I wanted to know the barrier to entry for the business. They are a relatively smaller business so why can’t their product be replaced by a larger player? They are manufacturing gears and shafts (even chassis components are gears as per the management). The product, prima facie, doesn’t seem to be involving too much complexity/technical know-how (please educate me on this as I am unaware). As per their Annual Report, their edge is their “unblemished track record of over a decade” with major European & American OEMs [AR FY 20, p.56]. Moreover, in their recent concall, after reiterating this, they have stated that the market is too big and there are no major Indian players who wish to set up such a business. Even if they do, the company has the advantage of the learning curve. Resultantly, their major competition is against foreign players from Japan, US or Europe. [Concall, March 2021, p.7-8] However, the issue that I have is the diversification of any known auto component manufacturer into the market and taking away just the premium/luxury brands. Is some disruption of this/any kind possible? Anyone having knowledge on the industry and the manufacturing process, I’d be grateful for the contributions.

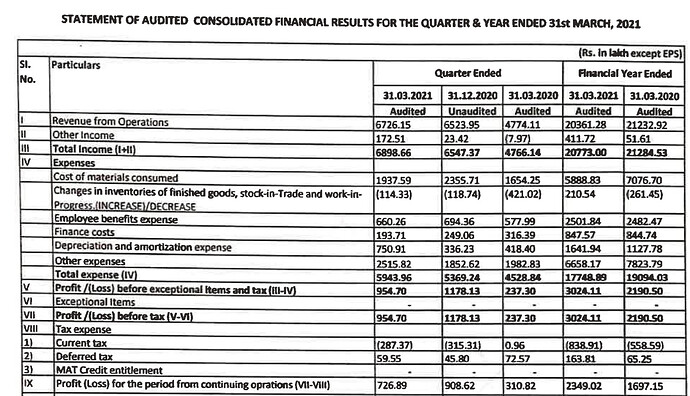

Decent quarter. Dep higher due to capex. Why has other expenses gone up QoQ.

Gross margins improvement is significant.

Cashflows year on year decent.

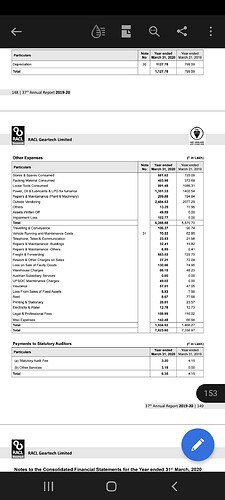

If we see the annual report breakup we get some sense for what might be happening:

Major costs are : freight, outside vendoring, lubricant, oil for furnace.

The first and third might be high due to covid disruption and preparation for capex coming online. Better to wait for annual report then try and disect it.

Perfect. Thanks

Export Freight could be one. Even one more company which is export dominated saw increase in export freight by 40%.

But yea, annual report will give better clarity.

Any update on Concall for Q4?

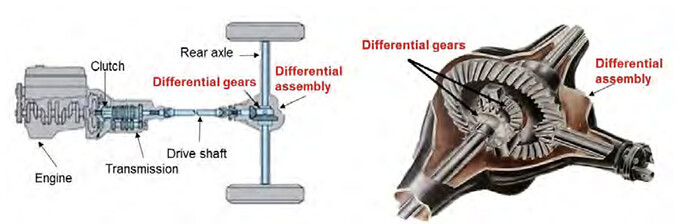

One of the upcoming IPOs: Sona Comstar provides some insights into the usage of Gears in EV cars. Sona is one of top 10 differential gears makers. RACL is slightly different since they are mostly into transmission gears, but in my limited understanding some of thee learnings do apply. In my understanding, 6 of top 10 passenger vehicles are Sona’s clients (and thus the company caters to mass market vehicles).

Pic above from Sona DRHP shows us the difference between the transmission and the differential gears.

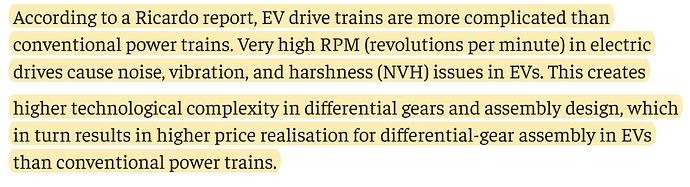

The IPO video Sona Comstar: Pre-IPO Discussion with Analysts - YouTube also mentions that gears for EV require higher precision since they need to handle much higher acceleration, RPMs, torque and also be quieter. This creates the need for higher precision in creating the gear. This increases the gross margins for such gears.

Given RACL’s focus on high precision gear engineering, when their clients move to EV, their margins could also move upwards if they are able to capture the incremental EV transmission gear business like Com Star has for the EV differential gear business.

Disc: Invested

The ET prime article (link) also summarizes the Ricardo report which says

So in EVs, the requirement for differential gear and assembly is more hi-tech (thus offering higher margins). This is also what the RACL management alluded to in their presentation.

Read this

EV tranmission is much easier and simpler than conventional with less number of component .

By the way in conventional engines gear box was very important and precision gears could create REAL difference to customer feel of smooth drive . So some one saying EV will need more precision gear than conventional is just not true …

Sorry but i think you’ve misunderstood the article, Shailesh. The gear volumes would go down, nobody made any comments about that. Transmission would only need 1 gear we have known this for many months now (please check out the RACL concall notes or transcripts). Conclusion being drawn is that since the gear operates at higher RPMs and torques than ICE, it would need higher precision. Nothing you’ve shared seems to invalidate that claim, which RACL management has made in the concall. I read both the articles you shared.

We have known this for a while. Please check my post, and the RACL concall. I did not claim that RACL would have higher volumes, reduction in volumes has been known for a long time. The only claim was that margins would be better since need for precision is higher. Nothing you have said invalidates that claim.

Conclusion being drawn is simply that need for higher precision gears would enable RACL to charge higher margins, has nothing to do with the end market.

Very nicely written blog on RACL geartech

Discl : My view may be biased as I am one of the Top individual investor

Thanks Sahil. Nice to see them doing concall. Is there any industry data available as to who are the other suppliers from India who supply to BMW, Kubota etc. or no one else from India

RACL Concall highlights :

Punchline of the call : I am custodian of Investors. Life is only one and we will continue to do the best.

PAT QoQ dip.

Depreciation high, premium freights we incurred. All Capex which happened, hence Depreciation.

Depreciation was higher in Q4, since lot of new equipments capitalized. It is ready for production of samples. First we give samples to customers for testing. It has 1 year gestation. Now Plant is ready in June-July. It will remain dull for the year.

We have to keep on reviewing our machines so if it becomes obsolete we have to reduce useable life and this also added to depreciation. Our machines have to keep in mind the latest trends.

We were best performers amongst peers.

All new contracts updated on last call, things are on track. Timelines/Volumes have already started.

New Plant is on track.

Gross Margin : We have maintained and improved it. Continuous thrust on improving. Input cost is inflating a lot, but eventually, this put challenges on profitability.

We will maintain the same trend in margin.

In Q1FY22, Plants were running full and Employees were there.

Next 5 years :

We will continue past growth rates. We will try to improve our profit growth rates. We provide value for money**.**

20-25% growth rates broad direction.

First EV was in 1880, so EV is old story. EV has to come no doubt. Successive Governments are incentivizing it. Transition of any mobility solution, has always happened in phased way. First few decades both will co exist.

Differential gears is different technology and we are not there.

Sona Comstar will not be here.

Transmission vs differential gear is Car vs mobile technology.

Gear manufacturers is most difficult post CrankShaft, plus heavy investment + technology. High barriers to entry. Hence 30 years in company, we understand fully and not many enter this space.

In Ev, Gears we are producing, our future is more safe than differential gears.

Gear for ICE vs EV :

EV gears are very high precision/high technology, not many. GPM will be very high there. Investment will be very high and we are prepared. New technology we are doing, we are making EV ready.

ZF we are supplying to location in Austria. It is going to go in BMW 7 series, which is Top End car.

We develop the product with customer R&D, which gets good value for money to customer + margins to us. We also give our own ideas so that we get value addition, we have team of engineers. We are not doing Product R&D, hence u may not find R&D as major expense. We invest in process R&D and invest in people where 15% work here.

Times come, we may get in product R&D also.

Invested in money judiciously, where we dont develop technology and then look for customer.

We work reverse : What customer wants, we create that technology.

One Customer is making one EV Scooter. We spent time, money, did R&D. We will be single source for next 10 years and it has committed some volumes. We have got higher value than fuel driven economy.

Pricing power (management acted humble), but these guys have pricing power :

We are too small to have pricing power. Our customers are big. We give them solutions, technology solutions, which they dont get from other customers. We command good respect.

We enter new products every 3 years. In 1980’s we were in after market, now we are enter EV. With criticality we get margins.

New customers are difficult to manage. They will fetch us higher margins.

We have good supplier base. Forging work is usually outsourced, so we get work at competitive rates.

Generally OEM have alternate suppliers but in customers we are the one in few products. OEMs like who have all in one solution. We have all solution in one roof, but that comes at high Capex.

10 years back, we had Japanese customer. He says, Mr. Singh (we were 30-40 crores company, BIFR phase). He said many Indian companies create base and then grow exponentially. Took Advice, We were building a strong base for organization, technology company, adding new technology, inherent strength not known to outside world. Those 10 years from 2007-2017, we were silently working on creating strong company.

Now we are getting growth on its own.

We didn’t look to grow since start. First strong base now growth.

End.

Do share, if i have missed any point.

Some notes from Q4FY21 concall:

- Manpower optimization, interest cost saving resulted in higher profitability in FY21.

- Depreciation being higher in Q4 due to all capex being capitalized is the reason for lower PBT in Q4.

- All new client business is on track. Whatever forecast of volume was there, they have already started, we are on track.

- New capex is on time, and is fully ready. Trial and validation is going on.

- In the past we have always improved the profitability/margins. Input costs are inflating. Only way out is to have a very serious thrust on efficiency improvement. Reducing wastages. Improve utilization. We do have agreements to pass on RM prices in some places.

- By next year, 3-4% of our revenue will be from components which end up in EV. One of our clients is launching e-scooter in Europe.

- In terms of Value added, differential gear is much lower than transmission gear in both ICE and EV.

- Even in EV, gears we are producing shall have more value addition than differential gears.

- EV gears are going to be high precision, higher technology required for manufacturing. Gross profit margins will be much more. Technology is different. Investment is also much higher. All our New technology and capex is EV friendly.

- For the new capacity We are billing already. Capacity will remain lul for a year and then be utilized. Validation happening.

- Austria ZF client, chassis components, top end premium car. BMW 7 series car. We are entering in car segment. This will be futuristic 2022 car. (this is their entry into premium passenger car market) We have also bagged 2-3 more projects from them. Are in discussion for new projects.

- We involve ourselves when new platform is being developed by customer. We get concept drawing. We work in tandem with customer R&D and our own process R&D team which is manufacturable product which gives good value for clients, and good margin for us. We do build to print but give our ideas to customers too. 15% of all our people work in process R&D with clients.

- One of the Major contribution in business is assembly now. Technology is customer driven. We invest our money very judiciously. We dont create tech then hunt customer, customers come to us we always work on customer driven model.

- We created Entire drive or kinematics of the e-scooter for the european scooter is something we are working on. They came to us few years ago this was outside our competence zone back then but in last 3 years we ramped up. We invest where customer demands. This electric scooter will be on our drive train. We will be a single source for the next 10 years. If they are saying certain volumes, they will commit to it.

- In one instance in terms of error tolerance: Customer wanted 50 PPM error margin, we are doing 20 PPM for the last 7 years.

- I call myself custodian of shareholders funds, not MD of company.

- High margins are a mix of many things. I dont claim we have pricing power. Customers are very large. But same customers if i give concurrent technology solution which they dont get from other suppliers, every minute spent is 200 Euro. But if we give them good solution, we are able to get good pricing. They keep upgrading vehicle platforms every 2-3 years, in that way we get increased business. If we provide solutions, they happily provide money.

- 1st we started with after market them moved to OEM. Even with piaggio first we were in 3W then we went into a critical 2W. Margins come with value addition. Our vision is always to keep upgrading our value addition for client every year.

- Word flows very fast. We supply to BMW and KTM. Generally competitors dont buy from same supplier. But we have that command because of customer experience in the past. We provide entire technology under 1 roof. Entire Gear Solution is provided by us.

- 10 years ago there was a japanese guy who was our customer. In 2007-8. We were 30cr company. He told Mr singh that for your company, you should create a pyramid which has a wide base. 1st 7-8 years we only grew 5-6%. I took their advice very seriously. Key requirement then was becoming a key technology company. Hidden strengths which the outside world might not know. Those 7-8 years we were not focussing on topline growth. Very silently working on creating a strong technology focussed company. Since the company is so strong, we are growing.

Disc: invested, owned

@sahil_vi Very well covered ,thanks for the quick update here for everyone .

I just want to add some broad takeaways from the conference call :

Competitive edge /Right to Win for Racl

* Technological edge

* Process R&D

* Customer service (quality /precision -better than expected /at right time )

Operating margin going forward -sustainable at current level of 20-25% (best in the industry )

Topline growth -will be able to do 500cr in 2025

EV -EV ready ,would be sole supplier for 10 years for worlds top (electric )scooter company .Next year 3-4% would start coming from EV

They supply to the top players in the industry (ie to competitions also) -both to BMW and KTM - a rare scenario

Discl - One of the top core holding in PF and hence views may be biased

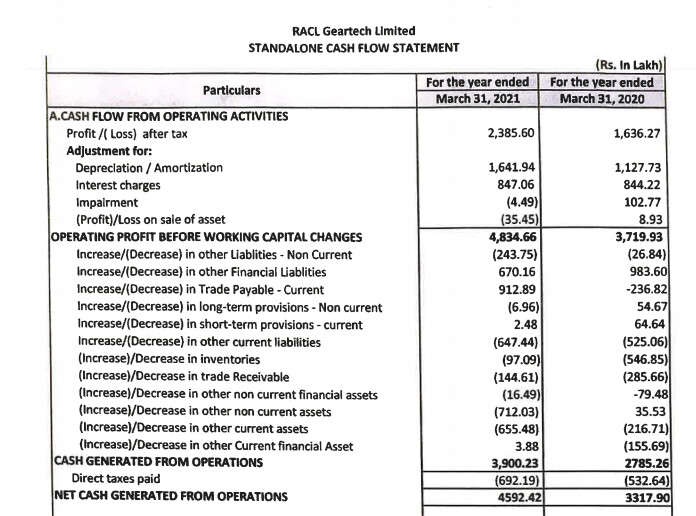

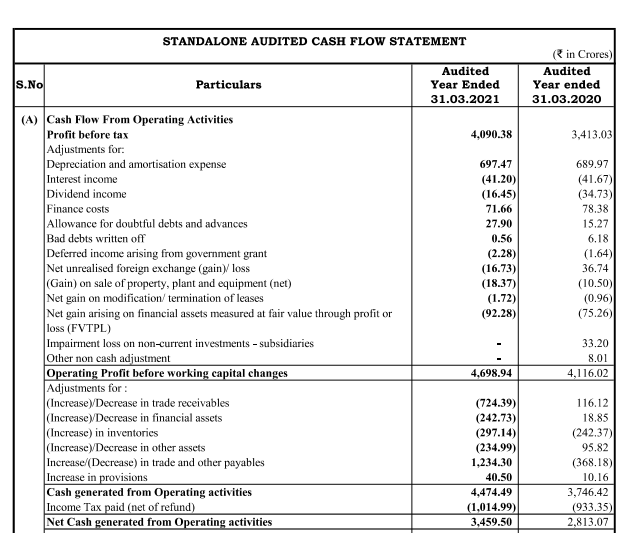

I have a question on tax treatment for RACL, why are they adding taxes back in their cash flow?

Shouldn’t the taxes be subtracted from CFO to arrive at net cash?

I checked Asian Paints report and other reports from Bluechip companies. All subtract net taxes from their CFO to arrive at net cash. Here is screenshot from Asian Paints.

RACL has added its Direct Taxes to CFO to arrive at Net Cash. Is that a right approach? Doesn’t seem right to me. Any accountant here that can opine on this?

Not saying anything is wrong with the company, I am just curious and want to explore this further and looking for collaboration on the same. I am invested in the company.

Please see the first line carefully:

In RACL it is " Profit/(Loss) after tax" while

In Asian Paints it’s " Profit before tax"

hence the difference.

Regards,

Raj

I have read it. Even with PBT, why would tax be added back? Its a cash expense, going out of the company. So tax wouldn’t be part of net cash from operations for the company.

Either you can start from PAT and not show direct taxes, or you can start from PBT and subtract direct taxes as a line item.

Starting from PAT and then adding tax to it to arrive at net cash from operations, doesn’t make any sense.

seems like what they claim to be net cash from operations is the gross. They have worked it other way round. Net CFO seems to be 3900 and not 4592. Then my cash flow wont tally

Had a couple of points / queries –

-

How sustainable are the margins – And that too sustaining a 10 to 12% higher margin than the industry. While I have read the points mentioned above; its a little intriguing that the reasons mentioned in the previous call for higher margins & sustainability are different from the points stated above. Namely higher exports, doing inward integration, outsourcing strategy; Prototyping resulting in a rise in margin.

-

Higher receivable days vs peers ?