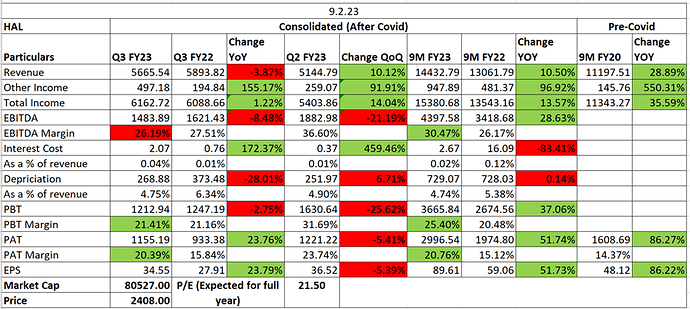

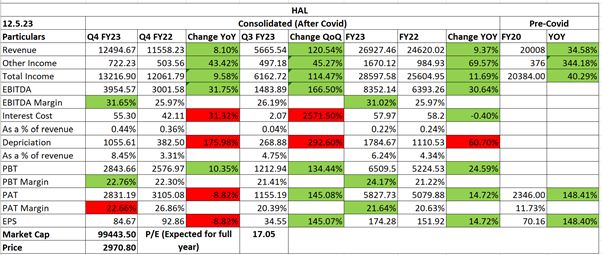

| - | EBITDA Margins reduced due to higher provisions. The guidance was of 25-26%. |

|---|---|

| - | PAT saw a growth due to tax refunds. |

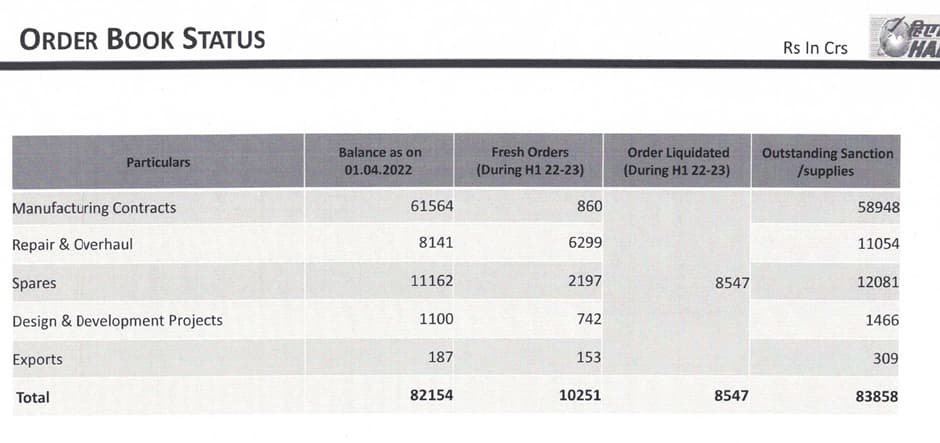

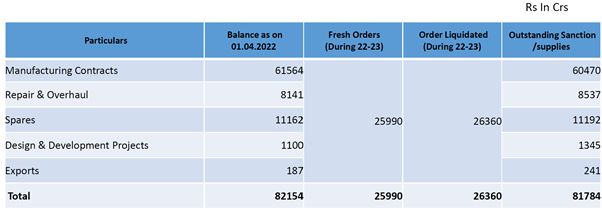

| - | Healthy order book position (84000 crore) led by large scale orders in manufacturing aircraft/helicopters (LCA, LCH, ALH). Implied order inflow was 16278 crore in 9M FY23. The order book is same as last quarter. |

| - | Continuous order inflows in maintenance, repair & overhaul. |

| - | Revenue was a little low due to muted execution in manufacturing contracts. |

| - | Gross margins improved due to lower RM cost. |

| - | In Q2 FY23, they said that they expect 8% revenue growth in this year. Revenue growth of 10.5% has already been achieved in 9MFY23. |

To me, more than any defence order, this seems game changing.

Sanctions-hit Russia pitches manufacture of its civil jet in India

India’s Hindustan Aeronautics Limited and Russia’s United Aircraft Corporation in talks to draw up a working arrangement to manufacture Sukhoi Superjet with foreign components.

India will be selling up to 3.5% stake in its aerospace and defence company, Hindustan Aeronautics (HAL) through an offer for sale (OFS). The offer will open on March 23 and will continue till March 24th. The 3.5% stake sale comprised 1.75% as the base offer and 1.75% as an additional option. The government seeks to raise more than ₹2,867 crore through this transaction.

First LCA Trainer manufactured by HAL successfully completes maiden test-flight.

HAL Q4 FY23 Result Update:

- Order book position is maintained at Rs. 81784 Crores with receipt of fresh Manufacturing Contracts, ROH and Spares orders.

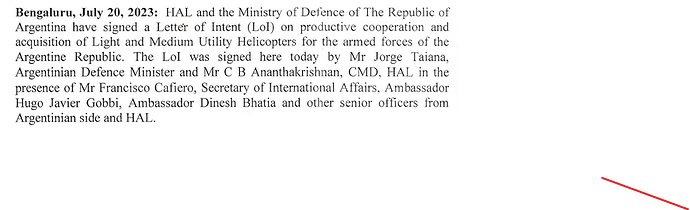

- Guidance: Revenue guidance for FY24E was maintained at 8-9%. For FY25, revenue growth is expected to be in double digits mainly led by execution of LCA Tejas MK1A. From FY26 onwards, revenue growth is likely to stabilise at 12-13%. Repair and Overhaul revenue is expected to see an uptrend of 5-6% in revenue. EBITDA margin (including other income) is expected at 26-27% in the coming periods. Moreover, execution of other key orders and sustained growth in MRO will drive revenue growth in double digits from FY25E. The manufacturing segment will remain subdued in FY24 and expected to pick up in FY25. The company is expecting order value of ₹48,000 crore to get concluded in FY24. They are envisaging orders from export market including Philippines, Indonesia, Argentina, Egypt, Maldives, Sri Lanka, Thailand, Nigeria and Middle East in the coming periods.

Brokerages are eyeing and increase in revenue in FY24E but PAT levels are expected to see a de-growth.

• Rs 48,000 crores of Orders are in various stages of finalization including Orders for Helicopters, Engines for AL 31 FP which constitute approx. 26,000 crores, RD 33 for Rs 4,500 crores, additional 12 numbers of SU 30 for Rs 12,000 crores, MiG engines, etc;

• HAL & L&T consortium, again, has bagged INR860 crores contract for end-to-end realization of this 5 Polar Satellite Launch vehicles, PSLV, from the New Space India Limited. These Satellites Orders are from ISRO;

• Delivery of RD 33 engines expected from the current fiscal;

• FY23 ROH revenue stands at 18,800 crores and Company has ROH Order Value of 17,000 -18,000 crores with an execution time frame of 12 months or so;

• Company benefitting from Atmanirbhar Bharat and set to manufacture and sell and as replacing defence imports;

• Manufacturing numbers should pick up as Company commences delivering LCA Mk1A and HTT 40 aircraft - HTT 40 delivery expected from September 25 onwards; and ALH and Sukhoi Engine contracts;

• Potential export orders HTT 40 aircrafts in the pipeline;

• 3 LCA Mk1A in FY24 (my guess – maybe less than 3 and balance in following FY), followed by 16 in next FY;

• Guidance - Double Digit growth for Revenue from FY24-25 onwards and post that rate to stabilize around 14% to 15%;

• Guidance - Net Margins will be around 10%-11% in FY25 and expected to grow beyond that and see stability around 15%;

• EBITDA stands at 31% which will settle in range of 26% to 27%;

Bottomline - Points to watch out would be Execution, Delivery Timelines , Geo Politics as they have suppliers’ from overseas and importantly Elections of 2024.

hdfc defence fund pres

HDFC Defence Fund - Presentation - May 23_0.pdf (5.1 MB)

entation enclosed

I came across this scathing article about HAL’s capabilities and union-controlled culture, by a retired Group Captain. He describes HAL as “Hindustan Assembly Line”. According to the article India’s Achilles’ heel is lack of knowhow in production of high tensile strength steel, which is required for producing turbine blades of an aircraft engine.

Disclosure: No investment in HAL.

If HAL has not been able to make a good fighter Jet engine, it does not mean that they can never make it.

There is nothing wrong in trying to learn through joint ventures & collaborations.

Earlier , we used to take help of USA for launching a satellite- Today ISRO has launched more than100 satellites independently without any help.

Every one can not make everything & Technology is unique and patented at times. In the whole world, there is only one “Airbus " one “Boeing” one “Apple” one " Facebook” one “WhatsApp” one “Google” one “Amazon” and there would be many more which are unique and no one has been able to replicate it.

As a country, We have our own Strength & Weakness - our strength is our Culture , our Values, our Traditions, our Democracy.

Indian Pharma industry is known as “The Pharmacy store” of the world and IT Service Industry is the largest in the world.

Our Digital payment system / UPI across 1400 million people is unique to India and no country has been able to replicate it.

Discl: Invested in a basket of Defence stocks that includes HAL. My Basket of Defence & Railway stocks has already given me 150% return during last one year.

This is not a buy or sell recommendation. please do your own assessment before investing.

Please ignore this article by Eurasiantimes. We don’t have an Indian engine because the GOI will not fund the billions needed for it. It’s not an HAL issue. While there are other issues with the writeup, purely from a biz side of HAL, it does what the GOI asks it to do. It will not front money for engine development; it actually lies with GTRE, NAL and DMRL and Midhani.

It will still make money in aerospace in different ways.

Eurasian is highly biased

Guardians of Security: Unveiling the Defense Sector’s Dominance

Defence has been one of the most talked about sectors since Shri Narendra Modi came into power in 2014 and announced Atmanirbhar Bharat & Make in India. It came more into talks since the first indigenisation list was announced by Ministry of Defence (MoD) in August, 2020 which comprised of 101 items. The second list came in May, 2021 comprising of 108 items. The third one with another 101 items came in April, 2022. And the fourth list was announced with another 101 items in Defence Expo, 2022 which was conducted in December, 2022. Indigenisation means the action or process of bringing something under the control, dominance, or influence of the people native to an area. All these lists will promote Make in India & Atmanirbhar Bharat.

This has increased the exports. India’s defence exports have grown eightfold in the last six years – from Rs. 1521 crore in 2016-17 to Rs. 12,815 crore in 2021-22 out of which 70% exports were contributed for by the private sector. This number in 2022-23 has reached Rs. 16000 crore which is a 23 fold increase from 2013-14.

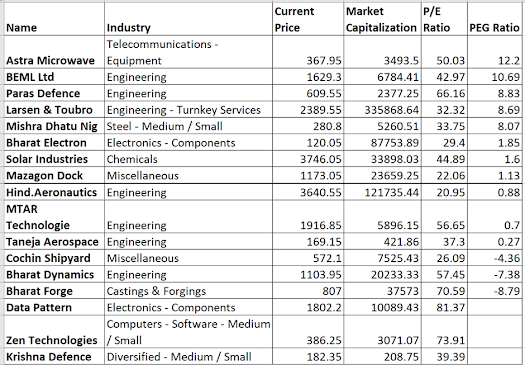

Looking at the above data, it made me want to look at the listed Defence space. I made a watch list of all the companies and came up with about 17 companies ranging from the Market Cap of 200 crores to 336000 crores which would include a few large caps like Larsen & Toubro, Hindustan Aeronautics and Bharat Electronics which are sure shot bets and are performing very well since Covid in 2020.

My eye was caught by the other Midcap/Small Cap/Micro cap companies. By Microcaps, I would usually refer to companies which have a market cap less than 1000 cr (There is no definition given by AMFI for Micro caps. This is my personal definition). The Midcap Space includes two names Bharat Forge and Solar Industries. The Small Cap space includes Mazagon Dock, Bharat Dynamics, Data Patterns, Cochin Shipyard, BEML Ltd., MTAR Technologies, Mishrat Dhatu Nigam, Astra Microwave Products, Zen Technologies & Paras Defence. The Microcap Space includes two names Taneja Aerospace & Krishna Defence with a Market Cap of 429 and 211 crores respectively as of June, 2023.

Before looking at their fundamentals, it made more sense to look at their current valuations as defence has been the most liked sector since 2020 and the sector overall has given great returns in the last 3 years. There has been a lot of frenzy about the sector and the stock prices have given a straight up move. I thought of comparing the PEG Ratio rather than the PE ratio as it provides more insight into the stock’s valuation as future earnings growth is also factored in.

A lower PEG ratio favours a stock to be undervalued especially below 1. MTAR Tech, Taneja Aerospace & HAL show PEG ratio lower than 1 but MTAR Tech has a P/E of 56 which doesn’t fulfil my criteria of investing in companies with a P/E below 50. Based on PEG Ratio, Taneja Aerospace would be a good company to look at and then maybe invest in but obviously after it passes most of my criteria from the The Equity Checklist. Taneja Aerospace has a good promoter holding of 51% and ROE and ROCE of 10.4% and 15.4% respectively.

A negative PEG can result from either negative earnings (losses), or a negative estimated growth rate. Either case suggests that a company may be in trouble. Cochin Shipyard, BDL and Bharat Forge have a negative PEG ratio with BDL and Bharat Forge having a P/E ratio higher than 50.

Companies with no PEG ratio mentioned might have been recently listed companies. Mazagon Dock, Solar Industries and BEL are still a little overvalued (PEG ratio above 1 but below 2) but as the P/E Ratios are below 50, it definitely qualifies for a Fundamental Check. Promoter Holdings of all 3 companies is above 50 and ROE/ROCE are in double digits.

There are a few risk factors in this sector. There is heavy dependence on government orders for the same. Exports are a part of the revenue but not a huge one. Also, there is this question of if Modi Government doesn’t win the 2024 elections, will these formal policies announced by him still continue or not.

The sector is very hyped and an investor needs to be very selective with the stocks as well as what time you invest in. A cool off period is definitely a requirement to invest in these stocks.

Hope this helps investors better analyze companies!!!

None of the above are a buy recommendation whatsoever!

Happy Investing!!!

HAL receives order for Rs458 crores from Indian coast Guard towards supply of two Dornier aircrafts cum order book @82000 crores

India in talks with French firms for co-developing Engines for Indigenous Fifth generation fighter Aircraft and Indian multirole Helicopters ( IMRH) being developed by HAL

There are many positive developments in HAL

The stock is consolidating