Company Introduction:

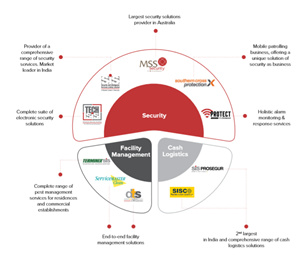

• SIS is India’s second largest and fastest growing security services company, 2nd largest cash logistic company and 3rd largest facility management

company in India. Also, the company is also the largest security services company in Australia through its subsidiary, MSS (acquired in 2008) with market share of 21%.

• Company came with an IPO last year

• Below snippets provide a details of company business

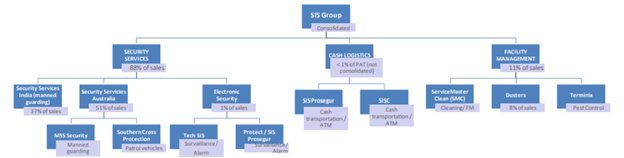

Company structure:

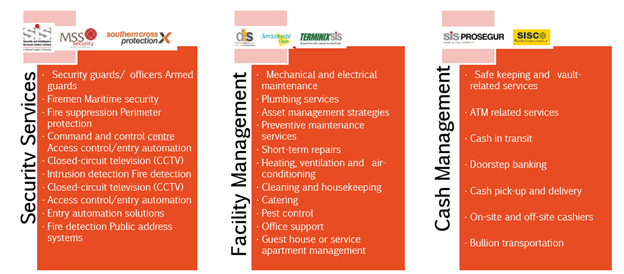

Services Offered:

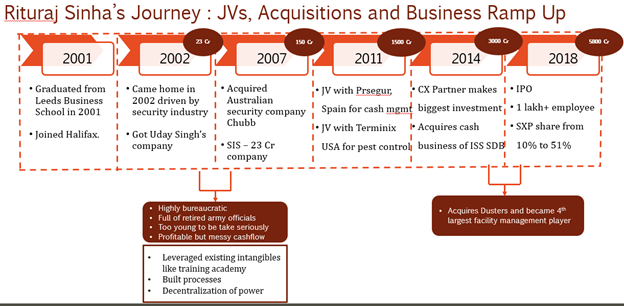

Company’s Journey:

The below table provides details of company’s journey and how it has evolved

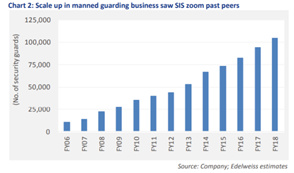

The company has scaled up its operation by adding security guards year after year and has a national presence

Below graphs provide information about historical evolution of the company

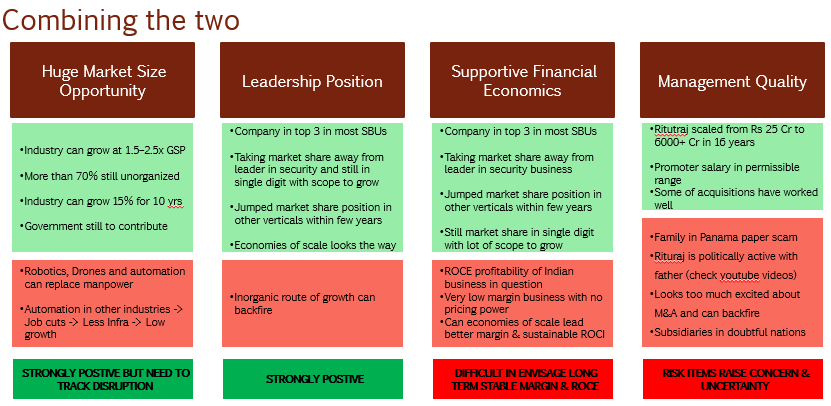

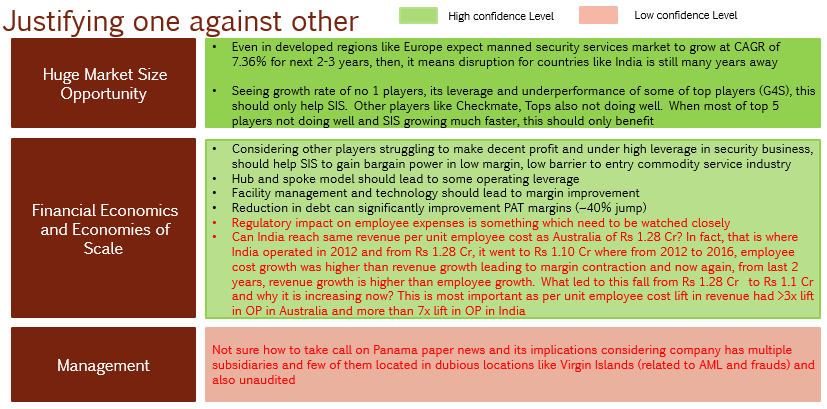

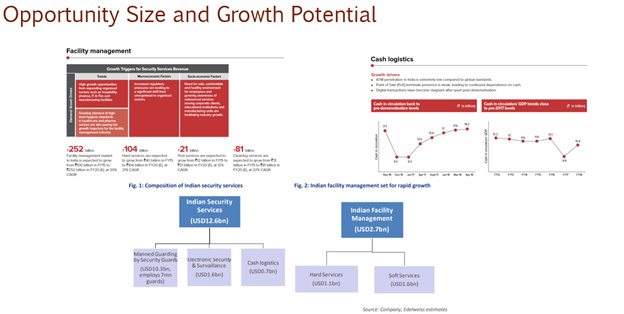

Market Size Opportunity:

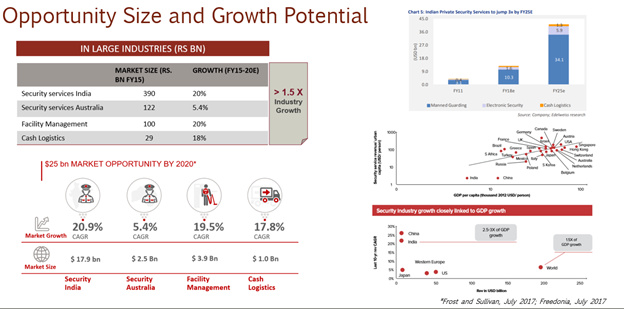

Company operates in manpower industry focusing on security management in India and Australia, Facility Management and Csh Logistics in India. In one of previous blog/post, I had written about market size opportunity which is available here:

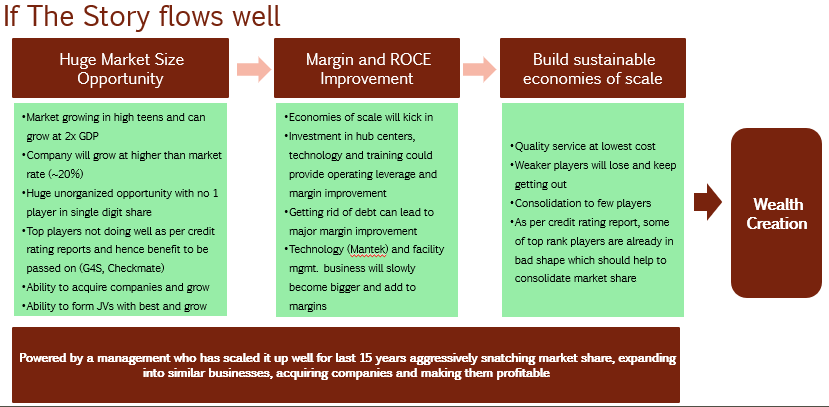

In summary Rs 150000 Crore market size opportunity is open for company where company has currently 3% market share being in top 3 in each of the businesses. Also, there is an unorganized to organized shift also happening apart from high double digit growth of the industry in most of the business verticals except cash logistics which is undergoing a slowdown

The Jockey:

The company is driven by Rituraj Sinha who is son of a BJP politician (well reputed and father has no involvement in business now). I came across his profile while reading this book “The Consolidators” and this is an inspirational story for what he has achieved in last 15 years at young age of 36. However, it also highlights his risk taking abilities which has worked so far but something to be cautious about

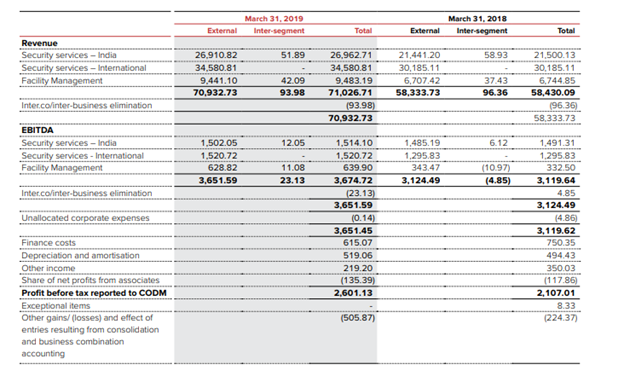

Financial Performance

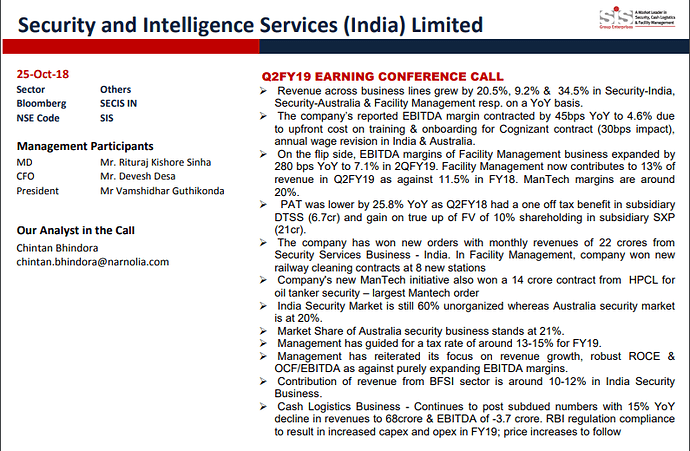

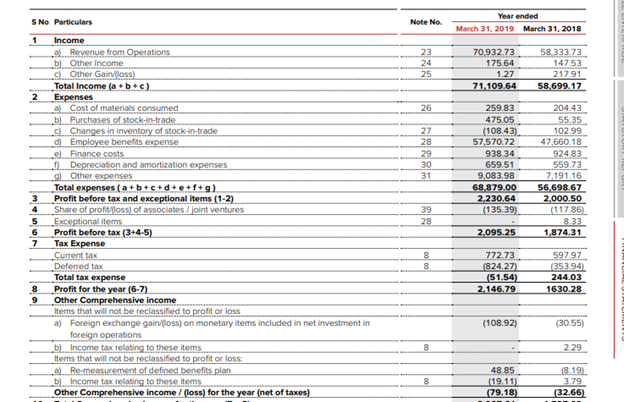

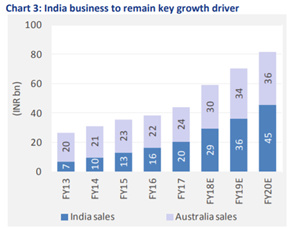

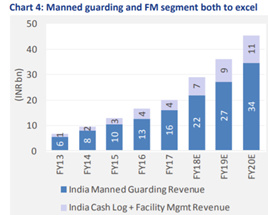

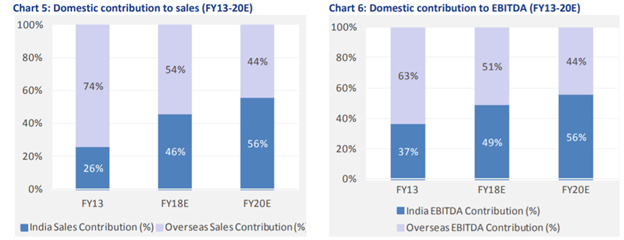

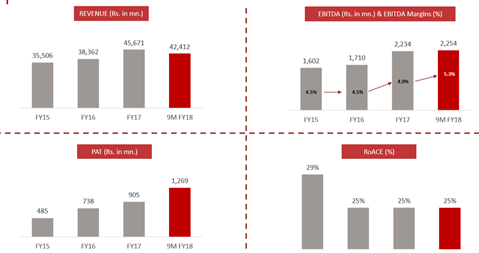

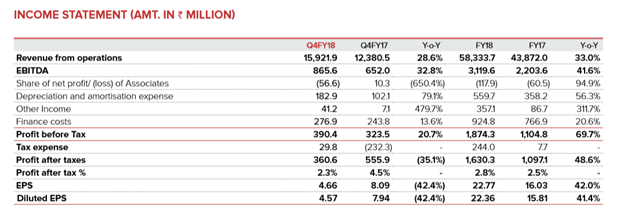

The company has been able to grow its topline and bottom line through both organic as well as inorganic mode with a healthy double digit growth rate. Also, slowly the share of Indian business is increasing compared to Australian business

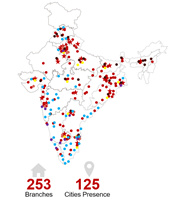

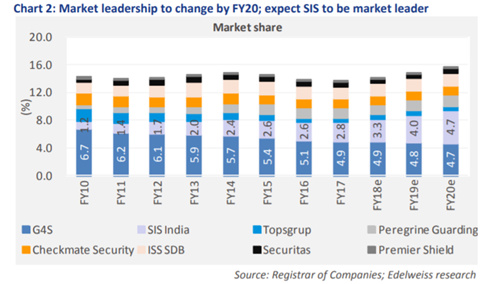

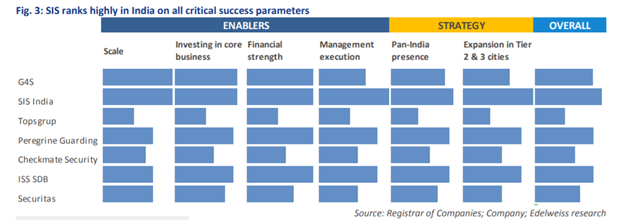

The company has been continuously gaining market share from competitors. Also, credit rating of some of competitors has been deteriorating off late. Company follows a decentralized model with better reach in tier 2 & 3 cities compared to number 1 player

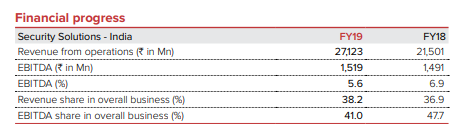

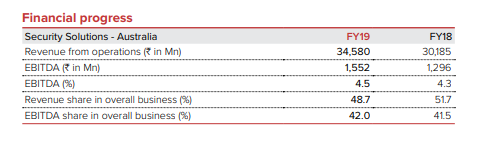

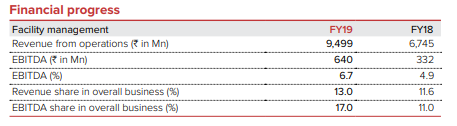

Here is a break up details of each of the business vertical

Security Management Business India

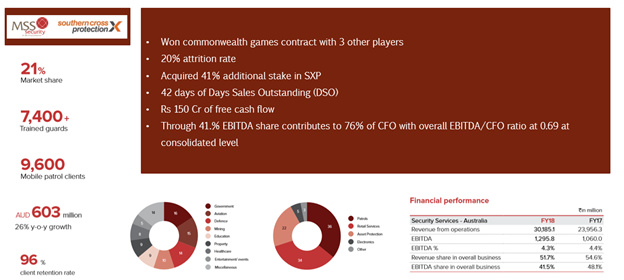

Security Management – Australia

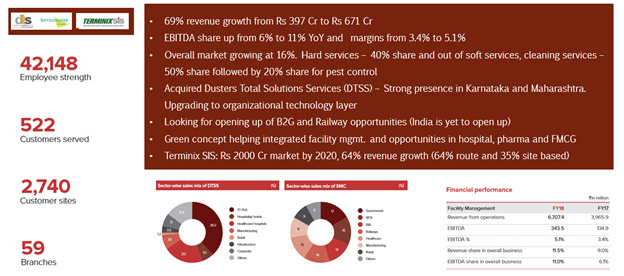

Facility Management – India

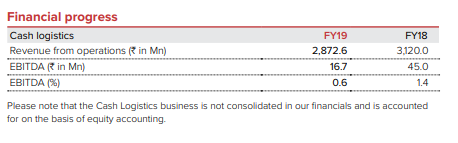

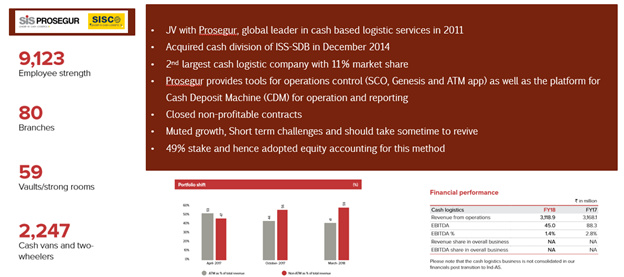

Cash Logistics – India

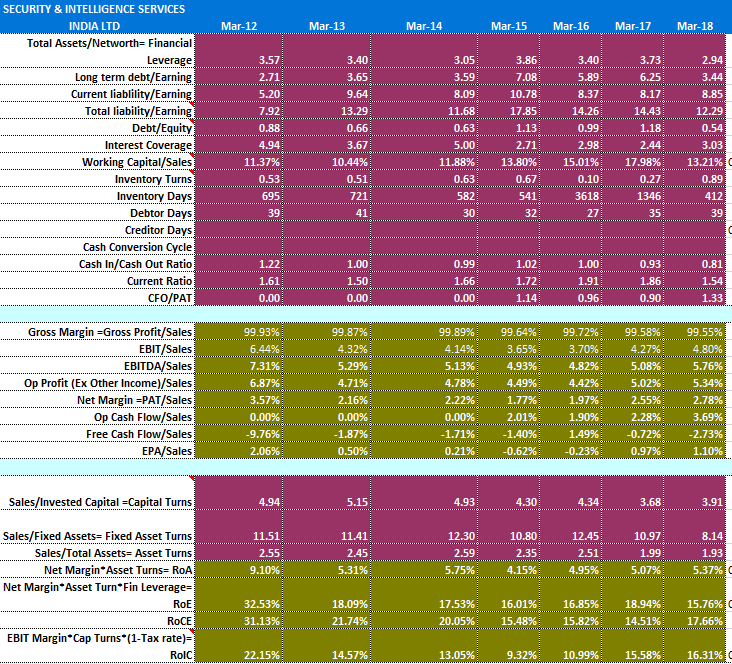

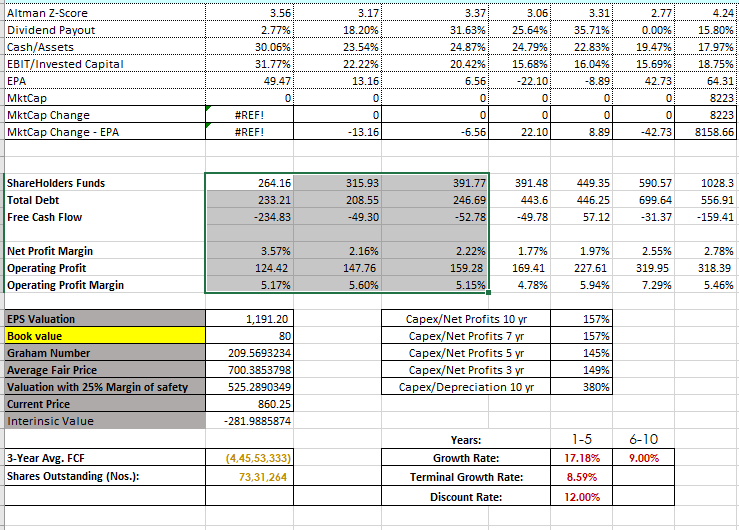

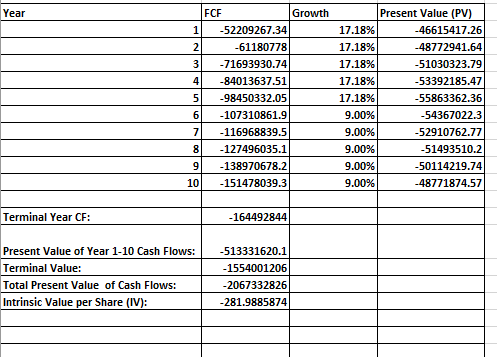

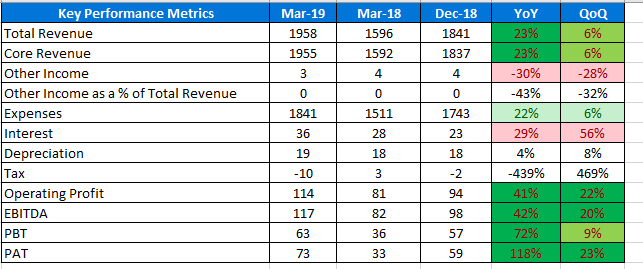

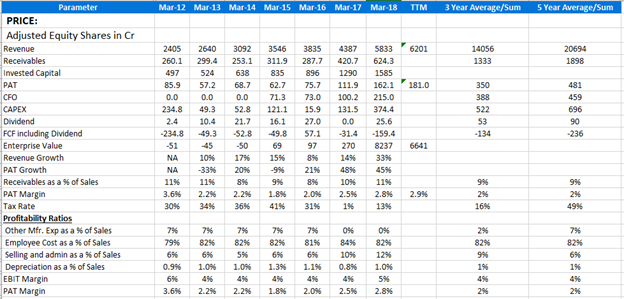

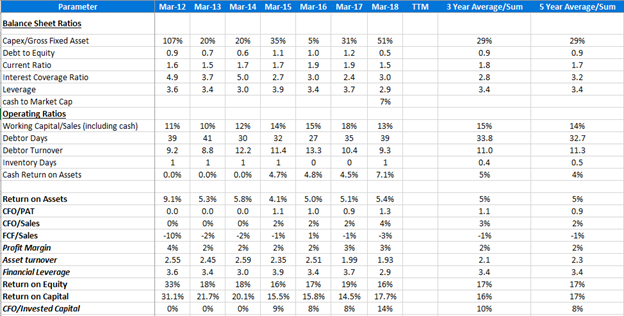

Overall Financial Performance Analysis:

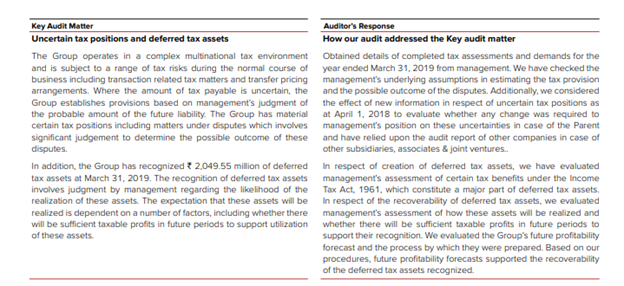

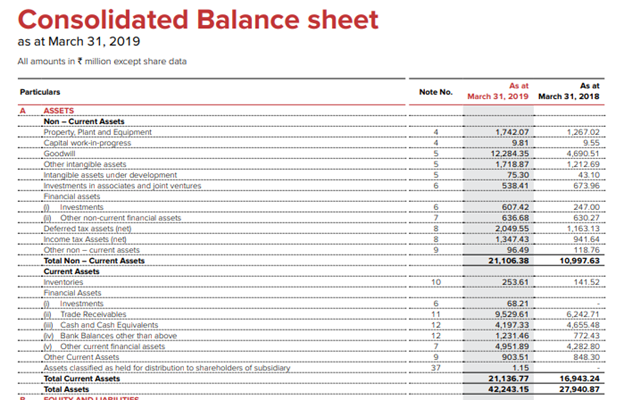

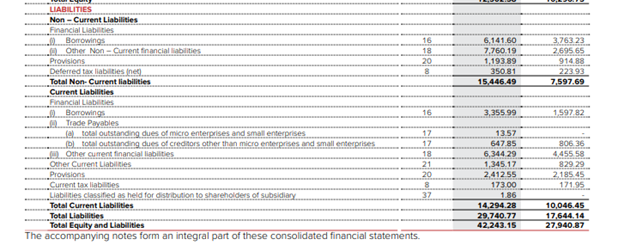

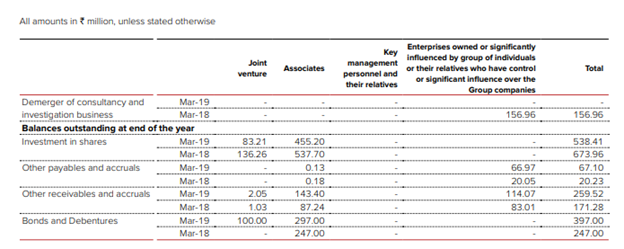

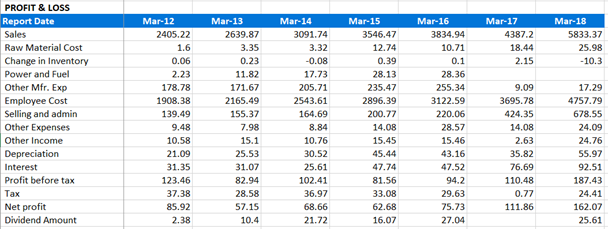

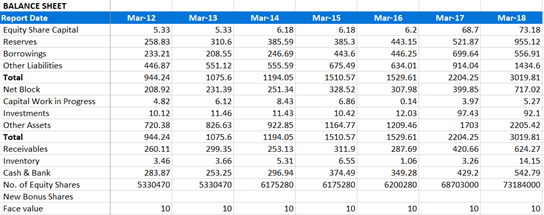

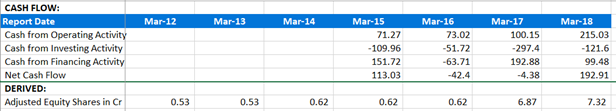

The financial statement details are below:

The key highlights/questions of financial performance analysis are:

- Topline and bottom line growth has been very impressive

- Company has used debt as one of means to grow. However, its leverage position has improved

- Company is generating cashflow from operations which is good

- 600 Cr loan line open from Australian banks

- CFO/EBITDA = 69%

- Acquisitions will be fewer but bigger to fill geographical gaps or capability enhancement

- CFO generated from Indian business is only Rs 75 Cr

- Security SBU contributed 90% in 2016 but every year its share falling by 2%

- Revenue from Australia security is 57% and is falling by 4% every year

- Rs 220 Cr on Rs 1092 Cr capital employed but India contributes only 75 Cr, what is capital employed for India and ROCE? Specially considering Australian share of EBITDA is 48% but CFO IS 66%?

- Share of losses from associate companies should come down slowly

- Interest cost should come down

- Share of high margin businesses is growing

- Economies of scale should help

- Invested capital has doubled in last 2 years on new acquisitions, will it lead to better profitability?

- Margins increasing YoY but will it go up?

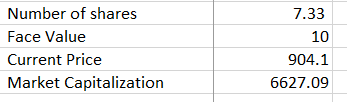

- Given scope for margin improvement and growth opportunity in terms of market size, is 30 times valuations too high considering the cash profit discrepancy between Indian and Australian business

- Why return on capital numbers not matching?

- Why tax paid was lower in recent years?

Other Relevant Information:

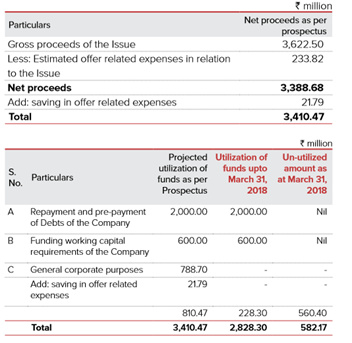

IPO Fund usage:

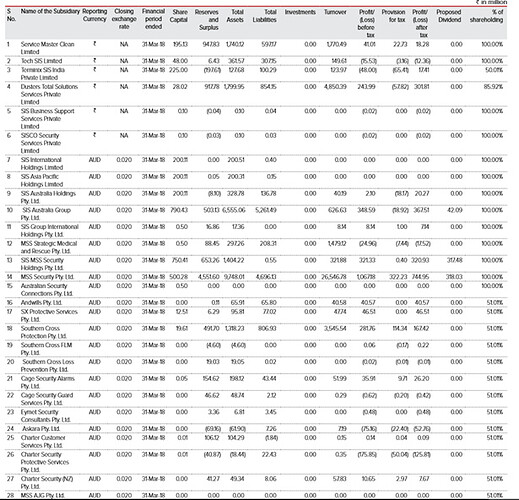

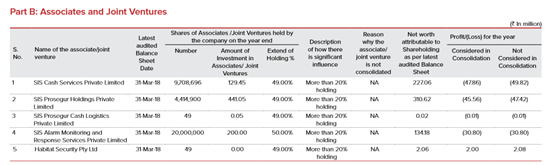

Subsidiary and JVs:

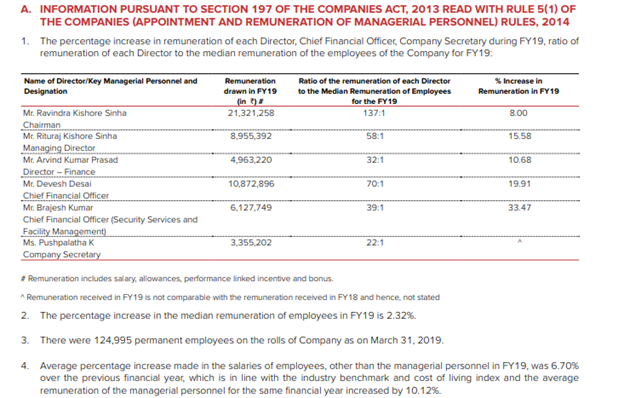

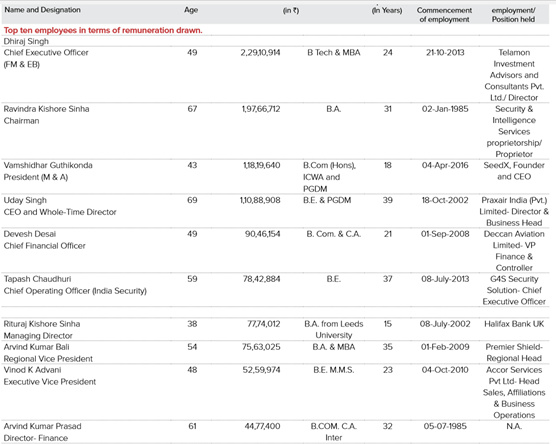

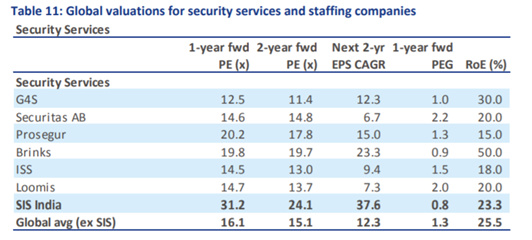

Management Remuneration:

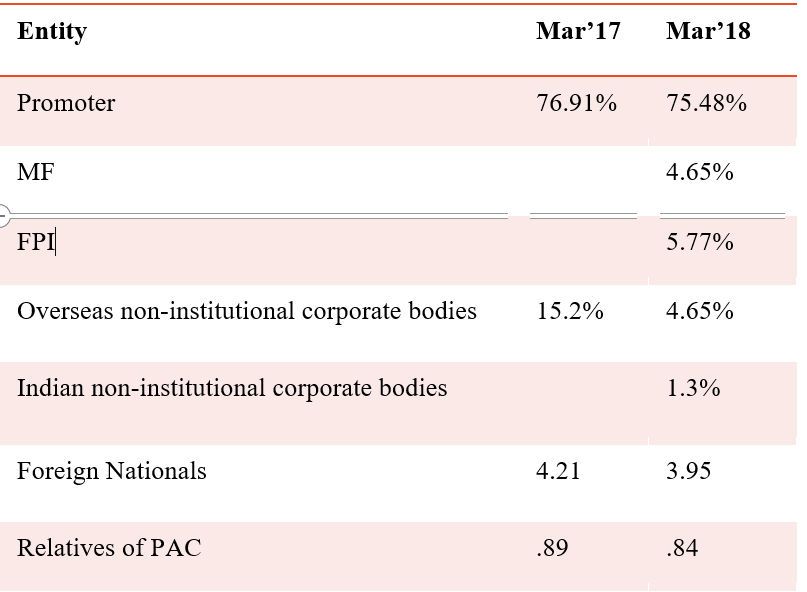

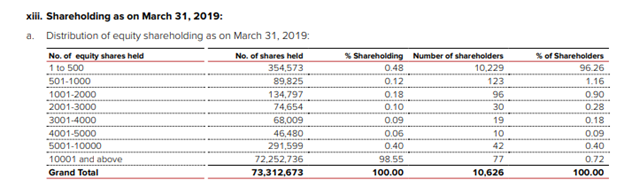

Shareholding Pattern:

Other Key Points:

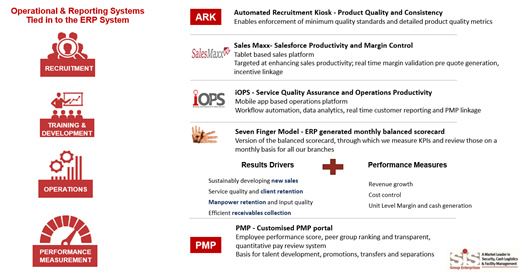

• ‘Man Tech’ services is adding human+technology, the solution aspect of security

• 2nd largest security provider , still, 3.5% market share

• Attrition down from 50% to 20%

• Some of top players not doing well as per credit rating report and SIS snatching market share

• Graduate Trainee Officer (GTO) – 6 month training

• 19 training institutes with 25000 capacity

• Revenue from Australia security is 57% and is falling by 4% every year

Opportunities:

• Australian business generating free cash flow of Rs 150 Cr

• Operating leverage possibilities in Indian security and higher margin facility management business

• Economies of scale possibility reflected in margin improvement

• Huge market size opportunities with high growth rate and unorganized to organized shift (PSARA act)

• Young and able promoter who is snatching market share from competition

• Increasing role of technology and service layer

• Ability to form JV with some of best international players

• Some of competitors not doing well which can benefit company (https://www.icra.in/Rationale/GetRationaleFile/63102~Tops%20Security%20%20-R-06102017.pdf)

Risks:

• Low margin and low barrier to entry business

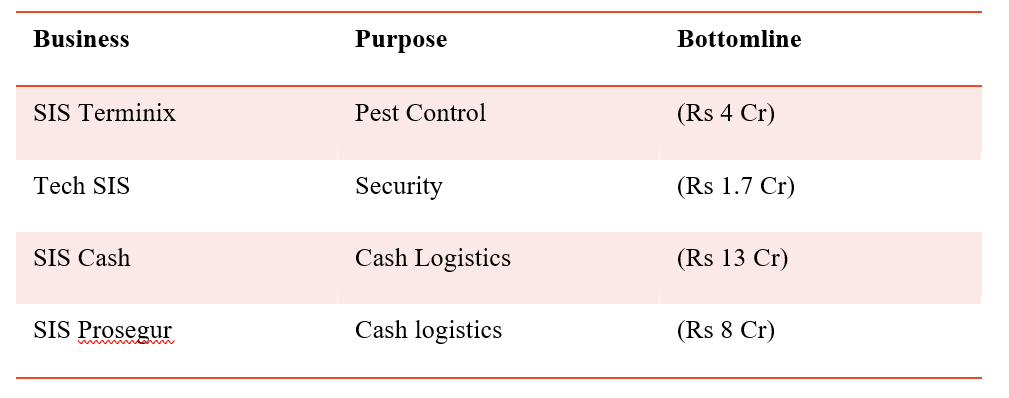

• Indian security business on a revenue of Rs 2144 Cr has made hardly 15 Cr cash profit and Rs 65 Cr accounting profit. So, basically, most of cash profit is coming from Australian security business or facility management business. So, Is Indian security business worth consideration despite of all growth projections? Also, loss making subsidiaries

• Auditors have not audited foreign subsidiaries which includes Australian business which is a major cash profit contributor

• Provisions as a % of PAT seems very high, getting rid of unviable contracts

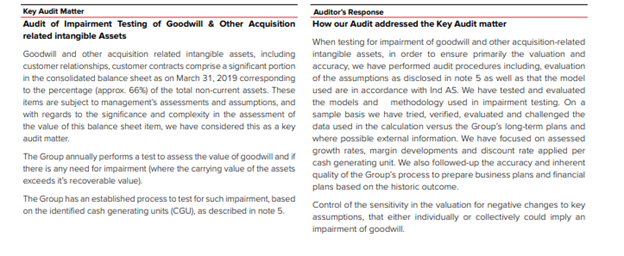

• Bulk of balance sheet asset is goodwill acquired from multiple acquisitions

• Company has historically used debt as a vehicle for acquisition

• Not sure if company has adequately hedged the loans it has taken from Australian sources

• Possibility for recession in Australia

• Operational, reputational and political risk

• RBI regulations on cash logistics business will lead to higher cost on security related expenses and hence may not give adequate profitability. Also ATM installations stagnant and pricing pressure increasing

• Aggressive acquisition history

• High attrition industry and company’s attrition is 20%

• Litigations related to labor laws (Rs 20 Cr quantitative impact)

• Regulatory wage hike

• Dependence on JVs and partners to grow

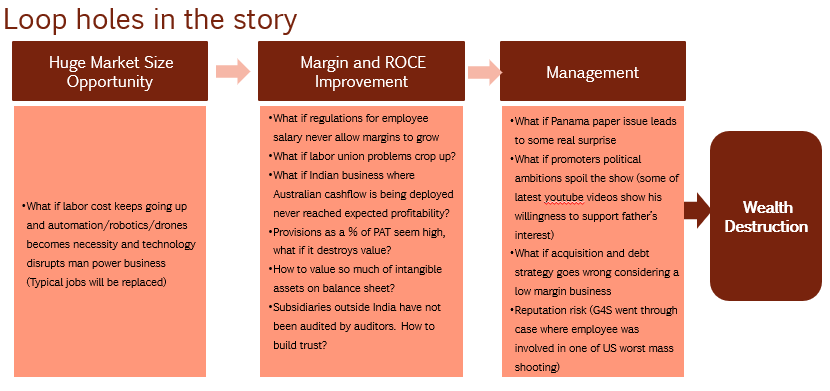

Overall Summary:

• In India, it is a high growing industry (15-20% CAGR) which is still highly non-complaint and unorganized

• Very less entry barrier and very less margins

• Relatively, facility management area seems to be a better area and has higher

• Catering management is another emerging industry ($B dollar businesses in developed nations like Sodexo, Compass group) with better financial ratios slowly picking up in India

• Security management is a low margin business where market leaders are trying to add technology services layer over pureplay manpower. Economies of scale might lead to margin gains

• Formalization of economy, compliance, PSARA act etc. might give additional benefit to organized players

• Compliant players are gaining market share. Government (specially Railways) could be a big opportunity

Valuation Rationale:

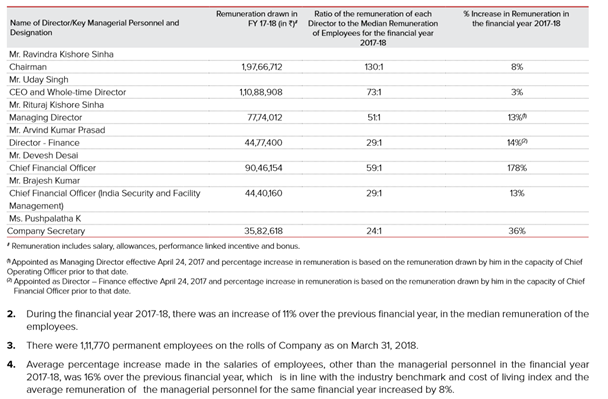

• For global staffing companies, the average one‐year forward PE is 15.5x, while EPS CAGR stands at only 9% (PEG of 2.1x).

• In this context, considering that TeamLease and Quess are estimated to clock 24‐31% EPS CAGR, their PE multiples of 33‐35x (PEG of 1.1‐1.4x) are not expensive, in our view.

• Also, RoEs of Indian and global companies are similar and hence the high growth in India justifies our implied target multiples.

Current price is almost 25% down from the above analysis done by Edelweiss. However, I believe that there are critical questions on overall business model viability and sustainability which are still open and need to be addressed before doing any kind of valuation exercise.

Key Questions for Management:

-

Indian security business on a revenue of Rs 2144 Cr has made hardly 15 Cr cash profit and Rs 65 Cr accounting profit. So, basically, most of cash profit is coming from Australian security business or facility management business. So, Is Indian security business worth consideration despite of all growth projections? Why Indian security working at <1% cash profit which means very poor return on capital?

-

Status of loss making subsidiaries

-

Auditors have not audited foreign subsidiaries which includes Australian business which is a major cash profit contributor

-

Provisions as a % of PAT seems very high, getting rid of unviable contracts

-

Fixed cost of branch and hub opening (capex fixed + fixed nature in opex)

-

Optimum revenue limit at branch range

-

Bulk of balance sheet asset is goodwill acquired from multiple acquisitions

-

Company has historically used debt as a vehicle for acquisition

-

Not sure if company has adequately hedged the loans it has taken from Australian sources

-

Employee count different, ROCE difference

To do list:

-

Study other companies in similar business : Teamlease, Quess Corp, Apollo Sindoori, Karya Facilities, ANI Integrated Facilities

-

Study JV partners how they have done in respective countries

-

Study world leaders like Sodexo, Compass Group

Disclosure:

I have a tracking position in this stock and this is still under study