Any idea wht is Reliancedoing with huge amount of borrowing on its book , Amount of interest paid on borrowing is also big, At the same time they have good reserves .

Can anyone tell why company will borrow so much when they have reserves , refer highlighted section?

Cost of borrowing in Foreign Currency is cheaper than deploying in INR locally. They don’t need to hedge since earnings are USD / USD denominated.

Also, reserves are just accounting numbers, there is no real cash in the bank to pay off the liabilities from reserves.

Google and Apple do the same borrow money even if Cash reserves are there.

Cheaper money coz west prints a lot of money

“JioBook will run on the JioOS operating system, the sources said, adding that some of Microsoft’s apps will also be available. It will use Qualcomm chips based on technology from Arm Ltd, they added”.

RELIANCE July-Aug-Sep-2022

• Gross Revenue +32.4%

• Net Profit + 0.2%

• Cash Profit +15.4%

• EPS ₹ 20.2 per share, decreased by 3.3

Q2-(FY-2022-23)-Financial-and-Operational-Performa.aspx (ril.com)

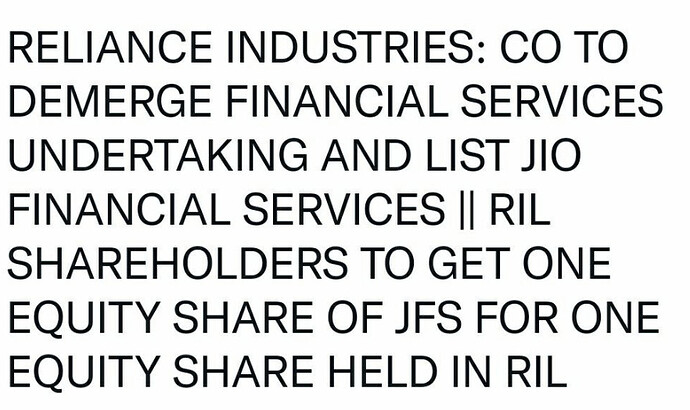

Maybe a stupid question, probably a result of me not being in India for over 6 years -

What is underlying the financials business they are spinning off?

They have some sort of an nbfc license, but those are doled out like freebies - and definitely not difficult for any large company one of some sort.

Would appreciate more information.

A quick search seems to suggest this is still in ideation phase. So the business doesn’t really exist yet.

Reliance has been developing and fostering a vibrant digital led-financial services platform

through various digital applications. Reliance has developed best-in class applications

having high customer engagement metrics and differentiated value propositions in their

respective categories. The current footprint touches more than 20 million consumers.

JFS plans to launch consumer and merchant lending business based on proprietary data

analytics to complement and supplement the traditional credit bureau-based underwriting.

JFS will continue to evaluate organic growth, joint-venture partnerships as well as inorganic

opportunities in insurance, asset management and digital broking segments.

Just a view Jio financial:

-

RIL is transferring 41.28cr shares (held by RIIH on behalf of RIL) to Jio financial, on the current market prices it is worth 1Lak Cr.

-

Jio Financial demerger rationale could be an aggressive expansion of the financial services division without hampering the debt profile of the consolidated entity & the RBI rule of mandatory listing on exchanges post crossing a networth of 500cr.

-

It is very interesting to note Piramal enterprise after their pharma demerger, became a pure play financial services company.

- Ajay Piramal confirmed that Anand Piramal is involved in the financial services business & will be heading it after him.

- Piramal Finance has a large presence across financial services which could take years to build for Jio Financials.

-Speculation: Since Anand Piramal is the son-in-law of Mukesh Ambani, There is a decent chance that Jio Financial & Piramal Finance could merge.

On a price-to-book multiple of 3x & considering the networth to be about 1lakcr, JIO financial could probably be valued at 3lakcr.

Disclosure: No holdings.

So they are essentially funding an entity with capital, and listing it and now we will have to wait for it to come out with a tangible plan.

Would be interesting to see how they use the existing retail and Jio Digital network. Probably see more consolidation in the financial services space.

Nice infographic about Reliance (Mukesh Ambani’s) conglomerate. It is not complete but quite exhaustive.

“From food to gadgets to sports, explore how the business empire of one of the world’s richest men touches the everyday lives of millions in India.”

Isn’t it time we started concentrating on Reliance Retail as distinct from Reliance? It has 15,196 Retail Stores, 41.6 Million Sqft of Retail Area, serves 7,000 Cities, and employs 3,60,000 people.

https://relianceretail.com/key-facts.html

https://drive.google.com/file/d/1DLQxw3QKCYodpdc6FLGfcq1PsyBL-taf/view

The above is the Reliance Retail Annual Report for 21-22.

D’mart has presence in 302 locations, across many states. I an aware that the information as regards D’mart given here is sketchy.

Any inputs are welcome.

While the Avenue Supermart share has closed at ₹3,439.00, the Reliance Retail share is being hawked at ₹2600 to ₹2750 or so as unlisted. Of course any input about any reliable web-sites from where one may buy unlisted share also would be welcome.

I am invested Reliance Retail. A token testing investment.

“Reliance remains a great way to play the long-term themes of rising share of organised retail and e-commerce, digital and technology penetration through Jio and its focus on new energy,” the research house said in a Jan. 31 note. “The IPO of Jio and retail could be big triggers to play out within 24 months.”

Read more at: Reliance Industries (RIL) Share Price Gains As CLSA Indicates 'Good Entry Point'

Copyright © BQ Prime

A first for Indian auto companies from Ashok Leyland and Hydrogen for Reliance.

i was reading about this very interesting battery tech.

ambri

and i can see Reliance has invested in this business

and looks like they have stated “2023 - Initial deliveries of commercial systems.” … where can i find more info as to how/when Reliance is going to start using it … BTW looks very promising

Watch the interviews of its founder Donald Sadoway. Very interesting technology.

Manufacturing of that battery by reliance in India is tied to progress in Dhirubhai Ambani Giga complex