With Flipkart entering into quick commerce, I guess, the longer term thesis is that either Blinkit emerges as a king with another duopolist or gets acquired. Too early to say but Blinkit has enough deep network in major cities so initial foray would mean a lot of price burn from Flipkart and margin compression for others?

Entering into main e-commerce with the 10min model. This has huge potential. In addition, the accompanying ad-revenue will also be huge.

They already sold iphones, gold coins in Q3. They can extend this to other major categories as well

I’m trying to find the pdf of HSBC report but they’re saying that Blinkit can be 3% of total digital ad spends in some years and Q3 shareholders letter pointed to growing ad revenues due to improved tracking enabled by Blinkit.

Also because of 10 min delivery, the brands are able to see results in quick time and understand consumer funnel.

Can someone help explain what is this other income zomato mentions in their pl statement

Its consistently high.

Thanku in advance

My Personal feedback on Blinkit. Have ordered in Bangalore and Chennai in last few weeks. Out of 5 times I ordered, once the delivery time was 16 min , rest others it’s 23,23,26,29 min. The app says the order is packed in 3-4mins and then there is a big delay in assigning delivery agent. Had I seen this just in one place I visited, I would have thought may be it’s a busy locality. Since I saw the same in a different city , I feel they are not having enough delivery agents at least in the localities I stayed. Also the location I stayed had BB Now which delivered the goods in 6 min. So I ended up using BBNow multiple times because of Blinkits delayed delivery time. I think they may need to may need to manage the number of delivery agents better to stay true to their 10 Min delivery tag line.

My only concern was me being invested despite my personal urge to order from Blink had to resort to BBNow more than Blinkit. ![]()

![]() The others might do too the same if the delivery times are higher.

The others might do too the same if the delivery times are higher.

Hope it gets better with time.

Recent unfortunate events surrounding the demise of a girl after consuming a birthday cake ordered via Zomato have brought the platform’s safety standards under scrutiny.Will these developments significantly impact Zomato’s sales moving forward?

Amazing piece! I have one question here… India had some e-com rules where the marketplace could not sell their own products… which is what led to Amazon restructuring some of its sellers etc.

Would this also affect Zomato everyday from an existing and/or a potential regulation pov (just equalising all forms of marketplaces)?

Great question. I am not sure how Amazon restructured the sellers, but what I know is that we do have brands like ‘Amazon Basics’ listed on Amazon which provide items at lower price. Though I dont exactly know how that works, but I feel the seller listed selling Amazon Basics probably is a separate legal entity over which Amazon has no control except that it has a partnership to manufacture/trade good using Amazon basic logo.

Similarly for Zomato Everyday they might be dealing with separate legal entities (dark kitchens) and having a commission based agreements with them. But the regulatory risk of such structure can’t be ignored.

@Aditya_Grover what is your take on the continious GST penalty zomato is facing? We know consumer facing companies like HULetc sometimes receive tax demand but for zomato it is like every alternative week. Though zomato have enough cash balance to pay that but Can it be a governance issue?

@ranjan_r My previous responses got deleted from the platform as they contained the blog link I was referring to. Here is my response to your question without the blog link:

-

My take on the tax related issues: Sep 30 of 2023, Dec 31 of 2023 and Mar 31 of 2024 were important deadlines by the GST department to send tax notices pertaining to cases pertaining to FY18, FY19 and FY2020. This kind of forced the tax authorities to send notices across corporate India including likes of HUL, Zomato, etc. before the deadline. I have covered the deadline issue in detail in my gaming related blog: Will Nazara receive a GST notice? on my substack - Finding Outperformers

-

Few of the tax notices are actually the ones based on how industry practices being followed and not specific to Zomato. But since Zomato is listed and is obliged to share the tax notice on exchanges, where as similar notices might be received by Swiggy as well. I am not a tax expert though, but we shall that need to closely track this risk over time.

Personally I used to order on zomato a lot but now after this news, I try to avoid as much as possible now honestly.

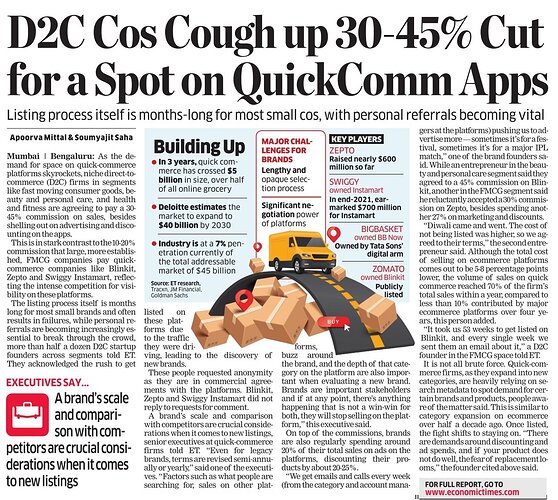

This is positive for Zomato. Quick commerce is growing extremely fast and now platforms are able to charge more fees. Very good development.

Zomato from 20 April onwards has increased the platform fee – by 25 percent to ₹5 per order.

In August 2023, the food delivery firm began charging the platform fee with ₹2 per order. After some months, in October, they hiked it to ₹3 and in January it was hiked to ₹4. While in April, it was surged to ₹5.

Not sure why Zomato did that. Given high burn by Swiggy, Zomato could have kept it at 3 and increased market share… more pressure on Swiggy, more chances of mistake. It’s not like Zomato isn’t a profitable standalone business.

Optically looks big that the increase is 25%. Its a 1 Rupee increase, for customers it will not impact. But given the volumes it can help Zomato’s profitability further. And 5 Rs is nice round number.

Maybe they are testing the market, but IMHO it will not impact the competition dynamics.

If they are able to increase platform at this rate, imagine the hockey stick growth of profitability just due to this. Talk about operating leverage!

Update: Reviewing @luckbychance post on status, this isn’t as big as I thought.

I don’t think so. Beyond a certain point, it has a -ve impact on demand. Also in absolute sense, this is around 60-70crs of EBITDA on an annualised basis so not really anything significant to bottom line.

Would have rather preferred to undercut Swiggy since optically speaking Swiggy has poor unit economics. See below:-

| FY23 | Zomato | Swiggy |

|---|---|---|

| Revenue | 7079 | 8265 |

| PAT | -971 | -4179 |

| Loss Margin | -14% | -51% |

There’s a reason why Swiggy is forced to raise platform fee but Zomato necessarily needn’t follow suit. Infact a delta of between 5-10 and my hunch is a lot of folks will shift from one platform to another.

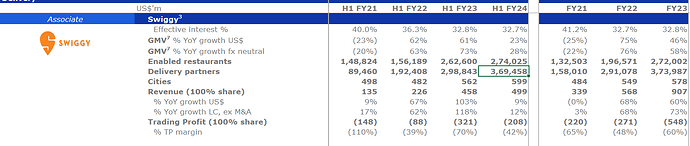

Even in H1FY24, Swiggy seems to be recorded a loss of around ~$200mn which is 1600 crs… Zomato on the other hand has a profit of 38crs in H1FY24

As a customer, i am not happy with Blinkit. I ordered 7 items and items was delivered in sealed bag. However, one item was missing despite paying delivery fees of Rs 9. There is no customer care executive to call, they are asking us to email the issue. However, since item was of low value (Rs 20), i feel writing email to Blinkit is Hassle/hurdle or not a good customer service. So i am not inclined to use Blinkit again.