Hi everyone,

While I joined this forum only in December 2019, I have been an avid reader since a year now. I will talk in different sections about various parts which have shaped my journey as an investor to make this thread structured.

Brief history on my evolution as an investor

Started out investing in Mutual funds. Realized that the structure makes it susceptible to being exposed to the worst of investing biases and the incentives also do not align with the investor. Read a bit about investing. The intelligent investor was my first book. I would not add each and every book here but suffice to say, I was extremely inspired by the success of Warren Buffett and many others like him. Wanted to at least emulate a fraction of their investing success. Started out building my own tools which are equivalent of screener. I wrote some scripts to download company info from the website moneyworks4me. Used a simple projection of past eps growth into the future. Calculated the discount to current value. Invested on that basis. Did not understand the concept of quality of earnings. Concept of owner’s earnings. Concept of cash flows. Concept of “just because it grew X% in the past it does not mean it would continue to do so in the future”. Discovered ValuePickr. To begin with, only followed company specific threads. Even those were very very useful. The amount of, the extent of, the breadth of knowledge and forensic research people had done was inspiring. It inspired me to do the same. I read through and read about valuepickr. Read through all of the “hall of fame” threads and many outside it as well. Slowly understood all the concepts i outlined above. Also learned about wonderful books that I am still reading and learning from. Still learning a lot.

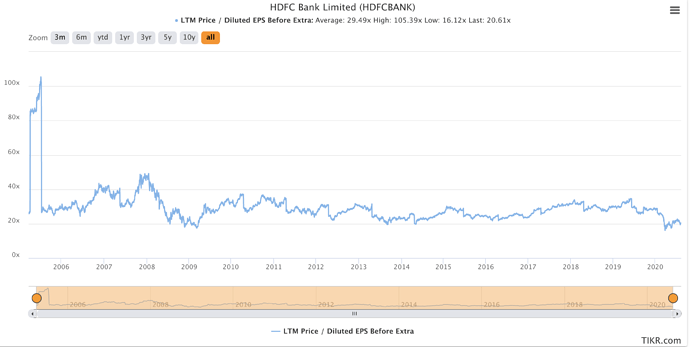

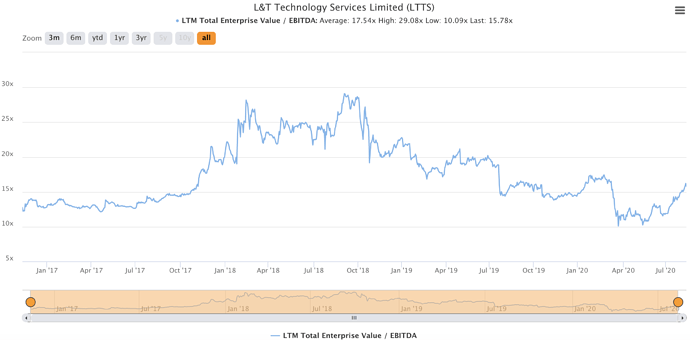

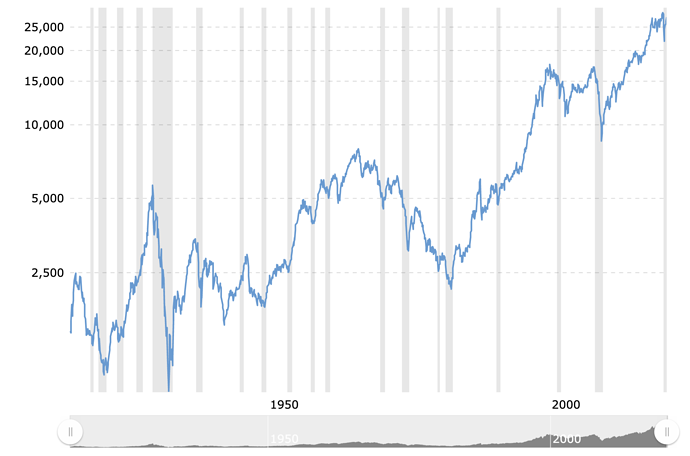

The graph of my understanding and knowledge (including the knowledge about my own lack of skills and knowledge) has really looked like some of these stocks that VP finds and invests in:

Current Investment Process

I generally seek to create good screeners which capture certain “types” of companies and then utilize all tools available to me (Annual Reports, VP threads, AGMs, ConCalls, Conversations with the management) in order to build conviction about investing.

I generally use two types of screeners these days:

- Consistent growers

- Turn-around stories.

I’ve realized that generally speaking, category one is priced well (there are bound to be exceptions). A large fraction of outsized profits and returns are made by finding turn-around stories. These could be company turn-arounds, sector turn-arounds (great thread on cyclical investing: Cyclical investing - case studies) or even country turnarounds. An example screen is here: https://www.screener.in/screens/245381/Sahils-smallcap-ST-or-MT-turnaround-stories. One of the custom screeners I have implemented in google sheets is to combine different valuation techniques to find under-valued companies (rule#1 investing, DCF, Magic Formula). I then go about studying all the 60 or 100 companies which show up, little by little. Starting from their Screener.in pages and going up to their VP threads and Annual reports where necessary.

Note: Not all companies I pick follow this nice process. Certain companies absolutely do not show up on any screeners because the turn-around parameters are not there on screener. I still invest in them when i can build the conviction from following the rest of the process.

Position Sizing

I have also come to realize that outsized returns are made by outsized portfolio allocations. If we simply assign each pick an equal amount of capital, the returns would definitely be good if we pick good stocks, but they won’t be as good as if the portfolio is skewed towards certain companies.

- I also use portfolio sizing to indicate my uncertainty/level of understanding about a business/company.

- Position sizing also depends on the size of opportunity (as i see it)

- the level of under-valuation (industry + company (both) is great, only one of them is good, none of them is bad).

- Sometimes it is a forced function for me. For example, if you see my MF below, my largest position is something i cannot control (that was the minimum quantity I could have bought). As we can see, i’m more comfortable being fluid about position sizing than I am about missing on a goof opportunity.

I also do realize that I do not have any proven track record of investing. For this reason, i only self-manage about 25% of my net worth. The rest is secure into Equity Mutual funds (which i dislike but the good ones generally do not blow up), Liquid Funds and Savings account. Over the next 5-10 years, I would like to grow the 25% up to about 50% where I would leave it until i have at least a 20 years investment record. if i am satisfied with my processes and returns, I would look to move most of my net worth into self-management. But this is a multi-decade process. I would not judge my investment prowess based on 1-year, 2-year or K-month returns. I’m ok with losing the up side because despite what might appear from my stock picks, I’m actually quite a conservative investor (now).

Current Portfolio

| Instrument | Avg. cost | LTP | Net chg. | Percent (Cost basis) | Percent (LTP basis) |

|---|---|---|---|---|---|

| CHEMCRUX | 181.5 | 226.6 | 24.85 | 0.2619843099 | 0.2611003739 |

| CAPLIPOINT | 302.09 | 585.55 | 93.84 | 0.08393937594 | 0.1298800082 |

| IDFCFIRSTB | 23.57 | 28.45 | 20.71 | 0.1343864034 | 0.1294872342 |

| KEI | 302.72 | 377.1 | 24.57 | 0.07712309992 | 0.07669178221 |

| RACLGEAR | 75.98 | 74.1 | -2.48 | 0.07271290079 | 0.05660819726 |

| LINCOLN | 169.96 | 213 | 25.32 | 0.04661213294 | 0.04663165106 |

| BAJFINANCE | 2572.74 | 3466 | 34.72 | 0.04084954626 | 0.04393077164 |

| POLYMED | 330.54 | 407.8 | 23.37 | 0.04055473814 | 0.03994052189 |

| GOLDBEES | 43.92 | 49.17 | 11.95 | 0.03962242042 | 0.03541015386 |

| SIRCA | 198.27 | 230.75 | 16.38 | 0.03720480322 | 0.03456468873 |

| RAIN | 85.71 | 100.1 | 16.79 | 0.03606356926 | 0.03362174305 |

| GAEL | 175.78 | 183.9 | 4.62 | 0.0380591752 | 0.03178488002 |

| NCC | 25.03 | 30.85 | 23.27 | 0.03034860888 | 0.02985946641 |

| LTTS | 1461.57 | 1594 | 9.06 | 0.02953563476 | 0.02571366259 |

| KPRMILL | 456 | 458.55 | 0.56 | 0.01645521285 | 0.01320913244 |

| SHBCLQ | 36.65 | 36.5 | -0.4 | 0.01454806812 | 0.01156573258 |

In this post, I will not talk a lot about individual companies. Happy to discuss in short about specific companies if anyone wants to. IMO more detailed discussions should happen on the specific thread so that everyone can benefit from them :-). For some of the large holdings, one would be able to find my thoughts on the specific company threads. For others, I did not add anything because i did not have anything to add. The forum threads covers the investment thesis beautifully.

Portfolio Goals

Invest in companies with a combination of earnings/sales/cash flow growth and valuation expansion leading to outsized returns. My expectations for the portfolio is to return at least 25% per annum over a long duration (10 years). From my observations, good mutual funds already provide 15-18% over long durations and hence I would discontinue direct stock picking if I think that I cannot achieve a sufficient return over and above mutual funds.

Why I am creating this thread

In order to:

- Seek feedback about every aspect of my processes. Without a healthy dose of criticism, we cannot improve.

- As a public record of my decisions (also doubling up as some sort of an investment journal).

- Give back to this vibrant community (and also myself) by having in-depth discussions with anyone that wants to have one specifically about my decisions (which would enable me to learn more about myself and my processes).

Disclaimer: please do not think of any of this as investment advice. All of these are my personal opinions and I could very well be wrong about any of them. Please consult your financial advisors before investing in anything.

I think it would be best to learn through experience. Thus please do share your progress on a regular basis so that everyone benefits form it. Good luck!

I think it would be best to learn through experience. Thus please do share your progress on a regular basis so that everyone benefits form it. Good luck!