Ceinsys Tech Limited- technology-driven company that specializes in offering solutions in the Geospatial, Enterprise engineering, mobility services space

The revenue is primarily derived from its Enterprise Geospatial & Engineering Services segment

MCap-589

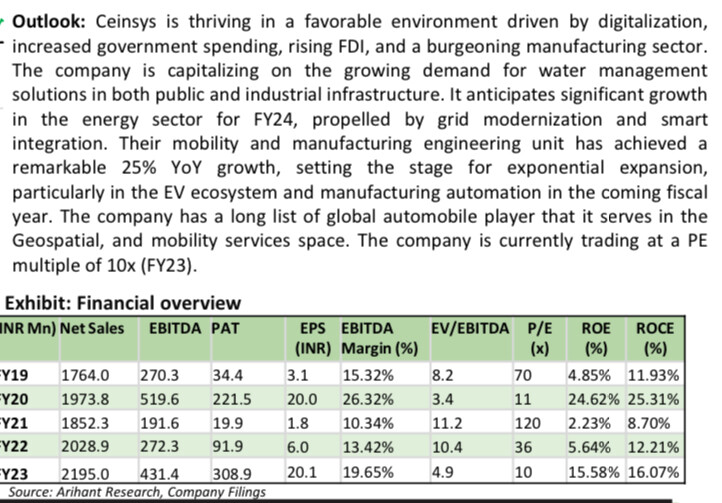

PE- 15

Sectorial Tailwinds because of Water & Sanitation Scheme

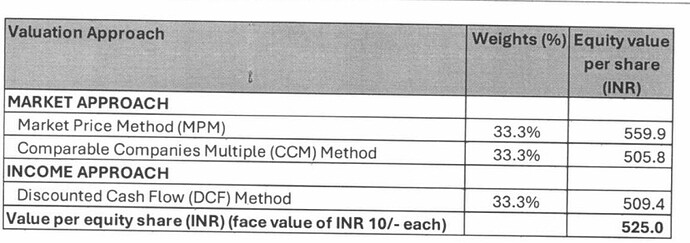

Valuations- Cheap Compare to peers

Full Thread- on my twitter

Geospatial Segment Overview-

Geospatial Key Services-unlike ordinary spatial data,geospatial tech innovations help to determine the exact location of an inventory on planet.

1-Data Acquisition & Processing-High

2-Navigation & HD Mapping Services

3-Photogrammetry

Consultancy Services-Different kind of services provided by them

Energy Management Consultancy

BIM Consultancy

Project Management Consultancy

Water Management Consultancy

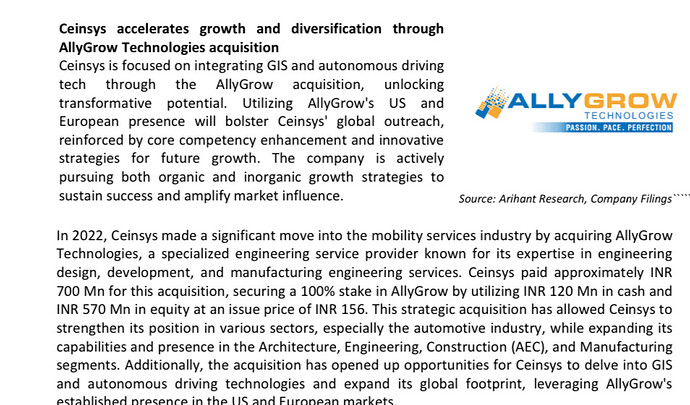

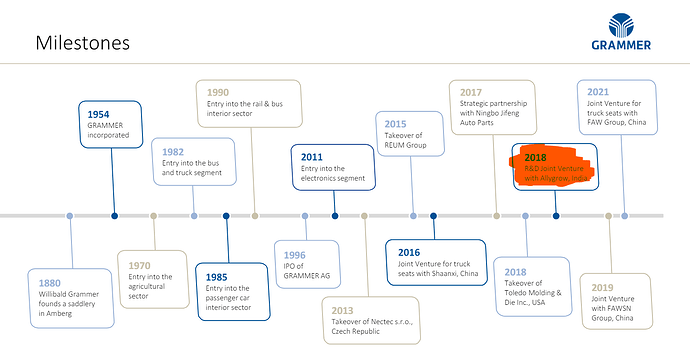

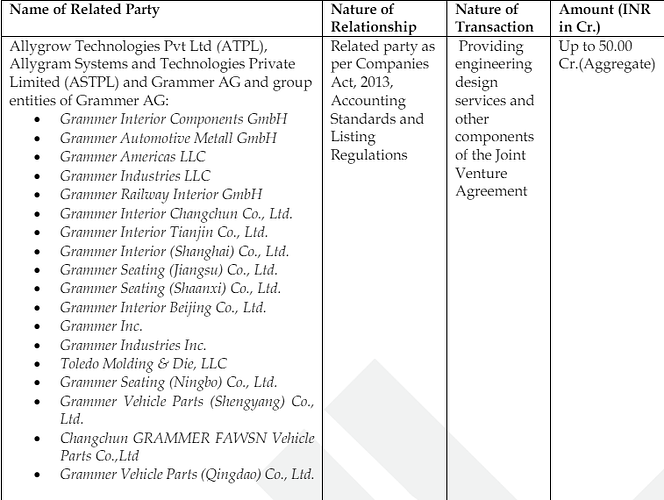

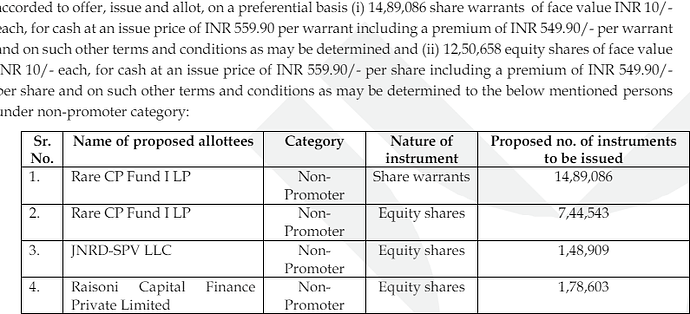

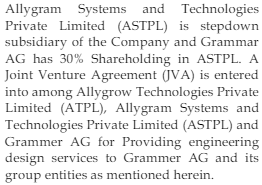

Mobility Segment Services- through recent acquisition of Allygrow (established presence in the US and European markets).

Services Available-

Style & Sketch

Concepts

Design & Validation

Feasibility

CAD & ECM

Plant & Manufacturing Engineering

Pre Series Development

The valuations comfort with growing profit + sectorial tailwinds is making it very well placed.

The solutions & services provided by them is interesting

Impressed by Ally Grow & MEG Nxt- serving two/three & commercial vehicles + Edutech + Gaming

Disc-No Buy Sell Advice