Thought of sharing this presentation first (which could be easily sanitised) for Public Consumption.

Received many questions on why I find it easy to average up? Why there is no price anchoring, and what’s the TRICK?

My!! - from my perspective actually once you really understand your business, it is the easiest thing in the world - just as simply as Mr D explained it to me in 2010 (as captured in the Capital Allocation thread), I just put complete faith and executed on it. Of course, Proof of the Pudding is in the Eating. Businesses where we hypothesised should execute well, continued to do so; no adverse developments/headwinds took place in the industry, etc. for any of these businesses, in the initial years from 2010-2014.

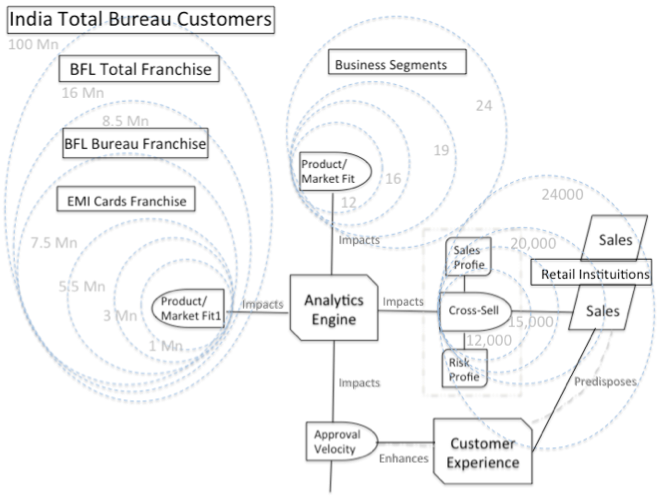

To come back to topic, if you work very hard at laying out the moving parts of a business model, ONLY THEN will you KNOW IF YOU UNDERSTAND the business. You will be able to explain the business issues/dynamics using very few words (3-4 paras at most); You will be able to transfer your CONVICTION to others much more easily with just a few KEY INSIGHTS. You will know what to look for to answer the question if things are getting better or worse, in other words the KEY MONITORABLES.

If you are thus armed, it is easy for you to measure objectively if your favourite business is GETTING STRONGER every year (or weaker). In my experience, that is the ONLY SURE-FIRE WAY to know when to AVERAGE UP, and HOW STRONGLY - just as strongly as your CONVICTION soars!!

Self-Reinforcing_Business_Model_Scrutiny_Framework.pdf (1.6 MB)

Here’s how this is all demystified.

Curious, wanna put up your hand and learn? Go through this, and start contacting Rohit Ojha, Sandeep Patel and/or Dhwanil Desai - who may like to help you think through this for your favourite business.

Very few folks do put their hands up for HARD THINKING WORK. The above mentioned are the guys who did make starting attempts. Am hoping some of you aspiring to know more of this simple learnable ART, will get infected vigorously by this, and get into ACTION!!!

We need to train our minds to think through in a structured manner. It takes some time to get used to thinking in this manner. Even I struggled for almost 1.5 months before I could capture things as succinctly, as above. But once you start thinking like this, you will be hooked - I can guarantee that.

; Go THINK - Don’t come back till you can explain.

; Go THINK - Don’t come back till you can explain. , such a tepid response to something that I had worked very hard to abstract and de-mystify to such a level that everyone GETS it, left me a bit unsure.

, such a tepid response to something that I had worked very hard to abstract and de-mystify to such a level that everyone GETS it, left me a bit unsure.