RACL GEARTECH

Market cap – 75 cr , CMP – 68 , Book Value – 65.5 , ROE – 16 % , ROCE- 17%

Promoter holding – 51.12% ( 28.54 % pledged)

Established in 1989 , based out from New Delhi

RGL (formerly Raunaq Automotive Components Limited) was incorporated in 1983 and is engaged in the business of manufacturing of transmission gears and shafts for automotive and industrial applications. The company was initially promoted by the Raunaq Group. However, due to financial difficulties the company was referred to Board for Industrial and Financial Reconstruction (BIFR) in 2001. Post-restructuring and with a new management team under leadership of Mr Gursharan Singh (CMD), RGL came out of the BIFR purview in November 2007.

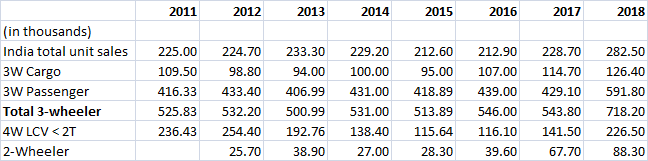

RACL is engaged in the Business of manufacturing of automotive components Transmission Gears and Shafts and other types of gears related to power transmission to engine. RACL manufactures drive train parts for Tractors, Two Wheelers, Electric Car, Three Wheelers, Cargo Vehicles, Light and Heavy commercial vehicles etc.

The company has also expanded into sub-assemblies, industrial Gears for electrical switch Gears and Circuit Breakers, Winches and Cranes.

Manufacturing Plants – Grajuala ( UP) and Noida

Grajuala plant is 100 km from New Delhi , while Noida plant is 15 km away

350 employees are there in the company .

Snapshot of financial performance of company for last 10 years. ( from screener.in)

There has been a consistent rise in sales , margins and profits over time.

| Compunded sales growth | Compunded profit growth | ROE | |

|---|---|---|---|

| Last 10 years | 12.71% | 16.67% | 11.87% |

| Last 5 years | 12.78 % | 39.19% | 12.59 % |

| Last 3 years | 17.37 % | 38.22% | 14.43% |

Clientele: Caters mainly to OEMs like

BMW Motorrad, Germany,

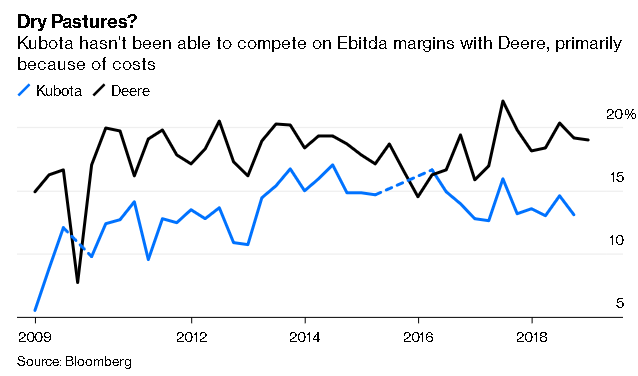

Kubota Corporation (Japan, Thailand & USA),

I.T. Switzerland (SAME Group Company) ,

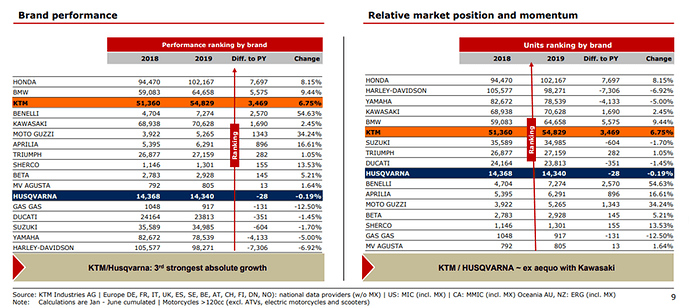

KTM AG (Austria),

Schneider Electric (Germany),

Dana (Italy & China)

Piaggio – Italy, Vietnam

BRP Rotax – Austria

In the domestic market - Yamaha India, Piaggio Vehicles, SML Isuzu , TVS Motors

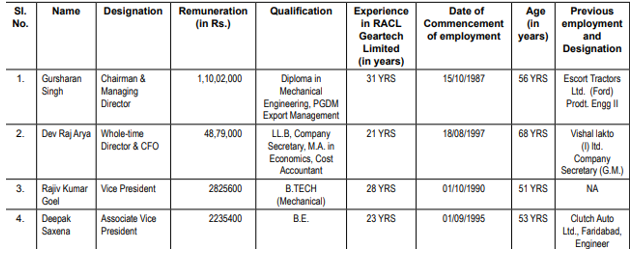

Management Information and Remuneration:

RGL has a long track record of operations with established market position and reputed client base and long association with these clients.

RGL has more than 3 decades of presence in the automobile component industry. Mr Gursharan Singh, CMD of the company, joined the company as a plant head and has been associated with the company since its inception. He is a mechanical engineer with Post-Graduate Diploma in Export Management.

This is the information of the top management of the company . One can see the vast amount of experience each one of them has in the given company.

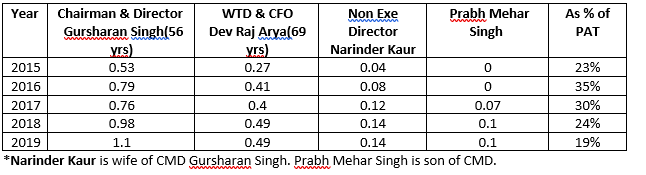

Management remuneration is very high

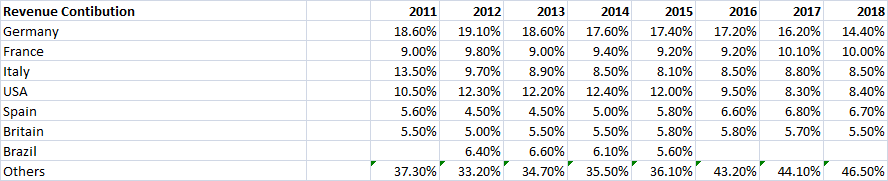

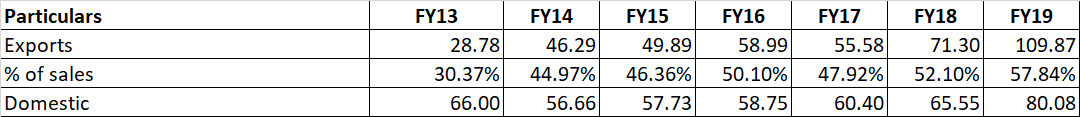

Exports as a percentage of sales is 58 % in FY 19 . The same was 17 % in FY 09 . Exports have steadily increased over the year as a percentage of revenue.

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| sales | 58.42 | 65.15 | 82.7 | 98.72 | 95.05 | 102.95 | 107.5 | 117.74 | 123.61 | 138.79 | 189.95 |

| exports | 7.55 | 11.17 | 13.27 | 18.93 | 29.46 | 46.29 | 49.89 | 58.99 | 55.85 | 71.81 | 109.87 |

| % exports | 13% | 17% | 16% | 19% | 31% | 45% | 46% | 50% | 45% | 51% | 58% |

Working capital management

The business is very working capital intensive .

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DSO | 43 | 40 | 40 | 46 | 68 | 55 | 58 | 27 | 32 | 107 | 98 |

| DIH | 60 | 66 | 71 | 65 | 79 | 75 | 86 | 82 | 79 | 87 | 69 |

| DOP | 0 | 0 | 0 | 46 | 54 | 81 | 72 | 44 | 46 | 55 | 41 |

| CC | 103 | 106 | 110 | 64 | 93 | 49 | 71 | 65 | 64 | 139 | 126 |

Although the working capital cycle was showing signs of improvement it has fallen back in the last 2 years to worse than previous levels. There are signs of competitive intensity in the business increasing , also shows better bargaining power of customers.

Ratio Analysis

| Year | RoCE | RoE | Sales growth | PE | PH | Div Payout |

|---|---|---|---|---|---|---|

| 2014 | 3 | 8 | 8% | 5 | 55.98 | - |

| 2015 | 6 | 12 | 4% | 6 | 51.07 | - |

| 2016 | 6 | 11 | 10% | 8 | 51.1 | - |

| 2017 | 18 | 11 | 5% | 8 | 51.07 | - |

| 2018 | 17 | 14 | 13% | 8 | 48.47 | - |

| 2019 | 21 | 15 | 37% | 6 | 51.12 | - |

The return ratios of the company have steadily improved over the years . that has been due to steadily improving operating margins. Valuation wise the market has not really given the company any value more than a single digit P/E . With improving ratios, and improving scale of the company there is a possibility of the company getting re rated by the market.

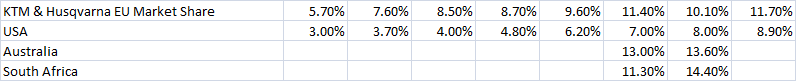

In smaller companies the client profile is of extreme importance . The clients of the company are some of the finest in the auto industry. The company is adding clients to its existing profile. For example TVS was added last year by the company( in FY 19). The company has a long standing relationship with some of the clients.

The company has much superior margins than the industry average. Having a 16 % OPM is not easy in this industry. For example Bharat Gears a competitior of the company has 8-10 % OPM.

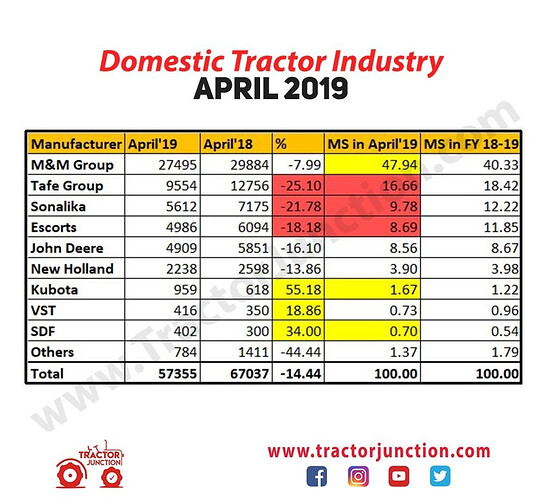

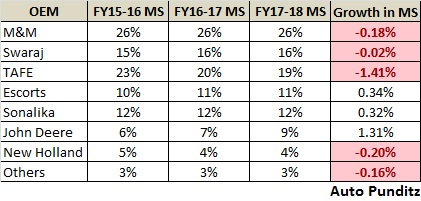

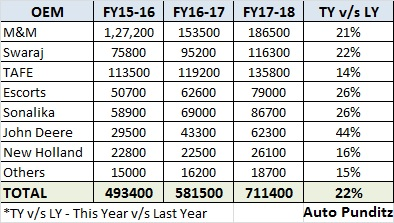

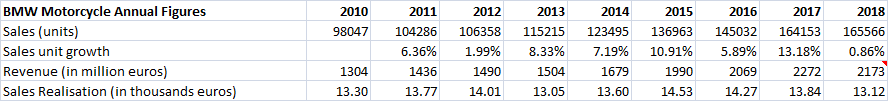

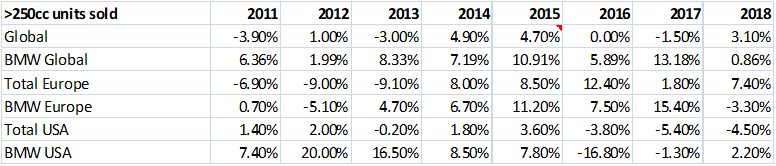

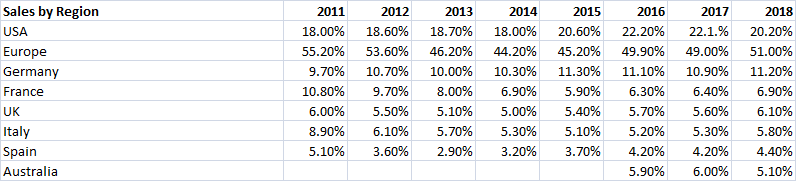

The company has been growing at a pretty fast rate , much greater than the end industry it is servicing. These are signs of improving market share. The company maybe targeting to service the new launches by its clients , which may lead to much faster growth rate than the end industry.

Company is gearing up for providing drive train solutions to the EVs also. It has already invested substantial capital expenditure in the recent past and is ready to cater to high precision drive train components for E-mobility solutions.

Also the company will not be much affected by the EV disruption coming in the future. Autmotive gears and axles the main product of the company is pretty much used in the EV vehicles as well. The company has 66 % of its revenues from tractors and 2 wheelers. These segments will be the last to face the EV disruption.

The other division which contribute are- 3 wheelers( 14 % of sales) , recreational vehicles (13% of sales), CV - 5 % of sales.

It is good to see a diversified end user industry of the company’s products.

RISKS

-

The business of the company is working capital intensive. The cash conversion cycle is over a 100 days. Also there is great competitive intensity among the suppliers to the auto industry. The clients also enjoy a good bargaining power in this industry leading to strecthed working capital cycles.

-

The auto industry is cyclical in nature. The slowdown in the auto sector globally can dampen the growth at which company is growing.

Disc- Not Invested , Tracking