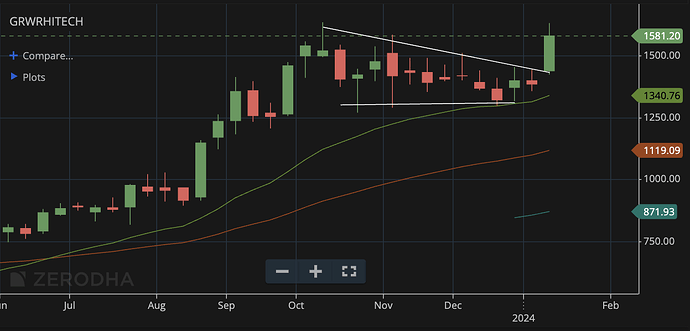

Garware Hi-Tech Films, Weekly - Strong breakout post 15 weeks of sideways movement.

Good example of stocks going sideways when expected outcome doesn’t happen but expectation itself still stays anchored forming a bottom to the price (similar thing in PML around 1400 levels as it waits for next triggers to price them in). A quarter or two here and there doesn’t affect the sentiment too much.

Here PPF volumes were very good in last quarter earnings but IPD played spoilsport giving rise to a flattish looking PnL. PPF volumes however continues to grow along with utilisation that even without a IPD turnaround, we should have decent growth and whenever the commodity business swings - be it in current quarter or next, the swing in earnings could be huge.

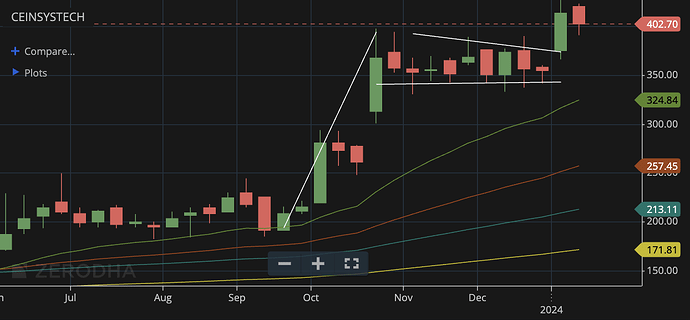

Ceinsys, Weekly - Similar sideways movement and breakout and getting a move on post breakout and consolidation. These weekly moves where it retraces some of the breakout week can be good point to buy in (especially useful when following monthly charts alongside as bulk of retracement is covered during the last week of the month)

Wockhardt, Monthly - If this month ends above 500 levels, it could imply a turnaround in fortunes for the company from the 7+ year decline. A double-bottom base has been formed around 200 levels and this month could be the breakout month. Did some fundamental work here on this. Fundamentals imply a much bigger upside through this year as there are lot of triggers aligned during the year from WCK 5222 Indian emergency use trials, taking WCK 4873 to other markets, growth in Emrok, US business restructuring impacting the PnL positively, the WCK 5222 phase-3 progress in US among other good things happening in the vaccines and biologicals business.

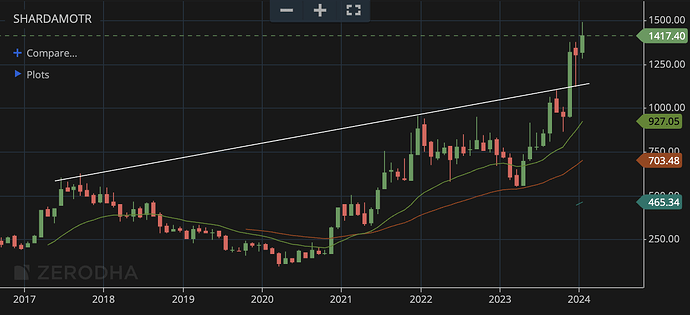

Sharda Motors, Monthly - Nice C&H breakout on the monthly followed by a month of consolidation and this month continuing in the direction of the trend. The HDFC Sec note covers all important details. Remains undervalued and has lot of triggers that can play out in the near/medium term.

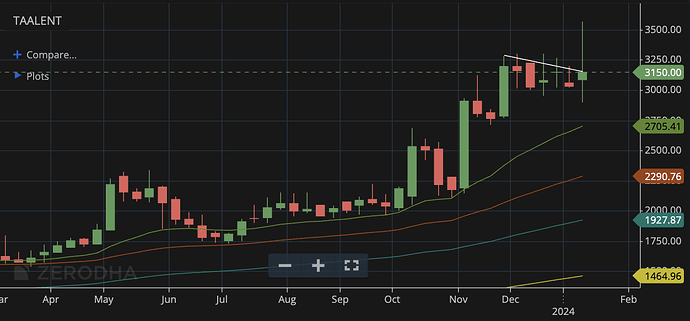

Taal, Weekly - Been going sideways post reaching 3000. Sees good supoprt around 3000 levels. Any close on the weekly abvoe 3300 levels could ensure continuation of trend. Next NCLT hearing is on 8th Feb for the reverse-merger with Taal Tech. Not that important a factor but it is a overhang that needs to be done with

PML, Monthly - I used to think this was expensive though I continued holding it but considering the state of the rest of the market, on a relative basis, lot of VP fav stocks like SBCL, PML, RACL, PIX are starting look attractive - as at least the business quality is wel lknown in these. Export data doesn’t suggest PML is going to do very well in Q3, unless domestic business surprises. The company is adding significantly to its capabilities every year which doesn’t completely show in PnL or in the Balance Sheet as intangibles - but these complimentary capabilities over time can substantially change earnings trajectory if horizon is longer.

Disc: Have positions in all