With the recent increase in price by 10% in a month, while all other FMCG stocks seem to be at a constant price. What is the take on current valuations?

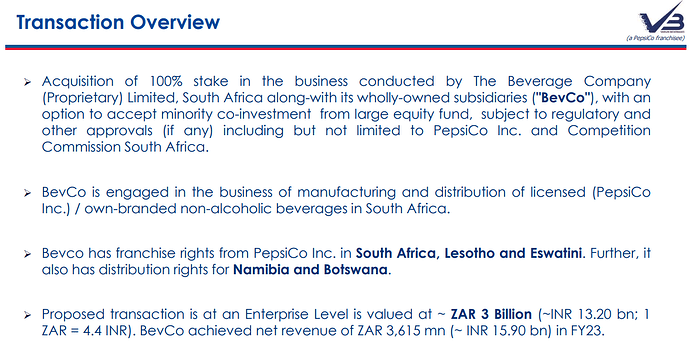

Yes, The valuations are on the higher side. Median PE is 57 around. current price will not come down as long as earnings shown. New growth engine for VBL is from geographies other than India and value added dairy products.

Let’s see how it pan out.

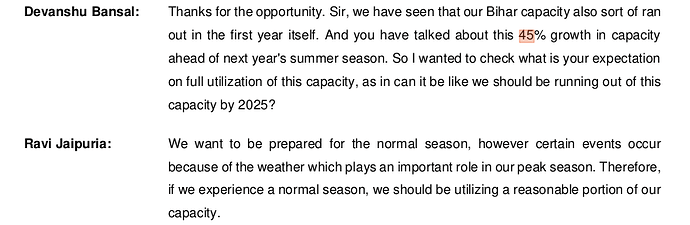

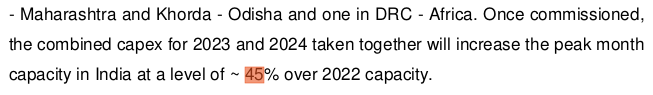

From the below three snippets from the concall for quarter ending sep-23, I have following three understanding -

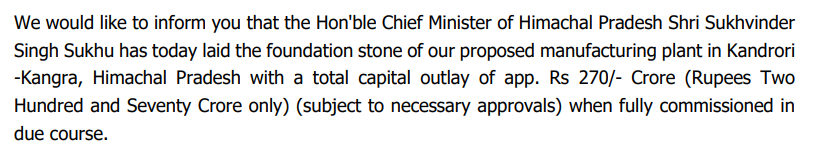

- The company will have additional 45% capacity addition.

- The 45% additional capacity will be ready before summer season of cy24.

- The additional capacity will be fully utilised in cy25.

Thanks

Disclosure - Invested.

There is no doubt that the valuation is elevated in comparison to other FMCG stocks. This is primarily attributed to the market assigning a higher premium (20%) owing to consistent growth. Despite the higher valuation, the growth projection remains steady at 25%.

I’d suggest using Vstop on the technicals and watching the growth like a hawk if you own the stock. Peacefully ride and set the alert if Vstop becomes negative on the monthly and weekly charts.

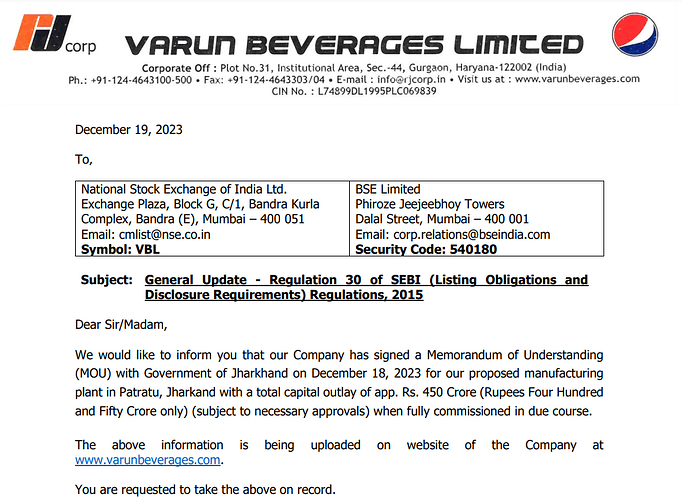

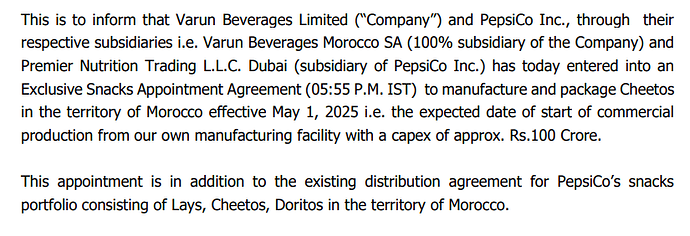

Just a news item for Varun’s investors.

Can Varun Beverages also enter the alcohol segment?

Coca cola forays into alcohol segment, Pepsi Co can follow?

https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwjCu8PgvIaDAxVdyjgGHXXlAdAQFnoECA0QAw&url=https%3A%2F%2Feconomictimes.indiatimes.com%2Findustry%2Fcons-products%2Fliquor%2Fcoca-cola-india-forays-into-the-alcohol-segment%2Farticleshow%2F105886820.cms&usg=AOvVaw2x1pYRYRuStKR6OOTTTTQH&opi=89978449

Historically Dec quarter has always been struggling for beverages companies WW. It’ll be interesting to see how result pans out after such rally in Dec’ 23.

VBL has Jan - Dec financial year, so there will be no quarterly results. Audited annual results can be declared within 2 months. Last year results were on 6th February.

I have not done any extensive analysis as of now, but one thing I am sure about is, PE expansion for this stock will soon touch its high. Net profit for 2022-23 is approximately 33% higher than last year, but the stock has more than doubled. Such outperformance cannot continue for long. There will either be time correction, which means the stock will consolidate for sometime to match its long term valuation average, which is around 56x EPS, or we can see a price correction which gives us a target price of 962-990 per share.

Disc- Invested

No No, I mean for the whole year. The YTM profit is 1958cr. The cumulative profit for last year was 1550cr. So with December Quarter Results the ball park figure might be 2150cr for this year. Which is a more than 30% growth, but the stock price has moved up a lot. This is not sustainable.

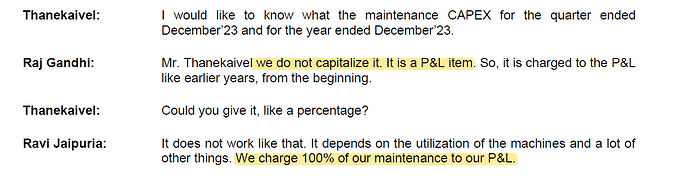

This is interesting… the company says they charge the entire maintenance capex to P & L. So there is a double charge - depreciation & maintenance capex, and yet they have the highest margins.

A wonderful video of Mohnish Pabrai’s talk at Flame University. He starts the talk with an analysis of the valuation of Varun Bev relative to other Pepsi bottlers. It would be great if fellow boarders and seniors could share their thoughts.

Mohnish Pabrai’s views on VBL sound little scary, No doubt the serving of 700 per case is next to impossible by 2038 with the kind of Market share and competition Indian Market offers. But at the same time Valuation forecast of $19-25 billion in 2038 when it is already at $ 22 billion is not justified. Any how based on the chart he showed for country wise serving per person, the servings will increase from 95 existing with 7-10% growth. If China at 400 servings at $ 12,500 per capital we should be also at 200 servings at $ 7200 per capital by 2038, which should atleast the take the Market cap of VBL to 2-2.5x of current Mcap.

Varun Beverages is @ $23.30 B

Pepsico is @ $232.48 B

Varun beverages @ 1/10th of PepsiCo Marketcap is just nuts imo.

But again - The market has it’s ways of proving naysayers wrong.