I am sharing an Excel Template for screener.in which will allow an investor to do the following:

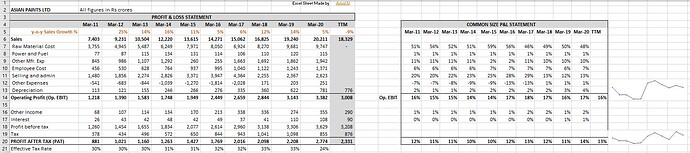

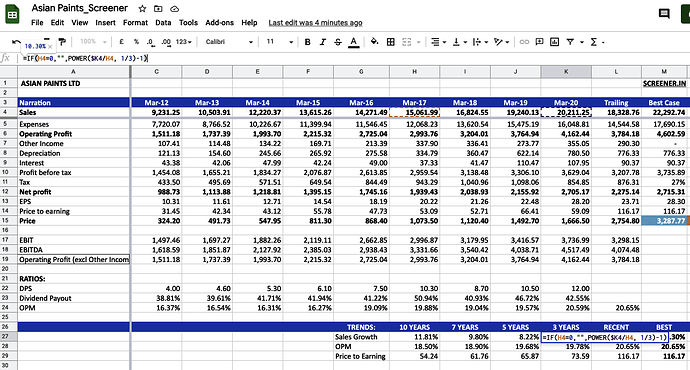

1. Income Statement Analysis

The template provides margin analysis of Income Statement items for the past 10 years

2. Growth Analysis

The template calculates the growth of Sales, PAT and EBIT over a period of 9 years, 7 years, 5 years, 3 years and TTM.

3. Debt and Solvency Ratios

The template calculates D/E and Interest Coverage Ratios for the past 10 years

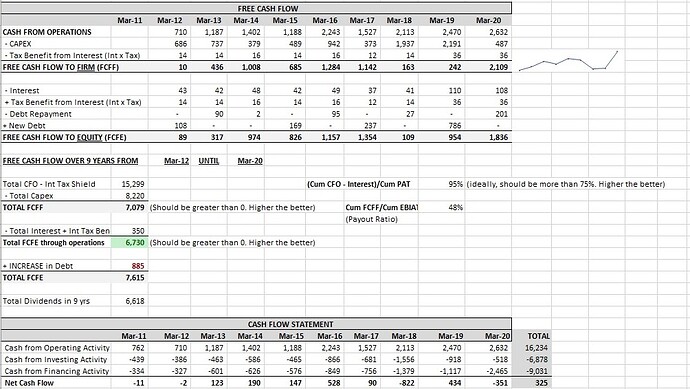

4. Free Cash Flow Analysis

The template calculates Free Cash Flow to Firm (FCFF) and Free Cash Flow to Equity (FCFE) for the past 9 years. It also calculates Cumulative FCF over the course of 9 years, which will help an investor to understand whether the company has earned any positive FCF over that period. In case a company has paid dividends but without earning FCF, the template will give out a comment that the dividends have been paid out of debt (and not FCF).

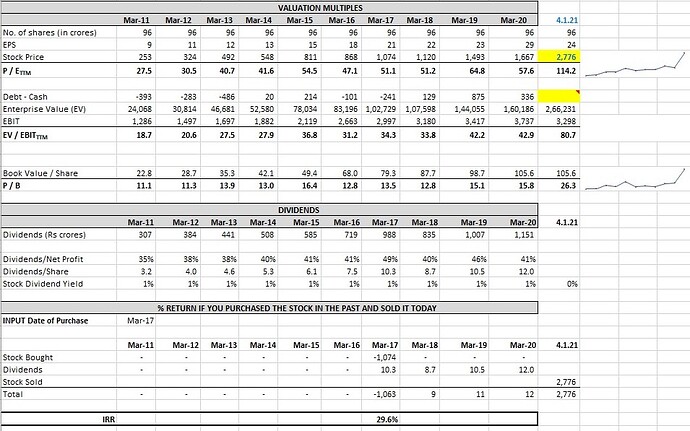

5. Valuation Multiples

The P/E, EV/EBIT, P/B multiples are calculated for the past 10 years.

6. Dividend Analysis

The dividends of the past 10 years are displayed. The template calculates Dividends/Net Profit and Dividend Yield. This will allow an investor to understand how the current dividend yield compares to that in the past 10 years and accordingly understand whether the current dividend yield is sustainable or not.

7. Return on a stock including dividends

Most websites calculate the return an investor made on a stock based on its price and do not account dividends. The template calculates the returns an investor has made including the dividends paid by a company

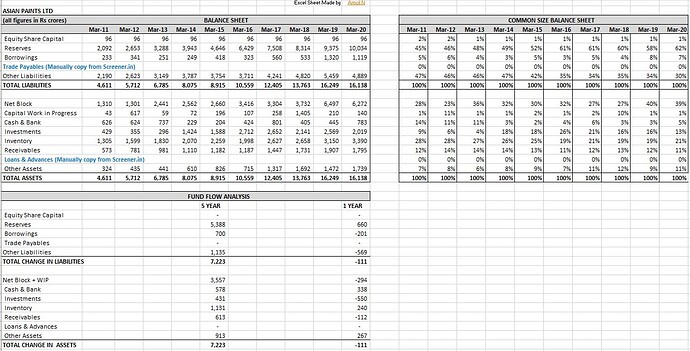

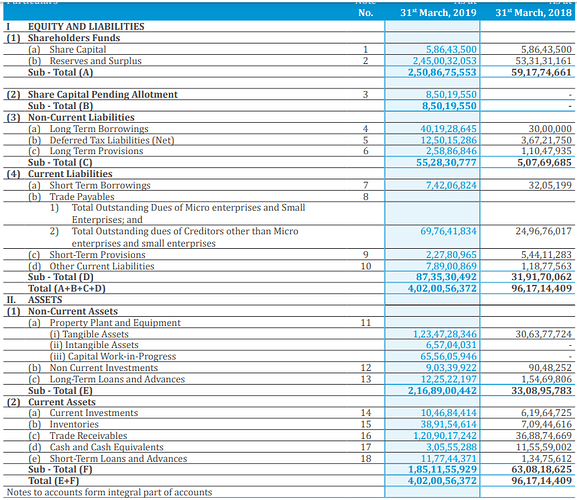

8. Balance Sheet Analysis

The template provides analysis of the Balance Sheet items by common sizing them for the past 10 years. This will aid for easy comparison of balance sheet items over the course 10 years.

9. Fund Flow Analysis

The template shows how a company has utilized its funds and how the company has raised these funds over the past 5 years and over the course of the past 1 year.

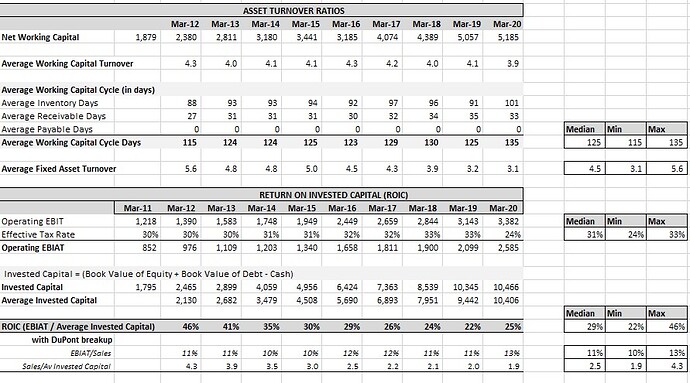

10. Asset Turnover Ratios

Working Capital Turnover and Fixed Asset Turnover for the past 10 years are calculated. Also calculated are the inventory days, payables days and receivable days.

11. Return on Invested Capital (ROIC)

For non-financial companies, ROIC is better measure of return than ROE or ROA. The excel template calculates ROIC for the past 10 years. Thus an investor can understand how the ROIC of a company has evolved over this time period.

I am offering this template for free. To download it click HERE