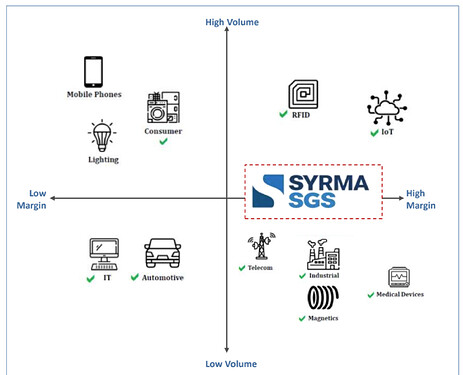

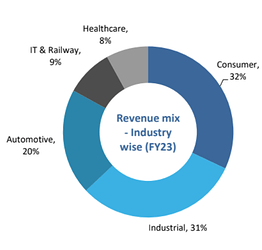

SGS Syrma is technology-focused engineering and design company engaged in turnkey electronics manufacturing services (EMS), specializing in precision manufacturing for diverse end-use industries, including industrial appliances, automotive, healthcare, consumer products and IT industries. The company provides high-mix, flexible volume, precision OEM manufacturing.

It caters to both Indian and international market (with presence in over 24 countries, including the USA, Germany, Austria, and UK). Domestic business accounts for ~70% of revenue.

The products offered include Printed circuit board assemblies (“PCBA”), Radio frequency identification (“RFID”) products, Electromagnetic and electromechanical parts and other products, which include motherboards, DRAM modules, solid state drives, USB drives and other memory products

![]() Printed circuit board assemblies (“PCBA”): Our PCBAs are used in products manufactured in the automotive, medical,industrial, IT and consumer products industries, and shall include box-build products.

Printed circuit board assemblies (“PCBA”): Our PCBAs are used in products manufactured in the automotive, medical,industrial, IT and consumer products industries, and shall include box-build products.

![]() Radio frequency identification (“RFID”) products: Our RFID products are used in products manufactured in the shipping, healthcare, manufacturing, retail and fintech industries.

Radio frequency identification (“RFID”) products: Our RFID products are used in products manufactured in the shipping, healthcare, manufacturing, retail and fintech industries.

![]() Electromagnetic and electromechanical parts: which include magnetic products like chokes, inductors, magnetic filters, transformer as well as high volume manufacturing assemblies. Company’s electromagnetic and electromechanical parts are used in products manufactured in the automotive, industrial appliances, consumer appliances and healthcare industries, among others.

Electromagnetic and electromechanical parts: which include magnetic products like chokes, inductors, magnetic filters, transformer as well as high volume manufacturing assemblies. Company’s electromagnetic and electromechanical parts are used in products manufactured in the automotive, industrial appliances, consumer appliances and healthcare industries, among others.

PCB assembly accounts for 66% of the revenue, Box build accounts for 18% of the revenue and RFID accounts for 16% of the revenue.

As of FY22 SGS Syrma has installed capacity to manufacture 10,120 Million CPA of PCBA, 300 M tags RFID, 6 M Coils of magnetics, 7.2 M modules of IT products, 180M CPA for zone of autonomous creation and 1,500,000 RFID label tags per month

Some of the customers they cater to include TVS Motor Company Limited, A. O. Smith India Water Products Pvt. Ltd., Robert Bosch Engineering and Business Solution Pvt Ltd, Eureka Forbes Ltd, CyanConnode Limited, Atomberg Technologies Private Limited, Hindustan Unilever Limited and Total Power Europe B.V.

Syrma SGS presence accross verticals and their margin profile

Growth Triggers

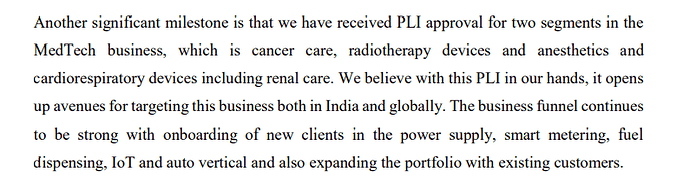

Technological advancements, China + 1 Strategy, System Automation and Analytics, Schemes like Production Linked Incentive (PLI) Scheme and Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors and Import Substitution.

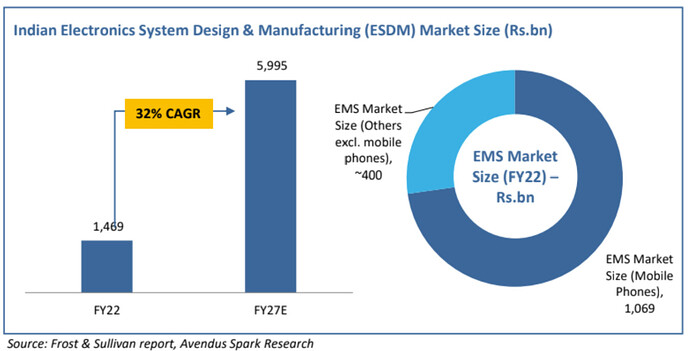

![]() Large addressable import substitution opportunity for domestic EMS players –The non-mobile domestic EMS market is estimated to be ~Rs. 400- 500bn in size, with the current revenue contribution from the well-known large players(both listed/unlisted) in India amounting to only ~Rs. 100bn. The remaining ~80% of the market demand is being met through imports, either in the form of direct PCB/PCBA or indirectly as complete box-build or equipment. The Indian government’s initiatives, such as PLI and EMC/SPECS, aimed at promoting domestic manufacturing in the electronics industry

Large addressable import substitution opportunity for domestic EMS players –The non-mobile domestic EMS market is estimated to be ~Rs. 400- 500bn in size, with the current revenue contribution from the well-known large players(both listed/unlisted) in India amounting to only ~Rs. 100bn. The remaining ~80% of the market demand is being met through imports, either in the form of direct PCB/PCBA or indirectly as complete box-build or equipment. The Indian government’s initiatives, such as PLI and EMC/SPECS, aimed at promoting domestic manufacturing in the electronics industry

and end-user sectors like telecom equipment, air conditioners, are resulting in a reduction in imports, an increase in domestic sourcing, and an expansion of the addressable market for EMS players.

![]() Global firms shifting sourcing from China to benefit EMS players – In an effort to reduce the risk of dependence on China, global firms (especially US & European) have started to source electronics/electronic products from other countries including India. The higher labour costs in China compared to India, coupled with the recent govt. incentives aimed at encouraging Indian companies to establish manufacturing operations and achieve scale, are creating greater export opportunities for EMS players in India.

Global firms shifting sourcing from China to benefit EMS players – In an effort to reduce the risk of dependence on China, global firms (especially US & European) have started to source electronics/electronic products from other countries including India. The higher labour costs in China compared to India, coupled with the recent govt. incentives aimed at encouraging Indian companies to establish manufacturing operations and achieve scale, are creating greater export opportunities for EMS players in India.

![]() Higher electronic content to expand addressable market –There is a marked rise in electronic content across end-user categories such as automobiles, consumer durables, industrial, and telecom, among others. In automobile, electronic content per vehicle is likely to treble due to transition towards electric vehicles. In consumer durables, growth of inverter air conditioners, BLDC fans, etc. is driving the demand for PCB/PCBA. In industrials, the shift from analog to smart meters and the adoption of digital displays in capital goods equipment are contributing to growth of electronic components.

Higher electronic content to expand addressable market –There is a marked rise in electronic content across end-user categories such as automobiles, consumer durables, industrial, and telecom, among others. In automobile, electronic content per vehicle is likely to treble due to transition towards electric vehicles. In consumer durables, growth of inverter air conditioners, BLDC fans, etc. is driving the demand for PCB/PCBA. In industrials, the shift from analog to smart meters and the adoption of digital displays in capital goods equipment are contributing to growth of electronic components.

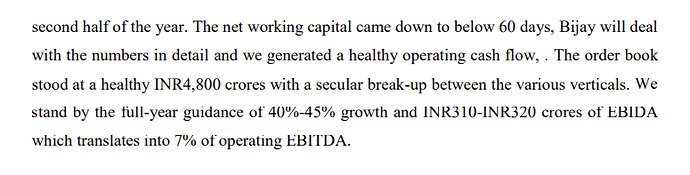

Company has doubled it’s revenue in FY23 and is expected to grow exponentially going forward

EMS market is expected to grow with a CAGR of 32% (FY22-FY27) and management is confident of growing more than industry

Key Risks involved:

Promoter is engaged in another sizeable business – an insurance company by the name Infinx

Shortage of semi-conductor supply from global market in future

Entry barrier to this industry is not too high. Future competition might come in

Slowdown in demand in few verticals

Delay in onboarding new customers/challenges in increasing market share from existing customers

Valuations are currently heated but the growth is also huge, so valuations may remain elevated for long

But any bad quarter may trigger a huge selloff

Looking forward for inputs from the industry experts or those who have more idea about the company

*This is not a buy sell recommendation, invested tracking quantity