Even in the past it has swung with the aluminium commodity price but yes the product is good but the margins are in tandem with the commodity cycke

Worth peripherals: Worth Peripherals Limited is one of the leading manufacturers of corrugated boxes. Last year it has been transferred to NSE main board from SME. Segments.

The company looks very undervalued at present. Recently it has completed a huge amount of expansion (60%). The company has also applied for land purchases for more expansion.

The future of the company looks very good. MP Govt will also be providing a 16 crores subsidy to this company installment basis. The expansion of the company shows that the day by day the demand for corrugated boxes is increasing in India. Financial of the company looks very good. Details will be found in the screener (Worth Peripherals Ltd financial results and price chart - Screener). As this company is listed in NSE only, annual report can be downloaded from NSE.

Views are invited from experts (@hitesh2710 @RajeevJ @ayushmit @HIMSHAH @sahil_vi @vikas_sinha) on this company. If I get positive inputs from experts, I want to add more.

Disc: invested

Thanks for bringing in the sector of corrugated boxes into the discussion.

In my view this sector is an untouched one for now. I have started looking into this recently.

Hard to find the big players or well established players. Mostly due to the fact that the unorganized players can play a big role in the industry. Do you have any information on the competitors and share of unorganized players in the corrugated boxes section?

Thanks in advance

As per the red herring of Worth Peripherals [page 91] no listed peers engaged in the manufacturing of corrugated boxes. RED herring documents can be downloaded from company siteRed_Herring_Prospectus-worth-packaging.pdf (5.3 MB). However, when I was google about Corrugated Box Manufacturers In India, I found the following article [Top 5 Corrugated Box Manufacturers In India]. It says top five unlisted Corrugated Box Manufacturers In India. 1. Canpac Trends Pvt. Ltd. 2.Multi Pack 3.Hariwansh Packaging Pvt. Ltd. 4.Trident Paper Box Industries 5.Kapco Packaging Company

I dont have any idea abouth their market share.

Interesting blog on Sharda motors: Sharda Motor Industries Ltd: Fundamental Analysis - Dr Vijay Malik

NDR Auto: Spinoff from Sharda motors. At the moment is pure-asset-play aka cigar-butt type investment. Cheers.

Thanks for sharing the documents.

In my view an in dept study would be needed at this point of time to evaluate the growth. As stated before and also in your post, market coverage from unlisted players would be of prime importance.

there is report by @yogesh_s on worth peripheal.

Hi @jaman_valuepickr , Worth Peripherals looks interesting. with increased demand for e-commerce, I guess the demand would increase for corrugated boxes. They have reasonable ROE/ROCE.

However a couple of key questions -

- How does the company manage the impact of raw material price increase? Being in a B-2-B business, i suspect the company has any pricing power.

- Do we know what is the market share of organized vs. unorganized vs. company’s market share?

- Is this just a commodity business or does the company have any competitive advantage? If they have, what is it?

Thanks.

I too was looking at this company for sometime and have literally found nothing concrete, The company migrating to main board successfully, Good management and the huge potential of this industry due to sudden increase in online shipments etc have nudged me to take a position (Half of which i intended to initially). I have shot off a question to their team regarding their capex and foray into diaper making ,Will share with you the details.

As for now the primary con is that it is a microcap and it has to withstand all the competition if a bigger player enters the market ,DO share any triggers you find

Voldemort

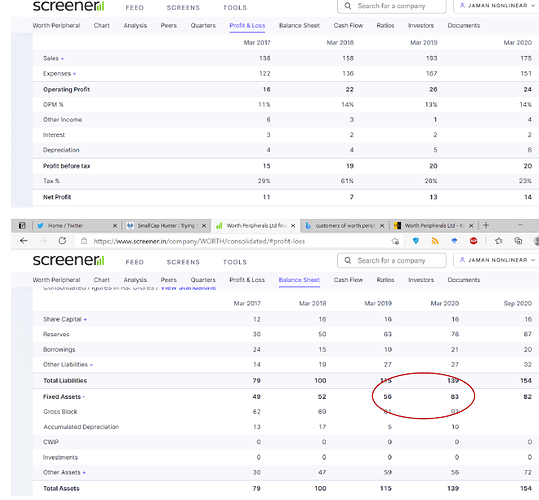

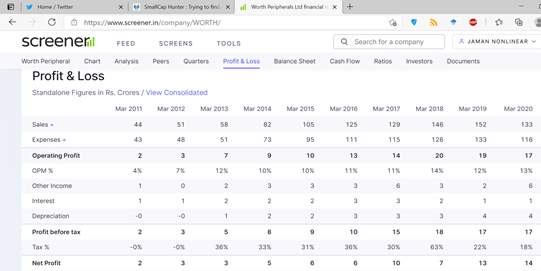

It is not easy to answer these question easily. But if we see 10 year sale growth, it looks noncyclical in nature as seen from sale.  .

.

Secondly, package boxes are essential and non seasonal products for end user. Any increase in raw material price could be transmitted to end user. Further, we see increase in fixed asset in 2020. But we have not seen the reflection of it in the sale. May be in future we can see in sale.

Makes sense but why hasn’t quarterly depreciation figures increased?

Do you have any clue on this? March 20 depreciation 6 crores looks ok. but Sep 20 it is only 1.56 crores.

Mar’20 dep is for 1 year , where as Sep’20 dep is for a quarter.

Dear Jaman, can u please direct me to the report by Mr Yogesh on Worth Peripherals – I was not able to locate it.

Many thanks

You will get here. Some discussion about worth peripherals during its IPO. Yogesh’s blue chip 10 Portfolio - Q&A: Questions & Answers / Portfolio Q&A - ValuePickr Forum

. screener will be found here.

Hello everyone. Came across this company called Raghav Productivity Enhancers.

Basic Background:

RPEL is engaged in the manufacturing of quartz based ramming mass, quartz powder, silica ramming mass and tundish board. It sells its products under the brand name of “Raghav” in domestic market as well as in foreign markets (majorly African and Asia Pacific countries).

Few graphs:

*Here 10 is FY21

Pros:

Commodities boom and metal prices skyrocketing

High promoter holding at around 73%

Last 3 years average ROCE is about 30%

Last 3 years average ROE is about 27%

Almost debt free

Operating margins at around 20 to 25%

5 years CAGR profit growth is 66%

No significant divergence between operating cash flow and profit

Exports opportunity(currently 18% of revenue)

Cons:

High debtor days at > 100 days

Capital intensive sector

Inventory turnover declined from 13x in FY15 to 3.7x in FY20

35x P/E multiple

5.5x P/B multiple

Company is paying zero dividends

Fixed assets turnover declined from 15x in FY14 to 2.4x in FY20

Large working capital requirements

Company has issued preferential equity shares to certain entities (including promoters) at a 20% discount to CMP

Non-cooperation with credit rating agency

Other interesting factors:

Mr Utpal Sheth is holding around 7% stake in the company

Mr Ashok Bhandari(CFO and president of Shree Cement for 25 years) is chief economic advisor to the company and visits the company every quarter

Customers:

R.L. Steel

Mahalakshmi TMT

Varsana SPA

Shreeyam Power and Steel Industries Ltd

United Steels Company

Rajuri Steel Pvt Ltd.

More customers

Sail, Tata, Essar, Jindal Stainless, Jindal Steel & Power, Rathi, Shah Alloys, Lloyds,

Facor, Electro them, Synergy

(from a brochure on their website. No direct link available)Pros:

-

Gross Margin has been fairly consistent since Q2 2019 i.e. 10 quarters

-

Operating and Net margins have fluctuated a bit but they also got stable since Q1 2020 except Q4 2020 and Q1 2021 (lockdown effect)

-

YoY sales growth is consistently improving for last 5 years

-

Consistently spending on R&D. They spent ~1Cr till Dec 2020 in FY 2020-21

-

A total of over 10Cr has been spent by them, FY 2017 - 2020

-

its R&D centre is the only one to be recognised by the Department of Scientific and Industrial Research (Government of India)

-

a technical collaboration with Sweden-based JWK AB. JWK AB is a technology consulting Company with a formidable R&D track record in the field of silica used in refractory applications.

-

Their ramming mass capacity is the largest in the world. The nearest competitor is not even half their size.

-

Products selling at a premium of 20% compared to competitors (Annual Report 2020, page 29)

-

They are organising analyst meets. For a company of their size, it’s surprising.

Cons:

-

They increased non-current borrowings by ~INR 89 lac. It’s unclear what this money is being used for.

-

Couldn’t find any investor communication channel. The investor presentation is missing which they supposedly uploaded on BSE on 6th November

-

Corporate presentation on their website is inaccessible

-

What is the difference between raghavsteel.com and rammingmass.com?

Something seems odd. Everywhere they mentioned they started Raghav Ramming Mass in 2009 and later changed it into Raghav Productivity Enhancers.

- But this youtube video uploaded by them mentions Raghav Ramming Mass was established in 1977.

- Youtube: Ferro Alloys, Pig Iron and Ramming Mass by Raghav Ramming Mass Private Limited, Jaipur

RPEL has the following charges registered. The most interesting one is INR 19.26cr amount and a couple other hypothecated motor vehicles. (A charge is basically mortgaging an asset)

Can we find out what these motor vehicles are? I wouldn’t be surprised if these are some fancy cars being used for personal use.

26th April 2021

Following are the people who attended the conference call on 7th November 2020.

Param Capital Research Pvt. Ltd.

Lucky Investments Pvt. Ltd.

Emkay Global Financial Services Limited

Mr. Nishid Shah

Ramesh S Damani

Relativity Investment Advisor LLP

These are the various contact details of the company:

Email:

Phone:

9829011963

9829019963

2235760

2235761

Contact details of people for some third party/channel checks:

Customers:

Auditors:

Lawyers:

Here is the link of their DRHP https://www.bseindia.com/downloads/ipo/2016125144222DP%20RRML.pdf

Interest free unsecured loans from promoter is a clear green flag

Promoters’ personal guarantee for 15 Cr loan is green flag

Interacted with Mr Govind Saboo

Did not get many answers, as he said there are certain limitations to what can be disclosed on a one on one basis

He said that you will have to do my own independent research (especially about competitors)

But few things which he said were:

Exports is direct sales, there is no broker or agent

Around 70% is induction furnace and 30% is foundry

In that, RPEL is catering to induction furnace

Industry is unorganized, so despite only 6% market share, RPEL is a market leader

Mr Bhandari is an advisor to the company; whatever management needs help with, they ask him

Private placement price was based on automated algorithm of past few months average stock price, and management did not decide that price

Raghav Steel is a promoter group company, and raghavsteel.com is the trade website of RPEL

Corporate gifting box on website is a designing mistake and they will change it soon

Around 90%+ customers are steel companies, but made some inroads in cement

Product reduces electricity requirement by a range but broadly 20%+

Fixed deposits to be utilized soon is going to be capex

About 300 players, broadly yes because it is unorganized sector

No patents as of now

JWK of Sweden helps in product development

Exports entry is long term strategic decision

Marketing people cannot comment

Some key questions:

Inviting comments

Infobeans Technologies:

• An IT services firm, Helps clients in Product engineering, Digital transformation, implementation and consulting of Service now and Salesforce products, Data migration to cloud (AWS, Azure, Google) and Robotic automation.

• Focus on the industries neglected by large peers

• 5 year Sales, PAT CAGR: 20, 22%

• Focusing on High Margin, repeat businesses

• Management looks honest, most from the top management are with the company since inception in 2000

• Management expects the company to grow 2x every year

• Currently 11 Fortune 500 clients

• Always looking for inorganic growth opportunities (acquisitions), good cash in hand

• Recently completed a Buyback, currently holds 75% of the total stake

I feel the earnings are expected to grow at a decent rate.

: Invested, will keep on adding as the conviction builds.

IST Limited. It may be one of the most undervalued companies on the BSE. NET Cash and lot of real estate , almost fully leased in partnership with Brookfield REIT. Would love to hear your research comments…

IST Promoters:

IST limited only, as I posted to the reply towards IST post. As mentioned by Kishan too, even though they have accumulated lot of cash and reserves, never returned even a penny to the retail holders. Let them first share atleast a minuscule amount to retailers, then only it will become a investable grade company.