Can we also put below these topics as corporate governance risk?

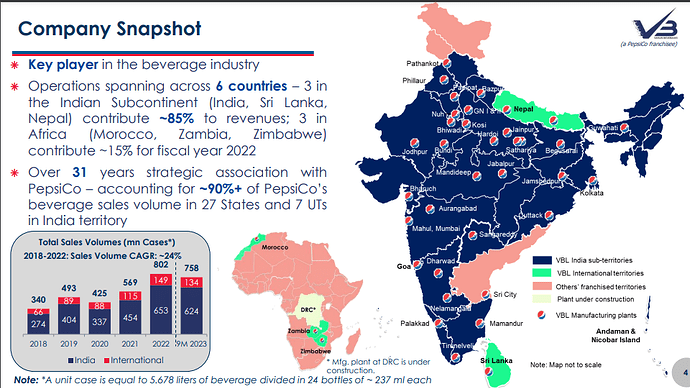

VARUN Beverages Q3FY23 Concall or Q4CY22 concall

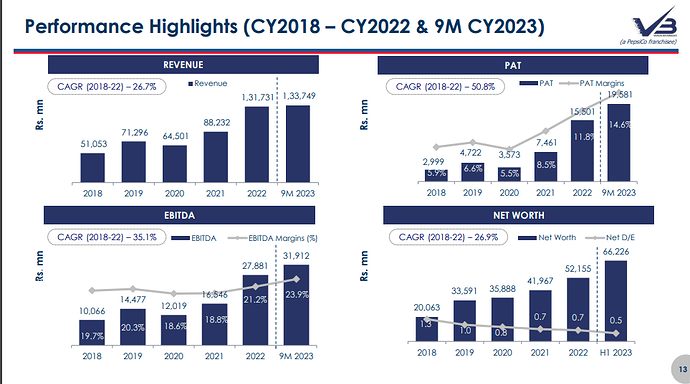

-Improved product mix led to 49% Revenue growth and PAT growth of 100%+.

-Sting contributed to realisation and revenue growth. Expect category to keep growing.

-Launched products in value added dairy segment recently.

-Sting is 9.6% of sales volume. Gross margins were minimally impacted inspite of higher cost of RM. Gm’s declined this year, yet EBITDA Margins increased due to realisations and operating leverage.

-Ebitda Margins at 22.2% for the full Year.

-Debt/ebitda at 1.23 times and D/E at 0.65 times.

-CWIP at 600+ crores for Greenfield and brownfield capex. Entire Capex for CY23 or FY24 at 1500 crores.

-Snacks Business: at the moment in India Pepsi isn’t looking for distribution. Only working on co packing and giving it to Pepsi. This is what they are looking for. Varun has started distribution and packaging for them in Morocco. Varun will start talks of manufacturing for them soon in Morocco. Currently importing from Portugal and Egypt.

-Production for Snacks business for Pepsi in India: production started in November and December. Pepsi has asked to expand the same.

-South and Western territories are growing faster. Seasonality in the business is structurally coming down.

-Looking at 10-15% expansion in distribution. Targeting to reach 3.5million outlets from 3million currently. Expanding trucks, visi coolers etc.

-National roll out for dairy business will happen in FY24. Tripling capacity by the end of this year. Sourcing for dairy also in place in all the regions.

-Don’t find much competition in dairy competition and Sting (energy drink) vs our key competitor.

-Rajasthan, Mp, and 6 brownfield: This is where we are doing our capex.

-Vision of the company is to reach 1 billion volume. Want 50% growth in volumes over 3 years in India. At 652 million today. Implies a 15%+ Volume growth in Indian Business.

-1500 crore capex+Cream bell capex will be capitalised.

-Analyst asked this Q: Gross margins if they revert back to mean and operating leverage kicks in. Margins might actually go to 22.5 to 23%. Management replied by saying- no guidance on margins, it might be possible.

-Snacks business for Pepsi- currently it is foot in the door. 1 line at the moment and talking about 1 more line.

-Volume growth for the Full year was 41%.

-Expect energy drink to become 15% of overall beverages business. As even in other geographies like Pakistan, Thailand etc. Energy drinks are at 15%. Energy drinks used to be very expensive, due to value and pricing. Energy drinks have really taken off in last 5-7 years.

-% Wise growth is faster in East, West and Souther India vs North.

-Juice and Dairy capex will be ready by the end of this year. Which will contribute to growth by next year.

-Difference between us vs Other FMCG in rural markets:

Only now power and electrification of villages has started. Due to this we are getting much more traction vs the likes of HUL, Dabur etc etc. As they were already present in villages since long. Thus, our category volume growth is much faster.

-Sting was 16% of total volumes in Q3FY23, Q4CY22.

-Sting volume has grown 175% vs the last year when looked at Q4CY22 or Q3FY23.

Disc: Invested and trades in last 30 days.

A few critical observations from the Varun Beverages Annual Report for FY22 that caught my eye. Note that this is not the formal analysis of the AR, I am not commenting on the usual stuff like growth rate / margins / volume & segment information etc. which is readily available elsewhere - and all of which looks very good!

-

The company is a net foreign exchange consumer. Last year, forex consumed was Rs.956 crore and forex gained was Rs.230 crore. Rupee depreciation affects the company adversely.

-

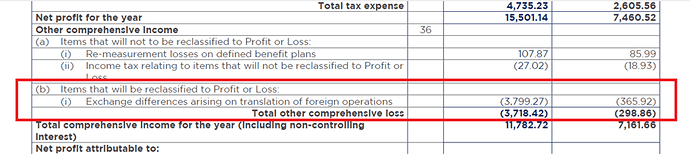

In FY22, there was a forex gain in India operations (Standalone P&L) of Rs. 46 crores but a forex loss of Rs.6 crore at consolidated level, implying forex loss in international operations. More importantly, a huge forex loss of Rs.380 crore is accounted under OCI. This is almost 25 % of the annual PAT.

My understanding is that unless the rates move back in the opposite direction, this loss will hit P&L in the coming year.

-

Franchisee Rights & Trademarks worth Rs.604 crore is capitalised as Intangible Assets. The current license agreement for India with PepsiCo India is till April 30, 2039. Company says this can be renewed at nominal cost and with no specific conditions attached, and therefore Franchisee Rights & Trademarks are no longer amortised. If these are amortized over a 20-year period, there will be a hit of Rs.3 crore per annum to the P&L.

-

Addition to Franchisee Rights was Nil during the year, despite company starting new operations in Morocco to distribute and sell Lays, Doritos and Cheetos. Not sure if this agreement is somehow different from other agreements elsewhere which created the Intangible Asset in the first place.

-

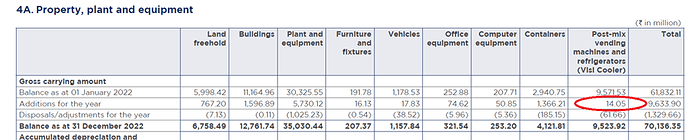

The large number of visi-coolers installed by the company at retail outlets is another fixed asset in the Balance Sheet. The number of visi-coolers installed have gone up from 840,000+ in FY21 to 925,000+ in FY22 i.e. 85,000 new visi-coolers installed during the year. At a cost of around Rs.15,000 per visi-cooler, there should have been an addition of Rs.125 crore to the asset base (gross block). However, addition to visi-coolers in Fixed Assets Schedule is just Rs.1.4 crore in Standalone.

Even if one assumes most of the new visi-coolers were installed outside India (unlikely), the addition in Consolidated is just Rs.43 crore. The numbers don’t match, not sure what I am missing here.

-

Rs. 185 crore of operating revenue is Government Grants under different industrial promotion tax exemption schemes. Outstanding government grants went up from Rs.185 crore in FY21 to Rs.301 crore in FY22. State governments are notorious for delaying on their obligations.

-

Company has operations in Zimbabwe, which is a hyperinflationary economy. Zimbabwe does not have a proper stable currency of its own, and hence conversion / translation of the transactions into INR are prone to inherent subjectivity.

-

A large part of the Annual Report is devoted to ESG, especially the company’s efforts at water conservation and management. Clearly, the company understands that cost and availability of water is the main risk to the long-term viability of the business. And for that, they are dependent on agreements with local municipal authorities. I went back to more than 5 years of analyst concalls but there is not a single question on this. What is the cost of water in the overall cost structure is not clear, and can the authorities deny committed quantities of water in a drought year? Interestingly, even the DRHP is silent on what I think is the most crucial aspect of this business (or maybe I am being unnecessarily paranoid).

-

Mr. Ravi Jaipuria made a Rs.56 lac settlement with SEBI with respect to a case during the year.

Just nit-picking, perhaps!

(Disc.: Invested)

Update on 27-Mar-2023:

I had written to the company on point no.5 above i.e., addition to the Visi Coolers Gross Block. After some follow up, the company has replied as follows:

Please note, the 85,000+ visi coolers added during CY2022 is at the consolidated level. Total cost of Visi Coolers (refrigerators / post-mix vending machines) procured during CY2022 is Rs. 430.47 Mn (as per Pg 208 of Annual Report) at Consolidated level and Rs. 14.05 Mn (as per Pg 310 of Annual Report) at Standalone level.

At Standalone level, the cost of purchase of Visi Coolers during CY22 is almost negligible as the same was reimbursed by PepsiCo as a one-off brand infra support to enhance the distribution reach. As a prudent accounting practice and good corporate governance, we have only capitalized the cost of such Visi Coolers which was paid by VBL.

ICICI Direct on the cola wars:

Varun Beverages Q1-CY23 Concall: (notes by Soic)

-

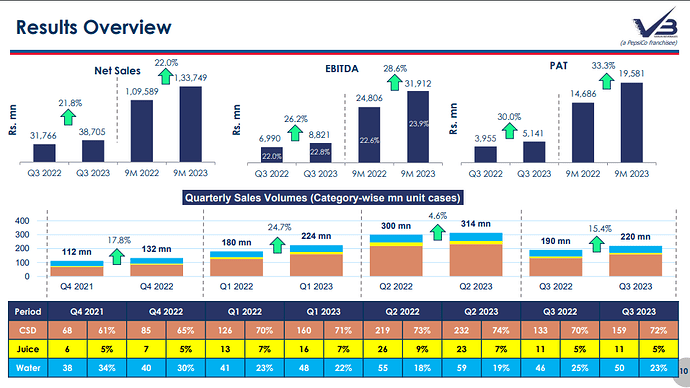

Net Revenue grew by 37.7% YoY to Rs. 38,929.8 million; volumes grew by 24.7% in Q1 CY2023 to 224.1 million cases

-

EBITDA increased by 50.3% to Rs. 7,980.4 million; Gross margins improved by 89 bps to 52.4% from 51.5%; EBITDA margins improved by 172 bps to 20.5% in Q1 CY2023

-

Commissioned greenfield in Bundi Rajasthan, and 6 brownfield plants at different plants. The additional Greenfield plant in Jabalpur, MP is expected to be operational very soon.

-

Energy Drink has established a leadership position in the category; now focus on Value Added Dairy, Sports Drinks, and Juice segments to sustain the growth momentum and to fuel the next leg of growth.

-

Well positioned to achieve the sustainable growth in medium to long term

-

CSD contributed to 71% of sales volume, 7% from juices and 22% from water

-

Witnessing healthy demand for peak season in next quarter

-

Putting up 2 plants to increase capacity for value added dairy and juices. Company has enough products in the category, and will not be adding new products in these categories. Company was previously facing issues in the capacity, which will be met with these plants.

-

There is always going to be competition in the market, there is enough room for each player whether it is campa or other players.

-

Capex guidance of 1500cr for CY23.

-

For growth in CY24 value added dairy, juices and sports drinks will play a role of growth. These are higher margin businesses.

-

There is plenty of room for growth in energy drinks. The energy drink market is 15% at industry level.

-

Margins from the dairy business will be at par with current level or maybe higher than current margins.

-

Getting huge demand for energy drinks but not able to fulfill due to capacity constraints; it is currently available only on key distribution channels.

-

Advertisement expenses by PepsiCo will not impact the margins of VBL.

-

Prices of gatorade are close to Powerade(coca cola). Company also has a Rs.20 pack of Gatorade; the company will expand its distribution reach in the current year. The same plant can make gatorade so no need to put additional plant.

-

Net debt as on 31-Mar is approx. 4000cr; Debt to EBITDA is at ~1x

-

The realisation per case of juice and Sports drink is higher than CSD.

Guidance to grow improve ROCE by 100 to 125 bps every year for next few years; current ROCE is 30% so it will go to 31%

Prices of PET bottles and Sugar have been in the same manner in the last few quarters; there is no major change in the last 3-4 quarters.

Disc: no reco.

VBL Concall Q2-CY23

Disc: no reco to buy or sell.

-

Consol revenue grew by 13% due to growth in international market.

-

New lines for Greenfield are now commercialised along with debottlenecking at various plants. The new facilities in juice and dairy products, along with the upcoming facility in DRC, are expected to be fully operational before the season next year.

-

Remain optimistic about full year performance even after low demand in H1-CY23 due to non seasonal rains

-

Gross margins improved due to softening of PET chip prices

-

Working capital days have increased to 21 days as on Jun 30, 2023 from 17 days as on Jun 30, 2022 due to untimely rains

-

Out of 3 plants; one will be commissioned by Dec. Capex in India will be around 1900cr for CY23 & 400cr in DRC for CY23. Capex will be 2400cr to 2500cr for CY24.

-

The peak debt will be around 3600cr to 3800cr for the company.

-

Energy drink journey is continuing at same pace; won’t share the specific numbers.

-

Margins could further increase by 50bps but it also depends on the PET chip price; in Q2 this price has came down bcz of which gross margins improved; overall EBITDA margins for full year will be around 21 to 22%. Can do better if commodity prices remains at same level or goes down further

-

In Zimbabwe company is gaining market share from other players.

-

This qtr growth in India volume is very low due to rains;

-

Even with disruption company is doing well and will do the same in future. Key growth drivers are energy drink, tropicnaca, gatorade, and sugar free products like Pepsi Black.

-

The asset turn on the new capex will be around 1.8 to 1.9x.

-

Test markets are done for new products and get the feedback on the basis of that the company will launch new products. The new products are normally 1 or 2 new products at a time; there are thousands of products of PepsiCo; In India we are just touching the surface currently as every market has different capabilities.

-

South Africa looks like a very big market after India; it is a large market with around billion case. VBL has created a subsidiary company, company is looking very seriously over there.

-

Dairy based products has around 6 months shelf life; distribution can be done from same setup of carbonated drinks. Nothing extra to be done for these products. Realisation for dairy products is higher as compared to current realisations.

-

Drink, dairy and juices will be the next leg of growth for the company and management is very confident to grow this segments. They just need the plant to be commercialise all other things like distribution and other infra is already in place.

-

Currently Pepsi is very weak in the South Africa, VBL is currently looking at the market, it is at very early stage; nothing is finalised yet.

-

During Q2 it was peak season for North which has been completely washed out; growth came from Southern market for India.

-

In long term VBL is targeting to get 25% of its bottles as PET recycled bottles. Company has just started using it, in this qtr it is only 0.5%

-

On campa cola competition, it is too early to say on it as management doesn’t know about their plans.

What surprised me despite unseasonal rainfall, they did well. I was expecting bad result.

Primarily due to the benefits of geographical diversification which wasn’t present at the time of IpO.

With African countries, Southern India and South African market (new entry)- company is much more diversified vs being dependent on North India earlier.

Thanks . Is it possible what is % of revenue coming from different regions of the country

Point-2., These OCI will not reclassified into P & L, Unless VBL sells its stake in foreign companies. Until then it will be part of Other Equity only.

VBL Q3 CY 23 Key take aways from con call:-

- 45% capacity expansion over CY 23 before start of season next CY

- The reason for doing better than 12 million FMCG outlets vs 3.5 million VBL outlets is, More room for penetration vs FMCG, FMCG have matured, basic infrastructure has improved in terms of power supply, roads and logistics as a result more and more vizi coolers have been installed, Prices have been reduced to capture Indian market to offer value preposition with volume.

- Sting continues to do exceptionally well, Sting blue is also a very successful launch and doing great.

- A subsidiary in Mozambique has been opened as the International market is opening up really well.

- Dairy business is doing well and will pick up well in the next season.

- July 23 was a washout because of unseasonal rains.

- Capex of around 2500 crs with a asset turnover 1.8 times.

- Dairy and Juice’s margins are similar to CSD, but they will not be significant in the total portfolio.

- Congo is 35-40 million cases capacity

- Many sugar free drinks on the cards to be launched next season

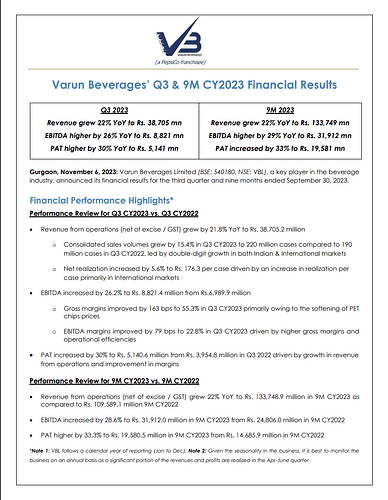

A blowout quarter for Varun Beverages, with strong sales growth and margin expansion both at gross margin and operating margin level. More importantly, the concall revealed a large number of upside triggers lined up. No wonder the markets are celebrating. And even though the stock has doubled in the last one year, valuation is still around the Oct 2021 level.

Some highlights from the concall:

-

Consolidated revenues have grown 22 % and sales volume showcased a healthy resurgence, growing at 15.4 %

-

The net realization per case rose by 5.6 % to reach Rs.176.3 per case, an upturn primarily driven by the improvement witnessed in the international markets.

-

Gross margins during the quarter improved by 163 basis points to the level of 55.3 % from 53.7 %, mainly due to the softening of PET chip prices. Operating margins have also moved up to 23 %.

-

The company has invested about Rs.1600 crores during nine months of CY 2023 for the next year primarily for the three greenfield plants in India at Gorakhpur - UP, Supa Partner - Maharashtra and Khorda - Odisha and one in DRC - Africa. Once commissioned, the combined capex for 2023 and 2024 taken together will increase the peak month capacity in India at a level of about 45 % over 2022 capacity. This will be up and commissioned before the summer of CY24. Once the plants reach full maturity and operate at full capacity, they will achieve a turnover of 1.8 – 1.9 times to fully utilize their capacity

-

The raw materials are pet chips and sugar. The company is getting into manufacturing recycled PET. So by the time it will be using the reasonable portion of recycled PET, it will be manufacturing it on its own. It has JV signed with Indorama, which is going to be in production by 2025

-

Why Varun Beverages is doing better than other FMCG players - Management said it is expanding its go-to market very aggressively, which maybe everybody is not doing as fast. Secondly, with the power situation improving in the country, it has been able to penetrate much deeper into the rural. This is not very relevant to others. There are about 12 million FMCG outlets in the country today and roughly it is going to about 3.5 million outlets. So others are already at a higher level of distribution. Varun’s reach is increasing by 200,000 - 300,000 stores year after year which is helping in increasing market share. It has about 925,000 visi-coolers at present and is increasing efforts to put more visi-coolers in coming years. It has also played aggresively with price pack architecture, said the management.

-

In January when the other two plants are ready, the value added dairy’s real growth will start coming. From next year you will see a major change coming in the value added dairy business

-

Majority of juice sales occur between March and June

-

The seasonality curve has started changing. Q2 is no longer the only important quarter, Q1 and Q4 are also becoming important. The percentage of every quarter is going to keep changing as South and West become more-and-more important. The other three quarters continue to grow sequentially much faster than the second quarter. (Note: Here they are talking about India but an important thing about seasonality that did not come up for discussion is that as the company expands in DRC, and further in Zimbabwe, Mozambique, South Africa etc. seasonality will come down even further as all these countries are in the Southern Hemisphere with summer in December)

-

There is a lot of innovation in the pipeline, especially in the no sugar portfolio. That has done extremely well. As Pepsi is moving towards a healthier portfolio, VBL is also promoting a lot of products in mid-calorie and no sugar segments.

-

The value added dairy and juice margins are similar to our CSD margins. So with growth in these segments, the total portfolio will also expand. The margins are not going to materially change and are not expected to come down either. Sting is a little more profitable

-

Energy drinks is going to be a big play going forward. Next year it may launch another energy drink. Management said not sure it will be Rockstar or what, but they are looking to launch one more energy drink next year.

-

Greenfield facility in DRC is progressing well and is slated to be commissioned in the upcoming months. It can do about between 35 to 40 million cases (capacity). It’s a large market and with one plant, it can serve around 55%-60% of Congo. To serve the other part of Congo, it will have to set up another plant. Congo is a large market with more than 100 million population as compared to Zimbabwe with a population of 16 million people. Congo is near the equator and has much warmer climate. So the market is large, much larger than Zimbabwe

For the first time, Varun Jaipuria spoke in the call, and quite a lot. The next generation is getting ready for the transition.

(Disc.: Invested)

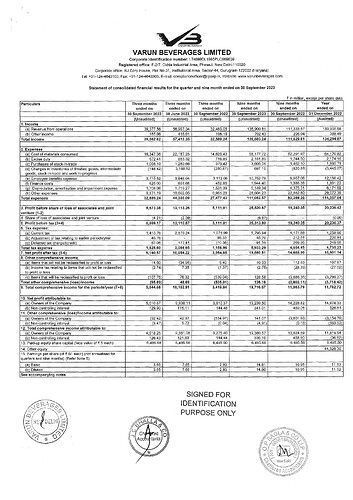

Varun Beverages released its financial results for the third quarter (Q3) and the first nine months (9M) of the calendar year 2023.

Q3 CY2023 Financial Performance Highlights:

- Revenue Growth: Varun Beverages reported a significant 21.8% year-on-year (YoY) increase in revenue from operations, net of excise/GST, reaching Rs. 38,705.2 million. This growth was driven by consolidated sales volumes, which increased by 15.4% in Q3 CY2023, totaling 220 million cases, compared to 190 million cases in Q3 CY2022. This growth was observed in both the Indian and international markets.

- Improved Realization: The net realization per case increased by 5.6% to Rs. 176.3, mainly due to an increase in realization per case in international markets.

- EBITDA Growth: Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) increased by 26.2% to Rs. 8,821.4 million in Q3 CY2023, up from Rs. 6,989.9 million in Q3 CY2022. The company achieved improved gross margins, which increased by 163 basis points (bps) to 55.3% in Q3 CY2023, primarily attributed to softer PET chips prices. EBITDA margins improved by 79 bps to 22.8% in Q3 CY2023 due to higher gross margins and operational efficiencies.

- Profit Growth: The Profit After Tax (PAT) increased by a substantial 30% to Rs. 5,140.6 million in Q3 CY2023, compared to Rs. 3,954.8 million in Q3 CY2022. This growth was driven by increased revenue from operations and improvements in margins.

9M CY2023 Financial Performance Highlights:

- Revenue Growth: Varun Beverages achieved a 22% YoY growth in revenue from operations (net of excise/GST), reaching Rs. 133,748.9 million in the first nine months of CY2023, compared to Rs. 109,589.1 million in the same period in CY2022.

- EBITDA Growth: EBITDA increased by 28.6% to Rs. 31,912.0 million in 9M CY2023, up from Rs. 24,806.0 million in 9M CY2022.

- Profit Growth: The company reported a PAT of Rs. 19,580.5 million in 9M CY2023, reflecting a 33.3% YoY increase from Rs. 14,685.9 million in 9M CY2022.

Mr. Jaipuria expressed satisfaction with the company’s Q3 and 9M CY2023 performance, with a 22% growth in revenue and a 30% increase in PAT year-on-year. He highlighted the company’s resilience, particularly in rebounding from unseasonal rains in Q2 CY2023 in India, which contributed to a solid 15% growth in consolidated sales volumes. This growth was evident in both Indian and international markets.

Mr. Jaipuria company’s significant progress on the operational front, with investments in developing greenfield and brownfield manufacturing facilities across India. Additionally, the upcoming greenfield facility in the Democratic Republic of the Congo (DRC) is progressing well and is expected to be commissioned in the near future. These strategic efforts are aimed at meeting increasing consumer demand and capturing untapped market opportunities.

The company is committed to diversifying and enhancing its portfolio, with a particular focus on increasing capacity for juices and value-added dairy beverages to align with evolving consumer preferences.

He also highlighted the significant growth potential in the Indian beverage market due to the dynamic demographic landscape and evolving consumption patterns. The company’s strategic initiatives are geared toward strengthening its position in the global beverage industry by intensifying its presence in India and expanding into Africa.

It seems that Q2 and Q3 FY24 could be also better this year due to heat waves across the country. With temperatures in Mumbai close to 36 degrees for almost entire October, chances are high that, revenue could be good in Maharashtra in Q3 as well.

The climate change have lot of negative impacts but it would be positive for cold drink manufacturers.

Just an observation.

We need to know from which are key states it generates revenue from ?