My interaction on mail with the company management.

How are we planning to add 5000 beds? What will be the capital structure for the same?

The capital cost per bed on an asset light model (where we do not own the land and building) is Rs. 40 Lakhs/bed. We plan to do another 4200 beds at a capital cost of Rs. 1,680 Cr.

We plan to raise PE money and based on their comfort, do a 1:2 debt equity structure.

Whats is our ARPOB(Average revenue per operating bed)?

For the flagship hospital it is currently hovering around Rs. 26,000 to Rs. 28,000

What is the current occupancy rate? and what are we targetting?

Current occupancy is around 31% and we are targeting to reach at least 35% by the end of the year.

What is the contract duration for QFunds annuity payment?

Most of the contracts are 3 years with an auto renewal clause. The contract with QC Holdings is for 10 years. Our first client and our largest client Advance America has been with us for the last 14 years.

What is the lease amount for BCH and Virinchi Hospital at Banjara Hills per year?

How do we plan to compete with other players like Apollo?

We compete with established players like Apollo, Case, Yashoda etc., based on the following parameters:

Patient experience (deployment of information technology solutions facilitating booking appointments, video calls with doctors, eliminating the need to carry physical copies of old medical records, access to medical records through patient app and faster discharge of in-patients)

Deployment of Cutting edge medical technology

Making the latest developments in science across the world accessible to patients through the “Right to Science” initiative

Having good doctors

Pricing – our procedures are priced slightly lower than competition

Can you help us with revenue contribution from QFund? Any guidance for future?

FY 2017-18 the revenue from Qfund was Rs. 129 Cr and for FY 2018-19 it should be around Rs. 150 Cr on a conservative basis

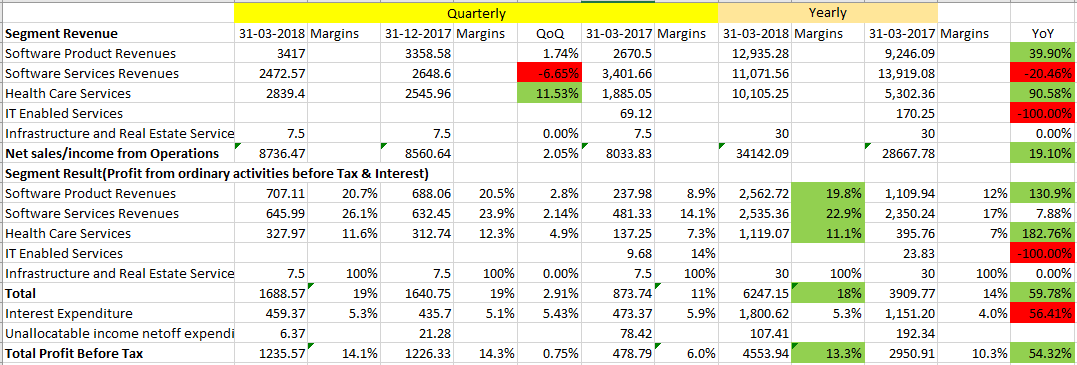

Guidance for margins in IT , Healthcare?

The EBITDA margin would be like in FY 2017-18 i.e., of the order of 37% for IT product business, 20-25% for IT Services and around 20% for Healthcare business.

What is the cost structure of healthcare segment?

Salaries, Pharmacy cost, sales & marketing expenditure, rent and utilities account for 75 to 77% of the cost as a percentage of revenue

Disc - Invested