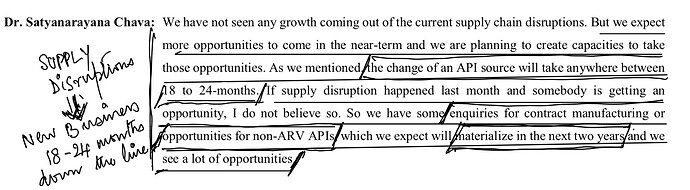

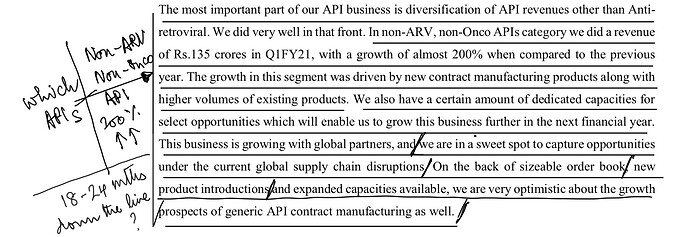

New Opportunities from API Supply Chain disruptions for Laurus - Medium Term Driver

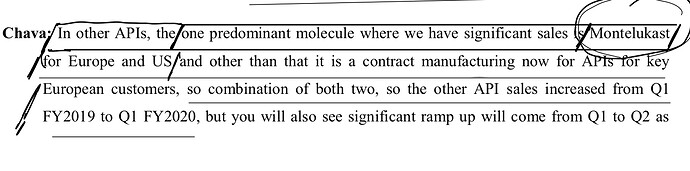

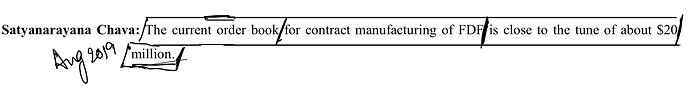

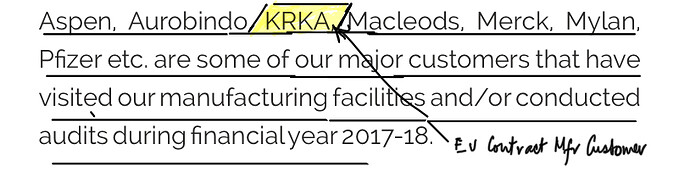

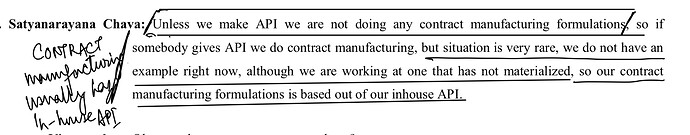

- Concrete interest in Non-ARV APIs and Contract Manufacturing APIs. API Source change takes anywhere between 18-24 months. New business opportunities 2 years down the line. Lot of Opportunities as per Mgmt

There is lot of work we can do take forward these data-points and firmly establish the addressable dominant market share opportunity for Laurus. In ARV, Oncology, Hep C, and other APIs

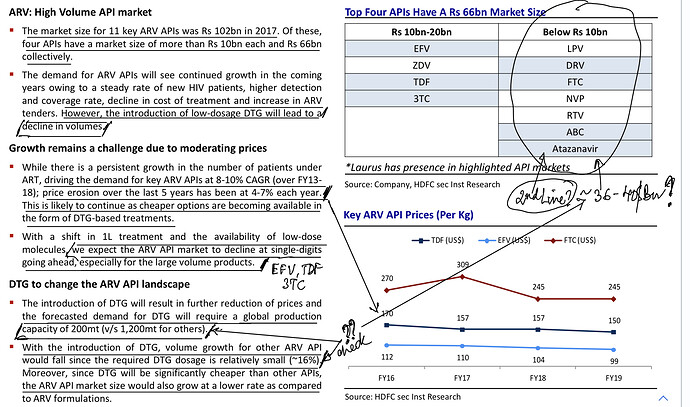

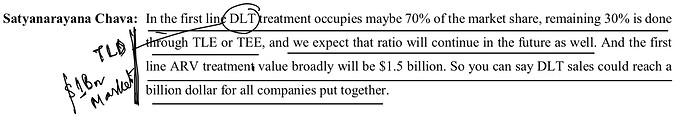

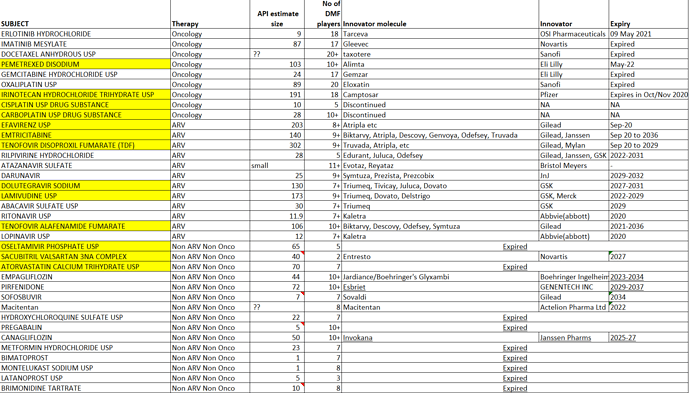

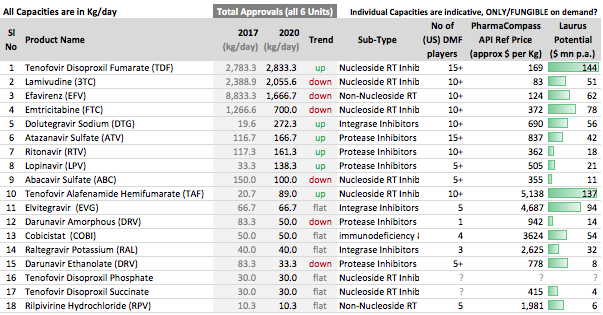

ARV API Track

- Efavirenz (~60% market share)

- Tenofovir (~35% market share)

- Emtricitabine (~25% market share)

slightly dated source: here

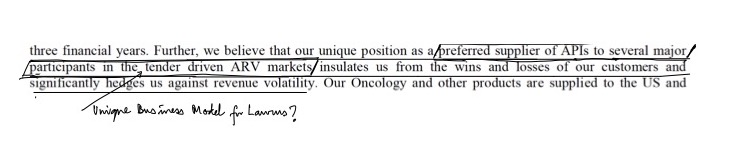

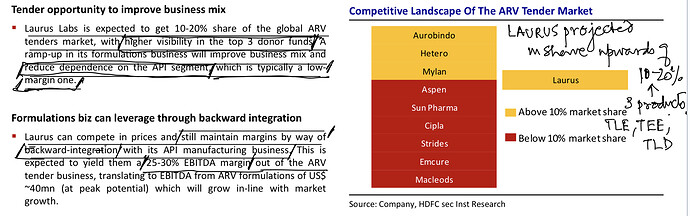

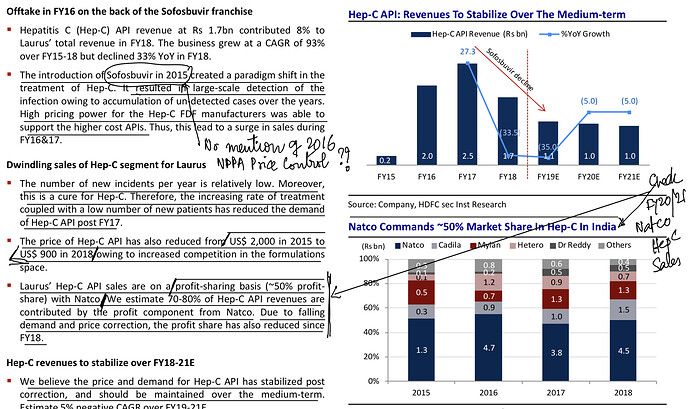

The fact that in ARV Market there is limited competition because products need to be approved by various regulatory agencies, and WHO pre-qualification is required (unlike say Hep C market where anyone can still launch in India by buying API from non-approved sources as well); Global funding that encourages Scale if the required quality is met are big advantages working in favour of Market Leaders.

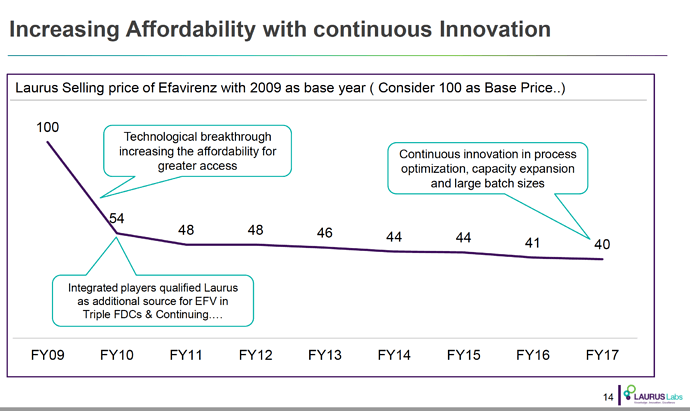

How does Laurus maintain and increase global market share (in the face of stiff global competition)? [source: slightly dated [corporate brochure] presented at IAS Conference, Amsterdam, July 23-27, 2018

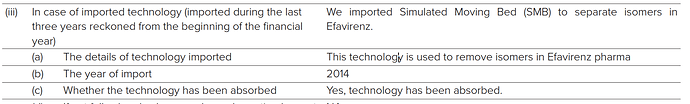

Source: AR 2016

Source: Laurus DRHP

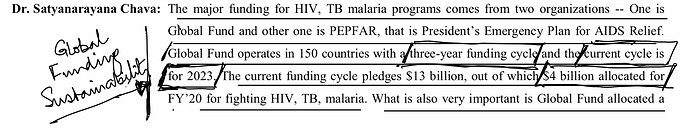

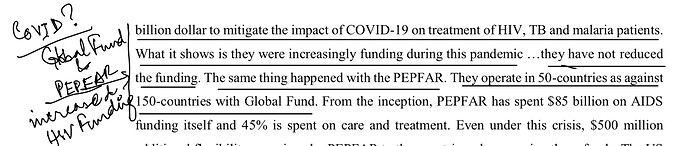

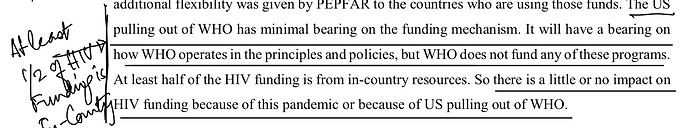

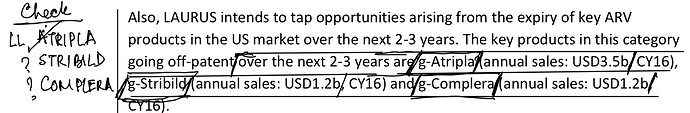

ARV Funding Sustainability

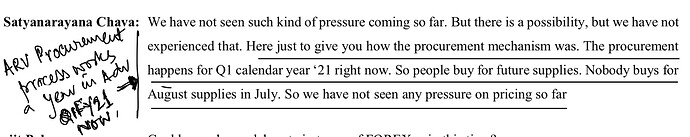

ARV Procurement Mechanism

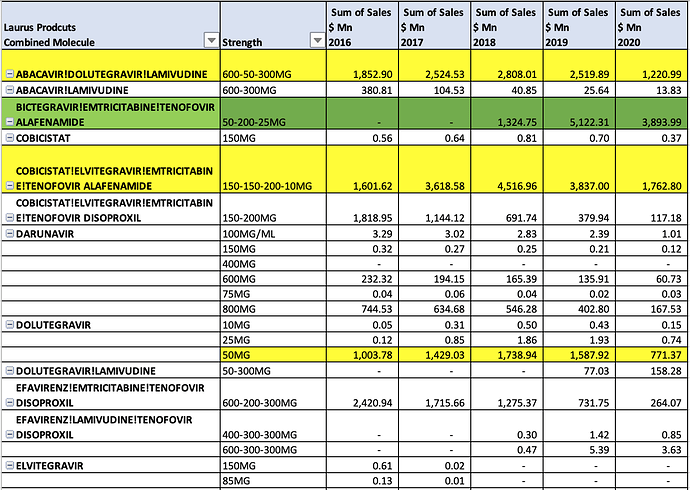

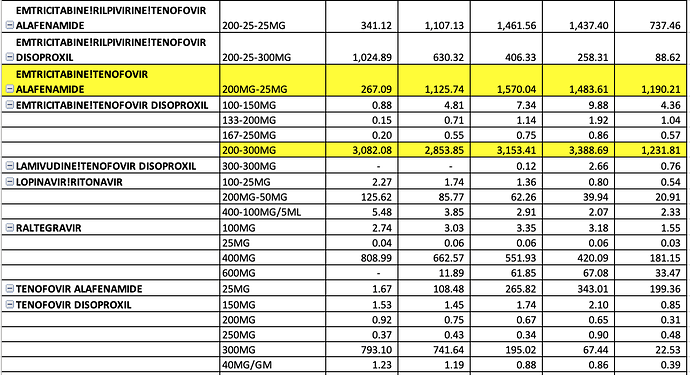

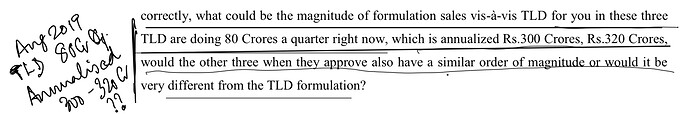

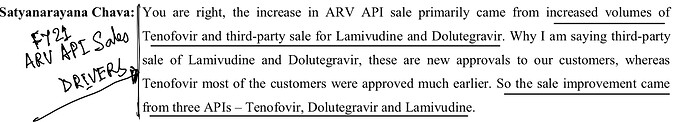

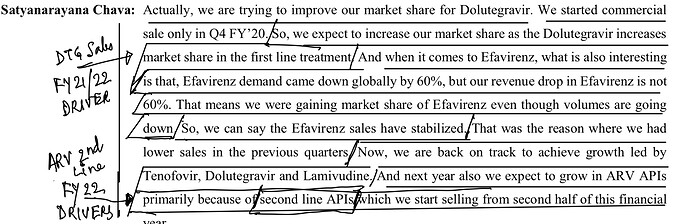

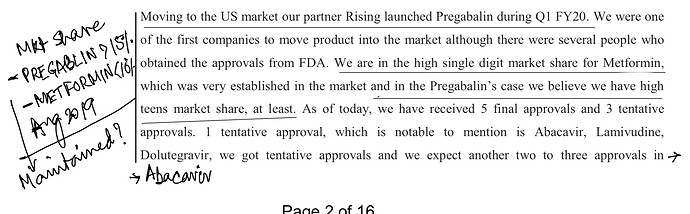

ARV FY20 Sales

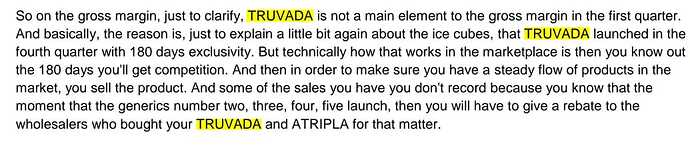

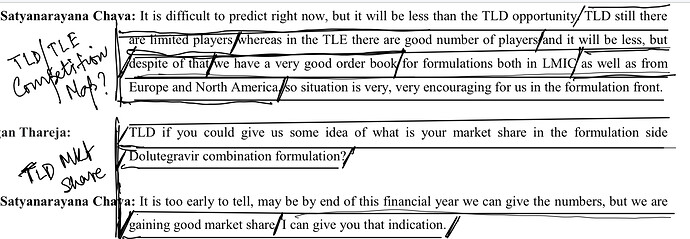

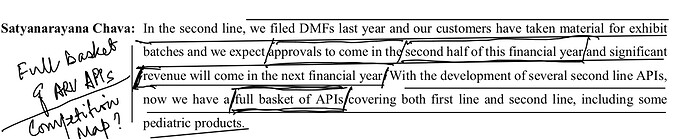

Medium Term ARV API Sales Drivers/Challenges

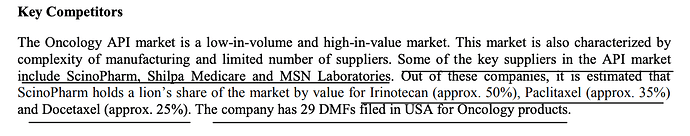

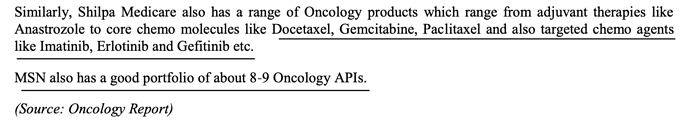

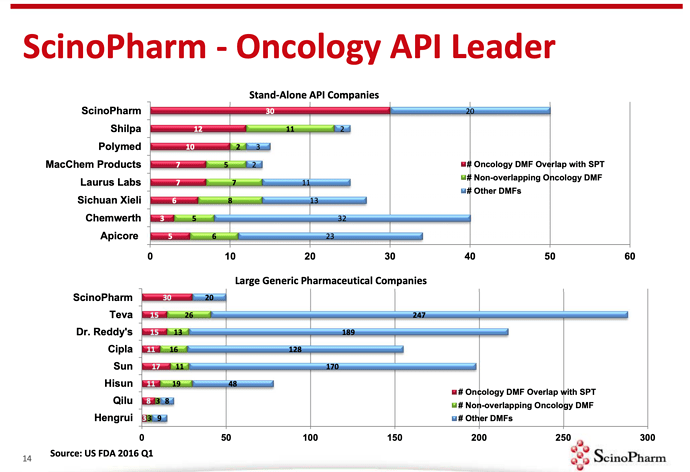

Source: Scinopharm Taiwan [2019 Annual Report]

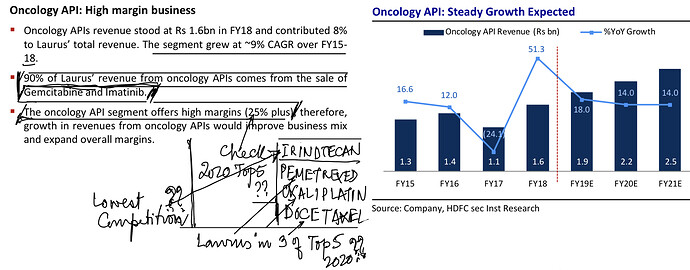

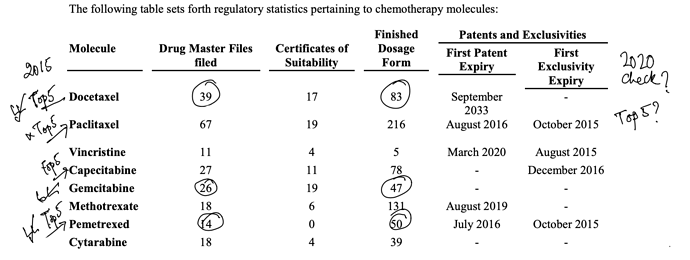

[reportedly with 25%+ market share in multiple Oncology products]

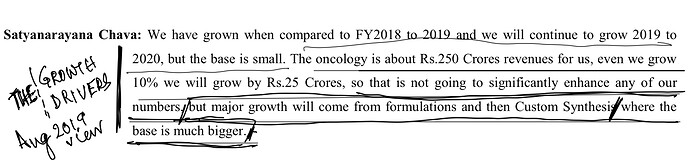

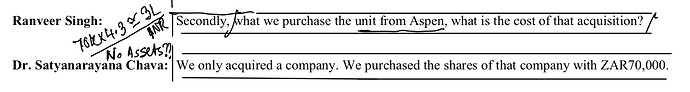

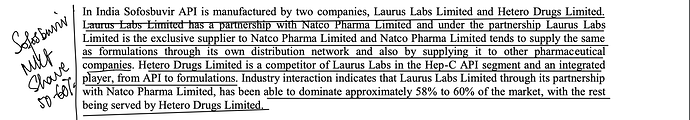

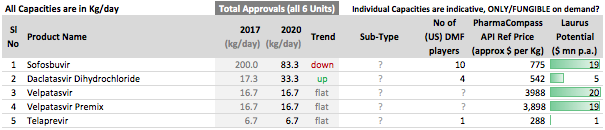

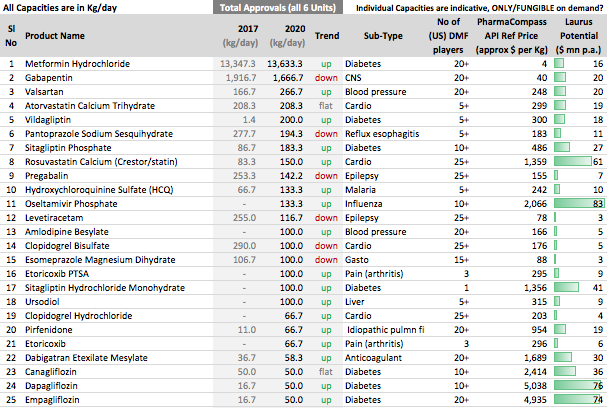

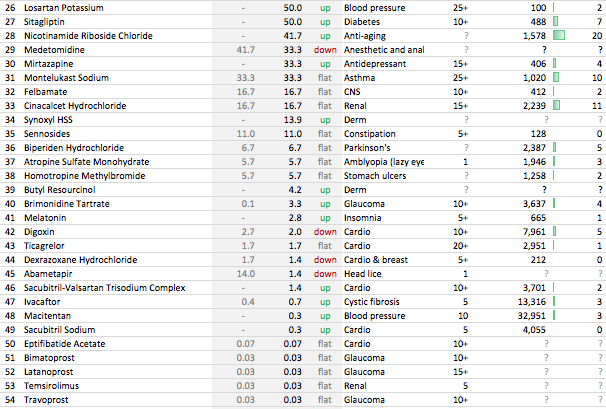

Other API Track

Disclosure: Invested from lower levels. Thanks to the conviction/hard work of @rupeshtatiya and the structural tailwinds for API, it started out as an easy Opportunistic bet in early June. That there was more to the story, became increasingly apparent on richer conversations with believers & skeptics alike. Felt compelled to energise everyone for a more structured deep-dive. Please excuse inevitable mistakes; and allow me couple of days to lay out what excites me about the business. Familiarity with the business is just 2+ months, so look forward to learn from those more familiar, and tracking/invested.

NOT a recommendation. Current levels may not leave much margin of safety. It’s important for us to understand/dissect the fundamentals of the business properly, first.

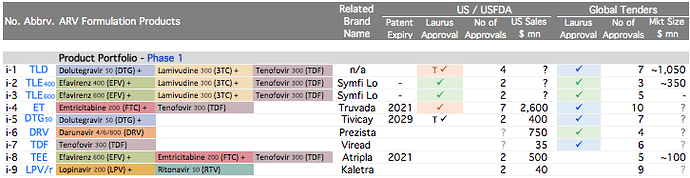

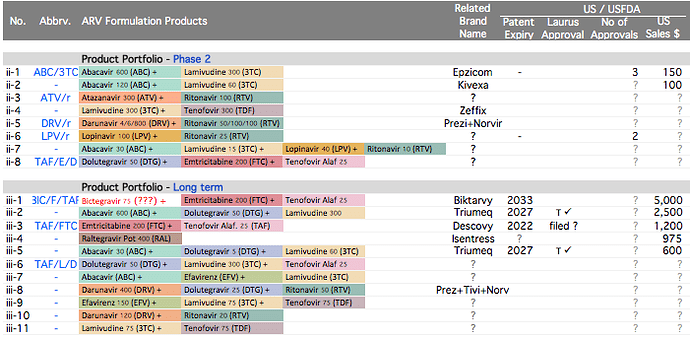

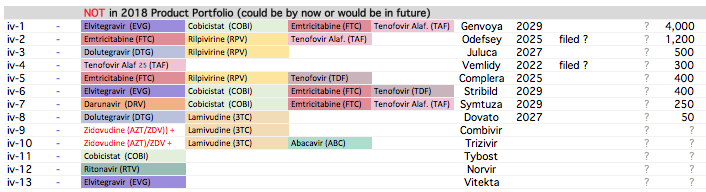

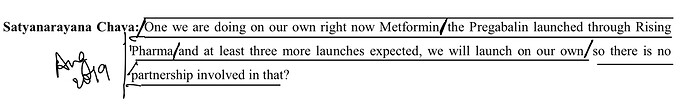

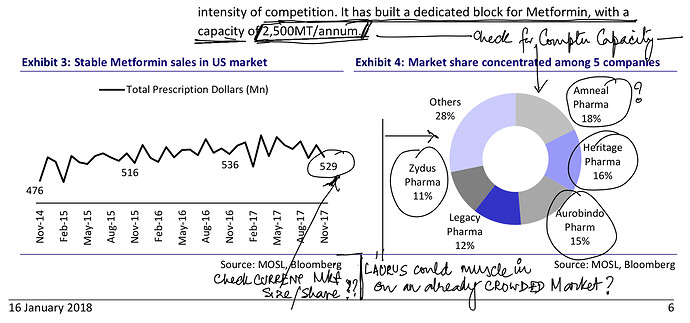

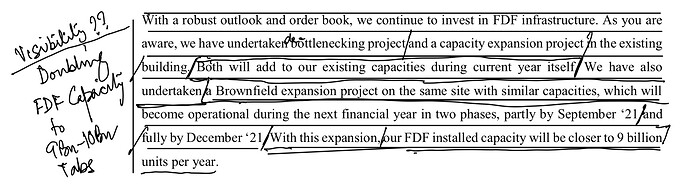

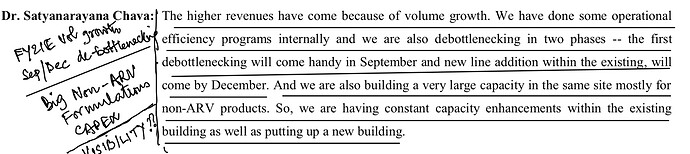

. Interesting ways to handle the trade-offs of (R&D/ANDA Filing/Front-End) Cost vs Opportunity. We have already seen Laurus taking self-confident bets and getting out of many Partnership products. I would think another way the ANDA gaps could be filled up is by buying out Dossiers even (where they are very sure of inherent API strengths, and the Market is LARGE enough). This helps bring everyone on the same page I hope on how important it was to nail down specifics in the above list. (Kudos to the Team again!).

. Interesting ways to handle the trade-offs of (R&D/ANDA Filing/Front-End) Cost vs Opportunity. We have already seen Laurus taking self-confident bets and getting out of many Partnership products. I would think another way the ANDA gaps could be filled up is by buying out Dossiers even (where they are very sure of inherent API strengths, and the Market is LARGE enough). This helps bring everyone on the same page I hope on how important it was to nail down specifics in the above list. (Kudos to the Team again!).