Background

Established in 1966 as Reliance Commercial Corporation by Shri Dhirubhai Ambani as a polyester firm, Reliance Industries today stands as the largest listed firm by market capitalization in India. Dhirubhai took a loan and started the Reliance Commercial Corp, a trading firm, with a capital of Rs 15,000, operating out of a corner in a borrowed office in Bhaat Bazaar. The firm was renamed as Reliance Industries in 1973. In 1975, the company expanded its business into textiles, with “Vimal” becoming its major brand in later years. It’s IPO was one of the most successful one. Rs.10000 invested in the IPO (for 1000 shares at Rs.10), after accounting for the 4 bonuses the company has declared so far, is now worth Rs.1.7 crores (as on 23 April 2020) - An astounding CAGR of 19% over 43 years, and that too without taking into account the dividends paid.

Segments

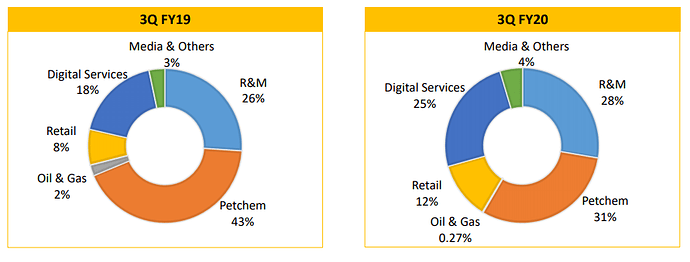

RIL has 5 major segments of revenue:

-

Refining: This is the bread and butter of the the company. They own the largest refinery in the world in Jamnagar. It’s gross refining margin (GRM) was $9.2/BBL for FY19. This is a highly volatile segment, considering the fluctuations in crude oil price and decreasing demand for oil. Some of the major products are Propylene, LPG, Naptha, Aviation Turbine Fuel. The business generated Rs.3,93,988 crores of revenue and Rs.19,868 crores of EBIT.

-

Petrochemicals: A cash cow for the company. Here various by-products of crude oil are produced which find their application in various industries like textiles, tyres, pvc pipes, plastic bottles, cables. FY19 revenues stood at Rs.1,72,065 crore and EBIT at Rs.32,173 crores.

-

Retail: Now moving on to its consumer business, which are the future of RIL. Retail industry has very high potential in our country. Unorganized retail still contributes almost 3/4th of the industry. To tap the potential, Reliance Retail has 10,000+ stores across the country and has presence in 6,600+ cities. Even the margins of are good enough (EBIT ~5%) for the company. Company has further decided to tap the unorganized space by starting delivery through collaboration with Jio using JioMart. Retail segment had Rs.1,30,566 crore of revenue and Rs.5,546 crore worth of EBIT and is still growing at a fast rate.

-

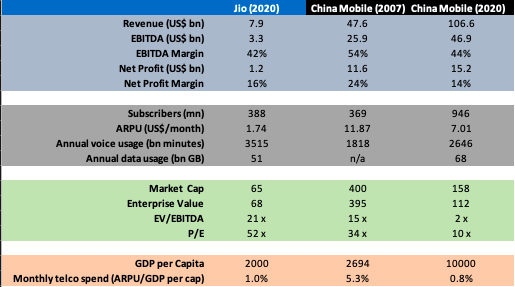

Jio: This is the newest business, but now has now become the crown jewel of the company. This contains the whole digital play from telecom to streaming services. They have become the largest telecom player in a span of just 3.5 years. Through Jio, the company acquired 11 startups over the past few months. These startup certainly state that they are aggressively pushing into the digital space. In FY19, Jio earned revenues of Rs.13,609 crore and EBIT of Rs.2,665 crore.

-

Network18: This segment contains various TV channels (Viacom, TV18), streaming (voot), moneycontrol, bookmyshow. This doesn’t contribute much as of now, but considering the plans of the company, has huge potential.

Image: Segment wise contribution of EBIT

Recent advancements

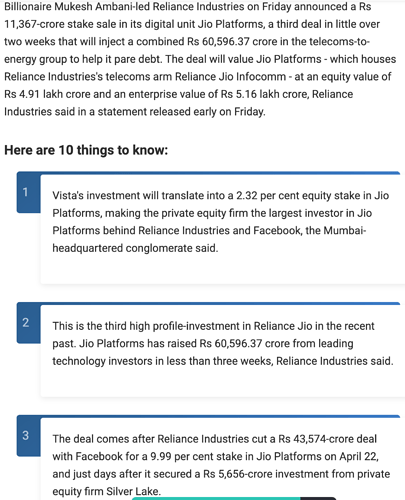

After the recent deal with Facebook picking up 9.9% stake for $5.7B, valuing Jio at Rs. 4.7 lakh crore, valuing Jio roughly 20 times EBITDA. After this stake sale, following two points are clear:

- The ambition of becoming a net debt free company by Q4FY21 seems to be on the right track.

- Reliance is moving towards becoming a tech giant

Positives

- Target to become net debt free by FY21

- Selling 20% stake in Oil to Chemicals business. The said deal with Aramco is valued at $75B

- Fast growing organised retail business in an underpentrated industry.

- Potential to tap the unorganized retail through Jio Mart

- Further value unlocking in media business (Network18)

- Higher cash flows after becoming debt free

Negatives

- Mediocre ROCE over the past decade (around 10%-12%)

- Telecom being a capital intensive business might require further investments

Investment Thesis

This seems to a great play on the ‘Great Indian Consumption Story’ via retail and Jio (tech business). Considering that Facebook paid Rs.43.5k crore for 10% stake, the rest 90% of Jio could be valued at Rs.390k crore.

The retail business has earned Rs.7,098 crores of EBIT for 9MFY20. Considering it earns another Rs.1350 crores in Q4 (50% of Q3FY20 - due to COVID-19), total EBIT stands at Rs.8400 crore for FY20. Assumming tax of 26% (highest), the net profit stands at roughly Rs.6200 crores. We can reasonably assign a P/E multiple of 50 to a highly growing profitable retail company (conservative as compared to other retail companies).

Some back of the envelope calculations:

Jio = 390k cr

Retail = 310k cr

Total value of consumer business = 700k cr

Total Debt = Rs.306,851 crore

Cash eq = Rs.153,719 crore

Debt repayment from Facebook = Rs.25000 crore

Net-debt position ~ 125k cr

Consumer business - debt = 575k cr

Based on the current market cap (23 April 2020), the Oil-to-Chemicals business + media business is getting valued at 275k cr, which is less than 6 times FY19 EBIT. Even though earnings are bound to decrease in Q4FY20 and FY21, this still appears cheap.

Apart from this, the consumer business are growing at a healthy rate, and could more likely grow at a >20% CAGR over the next decade.

It would be helpful if experienced members provide their insights on this.

Disclosure: Invested and holding RIL since the past 4 years and views may be biased.

Source: RIL Q3FY20 presentation, FY19 annual report