Here is the latest portfolio

| Sr. No | Company | Sector | Capitalisation | Allocation % | Rationale |

|---|---|---|---|---|---|

| 1 | HDFC ASSET MANAGEMENT COMPANY LIMITED (XNSE:HDFCAMC) | Financial | Mid Cap | 11% | Financialization theme |

| 2 | LAURUS LABS LIMITED (XNSE:LAURUSLABS) | Healthcare | Mid Cap | 9% | Growth |

| 3 | BSE Limited (XNSE:BSE) | Financial | Small Cap | 9% | Financialization theme |

| 4 | AVENUE SUPERMARTS LIMITED (XNSE:DMART) | Services | Large Cap | 8% | Long-term retail play, debt free |

| 5 | HCL TECHNOLOGIES LIMITED (XNSE:HCLTECH) | Technology | Large Cap | 8% | Coffee Can |

| 6 | OLECTRA GREENTECH LIMITED (XNSE:OLECTRA) | Automobile | Small Cap | 8% | EV theme |

| 7 | DR. LAL PATHLABS Limited (XNSE:LALPATHLAB) | Healthcare | Mid Cap | 7% | Coffee Can |

| 8 | DEEPAK NITRITE LIMITED (XNSE:DEEPAKNTR) | Chemicals | Mid Cap | 6% | Growth |

| 9 | ABBOTT INDIA LIMITED (XNSE:ABBOTINDIA) | Healthcare | Mid Cap | 6% | Coffee Can |

| 10 | ASTRAL LIMITED (XNSE:ASTRAL) | Chemicals | Mid Cap | 5% | Coffee Can |

| 11 | GATEWAY DISTRIPARKS LIMITED (XNSE:GATEWAY) | Services | Small Cap | 4% | Promising sector for future |

| 12 | TITAN COMPANY LIMITED (XNSE:TITAN) | Cons Durable | Large Cap | 4% | Long-term retail play, debt free |

| 13 | PSP PROJECTS LIMITED (XNSE:PSPPROJECT) | Construction | Small Cap | 4% | Asset Light business in construction |

| 14 | ADITYA BIRLA SUN LIFE AMC LIMITED (XNSE:ABSLAMC) | Financial | Mid Cap | 4% | Financialization theme |

| 15 | Fsn E-Commerce Ventures Ltd (XNSE:NYKAA) | Services | Large Cap | 3% | Growth |

| 16 | INDIAN ENERGY EXCHANGE LIMITED (XNSE:IEX) | Services | Mid Cap | 2% | Growth |

| 17 | HDFC BANK LIMITED (XNSE:HDFCBANK) | Financial | Large Cap | 2% | Coffee Can |

| Stocks | |

|---|---|

| Top 5 | 46% |

| Top 10 | 76% |

| Top 15 | 98% |

| Market Cap | |

|---|---|

| Large Cap | 25% |

| Mid Cap | 49% |

| Small Cap | 26% |

| Sector Split | |

|---|---|

| Financial | 27% |

| Healthcare | 21% |

| Services | 17% |

| Chemicals | 11% |

| Technology | 8% |

| Automobile | 8% |

| Cons Durable | 4% |

| Construction | 4% |

| Defensive | 29% |

|---|---|

| New Age/Theme | 11% |

Investing Objectives –

Return of Capital - ![]()

Beat BSE Sensex in terms of CAGR ![]()

Beat FD returns ![]()

Reach 15% CAGR ![]()

Beat MF(direct) returns (21% Vs 17% CAGR) ![]()

Changes -

-

Bought 4% ABSL AMC based on this rationale

-

Sold 1/3rd of stake in BSE Limited

Notes -

-

BSE Sensex is almost neck to neck with PF returns

-

The gap between returns from MF and stocks has increased even further. Thanks to fund managers

-

Ideally, I would have increased stake in HDFC AMC in place of adding new entrant ABSL AMC but valuation wise, ABSL AMC is very attractive. The only thing which can hurt can be any possible corporate governance issue which HDFC AMC is considered to be quite good. It also means, I spread my risk in financialisation theme from 2 to 3 - BSE Limited, HDFC AMC and ABSL AMC. To be very honest, UTI AMC is even better in terms of valuation but the promoter share holding is going to be a recurring problem there. HDFC is also attractive in its valuation especially with real estate upcycle however, in financials, but I am little biased towards exploring financialisation theme specific to AMCs.

-

Olectra lost 5450 mega electric bus tender to Tata Motors due to lowest cost quote. I did a very good research about Tata Motors in 2018/19, especially their R&D spend was one of the best in the world at that time. However, I did not go further looking at its debt. During the March 2020 crash, the price of Tata Motors has fallen below its book value and in fact, the market cap was below 30k crores. With a strong promoter like Tata, given that it was its down cycle, it must have been an easy pick, given the fact that with so much of liquidity around, the interest expense also can be brought down. For now, comparing between Olectra and Tata Motors, the chance of Olectra giving higher returns is much more given that the market cap of Olectra is below 5k Crores and recently they won 2100 Electric Buses Order which is worth ~3600 Crores. As Olectra has to deliver them in an year’s time, the price/sales is going to be less than 1. Apart from that, the promoter is rebranding Olectra where they are no longer going to be dependent on BYD from China. With government itself looking for 50,000 Electric Buses in 5 years, the sector can give multiple winners with demand in place and also with localisation policy enforcement in place, costs also can become less in future

- The reduction in share price of Dr. Lal path labs is significant. Diagnostic space is attracting multiple big firms as the opportunity size is gong to be huge. The latest one is Tata 1mg which started with promotional pricing of 100 Rs for some medical tests whereas the existing players are charging higher. Now, the valuation multiple got reduced immediately. My idea of staying put in this company is - the company is nimble in upgrading its technology, have deep understanding of target market and looking for adding the next level tests. Mr. Arvind Lal who is the MD mentioned that they are not going to cut the prices due to the competition. As per Dr. Velumani, ex-CEO of thyrocare technologies, to capture B2C market of diagnostic space, around 1 billion dollars of money needs to shell out. For a Tata backed company, funding should not be a problem but then Tatas are also not successful in all of their ventures. I could have sold my shares immediately after Tata 1mg news came up and sit on the sidelines till I get the confirmation but then I wanted to stay put. The experience is going to be more useful here

- Studied a mining company called OZ Minerals by going through their annual report. The company gives dividend regularly and also is a big beneficiary of post-covid commodities boom. Their incentive structure for executives is well worth replicating in cyclical industries.

Interesting Videos -

Astral is one of those few companies which has increased their cashflows significantly. Their enterprising foray into adjacent segments is worth listening to from the founder & promoter himself in this video. From pipes and adhesives, now they are expanding into the new segments - tanks, valves, faucets, paints and some infrastructure divisions. Many companies are entering the paint business with Grasim recently announced 10,000 crores capex to their paints business. I have a vague feeling that Saurabh Mukherjee in his appreciation for Asian Paints business spilled out to the market that its not about the quality of paint but mastering the logistics in selling paints. Astral is targeting 600 cr revenue in coming years from its paints business. With signs of real estate cycle in the uptrend, may be Astral wanted to capitalise the opportunity the market is presenting now.

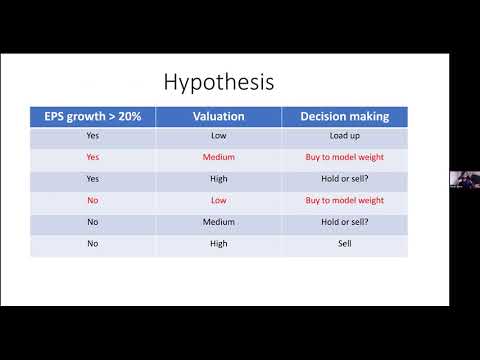

@harsh.beria93 has explained well about correlation between returns and the valuations here. The art of selling has to be mastered to beat index returns.