Intro

Started in 2008 as a food discovery and ratings platform, today along with Swiggy it`s the last man standing in the food delivery. When Zomato entered food delivery market in 2017 it was already an overcrowded space with players like FoodPanda, Ola, Scootsy, Swiggy and other VC funded companies battling it out. Over the years after a lot of cash burn, most of these companies have either closed shop or been acquired. Despite its late entry and such fierce competition, today Zomato and Swiggy ARE basically the market.

Lets start with the other sources of revenue and then end with crown jewel-food delivery

Dining out:

Its largest food-focused restaurant listing and reviews platform. Customers can look up restaurants, read and write reviews, and book a table online.

- 350,174 Active Restaurant Listings from 526 cities (as on Dec 2020)

- 8,064 Restaurant paid members

- Revenue Model : AdvertIsing

Zomato Pro

Customer loyalty program which encompasses both food delivery and dining-out. Provides discounts for members at select restaurants for a fee. Pro Restaurants choose and fund the percentage discount available to Pro Members.

- 1.4 million Pro members

- Over 25,350 restaurant partners as on Dec 2020**

- Revenue Model : Subscription based

Hyperpure (B2B)

- Started in 2019 as a farm-to-fork supplies offering for restaurants

- 6000 restaurants in 6 cities as on Dec 2020

- Revenue Model: Transaction based

It is a one-stop procurement solution for restaurants where food ingredients are procured directly from the source (farmers, mills, producers and processors) Eg Vegetables are sourced farmers that don’t use pesticides. Poultry is procured from farms that ensure that the chicken is antibiotic-residue-free . Restaurant partners ordering supplies through Hyperpure get a “Hyperpure Inside” tag on their Zomato page, which is intended to provide customers with an assurance of the quality of ingredients used at the restaurant. Apart from assurance of quality this helps restaurants by making their supply chains more effective and predictable.Any restaurant owner will tell you how much time and energy is spend in sourcing. Now a restaurant can order supplies online. Inventory management becomes easier because you can forecast demand using machine learning and avoid overstocking, Globally this sourcing of food and ingredients for restaurants is a big business but in India it is still at a nascent stage.

Food Delivery

- Started in 2017

- 1.31 Lac active restaurants

- 1.6 Lac delivery partners

- Revenue Model: Commission and Advertising

Even though they have 3.5 lac restaurant in its search / discovery business, its food delivery business has a mere ~131k. So there`s room for more restaurant onboarding. It has experienced rapid growth in food delivery in India with their orders increasing by 13.2 times from 30.6 million in Fiscal 2018 to 403Mn in Fiscal 2020 and their GOV growing 8.4 times from ₹13,341Mn in Fiscal 2018 to ₹112,209Mn in Fiscal 2020. Now please remember that Zomato was a late entrant and a lot of this growth is not just because of low market penetration but also due to market consolidation. Players have either exited or been acquired. Zomato acquired Uber Eats in 2020

Company claims that 9MFY21 GOV has dropped due to COVID-19. People became reluctant to eat restaurant food due to the fear of catching the virus.In the first quarter of Fiscal 2021 they saw a significant impact on their business and their food delivery business in India. However, since then, their food delivery business in India has recovered strongly, with GOV growth of 91.6% and 42.3% in the second and third quarters of Fiscal 2021. Their GOV in the third quarter of Fiscal 2021 was ₹29,810Mn which was the highest GOV that we have achieved in any quarter till December 2020.

Average order value has gone up last year. This could be due to different members if the household ordering together due to work from home.

Unit Economics: Lets understand the business through its unit economics

i. Commission and other charges comprises commission from restaurant partner, food delivery related advertisement sales revenue and other revenue

ii. Customer delivery charge comprises delivery fees paid by customers

iii. Delivery cost comprises payout to delivery partners which includes customer delivery charge plus availability fee paid by the company

iv. Discounts comprise platform-funded discounts

v. Other Variable Costs comprises payment gateway charges, support cost, restaurant partner refunds and other variable spends on account of activities like delivery partner onboarding, delivery partner insurance, SMS, cash on delivery handling and call masking, among others

vi. Contribution profit/(loss) is (i) + (ii) – (iii) – (iv) – (v)

So as you can see at a contribution level for 9MFY21 Zomato in finally in the green but this does not include Costs associated with marketing, branding and other fixed operating costs. This is still a loss making company( Generally, Contribution is Revenue minus Variable Cost. Zomato doesn’t think of its marketing expense and employee costs as fixed costs)

Advertisement and sales promotion expenses as percentage of total income have been trending down These primarily include(i) platform funded discounts (to the extent not netted off in revenue) (ii) marketing and branding costs (c) customer appeasement costs and (d) refunds made to restaurant partners.

Industry outlook

According to RedSeer, they have a large total addressable Food Services market opportunity of US$65 billion (₹4.6 trillion) growing at 9% per annum to US$110 billion (₹7.7 trillion) in 2025 with highly under-penetrated restaurant food-eating behavior today.

Restaurant food in India is just 10% compared to 54% USA and 58% in China (of the total food consumption). Growth will be driven by changing consumer behavior, reduced dependence of millennials on home-cooked food/kitchen set-up, increasing women participation in labour force higher adoption among the smaller cities. Also Gender stereotypes and health perception of outside food are cultural reasons as to why a lot of indians dont order food are some of them.

NETWORK EFFECT

What makes Zomato flywheel a bit different than that of Swiggy`s is their Dining out platform which consists of Customer generated content. Now more content leads to more customers visiting the platform and more customers attract new restaurants which in turn attracts new customers thus creating a strong flywheel. A lot of these visitors on dining out platform become customers on food delivery platform.

Word of caution: As soon as most people here networks effects in tech they start comparing it with Amazon, Facebook, Google. Major difference between Zomato and Amazon`s Network effects is that it is somewhat limited by location. A restaurant in Mumbai cannot satisfy a hungry customer in Delhi. 69.3% of our new customers were acquired organically and not through any paid advertisements.

Threats:

Direct ordering platforms. (Dotpe, Thrive, Eatable, Peppo, Airtable etc)there have been a lot of protests by restaurants against the high commissions charged by Zomato and Swiggy without much success. That discontent has led to the rise of direct ordering platforms. These startups provide a platform to take online orders and the commissions are as low as 3% in some cases. Delivery of food can be via own riders or 3rd party delivery agents like Dunzo or WeFast. Besides lower commissions there is another reason for restaurants choosing these startups. Zomato and Swiggy dont share customer data with restaurants, With data restaurants can learn about customer preferences and accordingly tweak their menu. Now of course a customer would naturally prefer ordering through Zomato because of convenience but customers also like low prices and because restaurants are paying lower commissions they can lower prices. Now none of these companies are big enough to threaten the duopoly of Zomato or Swiggy right now and I dont see them as a direct competitor but over time they could take away some market share.

Amazon FoodCurrently its operations are restricted to Bengaluru. It has been one year and it is still testing the waters. They have bundled it with Amazon prime membership. Amazon charges restaurants a much lower commission of 10-12 percent on orders, compared to the over 20 percent commission charged by Swiggy and Zomato, an issue that has been a pain point for restaurants for years. Now of course handling food is not like delivering goods. Last mile delivery is different. Food deliveries cannot be late by 2 hours and Amazon has retreated from Food delivery earlier.So Amazons pan India entry into food delivery is not a given. However if it does decide to take it seriously we may see a prolonged period of cash burn by all the players and this poses a risk to Zomato’s road to profitability.

My Thoughts

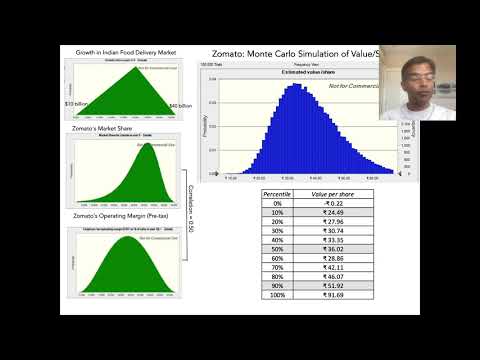

To their credit both Zomato and Swiggy have built robust network effect, great customer experience and hyperlocal delivery system. Even though it is a duopoly market Customers will shift to the one with the cheapest options. People call it food tech but Google or Facebook can double their revenues without doubling their workforce but that’s not the case with Zomato. In the developed world no one is making money in food delivery. Meitun in China is different but that’s largely due to its ability to get it into adjacencies. Things could be different for Zomato and Swiggy due to low market penetration and lower expenses on delivery partners. Over time deliveries will become more efficient as Multiple deliveries will be bundled owing to better data(seeing signs of that already). Contribution is unlikely to go up much from here as they are already facing a lot of heat from restaurants and delivery partners but employee cost and marketing expenses are unlikely to scale with revenues so there can be operating leverage at play. They are moving into adjacencies like nutritional products. They are investing in Grofers. In future they may choose to deliver other things as well. Will be interesting to see how this space evolves. I have left valuation out as I dont know how to value these loss making companies but the dean of valuation Ashwath Damodaran reckons its fair value is 41 Rs.

I have a lot more to say on Zomato but have tried to keep this thread as short as possible without ignoring any important details. Please let me know if I can add/edit anything to the original thread.Would be interested in hearing your views

Disc: Tracking with no position