Hi Guys/Gals

This is a CALL for Volunteers who have a natural bent for Excel Number crunching and Visualisation. Macros, and all that charting skills, and data aggregating skills! And want to excel in that!!

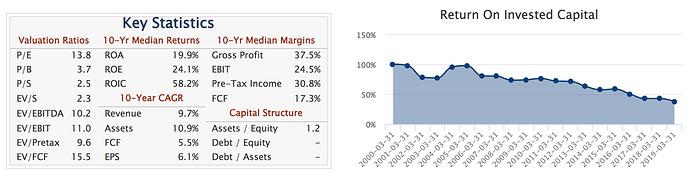

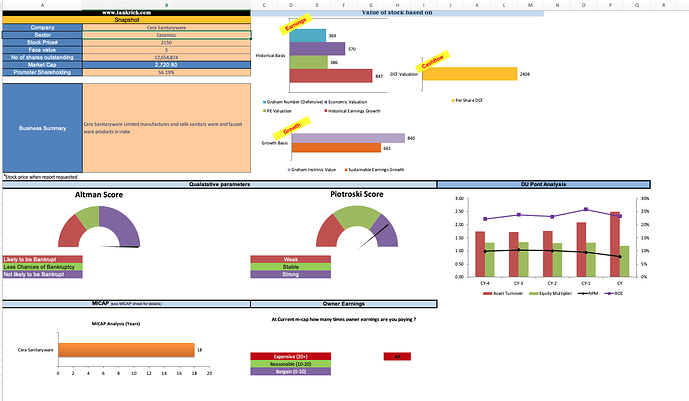

Or, you are like me - and desperate to use excel well for learning faster, better. I was from a completely non-accounts, non-finance background. The important ratios/their impact that I read about in books like Free Cash Flow, ROE, Net Margin, Financial Leverage, Working Capital/Sales, Cash Conversion Cycle, Fixed Asset Turns, Invested Capital, RoIC …all sounded very interesting, but I couldn’t sort of get a solid grip around the linkages between them (or their constituents) - no matter how many times I read; I just had to compute them myself - for the linkages to get established in my mind. I know that for my productivity to improve, I needed things computed and literally thrown up at me e.g. Equity Dilution - I couldn’t run my eye across the numbers in BS (even in a 5 yr/10 yr consolidated summary picture) and get a sense of the equity dilution extent for myself. I had to see a number like 20% flash up!!

Whichever camp you belong to, you will benefit immensely from the extensive number crunching, data visualisation, and data aggregation skills that (at least) four senior VP Contributors have excelled in!! (pun intended ![]() )

)

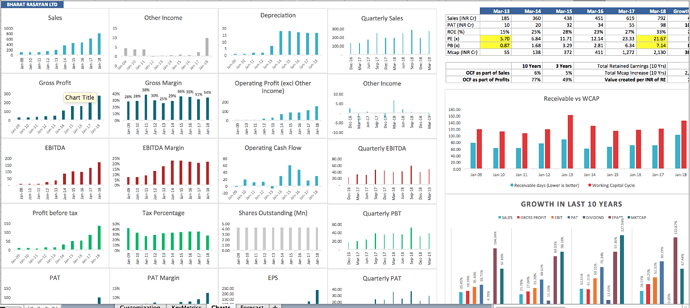

Calling @Yogesh_s, @spatel, @crazymama @Prdnt_investor to initiate the excel eager-beavers into some structured exercises, progressively to deliver e.g. an Excel Dashboard for Emerging Moats, Excel Dashboard for Perennials/Large Caps, an Excel Dashboard for Financials, and more -that most folks would admire, find extremely useful, and love to use and show off!! ![]()

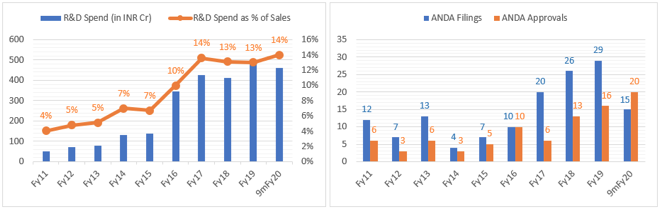

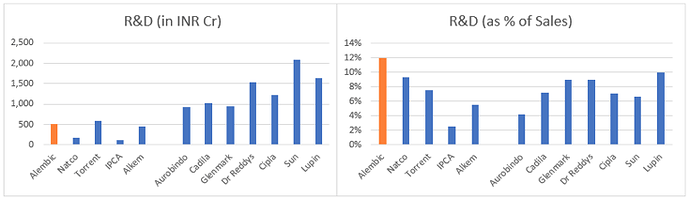

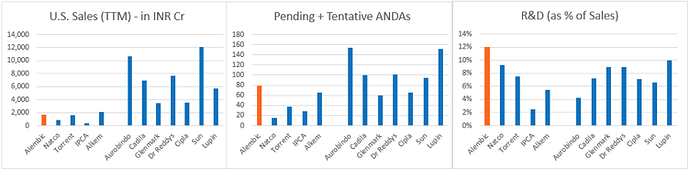

This is a much needed essential skill-set, that everyone at VP has to learn to harness well - Be able to talk about the most noticeable aspects of a business that you are analysing - in under 5 minutes! And in the same breath that of its major competitors too, in the next 10 minutes!!

Towards, that end we will actively collaborate (among senior and junior members) at later stages of the practicals, to highlight the most effective way of slicing/dicing the data-sets, towards creating Unified Templates for VP readership, and the larger investment community.