Just evaluating the trades post monthly close. Some of the new trades from last 2 months are doing quite well.

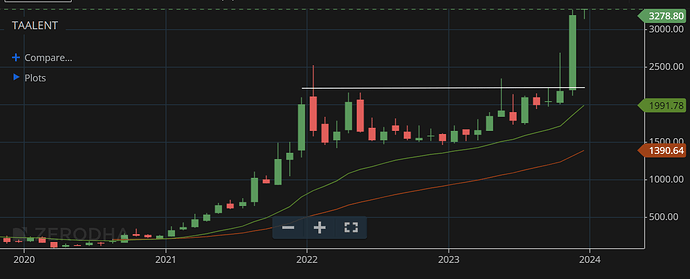

Taal - Big breakout last month. Still considerably undervalued compared to other Engineering services firms. Taal Tech has respectable 40L rev/emp and exceptional margins. I feel compared to Tata Tech listed valuation (its rev/emp is 45L and a margin of 20%), this still offers great margin of safety. The hiring in recent months has been quite strong (EPFO) and is infact probably depressing the margins (should hopefully get back above 30% when it normalises). Compared to IT services businesses ER&D and Engineering services clearly is showing strong uptick in hiring and growth and should sustain due to the high wage inflation in Europe and US.

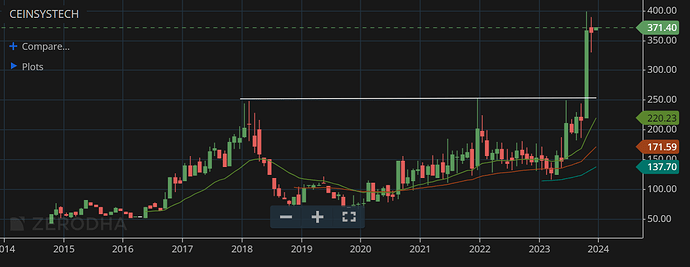

Ceinsys - The business has been winning and renewing orders in its geospatial and IoT business for Jal Jeevan and State water sanitation missions (SWSM). Ceinsys probably has a rev/emp of around 25L while AllyGrow likely tops 50L (And likely does 30% margins). Here again the engineering services division should grow strongly and the geospatial division is seeing strong revival with govt. orders in Jal Jeevan (both have strong tailwinds). Valuation remains cheap even post the strong breakout and consolidation.

Sharda Motors - Pretty strong breakout on the monthly as anticipated. Remain cheap still and hopefully should sustain the run

MOTILALOFS - Good breakout from the congestion zone around 1000-1100. Did a re-test of 1100 odd levels during the month and the shakeout should help contnuation of the trend. Still remains cheap

Holding most of the rest (PML, Goodluck, Mazda) as is and reducing Shilchar. Took a few new small bets in Wockpharma, Eimco Elecon and Electrosteel castings (EDIT) to delve deeper. First two especially appear quite promising. Wockpharma has been restructuring its business (it has no choice) and is betting big on WCK5222. Numbers may not come until FY26 but if they manage to raise money for phase 3 which appears very promising, can run up in anticipation. Its perhaps a good turnaround bet. Eimco Elecon, since govt is planning to increase underground mining by 3x and at the same time also planning to cut down on imports of equipment. Eimco is also doing well in diversifying its business away from Coal mines (mining of metals) and also into construction (piling rigs). These two appear the most promising in terms of triggers and valuations but over the medium/long term.

The GDP growth (13%+) in manufacturing, infra and construction clearly shows where the fish is - most of the bets that have worked well this year have also been in these sectors. This tailwind should hopefully continue. Engineering services too clearly has a strong tailwind due to wage inflation in the west and could be a trend that could sustain for sometime

Disc: Invested in the names mentioned and not qualified to advise