I have made a few changes to the model portfolio:

-

Initiated 1% position in Sharat Industries. I plan to play the shrimp sector via the market leader Avanti, where I already own 4% position and a smaller co like Sharat which can benefit disproportionately with revival in the industry. Sharat is currently operating at 50% utilization and has reported good quarterly results (flat sales, 32% EBITDA growth, 64% EPS growth). Management has been guiding for 15-20% sales growth, 20-25% EBITDA growth, and 25-30% PAT growth over next 3-4 years. By FY26, they want to reach 9-11% EBITDA margin by improving their capacity utilization. If this turns out to be the case, their FY26 revenues can be around 500 cr. and they can potentially report 20-25 cr. PAT. Their current market cap of 137 cr. offers a very good risk reward.

-

Reduced position size in NESCO (from 4% to 2%), Ajanta Pharma (from 4% to 2%), Sundaram Finance (from 2% to 1%). This transaction is largely to make space for new companies in the portfolio, and reallocation to other bets, where I feel risk reward is better. Ajanta has been one of my favorite businesses, however they have been topping out around 6.5x sales, where they are currently trading. Nesco is not so expensive, so my quantum of selling has been much more measured here. Sundaram has doubled since I bought, and are now trading at higher end of their valuation band, hence taking money off table.

-

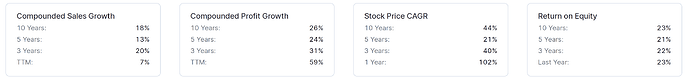

Increased position size in Aegis Logistics from 2% to 4%. I have been amazed at how Aegis has grown over time. Its rare to find a small cap which has grown profits by 10x+ in 10 years, while maintaining 20-40% dividend payout without equity dilution.

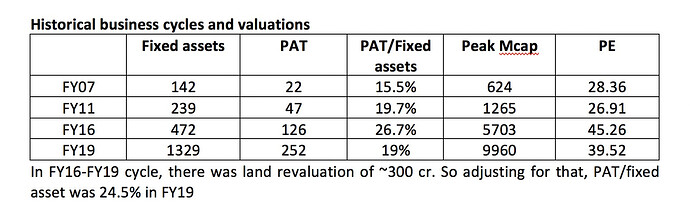

They have managed to reach PAT/fixed assets of 15-20% in good times. With current LPG expansion, their net block in 3 years will be around 5000 cr., which implies they can reach potential PAT of ~1000 cr (vs 510 cr. in FY23). I am reasonably confident of them achieving these nos, given their very good track record. Current valuation of 21x PE is towards the lower end of their traded band.

-

Increased position size in Propequity from 2% to 4%. This is largely due to stock doubling in quick time, rather than me adding to existing positions. They have been scaling very well, and plan to maintain sales growth of 30%+ in the near term. Their current revenue runrate is around 35 cr., and I feel they can reach 70-80 cr. sales in next 3-4 years. As this is a unique business model with very high margins and low capital requirement, I feel market will ascribe 10x+ Mcap/sales if they scale well, and I hope that they cross 1000 cr. Mcap in the next few years.

-

Reintroduced Chamanlal Setia at 2% position size. The numbers being reported by Chamanlal is worth noticing. For these kind of nos, I feel 8-9x PE is quite cheap. This being a cyclical space, I am closely tracking basmati prices as any sharp drawdown in that can bring down their earnings. I just hope that I am not buying at peak earnings!

Updated folio is below and cash stays at zero.

Core compounder (44%)

| Companies | Weightage |

|---|---|

| Aegis Logistics Ltd. | 4.00% |

| Eris Lifesciences Ltd. | 4.00% |

| HDFC Bank Ltd. | 4.00% |

| HDFC Asset Management Company Ltd | 4.00% |

| Gufic Biosciences | 4.00% |

| Godfrey Phillips | 4.00% |

| P.E. Analytics Ltd | 4.00% |

| Ajanta Pharmaceuticals Ltd. | 2.00% |

| NESCO Ltd. | 2.00% |

| I T C Ltd. | 2.00% |

| PI Industries Ltd. | 2.00% |

| LINCOLN PHARMACEUTICALS LTD. | 2.00% |

| Caplin Point Laboratories Ltd. | 2.00% |

| Aptus Value Housing Finance India Ltd. | 2.00% |

| Shree Ganesh Remedies Ltd - PP | 2.00% |

Cyclical (44%)

| Companies | Weightage |

|---|---|

| Kolte-Patil Developers Ltd. | 4.00% |

| Avanti Feeds Ltd. | 4.00% |

| Alembic Pharmaceuticals Ltd. | 4.00% |

| Amara Raja Batteries Ltd. | 4.00% |

| Sharda Cropchem Ltd. | 2.00% |

| Stylam Industries Limited | 2.00% |

| Ashiana Housing Ltd. | 2.00% |

| Ashok Leyland Ltd. | 2.00% |

| Kaveri Seed Company Ltd. | 2.00% |

| Time Technoplast Ltd. | 2.00% |

| RACL Geartech Ltd | 2.00% |

| Manappuram Finance Ltd. | 2.00% |

| ANUH PHARMA LTD. | 2.00% |

| Dharmaj Crop Guard Ltd | 2.00% |

| MAYUR UNIQUOTERS LTD. | 2.00% |

| Godrej Agrovet Ltd. | 2.00% |

| Chaman Lal Setia Exp | 2.00% |

| KSE LTD. | 1.00% |

| Sundaram Finance Ltd. | 1.00% |

Turnaround (2%)

| Companies | Weightage |

|---|---|

| Punjab Chem. & Corp | 2.00% |

Deep value (10%)

| Companies | Weightage |

|---|---|

| Geekay Wires | 2.00% |

| Worth Peripherals Ltd | 2.00% |

| Sharat Industries | 1.00% |

| Jagran Prakashan Ltd. | 1.00% |

| D.B.Corp Ltd. | 1.00% |

| Shemaroo Entertainment Ltd. | 1.00% |

| Modison Metals | 1.00% |

| RKEC Projects | 1.00% |

I have never found a single good stock idea from a MF, instead I have seen a lot of MFs buying a stock I already own or track, which then increases its valuation. So, I am not the right person to answer this. On VP, there is no dearth of stock ideas.

Very good performance, I have increased allocation a bit, but not a lot. In hindsight, I should have taken larger bets on a number of pharma cos earlier this year (SGRL, Caplin, Anuh, Lincoln, Ajanta). But overall I am reasonably satisfied with my bunch of pharma cos, I will try to increase position in SGRL if there is a big dip.