My Notes About Godrej Agrovet

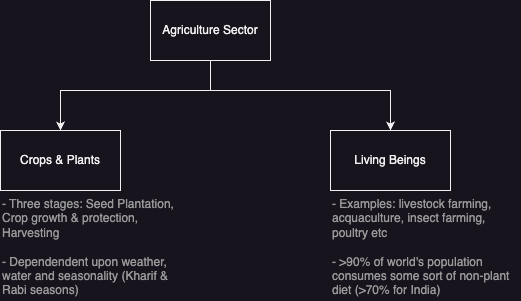

Agri Sector

– Provides livelihood for ~55% of India’s population. This number has been de-growing and is expected to further reduce over the longer period.

– From FY16 to FY22, agri exports grew at a CAGR of ~7.5% (from ~$32B to ~$50B)

– Detailed report on agri sector - here

–

Overview of Godrej Group and Agrovet

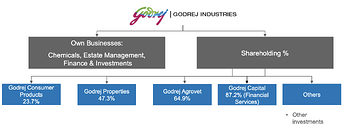

- Over a 100 year old group (estd. in 1897)

- Godrej Agrovet is a subsidiary of Godrej Industries

- Journey of Godrej Agro

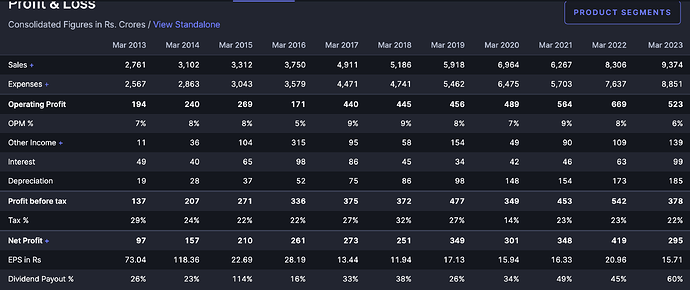

- Last 10 Years Revenue CAGR: 13%

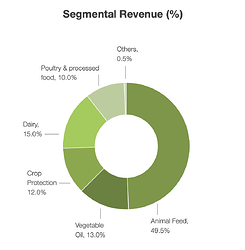

- Largest feed and crude palm oil produced in India

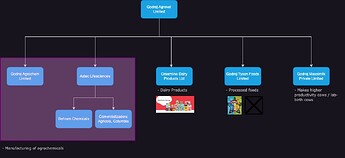

- Godrej Agrovet Subsidiaries

- Company also has a couple of Joint Ventures and some investments in UAE. One of the JV is in Bangaldesh (agrochem) and another is a VC firm that invests in agri-startups.

- Has some investment in UAE but I have never been interested in their UAE investment so I’ll skip it.

Seasonality and Triggers

- During Drought: Cattle feed sales increase. However, other costs also go up and the impact is nullified at present [Page 7]

- Company is involved in a seasonal sector. However, it is working to reduce the seasonality effect

- Can take 5 to 7 years for the new processes to be set up and come into action

(infrastructure requirements, regulatory approvals, crop protection business, et cetera)

Capex

- Herbicide Plant worth Rs 500 Cr - to be commissioned by Dec’24

Valuation Comfort

There are a lot of different metrics that you can look at. However, this attracts me:

- Market Cap (9300) <= FY23 Sales (9300)

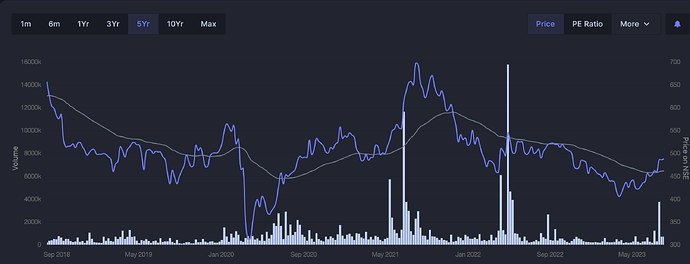

- Market cap at ATL v/s Profit at ATH: (Market Cap 5 years back was around 12k)

{This is a WIP post. I’ll update the notes as per time availability}

Disclaimer: Invested (PF sizing here). I may increase or decrease my investment at any time without informing anyone so please do your own research.