Hello everyone,

I am creating this post since could not able to find a dedicated thread on Vimta Labs Limited (VLL)

Introduction

VLL incorporated in 1990 by Dr S P Vasireddi and currently engaged in the business of testing and contract research in the areas of analytical testing of food and water, drugs, environment testing, clinical research and clinical reference testing (diagnostics), biopharmaceutical testing, pre-clinical studies and testing services for electronic and electrical products. It has one of the largest lab network across India with 400000 sqft lab area. Vimta is the first gazette notified EPA laboratory (1986) in India and is highly reputed for its quality and integrity. VLL have around 20 Labs pan India (Inc 9 food labs)

Around 60% of their revenue come from Pharma, 15% from Food testing, 15-20% from diagnostic and rest is others. 25-30% revenue come from exports (100% from Pharma) and rest is domestic (Inc Pharma, food, environmental etc.). Mainly they export to US, Europe, Dubai, China and Malaysia.

Food testing is very fragmented and unorganized sector, VLL is among top 7. Vimta has acquired 100% stake in EMTAC Lab in Mar’20, EMTAC is engaged in testing of electrical & electronic equipment against standards and physical testing and certification of physical things like lockers, fire resistant doors etc.

Promoter stake is low around 37% but consistent over the period, however they have silent investor like Eurofins, LCGC which operate in similar field.

Customer Concentration

Top 5 customers contribute mostly around 20% and are from pharma industry.

Market Size

- Diagnostic market in India is of 60000 Cr and expected to grow at 16% CAGR for next 5 years. Unorganized players have market share of 48%, hospital own labs have share of 37% and organized player just have 15% market share. Further as organized player will take over unorganized players (consolidation), rising middle class and aging population diagnostic may do well for VLL.

- Electrical & Electronic market in India is of 1000 Cr size and have competitors like TUV, Wipro, SGS, STQC labs, LAB-UL etc.

- The market for India’s environmental testing is forecast to reach 2500 Cr by 2025, growing at a CAGR of 10.8% from 2020 to 2025.

- Indian Food market is of 6000 Cr.

- Pharma (Global Scenario since VLL has pharma business globally):

- The global drug discovery and development services market size is projected to reach USD 21.4 billion by 2025 from USD 11.1 billion in 2020, growing at a CAGR of 14.0%

- Global preclinical CRO to grow at cagr of 8.3% and reach usd 7.8 billion by 2027

- Biologics safety testing market was valued at USD 3.05 billion in 2019 and is projected to reach USD 7.15 billion by 2027, growing at a CAGR of 12.13% from 2020 to 2027.

- The global bioanalytical testing services market size was valued at USD 3.3 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 8.6% from 2021 to 2028.

Positive Triggers

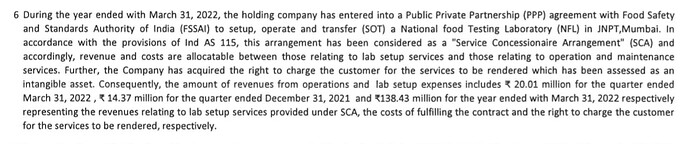

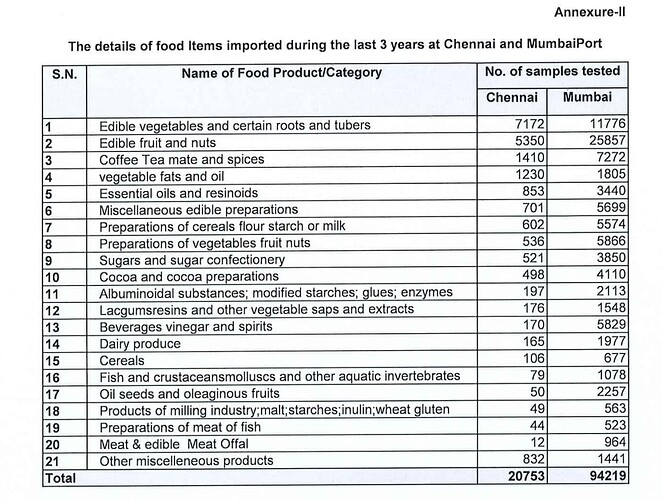

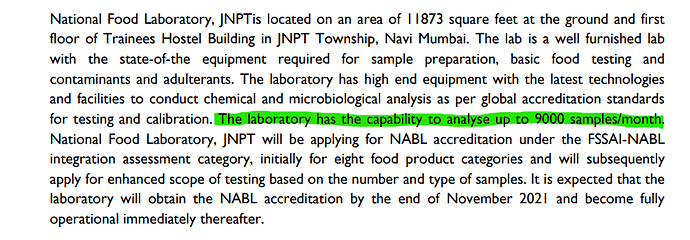

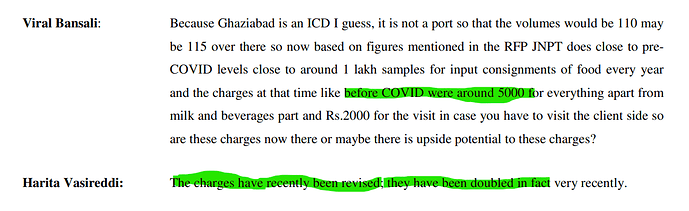

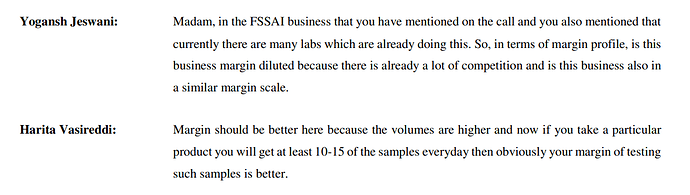

- Last year they have been authorized by FSSAI to open a national food lab on PPP basis at Jawaharlal Nehru port, Mumbai and operate for 25 years and agreement can be renewed further. Vimta will have right to charge customers and will have revenue sharing model with FSSAI. Facility has commenced operation on 7th Feb’22 as per company fillings.

- With EMTAC acquisition now they are present in electrical & electronic equipment testing, further they are setting up new labs which will be NABL accredited and also have EMI-EMC testing capabilities. Main focus is on medical device (for existing pharma client and GOI has taken medical device under DGCI) and in future to go for telecom, defense, EVs etc. Further a lot of MNC R&D setups are coming up in cities like Bengaluru, Pune & Chennai. They would prefer to outsource these testing to the logistical nearest lab.

- Dividend payout is consistently 20-30%.

- Their diagnostic business was mainly B2B (health checkup for volunteers for pre-clinical research). But after covid they realized the potential of entering to B2C. Now management is going aggressively in diagnostic space (like Lal Path Labs).

- Their food business is not contributing meaningfully right now but company expect it to take front seat once the regulation related to food items testing tightens.

- Environmental business is laggard right now, but going concern over environmental may prompt government to tighten the regulation which may result in growth for VLL business.

- 1300 employees and around 70% of them are scientists.

- As per credit report, the average length of relations with its top clients runs to ~14 years.

- Remuneration of the management is on higher side, but this statement from AR can sooth nerves on management quality:

“Smt. Harita Vasireddi, Managing Director has voluntarily foregone the remuneration from April 2020 to September 2020, in view of the uncertain economic conditions owing to Covid-19 pandemic” - From 2022, proposed to start ESOPs for linking employee interest with performance of company.

- Compliant with GMP, GCP and over the years have been successfully conducted USFDA audits.

- Strengthen the leadership, recruited Mr. Suresh from competitor TUV SUD in 2019, IT experts are being taken over the years to automate things and improve efficiencies.

- Company has started concalls form 2019.

Key Risk

- Since with tightening of regulation in Pharma industry, old testing equipment needs to be replaced or upgraded every 5-6 years. So, to be relevant in this business company has to do fresh capex every 5-6 years. In fact, company takes useful life of their equipment round 5 years for the purpose of deprecation.

- Slowdown in pharma industry globally can pose risk (as 60% revenue comes from Pharma)

- Regulatory risk (like USFDA).

- Foreign currency volatility risk, currently VLL hedge part of their risk through loan in foreign currency.

- Two CFO resigned since 2015 may be a red flag…

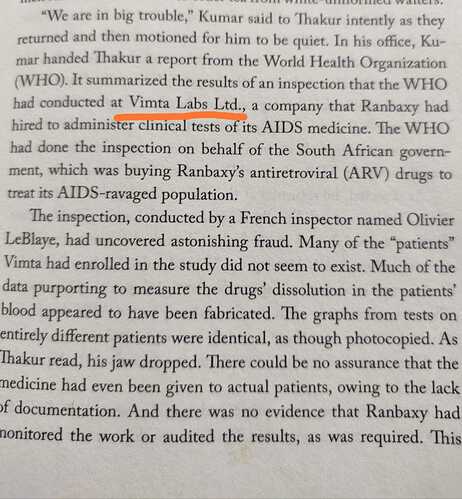

- Reputation risk (like IP data breach and adverse effect on health of volunteer for clinical research)

- Company has long receivable days, may be that is partially because VLL says average receivable days from export is around 180 days.

- In earlier years, company has a dealing with a IT service company which was related to one of the independent director and that director was not taking sitting fees. One other independent director was also not taking sitting fee, but I could not able to find the reason for this case. Currently both have left board, further dealing with that IT company has also stopped. May or may be not corporate governance related issue.

Guidance

- 70-80 Cr capex in 4 years on electrical & equipment segment alone.

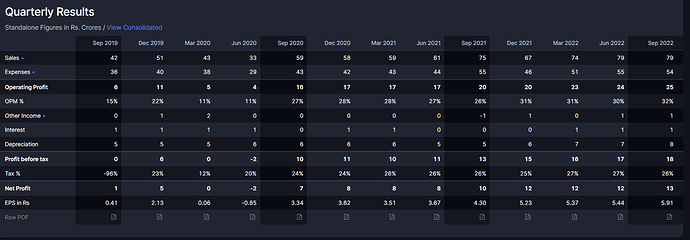

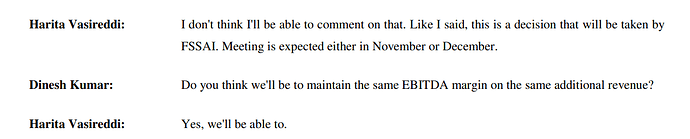

- Operating margin to stay between 20-25% in future.

- Revenue can double in next 6 years.

- Target to reach around revenue of 100 cr in the electronic segment in next 5-6 years.

- In normal course company has guided to do capex equivalent to deprecation.

Competitors

SGS, Intertek, TUV, Eurofins, Covance and PPD, Charles Rivers are global peers and they all operate in India also.

Valuation

- Company acquired EMTAC labs with Price to Sales of 6 (loss making company with turnover of 1 Cr). However, VLL itself has price to sales of 1.53.

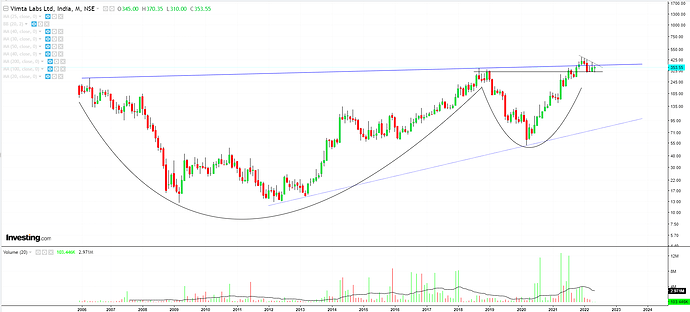

- Over the last 5 years, VLL has traded on a PE of 25. Currently trading around 22.

Looking forward to have view of other members who may be tracking VLL. @ayushmit sir, you have participated in some of the concalls, appreciate if you can share your views

Disc - Small tracking position.

Regards

Mayank