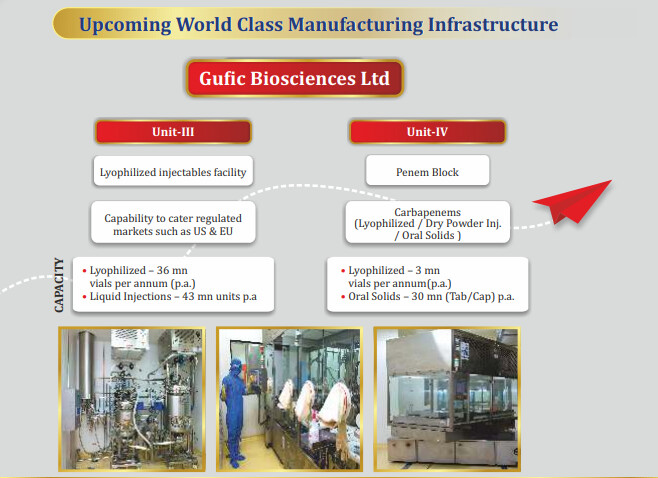

So I guess after Kopran, Gufic will be the only company into carbapenem.

Correct me if I am wrong

Regards,

Dr. Vikas

http://gufic.com/Notice/Written%20Transcript%20120822.pdf

concall transcript

discl: holding

shiv kumar

Penned a note myself after a very long time. Here it goes:

Gufic Biosciences Limited was established in 1970 and the business of two over the counter (OTC) products of Gufic was sold to Ranbaxy Limited in 1997 for Rs. 80 cr when it had revenue of Rs. 85 cr and profit of Rs. 5 cr. In 1997, it started afresh by making several OTC products like Roll-On, Stretch Nil, Onergy (energy supplement), Shapers (Sanitary Napkin) and also Hybrid Seed and Tissue Culture. Also, they were doing some contract manufacturing of injectables in small scale. But doing so many things took the company nowhere for next 12 years as in none of the areas they had scale advantage or unique ability to serve a larger target customer base.

In 2007, Mr. Pranav Choksi, grandson of the founder joined the business, who just completed MS in 2006 in Bio Technology from John Hopkins University. He over next 15 years given some shape to the business using more scale-based approach in some areas and technology focussed approach in other areas.

They were the first company in India to import Lyophilization systems (freeze drying system). Lyophilizers are used to remove water & moisture and make food and pharma grade product transportable over long distance. This is one of the best ways to make biotechnologically manufactured injectables as these are not sufficiently stable in aqueous form. In 1997, the had capacity to manufacture only 55,000 vials which by now has been raised to 48 million vials and further establishing a new capacity in Indore for another 36 million vials and one dedicated capacity in their existing plant in Navsari as Unit 3 for 3 million vials for carbapenem variety. Carbapenem is used to treat acute and severe bacterial infections. So, by Q1 FY 24, their total capacity would be about 87 million vials for 50+ different types of injectables, manufactured for 70+ partners. Nowadays as much as 25% of new injectables discovered and approved are coming in Lyophilized form.

But from the scale of manufacturing, it’s evident that the process chemistry has been commoditized and margin would be fixed but due to their scale of operation, competition would be limited. Also, this new plant in Indore would seek for US and EU regulatory compliance, so the margin may improve marginally over longer term.

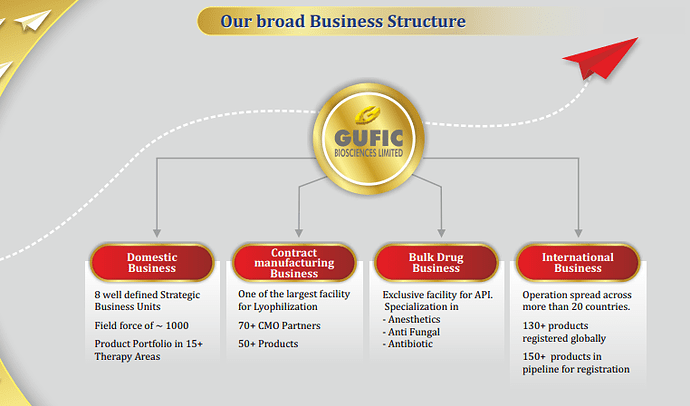

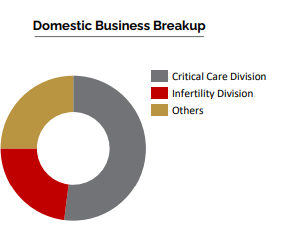

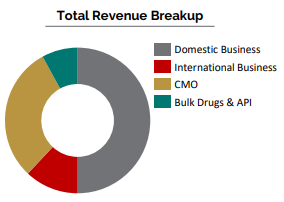

Apart from this Gufic has moderately bigger size business in Natural / Herbal / Nutraceutical products. Gufic Sallaki Oil Linment is a moderately successful product in area of muscle and joint pain relief. They also have smaller businesses in critical care, pain management, infertility, orthopaedic and gynaecological generic formulations. They make these under their own brands and also for third parties. Their export revenues in these areas are increasing consistently and presently forms 15% of revenue which they plan to take to 25% in few years. 55% of the business come from domestic formulation business, 25% from contract manufacturing and rest 5% from manufacturing few APIs which they primarily use for backward integration.

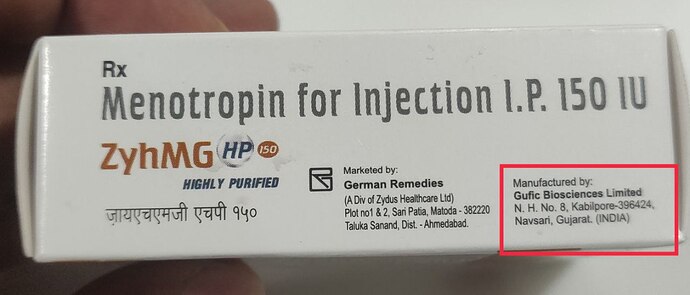

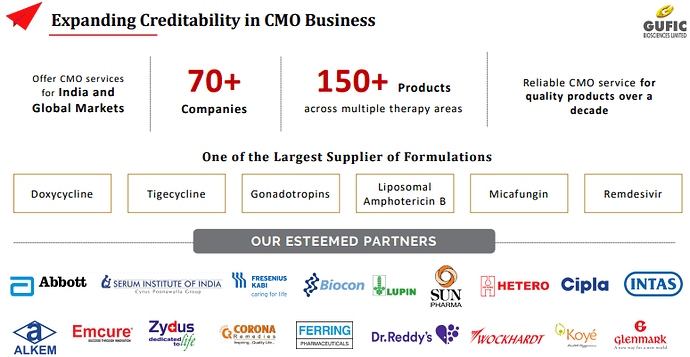

They ended last year with Rs. 780 cr revenue but almost Rs. 170 cr of that revenue was one time due to contract manufacturing of Remdesivir and Thymosin Alpha for their own, and third-party sales. It had demand surge due to Covid pandemic. If we remove these, then core revenue grew to Rs. 610 cr in FY 22 from Rs. 480 cr in FY 21 (25%). Their contract manufacturing clients include Abbott, Serum Institute of India, Fresenius Kabi, Lupin, Hetero, Sun Pharma, Cipla, Alkem, Zydus, Dr. Reddy’s and Glenmark among others.

Apart from all these Gufic is creating few interesting businesses which may grow steadily and consistently over a long period if successful. These are

- They have introduced newer drug delivery mechanism in lyophilized parenterals (doses form of injection which is generally dissolved in water before administering to body). Recently they introduced dual chamber bags for Intravenous delivery of unstable compounds which needs to be diluted just before administration. It’s a Rs. 3000 cr market in India and was mostly imported. Here Gufic is first Indian manufacturer to make this.

- In early 2021 they introduced Type A Botulinum Toxin under brand name Stunnox which is Indian equivalent of Botox (manufactured by Allergen which is acquired by AbbVie in 2019). Type A Botulinum Toxin is aesthetic dermatological product which helps in temporary elimination of facial frown lines, forehead creases, wrinkles, lip lines and gummy smiles. Botox has equivalents in the names of Dysport (made by Ipsen), Xeomin (made by Merz Pharmaceuticals) and Jeuveau (made by Evolus). This is globally US$ 4 billion market but Indian market size is less than Rs. 150 cr. High cost, lack of training to administer it and lack of awareness are major reasons which kept the usage confined to extremely wealthy people. Presently the sale of Stunnox is less than Rs. 3 cr but company is using training and awareness program and we can expect a decent growth going ahead. It is made in collaboration with Prime Bio which is promoted by Prof Bal Ram Singh, who is a PhD in Bio Physical Chemistry and professor of University of Massachusetts in North Dartmouth. The company has a to share a part of profit and an undisclosed technology fee to Prime Bio. Incidentally, Prof Singh also sits in Board of Gufic as a Non-Executive Director.

- With help of Prime Bio and Prof. Bal Ram Singh, they recently introduced Zarbot, a new Type B Botulinum Toxin, which has been found effective in treatment of cerebral palsy, migraine and overactive bladder. We were unable to verify the size of opportunity here but even if it is small, can add credibility of R&D prowess of Gufic. There is only one other Type B Botulinum Toxin brand in world named Myobloc but it has use in treatment of other type of disease.

- Type A Botulinum Toxin has use in various medical conditions. One area where Gufic has started commercial level use is vaginal tightening and vaginal rejuvenation. The segment has just started and doctors are being trained on its use.

- In March ’22, Gufic entered into research and collaboration agreement with Selvax Pty, Australia to accelerate commercialization of Selvax’s cancer immunology treatment. One area where Gufic is actively involved with Selvax in pre-clinical trial for immunotherapy of pancreatic cancer. Presently this type of cancer only has symptomatic relief but no effective cure. In the long term, if the trials are successful, can act as game changer for Gufic fortune.

Last year Gufic merged Gufic Life Sciences with itself and it increased promoter holding to 75.48% from 65% level. Recently the excess 0.48% shares were sold in open market to bring the promoter holding back to maximum permissible limit of 75%. Presently the group has no other conflicting interest and every family-owned company merged with the listed entity.

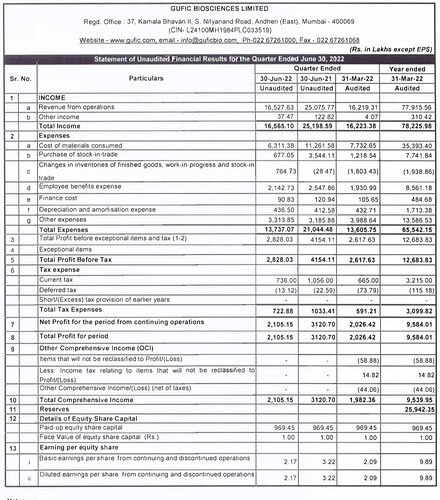

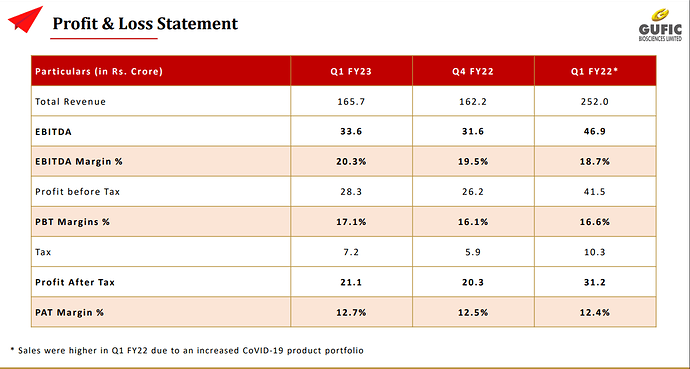

Q1 ’23 sales are optically lower than Q1 ’22 because last year main sales of Covid medicines were done in this quarter. This quarter they showed a healthy operating margin of 20%. It has nominal debt in spite of large capex going on to start Indore facility. We feel, going ahead their debt level may increase a little when final set of equipments arrive but the quantum would be small. CRISIL upgraded their rating recently for all type of bank facilities of Gufic. Also, R&D expense for Gufic is about Rs. 65 cr which is expensed and it’s mostly spent in all new areas of development.

Gufic’s cash flow from operations were abysmal till few years back. It has been Rs. (-) 4.82 cr in 2018, Rs. 5.21 cr in 2019, Rs. 47.10 cr in 2020, Rs. 87.25 in 2021 and Rs. 104.44 cr in 2022. Gufic’s gross block increased from Rs. 31 cr in 2018 to Rs. 178 cr in 2022. Also, they have Rs. 41 cr WIP as on Mar ’22. They have a total debt of Rs, 61cr. They possibly use a portion of debt for capital expenditure and capitalizing a part of interest cost as interest expense is only Rs. 4.85 cr.

Disclosure standards of the company is reasonably good. CRISIL upgrade their credit facility from BBB (stable) to BBB+ (stable). They have very little related party transactions.

Disclosure: The author is a SEBI Registered Investment Adviser (RIA). The stock has been recommended to members of www.aveksatequity.com and author is also invested in the stock. Views may be biased. It is not an investment advice. Do your own due diligence if you plan to invest in this company.

Botox now has new competition with USFDA approving Daxxify as per article below:

With long-awaited FDA nod, Revance set to take on AbbVie’s Botox with its longer-lasting Daxxify

The key differentiator for Daxxify is that it’s anti wrinkle effect is longer lasting than Botox. Daxxify is also being investigated for therapeutic benefits.

From Gufic’s perspective, this may not have any effect in the short/medium term. Gufic is still building it’s brand presence with Stunnox in India and, if executed well, has a lot of market share to grab.

Good insights. Story continues

Collective Management Commentary : My Notes on Gufic

Gufic Business Structure

Industry Structure as of 2022 :

• Botulinum Toxin Indian Market Size is 120 Crore at the moment (Potential is huge in India and international market as well but it is not easy)

• Botulinum Toxin International Market Size 8 Billion and USA 5 Billion

• Critical Care India Market size is 181000 Crores in India

• Infertility is around close to 4000 crores in India and growing 15% yoy

• Dual Chamber Bag initially targeting Anti-infectives. Addressable market size is ~Rs. 3,000 crores in India

• Dydrogesterone product size for this product is ~Rs. 700 crores growing at 60% YoY in India

• Critical Care around 36000 Crores to 38000 Crores

• D29 Market size 6 million in India

Market Share

• Gufic has selected market segment in Critical Care around 36000 Crores to 38000 Crores out of which Gufic has products of 14000 to 15000 crore.

• Criticare they have 4% market share which is Rs. 200 crore sales in FY20-22.

• Ferticare, they have 3% market share which is around 120 crore

Company’s Standpoint - This might infrequent and change to market conditions

• we are the number 1 company for some Fungins

• we are the number 2 company for some antibiotics

• we are the number 3 company and because of these individual molecule markets,

• we already might be in double digit right now itself, we might be in certain cases maybe 20% of the market, in certain cases we might be 33% of the market share also

Merger/Partnership

• Gufic has also tied up with Metaverso TS, Portugal to launch series of recombinant molecules in India starting with the candidate ReF in the field of infertility. This will be the first recombinant product which will be made in Gufic’s facility.

• Gufic has tied up with Prime Bio, USA for manufacturing Botulinum Toxin API and formulation and they will develop several innovative formulations with Botulinum toxin in the field Dermatology, Neurology and Pain Management

Therapy Area: Toxins Strain transfer, Tech transfer, formulation development and manufacturing at Gufic

• Techno flex European leader in IV drug delivery systems. Collaborated with Gufic to launch Dual Chamber Bags for the 1st time in India for anti - infectives

• Bright Gene, China Therapy Area: Recombinant products and Anti Infectives Collaboration on several API to develop new product

• Cinna Gen Therapy Area: Infertility Tech transfer and Clinical development(Phase III) of the product at Gufic

• Lucas Meyer Cosmetics Therapy Area: Dermo Cosmetics Technical collaboration and Product Development

• Forayed into cancer immunology by undertaking research, collaboration with Selvax which is a research company based in Australia and as a part of this initiative is to focus on development activities in return for exclusive commercial rights for the immunotherapy in India along with an equal share of revenues from Europe and Selvax goal is to develop a very safe, effective immunological based treatment for a range of hard-to-treat solid tumours.

• GUFIC UK LIMITED (“GUL”), a wholly owned subsidiary of the Company, was incorporated in United Kingdom on March 15, 2022 with the intent of expanding the Company’s business in United Kingdom

| Partner | Therapy area | Type |

|---|---|---|

| Prime Bio USA | Toxins and Biologicals | Technical collaboration, Development, Manufacturing, Formulation |

| Pharmaaz | Emergency Medicine | Technical collaboration |

| Lucas Meyer | Derma-cosmetic | Technical collaboration & Product Development |

| BrightGene | Recombinant and Anti-Infective | Technical collaboration |

| Cinna Gen | Infertility | Technical collaboration & Clinical Development |

| Techno flex | Dual Chamber Bags | Technical collaboration |

| GUFIC UK LIMITED | Expansion into UK | Tie |

| Selvax Private Limited | Oncology | Tie |

Applications

| Salt Composition | Product |

|---|---|

| Omadacycline Tosylate | |

| Isavuconazole Sulfate | |

| Anidulafungin | Canidula |

| Caspofungin Acetate | Guficap/ Guficap Plus |

| Clarithromycin | Clarific |

| Colistimethate Sodium | Guficol/Guficol Plus |

| Doxycycline | Doxific |

| Fosfomycin | Fosfocide |

| Micafungin | Micafung/Micafung |

| Minocycline | Mific/Mific Plus |

| Paracetamol | Mol Plus |

| Polymyxin B | Polyfic/Polyfic Plus |

| Teicoplanin | Ticofic/Ticofic |

| Tigecycline | Tigefic |

| Ulinastation | UNlinafic |

| Vancomycin | Gufivan |

| Voriconazole | Vorific |

| Tranexamic acid | Tranafic |

| Methy! Prednisolone Sadium Succinate | Gufipress |

| Highly Purified Human Menotropin | Puregraf |

| Highly Purified Urofolitropin | Follicare |

| Human chorionic Gonadotrohins | Puretrig |

| Liposomal Emulsion Ampbhotericine B Gufisome | Emphoter |

| Vecuronium Bromide | Gufivec |

| Thymosin Alpha-1 | Alpha |

| Azithromycin | AZ-OD |

| Leuprolide Acetate | Luprocare Depot |

| Cetrorelix acetate | Cetrofirst/CBTROCARE |

| Enoxaparin Sodium | Gufinox |

| Botulium Toxin | Stunnox |

| Isoxsuprine Hydrochloride | TOCOLYTE |

| Piperacillin + Tazobactam | Tazofic/Tazofic Plus |

| Meropenem | Merofic/Merofic Plus |

| Dortpenem | Donific/Dorific Plus |

| Imipenem + | Imefic/Imefic Plus |

| Human Normal Alburnin | Albusure |

| Tab.Cefpodoxime | Prodox |

| Filgrastim | Gofigrast |

| Tab.Nitrofurantoin | Tab. UT Guard |

| Cefoperazone+salbactum | Cepofic |

| Posaconazole | POSAFUNG |

| Natural Micronized Progesterone | Gufigest |

| Human Normal! Immunoglobulin | Immunccin/Immunocin |

| Estradiol Valerate | Gufistra |

| Octreotide | Gufioctre |

| Dalbavancin Hydrochloride | GufiDal |

| Daptomycin | Gufidapt |

| Amphotericine emulsion | Ampofic |

| Dydrogesterone | Dydrofic |

| Estrodiol | Estafert |

| Loperamide | Ridol |

| Clotrimazole % + Neomycin + Beclomethasone | Lotril |

Gufic Biosciences Herbal Products

» Sallaki 400/600 mg Tablets ( Strengthens joints to cope with muscular pains )

» Sallaki M.R Tablets ( Muscle relaxnt )

» Sallaki Liniment ( Joint pains and inflammation )

» Laxive Powder ( The complete laxative )

» Imunocin Syrup ( Stimulates underdeveloped immune system )

» Livpar Tablets ( Fights liver damage )

» Aswal Plus Capsules ( The Stree Eleminator )

» Zulcer Capsules ( Combats hyperacidity, gastritis & chronic functional dyspepsia )

» Eugynin Tablets ( Gives freedom from menacing menstrual excesses )

» Eugynin-L Tablets ( Puts stop to leucorrhoea )

» Sallaki Plus Tablets ( Strengthens joints to cope with muscular pains )

» Sallaki Ointment ( Strengthens joints to cope with muscular pains )

» Nucart OA Tablets ( Management of Osteoarthritis )

» Rumastal Forte Tablets ( Fights aches and pains associated with fever)

» Imunocin Tablets ( Stimulates underdeveloped immune system)

» Livpar Syrup ( Liver tonic par excellence )

» Kofend Cough Syrup ( Relieves cough )

» Zulcer Syrup ( Combats hyperacidity, gastritis & chronic functional dyspepsia )

» Eugynin Syrup (Gives freedom from menacing menstrual excesses )

» StretchNil Lotion ( for Prevention of Pregnancy Stretch Marks )

Contracts

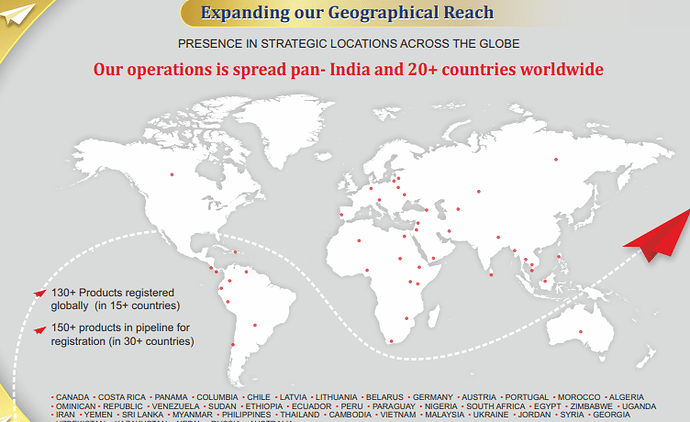

• 120+ Products registered globally on the name of Gufic in more than 20 countries

• 3 Contracts out of which two of them already the dossier is in place and going very aggressively, one might depend on the timelines of when will the Indore commercialization happen and time for the ANDA filing by the client.

Key Markets

§ Sri Lanka

§ Myanmar

§ Philippines

§ Vietnam

§ Canada

Key Products

§ Tigecycline

§ Liposomal Lyo Amphotericin-B

§ Micafungin

§ Anidulafungin

§ Vancomycin

§ Pantoprazole

§ Sallaki

Key Domination/Largest Supplier of formulations :

§ Doxycycline

§ Tigecycline

§ Gonadotropins

§ Liposomal Lyo Amphotericin B

§ Micafungin

§ Remdesivir (It has recently entered into an agreement with Hetero to supply Remdesivir – the only approved COVID-19 drug by US FDA. Hetero owns the license to market Remdesivir in 127 countries including India)

API & Intermediates Applications

ANTIFUNGALS

• Miconazole Miconazole Nitrate USP/BP/EP

• Cespelungin Acetate

• Econazole/Econazole Nitrate USP/BP/EP

• Micelungin Isaconazole Nitrala BP/EP

• Anidulafungin Ketoconazole USP/BP/EP

• Butoane.role Oxiconazole Nitrate (IHS)

• Terconazole Nitrate USP/BP/EP

• Tioconazole BP/EP

• Sulconazole Nitrale USP

ANTIBIOTIC

• Arbekan

ANAESTHETICS

• Prilocaine / Prilocine HCL USP/BP/EP

• Tetracine HCL EP/BP/USP

• Lidoraine / Lidocaine HCL USP/BP/EP

• Articaine HCL BP

INTERMEDIATES FOR ANTIFUNGALS

• 1-(2,4-Dichlorophenyl)-2-1 – Imidazole) - ethanol

UNDER DEVELOPMENT : ANTIFUNGALS

• Loliconazole

• Sertoconazole

Capex

• CMO have expanded the capacity pre-COVID of 31 crore

• 2021 Q3 and Q4 they have very aggressively invested in a new biological technology platform

• Indore Plant supposed to be Live on September as directed by Management

• Had some small expansion coming up for not only replacement but an injection of capacity of lyophilization

• Total capex of around 220 Crores for Indore plant

○ Out of 220 Crores 60 Crores has been already spent up to March 2022

○ 200 Crores for lyophilization facility including construction and land cost

○ Around 3 Crores to 4 Crores spent on the capex for our SAP implementation plus hardware for IT department

○ Indore plant 20 Crores they are spending for R&D facility

○ Remaining balance 160 Crores they are expecting to be incurred in the next financial year 2023-24

○ They are expecting internal accrual and for remaining amount

○ They are going to take a certain bank loan on a long-term basis.

• Around 25 Crores they have spent in Navsari plant for

○ Penem

○ Dual chamber

○ Increasing in lyophilization capacity.

• Gufic has invested in the development of H 15 - a candidate for Asthma and 3 new NDDS formulations for Anti-infective use.

Capacity Utilization

• 70% in lyophilization right now which should pick up

• 2.5 to 3 years window the company aims to 80% in capacity

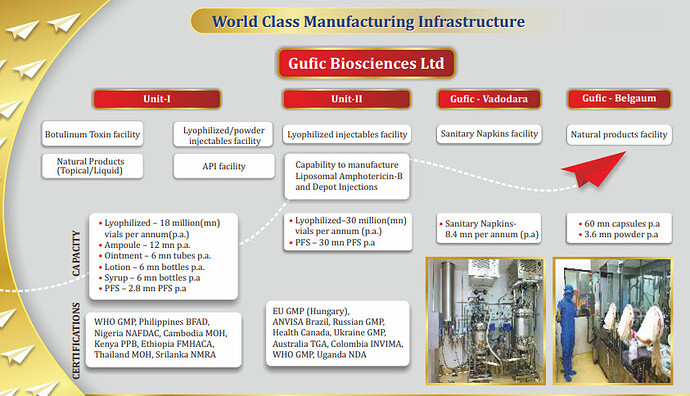

**• Unit - I at Navsari**

Lyophilized/Powder Injectables Facility : Natural Products (Topical/Liquid) API Facility Capacities

○ Lyophilized – 18 mn vials p.a.

○ Ampoule – 12mn p.a.

○ Ointment – 6mn tubes p.a.

○ Lotion – 6mn bottles p.a.

○ Syrup – 6mn bottles p.a.

○ PFS – 2.8mn PFS p.a.

**• Unit - II at Navsari : Lyophilized Injectables Facility Capability to manufacture**

○ Liposomal Amphotericin B

○ Depot Injections Capacities

§ Lyophilized – 30mn vials p.a.

§ PFS – 30mn PFS p.a.

**• Gufic - Belgaum Natural Products Facility Capacities**

○ 60mn capsules p.a.

○ 3.6mn powder p.a.

Upcoming

○ Unit - III at Indore Lyophilized/Powder Injectables Facility Capacities

○ Lyophilized – 36 mn vials p.a.

○ PFS – 15mn PFS p.a.

○ Liquid Injections – 60mn units p.a

**• Penem Block :** Dedicated facility for Penem Carbapenems

○ Lyophilized – 3mn vials p.a.

○ Dry Powder Inj - 30 mn Vials

○ Dual Chamber Bags-24 mn IV bags

**• UPDATE ON CAPEX**

○ Indore Civil Construction and Site Development work is progressing as per schedule and is near completion All equipment have been selected and orders have been placed and we expect it to reach us by September Expected commercialization by Q1 FY24

**○ Penem Block at Navsari**

Strategic decision to move the penem block to Navsari to reduce the time to market turned out well Civil work complete, Equipment received and Installation complete Commercialization to begin in August 2022 as announced earlier.

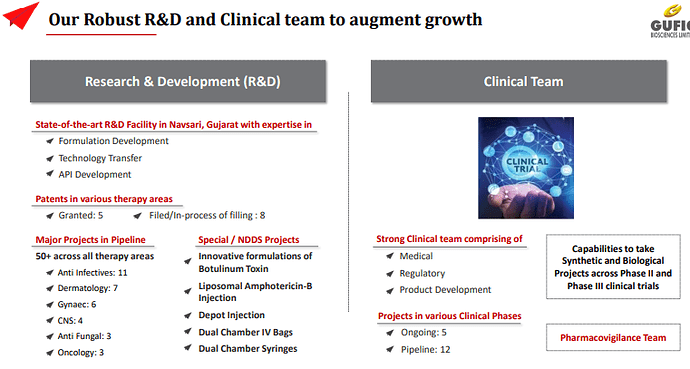

Patents : (Granted: 5 in India)

2015

○ Anidulafungin

○ Tigecycline lyophilized injection

2017

○ Rifabutin

○ Micafungin Lyophilized

2023 **

** ○ Filed/In-process of filling : 8

• Other Updates

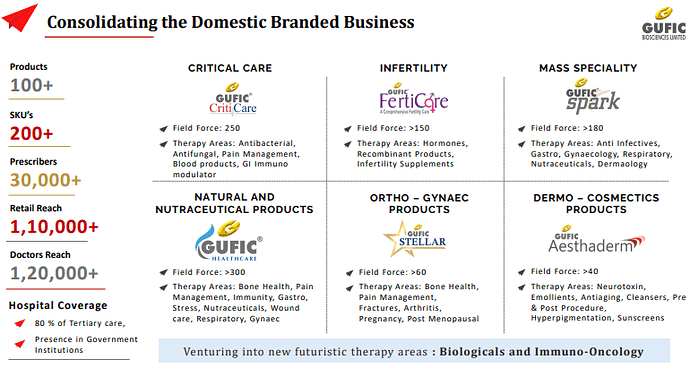

○ Doctor reach: Over 1,20,000

○ Prescribers: 30,000

○ Retail reach: 1,10,000

○ Hospital Coverage: 80-85 % of Tertiary care centres

○ Presence in Government Institutions

Projects in various Clinical Phases

Ongoing: 5

Pipeline: 12

| Product | Reference Drug | Generic Name | Treatment Division | Expected | Launch Date |

|---|---|---|---|---|---|

| D-29 | Dalvance | Dalbavancin Hydrochloride | Novel second-generation lipoglycopeptide Antibiotic | Criticare | Q3 FY22 |

| Stunnox | Botox | Botulinum Toxin Type-A | Anti-Aging injection | Aesthaderm | Q3 FY21 |

| O-26 | Nuzyra | Omadacycline Tosylate | Community-acquired bacterial pneumonia and acute skin and skin structure infections | Criticare | Q1 FY23 |

| IS-6 | Cresemba | Isavuconazole Sulfate | Antifungal to treat invasive aspergillosis and mucomycosis | Criticare | Q4 FY22 |

| Immunocin-α | Zadaxin | Thymosin Alpha-1 | Chronic hepatitis B virus (HBV) infection & undergoing clinical trials for COVID-19 | Criticare | Launched |

| Vancomycin | Market : Germany | Launched 2022 | |||

| Remdesivir | Market : India | Launched 2022 | |||

| Tigecycline | Market : Germany | Launched 2022 | |||

| Anidulafungin | Europe | Yet to Launch | |||

| Micafungin | Europe | Yet to Launch | |||

| Vancomycin | (ex-Germany),South Africa, Canada | Yet to Launch | |||

| Tigecycline | (ex-Germany) | Yet to Launch | |||

| Liposomal Amphotericin-B Injection | Yet to Launch | ||||

| Dual Chamber Syringes | Yet to Launch | ||||

| Dual Chamber IV Bags | Yet to Launch | ||||

| Division | Approx No. of Products to be launched in 12 -18 months |

|---|---|

| Critical care | 6 |

| Infertility | 4 |

| Healthcare | 5 |

| Spark | 5 |

| Stellar | 8 |

| Aesthaderm | 12 |

Herbal : Target

○ Rheumatoid Arthritis

○ Orthopaedic

○ Renal calculi

○ Gynaecological

○ Immunity Boosters and Tonics

○ Gastro intestinal

○ Respiratory

Stridden : A newly created specialty SBU with specific focus on Orthopaedic and Gynaecological products in various segments

○ Pain

○ Infection

○ Pregnancy

○ Lactation

○ Bone and muscle products. Focussed markets are metros

Critical Care Division :

Most of these are Lyophilised injectable - Used in Tertiary Care Hospital (Tertiary care is a higher level of specialized care within a hospital)

○ Anti-Bacterial (Penicillin - based Finished Dosage Forms) - LEADER

○ Anti-Fungal - LEADER

○ Pain

○ Blood products

○ Gastro

○ Neurology Product

○ With the launch of Dual Chamber Bags and normalization of hospitalization we see growth coming back in the next few quarters

Ferticare Division

Most of these are Lyophilised Injectable. - Used in Tertiary Care Hospital

○ Recombinant products

○ Infertility supplements.

○ Menotropin

○ Dydrogesterone: This product is ready for launch. To de-risk they have backward integrated API.

○ Gufic has invested to develop recombinant alternatives to the urinary source of certain hormones which are critical in the treatment of infertility and thereby ensuring we will be independent of geopolitical as well as currency exchange risks and potential pitfalls in the next 15-18 month

Healthcare & Spark Division

Healthcare :Target Ayurvedic doctors and General Practitioners - LEADER in asthama

○ Bone health

○ Pain management

○ Immunity

○ Gastro

○ Wound care

Target General Practitioners and Physicians

○ Anti-Infective

○ Gastro

○ Gynaec

○ Paediatric

○ Respiratory

○ Nutraceutical

○ Cardiac Diabetic Management

○ Anti-Inflammatory - LEADER

○ We are market leaders in anti-inflammatory and herbal medicines

○ We initiated trial of a new product made from an Indian gum by a standardized extraction process for use in the management of asthma

○ Our brand Sallaki continues to be the market leader in Boswellia Serrata

○ The new multivitamin and anti-inflammatory basket should do well in the coming quarters aiding growth in this segment

Stellar Division

Target Orthopaedics and Gynaecology

○ Bone health

○ Fractures

○ Pain

○ Arthritis

○ Pregnancy

○ Post-Menopausal

○ Sallaki Max complimented with launches in the field of pain management and muscle recovery and topical unique oil suspension for better penetration and faster recouperation has led to higher growth in this division

Aestherderm Division

Venture into the potential sub-chronic segment of Aesthetic Dermatology focus on

○ Moisturizing agents

○ Anti-aging

○ Hyperpigmentation

○ Sunscreen

○ Pre/ post procedural products

○ Boutolix i.e. Stunnox

○ Stunnox continues to increase penetration in the market. We are developing fillers to complement and complete this basket

○ Started the training center for new therapies with combination of machines and use of fillers and Botulinum Toxin for face and body contouring

○ Gufic has partnered with experts in the field of vaginal tightening and vaginal rejuvenation and organized training on a national level to promote the use of Botulinum Toxin for these indications

Domestic Business

○ 50% to 55% of our revenue comes from the domestic business

○ 8 well defined Strategic Business Units Field force of ~1,000+ Product Portfolio in 15+ Therapy Areas

International Business

○ In Financial year 2022 we have commenced exports to regulated markets for molecules such as

§ Vancomycin Exported Vancomycin lyophilized injectable to Germany (European Union)

§ Clarithromycin

§ Teicoplanin

§ Tigecycline

○ Have seen growth of ~25% through International Business.

○ Operation spread across more than 20 countries 130+ Products registered globally 150+ products in pipeline for registration

○ Currently 180 Registrations, 13 received and 33 applied in Q1FY23

○ For Europe and LATAM, strategy is in place to register existing developed formulations in countries in which they have presence and enter new countries based on market gaps and opportunities

○ Accreditations

WHO GMP, Philippines BFAD, Nigeria NAFDAC, Cambodia MOH, Kenya PPB, Ethiopia FMHACA, Thailand MOH, Sri Lanka NMRA EU GMP (Hungary), ANVISA Brazil, Russian GMP, Health Canada, Ukraine GMP, Australia TGA, Colombia INVIMA, Uganda NDA, SAHPRA South Africa

CMO Business

○ CMO market also grow by around below 20%-22%

○ Contract manufacturing division grew by 15% YoY, aided by the merger of Gufic Lifesciences Pvt Ltd & contract manufacturing business of Remdesivir (served ~ 5mn doses)

○ CMO BUSINESS One of the largest facility for Lyophilization 70+ CMO Partners 50+ Products

○ Stunnox brand in February 2021 which was mostly related to the facial aesthetics and we were very keen I think to launch the Gufic Biosciences Limited May 23, 2022

○ Zarbot brand which is our medical I would say related to medical users and specially for neurological uses apart from other uses in pain also

API Business

○ API division grew by 40% aided by increased capacities and substantial investments in product development.

○ We aim to launch 5 new molecules in FY 22.

Centre of Excellence in Mumbai

○ The centre of excellence will treat the skin (not just facial skin) and the body as a holistic organism using most advanced equipment, toxins and fillers for face and body contouring.

○ Moreover, the knowledge repository of the centre will be made open and available to all the members of the medical fraternity across fields, specializations and philosophies to leverage our findings, thus making available the magnificent and marvellous capabilities of botulinum toxin to the society at large

Update on Research & Development and Innovation

○ The API Research Development at Navsari has made noteworthy progress in development of molecules in therapeutic categories such as Antifungal, Anticoagulant, Tetracycline Antibiotics, Progestin, Beta 3 adrenegic agonists, Antidiabetic, Cyclopeptides Hormones. These development projects are all progressing in line with the plan

○ Clinical Trial for D29 will be completed by Q2 FY23 and will be submitted by Q3 FY23 to the DCGI for final approval. This is a novel once a week anti-infective to be launched for the first time in India

○ Biapenem – Approvals are expected soon for vials and for Dual Chamber Bags (first company in India for Dual Chamber Bags). Currently, the market penetration is low due to unviable pricing. Gufic via its pricing and reach will plan to increase the market for Biapenem in India

○ Launched of Dual Chamber Bags for the first time in India.

○ Isavuconazole oral option to compliment the injectable by Q3 FY23. The overall market of this molecule is growing at 100%

Selvax Update : Biotech Company

§ Immuno Oncology

§ It has showed some good clinical success in animal studies (Preclinical stage) and is now preparing for human trials (Phase 1).

§ Thymosin alpha1

○ The Selvax immunotherapy demonstrated promising results (100% long-term cures alongside induction of protective immunity) in the two pancreatic cancer models tested in the pre-clinical stage. These results align with the other different mouse tumour models tested.

○ Moreover, it has consistently outperformed FDA approved checkpoint inhibitors which have become first line therapies for some cancers, including melanoma. These results indicate that the Selvax immunotherapeutic approach could offer a viable alternative to existing therapies for the treatment of pancreatic cancer.

○ Current treatment options for pancreatic cancer include surgery, chemotherapy, radiotherapy, and ablation. These options are rarely effective, and in most cases are used to manage symptoms rather than eradicate disease, highlighting a dire need for new treatments that are effective at combating a cancer that is currently incurable

Next Growth Drivers

○ Gufic aims to achieve 1000 Crores as soon as possible not sure whether in 2024 or 2025 or 2026, but this is their internal target

§ Gufic hopes in the next 3 years, they should definitely grow to a double digit, maybe next 2 to 3 years

○ Gufic hopes to have a double-digit market share in the represented market.

○ Gufic has plans from the Indore factory and from the Navsari factory to actually go and gradually address in the next 3 years a Rs. 25,000 crore market share where they have listed out molecules as per ORG IMS.

○ Earlier Gufic was mainly targeting secondary and tertiary care hospital, now they have started penetrating into primary care hospitals and nursing homes, which is a fragmented but a large and a fast growing

○ Gufic has a very strong field presence in infertility segment and intend to be among the top 3 players in India in the next 3 years

○ With the launch of Dual Chamber Bags and normalization of hospitalization we see growth coming back in the next few quarters

§ Gufic is planning annual sales of Rs. 20 Crs. in less than 2 years for Ferticare Division especially for Dydrogesterone

○ Venturing into new futuristic therapy areas : Biologicals and Immuno-Oncology

○ Zarbot, which is the first Botulinum Toxin in India targeting cerebral palsy migraine and overactive bladder

○ Planning to have 140 molecules to be prepared and launched in the next 2 to 3 years.

○ With Lyophilization as backbone the product extension to support to lyophilization in terms of prefilled syringes, ampoules, suspensions, vials, dual chamber bags to even provision for ophthalmic line also in Phase 2

○ Gufic is also in look out for CDMO opportunities as and when market opportunity for US opens, they are equipped to handle their CMO business or CDMO business.

○ D29 is a novel once a week anti-infective to be launched for the first time in India there is no innovator in India for D29 and also DD29 is backward integrated in terms of API with having limited, no competition at least for the first year in India.

There will be an upgrade to the existing therapy of Vancomycin, Linezolid and Teicoplanin

○ New indications for an existing peptide molecule mainly targeting endometriosis and recurrent implantation failure. The results of studies and initial trials are very, very promising. Both these indications have a large unaddressed market in India

○ To take D29 from Indore factory to the European and the US market where in the product is already approved, the innovator is already there.

Strength

• The capacity for lyophilization is huge. This we’ll be the largest facility manufacturer in the world of lyophilization and it take minimum of 2 years for setting up the plant and getting approvals

• Only company to make Botulinum Toxin

• Complete autonomous manufacturing for Lyophilization process and no manual intervention needed

• High success rate of USFDA approval in Lyophilization injectable space compared to traditional injectable space

• They have the widest basket of products now in the infertility segment and are vertically integrated with own manufacturing API.

• Products widely circulated across 1,500+ hospital chains and leading medical facilities through an extensive network of 1000+ marketing representatives across India

Margins Trajectory

• First year the gross margin may be in the range of around 45%.

• Second year, it can be increased to 50%

• From second year onward the gross margin will be around 55%

Geography

• 2022 entered in two new regulated markets of Brazil and Canada.

Approvals

FY 2020-2021 :

• Rifampicin injections have been approved to be manufactured from GLPL for the Germany market in January, 2021

• 0-26 has been planned to be submitted to the drug regulatory body by the month of July 2021 with an aim of commercialization in the financial year 2022-23.

• IS -6 project has been progressing well and expect an approval in financial year 2021- 22

• Immunocin Alpha trials in Covid are progressing well and with the help of the medical department, the Company has decided to initiate trials in 2 other indications by Q4 2020-2021 which will cement lmmunocin alpha as the biggest brand of Gufic in the shortest span of time.

• Gufic also launched two brands of

• Prefilled syringe molecules in Q3 2020-2021 for cardiac conditions

• Planning at least 3 new molecules in the next 12 months period in the category of biological peptides in the field of gynaecology

• Gufic in Q3 2020-2021 also initiated heavy investments in the development of H 15 candidate for Asthma along with DC 1, DC 2 and DC 3 NODS formulations for Anti-infective use

• Indore Factory inspections will start from, November, December, January itself even before going live with commercialization.

• 3 Contracts out of which two of them already the dossier is in place and going very aggressively, one we might depend on the timelines of when will the Indore commercialization happen and if the client happy time for the ANDA filing.

FY 2022-2023 :

○ Five new product approvals from regulated markets

○ Eight new product approvals from the semi regulated market

○ 13 registrations received

○ 33 new registrations applied

• Applied to DCGI for sepsis indication it is a large market

• Launched Sallaki Max it is a nutraceutical targeting arthritic pain (Stellar Division)

• Completing the clinical trial for D29 by Q3 of FY23, and will be submitting by around the same time to DCGI for final approval

• Interesting work done in biapenem in the 2023 Q1 quarter and expecting approval soon not only in the vial form, but also Dual Chamber Bag and Dual Chamber Bag will be the first company in India to launch biapenem.

• Another thing about biapenem is that currently the market penetration is quite low due to the unviable pricing, but using our proprietary technology, Gufic intends to reduce the pricing and increase the reach and thereby increasing the overall market for biapenem in India

• Current treatment options for pancreatic cancer include surgery, chemotherapy and radiotherapy

• Demonstrated promising results in 2 pancreatic cancer models tested in the preclinical stage by Salvax

2021 Covid Growth - One Time Growth and continuation

• 2021 very strategic developments had happened in Q4 was we Gufic had received permission to manufacture sell and distribute Sodium Sulfate API and the finished formulation which is Isoconazole for injection

• This is an injection targeting patients above 18 years of age for treatment for invasive Aspergillosis and invasive Mucormycosis.

• Beyond this we Gufic has received the DCGI approval for Thymosin Alpha-1

• Immunocin Alpha was a homegrown brand in this molecule, which is used as an add on therapy for treatment of moderate-to-severe COVID-19 patients who require ventilator support

• Thymosin Alpha, which Gufic got approval in COVID we do not foresee much traction in sales in India for COVID

• Immunocin has significantly reduced the risk of death in phase three clinical trials in adult patients with moderate-to-severe COVID-19.

• The domestic market market size of $6 million specifically related to the molecule Isoconazole where there is only one innovator that is of course Pfizer which is there in the market, Gufic foresee that this product is also going to be working against other molecules having a similar therapeutic profile like Posaconazole amphotericin based molecules and also use in combination with Echinocandins so if combined all that market up of course it goes beyond 230 Crores, but management commented that they are in talks about oral permission to receive whereas currently permission is available for injection, management are expecting in third quarter or fourth quarter to receive permission and will be a good basket to take it forward.

Clients

Disc : Studying, not invested

Opportunities

• Botulinum Toxin Indian Market Size is 120 Crore at the moment (Potential is huge in India and international market as well but it is not easy)

• Botulinum Toxin International Market Size 8 Billion and USA 5 Billion

• Critical Care India Market size is 181000 Crores in India

• Infertility is around close to 4000 crores in India and growing 15% yoy

• Dual Chamber Bag initially targeting Anti-infectives. Addressable market size is ~Rs. 3,000 crores in India

• Dydrogesterone product size for this product is ~Rs. 800+ crores growing at 60% YoY in India

• Critical Care around 36000 Crores to 38000 Crores

• D29 Market size 6 million in India

• Sparsh market size is ~Rs. 9,500 crores, growing at a CAGR of 12%

Updates on Capex

- Indore Plant supposed to be Live on September as directed by Management

- Management is walking the talk as the plant is now LIVE and they have started investing in R&D and started to plan on validating Batches

Critical Care Division

- Anti-Bacterial (Penicillin - based Finished Dosage Forms) - Still Maintaining LEADERSHIP POSITION

- Anti-Fungal - Still Maintaining LEADERSHIP POSITION

Approvals

- DCGI Approval received for manufacturing and marketing of Biapenem Dual Chamber Bag

- DCGI approval received to conduct Phase III Clinical trials for Thymosin Alpha injection in

Sepsis - it is a large market

Launched

- Launched Sparsh sub division under Critical Care Division - This will use the most advance technology to smoothen the supply chain process for delivering 100+ high quality injectable products to untapped hospitals and nursing homes including the sub-urban and rural market. Addressable market size is ~Rs. 9,500 crores, growing at a CAGR of 12%

Yet To Launch

- Planning to launch Ceftazidime + Avibactam soon. Gufic will be the only Indian Company to launch this product other than the innovator with inhouse manufactured API (Avibactam)

- Launching the novel ‘Once a week’ anti-infective - Dalbavancin for the 1st time in India in Q4 FY23

In Developement/Clinical Phase :

- Isavuconazole oral option to compliment the injectable by Q3 FY23. The overall market of this molecule is growing at 100%

- A wide range of products being developed in the new drug delivery system of Dual Chamber Syringes which will ensure ease of reconstitution,accurate dosing and maintain

terility from plant to patient - The API Research Development at Navsari has made noteworthy progress in development of molecules in therapeutic categories such as Antifungal, Anticoagulant, Tetracycline Antibiotics, Progestin, Beta 3 adrenegic agonists, Antidiabetic, Cyclopeptides Hormones. These development projects are all progressing in line with the plan

Investment/Partnership

NA

Ferti Care Division

- Maintained 2nd Rank in the high growing Cetrorelix market and increasing its penetration for Enoxaparin in the infertility segment

- Puregraf (HMG) and Puretrig (HCG) continues to register high double-digit growth for female infertility hormones

Approvals

- DCGI approval received to conduct Phase III Clinical trials for Thymosin Alpha injection in Endometriosis

Launched

- Dydrogesterone: This product has been launched. Further, to de-risk the short supply of API, Gufic has vertically integrated to manufacture its own API. Market size for this product is ~Rs. 800+ crores growing at 60% YoY

Yet To Launch

NA

In Developement/Clinical Phase :

NA

Investment/Partnership

- Gufic has invested to develop recombinant alternatives to the urinary source of certain hormones which are critical in the treatment of infertility and thereby ensuring we will be independent of geopolitical as well as currency exchange risks and potential pitfalls in

the next 12-18 months

Healthcare, Stellar & Spark Division

- Sallaki continues to be the market leader in Boswellia Serrata market

Approval

- NA

Launched

- A new multivitamin formulation has been launched which should do well in the coming quarters aiding growth in this segment

- Launched a cannabis extract based topical solution for muscular and arthritic pain relief

Yet to launch

NA

In Developement/Clinical Phase :

- We initiated trial of a new product made from an Indian gum by a standardized extraction process for use in the management of asthma

- Initiated development of a unique liposomal iron formulation

Investment/Partnership

NA

Aestherderm Division

- Stunnox continues to increase penetration in the market.

- Started the training center for new therapies with combination of machines and use of fillers and Botulinum Toxin for face and body contouring

Approval

NA

Launched

NA

Yet to launch

NA

In Developement/Clinical Phase :

- Break-through in the development of novel topical formulation of Botulinum Toxin for the first time in the world

- Developing fillers for Stunnox to complement and complete this basket

Investment/Partnership

• Gufic has partnered with Indian College of Cosmetic Gynaecology (ICCG) in the field of cosmetic vaginal tightening and rejuvenation and organized trainings to promote the use of Botulinum Toxin for these indications

Selvax

Approval

NA

Launched

NA

Yet to launch

NA

In Developement/Clinical Phase :

- The Selvax immunotherapy demonstrated promising results (100% long-term cures alongside induction of protective immunity) in the two pancreatic cancer models tested in the pre-clinical stage. These results align with the other different mouse tumour models tested

- Moreover, it has consistently outperformed FDA approved checkpoint inhibitors which have become first line therapies for some cancers, including melanoma. These results indicate that the Selvax immunotherapeutic approach could offer a viable alternative to existing therapiesfor the treatment of pancreatic cancer

- Current treatment options for pancreatic cancer include surgery, chemotherapy, radiotherapy, and ablation. These options are rarely effective, and in most cases are used to manage symptoms rather than eradicate disease, highlighting a dire need for new treatments that are effective at combating a cancer that is currently incurable

Investment/Partnership

NA

Domestic Business

International Business

- 25% Growth in International Business

- 150+ products are in pipeline for registration in over 40 Countries

- Received 2 new product approvals received from each, UK-MHRA and ANVIZA Brazil.

- Received 1 product approval from Health Canada

Awaiting to hear more in CONCALL on Monday 14th November 2022

This is good. Combination of Ceftazidime+Avibactum is one of the very few therapeutic options available to treat multidrug resistant(MDR) gram negative bacterial infection (particularly Enterobacteriaceae family) which are increasing significantly in India. These are resistant to carbapenem drugs(eg:Meropenem, Gufic does have good product portfolio of carbapenems) , Ceftazidime+Avibactum has emerged as one of the main treatment options in critical care in such cases. As I have seen , use of this particular antibiotic has increased exponentially in last 2 years in higher medical center’s and likely that the use will increase further as overall incidence of MDR bugs are increasing and more awareness of product among practitioners. Increase in availability of detecting particular enzyme causing drug resistance also contributing to selecting Ceftazidime+Avibactum as treatment option.

Presently only Zevicefta by Pfizer ltd is available in market. The standard dose( Ceftazidime 2gm/Avibactum 0.5gm) vial is marketed at around MRP Rs.4500.00

Today Gufic concall is scheduled at 4.30PM, we may get more details about product pricing, growth and market size.

(One of their main product in critical care, Meropenem has come under NLEM list. We can ask management about impact of same on critical care segment revenue. My guess is it will be at least 15-20% of their critical care revenue).

Discl: tracking.

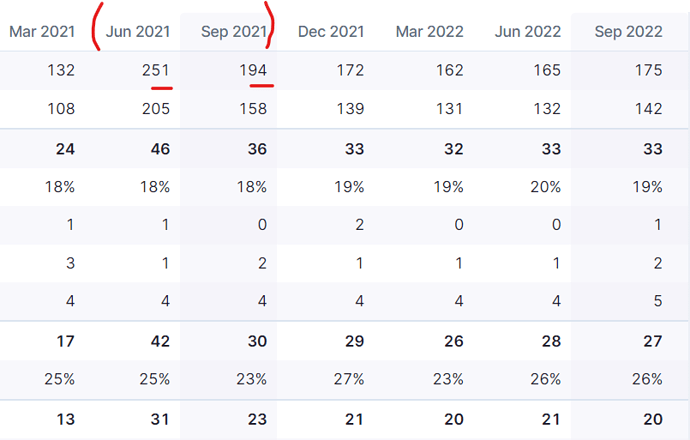

Despite all the great forward story telling it is interesting to see no QoQ profit growth for the last 6 quarters.

How long can stock run on stories of great company and great future. Numbers need to start growing first.

I think management had mentioned in previous calls about the higher base due to Covid-related sales. They have also been mentioning ex-Covid sales growth to paint a fairer picture. If I remember correctly, June and September quarters of 2021 had the most one-time covid related sales. Whether we should worry about QoQ growth, is subjective to our vision and expectations.

I never mentioned YoY. I know about high Covid base of last year. I said QoQ. Please take note.

I am trying to share my opinion on the statement that there has been no growth QoQ for 6 quarters. Sorry that I didn’t explain better, pls allow me to elaborate. I meant to say out of the last 6 quarters, atleast 3 are affected by covid related sales. June was high, Sep saw a waning effect hence could not match the sales of June. Dec did not see any covid sales so again could not compare with June or September. We can now tune the staement to “little to no growth in last 3 quarters” which does take some heat off. Now, it is upto an individual to judge if this a good metric to make a conclusion for a 2000 crore company. Thank you for asking for clarification.

I am invested and hopeful.

Hi @vnktshb ,

Management had clearly mentioned that ex of COVID drug sales, FY22 sales was 610-620 cr. They then guided for 15-20% growth in FY23 which means potential sales of 700-750 cr. In H1FY23, they did 340 cr. So they are broadly doing business in-line with their own guidance. Hope this provides a bit of context.

Disclosure: Invested (position size here, no transactions in last-30 days)

This year earning will be flat comapared to last year. So price also will be flat if it follows eps. Anyway now a days market wants qoq growth or else getting slaughtered.

Gufic Bio Initiating Coverage

Disc - holding

Gufic BioSciences Ltd- Master doc-Ajinkya-18-12-2022 1PM.pdf (1.4 MB)

Gufic came with flattish nos, they are confident of growing at 15-20%. Concall notes below

FY23Q3

- Navsari: 3 blocks (Unit I → legacy; Unit II → EU approved; Unit III → Penem block commissioned in Q2FY23) + API block. Will convert Unit I into recombinant + infertility product

- On track to commercialize Indore facility, civil work for utility & R&D work is 90% complete. Have received both shipment of imported equipment (lyophilizers) and installation is underway. Indore capacity is 1.5x of current Gufic capacity taking total capacity to 2.5x. It will take time to operate at high utilization as they are also targeting regulated markets from Indore. Hoping to get all accreditations by 2024, it will be commercialized in 2023 and initially cater to domestic markets + CMO

- Sparsh division: Completed primary and secondary research to potential hospitals. The molecules will give potential revenue of 500-600 cr. (to Gufic) with 20-25% market share in their target market segment

- International division: Received approval for 3 products (Colombia, Kenya and Philippines). Exports are being led by Germany, Colombia and Sri Lanka

- Quarterly revenue run rate in FY23 is 170 cr.

- Critical care revenues were flat (20-22 cr. of stock returns)

- Other expenses is higher this year as there has been more spends on biological R&D. All these investments should lead to 15-20% growth on a sustainable basis

- Dual chamber bags for penems: NPPA has given only a 15-20% higher price realization which is not feasible. Are waiting for meropenem revised MRP and for permission to launch the product at a higher MRP. Hopefully it will get launched by Q1FY24

- Receivable cycle has increased in the CMO business from 40-45 days to 70-90 days across the industry

- Domestic market: 45 days receivables

Disclosure: Invested (position size here, no transactions in last-30 days)

Gufic came in with another flattish set of nos (7% sales growth, 1% loss in EBITDA margins and 10% drop in profits). FY24 is likely going to be a flattish year in terms of profits, as depreciation and interest costs from Indore facility will kick in along with other operating expenses. The interesting thing shown by Gufic is launch of some interesting products (Biapenem in dual chamber bags, Dalbavancin, SeraSeal, etc.). Lets see how they can scaleup in next couple of years. Concall notes below.

FY23Q4

- Ex-of COVID sales of 170 cr., sales grew from 610 cr. to 691 cr. in FY23 (13%). Ex of sale returns of 26 cr. growth comes to 17.5%

- Critical care:

o Sales declined in FY23 due to inventory build-up post-COVID. Had to take 26-28 cr. sales return. With new launches, hoping it to return to growth trajectory

o PCPM of 7-8 lakhs

o Surveyed 8000 new hospitals (in urban markets) to finish product mapping, these can potentially contribute 0.5–15 lakh monthly sales

o Received DCGI approvals for Biapenem and dual chamber bag. Will also be offered to a select CMO partners

o Received DCGI approvals for Dalbavancin API and Formulation and also applied for a process patent. Will be launched for the first time in India in H1FY24. Will also be offered to a select CMO partners and also exported as its already a big product in US and Europe. The main advantage of this product is only 2 injections are required on first day and the third injection on 8th day. So patient can be discharged after surgery and doesn’t have to stay in hospital. This will be a product where market has to be built in India vs in exports where market already is very big

o Launch of Ceftazidime + Avibactam was very successful. Sold 98000 vials (own brand + CMO) in Jan-March 2023. Hoping to be in top-3 by end of this year as they are also manufacturing the APIs

o Most of penem requirement is now being fulfilled by Navsari facility (which was earlier outsourced). Also filing new registrations in international markets

o Plan to launch oral form of Isavuconazole, have already launched injectable form

o Haven’t yet got required prices for Meropenem and Piperacillin-Tazobactam dual chamber bags. Currently focusing on launching Biapenem and Teicoplanin which are not in NPPA control

o Sparsh:

Launched with field force of 33 people aiming with a PCPM of 10-15 lakh. Reached 5 lakhs by mid-May.

Have launched 85 products in first phase and will launch 45 more in next phase taking total molecules to 130

Process validation batches for these 85 molecules are being used to create new dossier for registering molecules in different markets

Have in-licensed some differentiated wound management products (SeraSeal; 15-20k per vial) for the ICU

o Tring to bring all the hospital demand into one sales channel - Ferticare

o Was the main growth driver in FY23

o PCPM of 5-6 lakhs

o Hormone business (hMG, FSH, hCGs and Cetrorelix) did really well

o Dydrogesterone launch was successful, plan to launch a sustained release form in FY24

o Have launched a more potent form of hMG which reduces the chances of failures of IVF cycle

o Trials with Thymosin Alpha injection for endometriosis is progressing well - Healthcare, Stellar and Spark

o Spark (smaller division) grew by 22%

o Asthma: Trials for a new product derived from Boswellia Serrata were successful. Plan to launch this in FY24

o Launch of new zinc-based multivitamin was successful

o Plan to launch a novel analgesic Polmacoxib for osteoarthritis in FY24 (Hetero got approval for same condition on 14.02.2023)

o - Aesthaderm

o Stunnox is now the second largest player in the Botulinum Toxin market in India, grew 2.5x over FY22 (still very small)

o Zarbot: Launched by a new team of 12 people in January and sales are way below expectations. Expand team size to 16

o Have spent 9cr. on Center of Excellence project (led by Dr. Rajesh Lalchandani, Instagram link has 26k+ followers). Will be importing the fillers for next 2-3 years and only invest in CAPEX once they have economies of scale. - Cleared ANVISA Brazil Audit successfully without any observations

- Received four new registrations and details of which we have mentioned in our Investor Presentation

- Indore: Validation of facility will be completed by Q2FY24

- Increase in inventory

o Sparsh division launch of 85 products

o Dual chamber bag launches: Had ordered dual chamber bags from Europe based on six-month forecast which didn’t yet pan out as they didn’t get higher prices by NPPA for Meropenem and Piperacillin-Tazobactam - Increase in receivables: Payment terms have now been restored to pre-covid levels of 90 to 120 days for contract manufacturers. COVID

- R&D: 10-12% in FY23, should come down to 6-7% in FY24 due to more focus on validation batches in Indore and again increase to 10-12% in FY25

- Exports are 15% of sales (including selling via agents)

Disclosure: Invested (position size here, no transactions in last-30 days)