About company:

-

Started as a small pharma company in 1992 and later Chandu Kothia, chairman & MD founded Shree Ganesh Remedies in 2004. Company has two decades of experience in the pharmaceutical sector, and is one of the leading manufacturers of Pharmaceutical Intermediates and Fine & Speciality Chemicals in India.

-

Its products find application in multiple industries including pharmaceutical, polymers, agrochemicals, electronics, aroma industry and many others.

-

It’s a family run business as father and both sons are fully involved in the business operations.

Manufacturing facilities:

-

Company has two manufacturing plants in Ankaleshwar, GIDC Gujarat and both of them are located close proximity to each other.

-

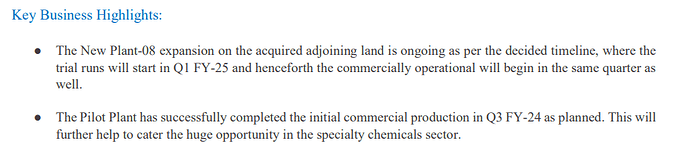

They have a total of 10 production blocks (2 of them are upcoming).

-

Unit-1 production area : 3,76,000 sft

-

Unit-2 production area : 36,500 sft

-

In addition to these plants, they also recently acquired the adjoining company with land area of ~2,15,000 sft which is now merged and this will be used for future expansion.

Business segments:

- Company is mainly into three different verticals:

- Human health API intermediaries

- Veterinary API intermediaries

- Specialty and fine chemicals

-

They have a 40+ product portfolio, 32 in API intermediaries and 11 in specialty chemicals. 4 of their products have more than 50% market share.

-

Clients spread in more than 15 countries. They want to focus on niche chemistries and provide the best possible solutions to their customers.

- Company also started a subsidiary in the USA to strengthen marketing there.

- They also entered into contract manufacturing with some of the Europe clients and one of the projects is already producing revenues from last quarter. Currently they have 3 ongoing projects.

Research & Technology:

-

Company believes in Research & Technology is the way to sustainable growth and has recently opened a dedicated facility for R&T. Focus of the R & T team is to develop not only new products but also focus on improving existing processes. In future they want to get into more sub segments of specialty chemicals to attract more clients.

-

More than 50 people are working in research & process development.

-

A new pilot plant has been set up and commenced operations to reduce the overall process and development time. The best practices from here will be shared to commercial sites for faster production, better lead times, and better utilization of the capacity.

-

As you can see there is a 3 fold increase in fume hoods from 2022 to 2023.

-

They are spending around 3-4% of revenue in R & D from the last few years.

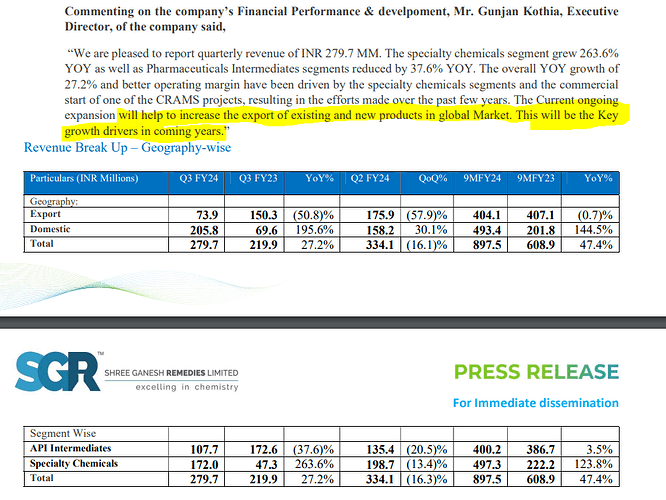

Revenues:

- Revenue:

- H1FY24 : 60 crores vs H1FY23 39 crores

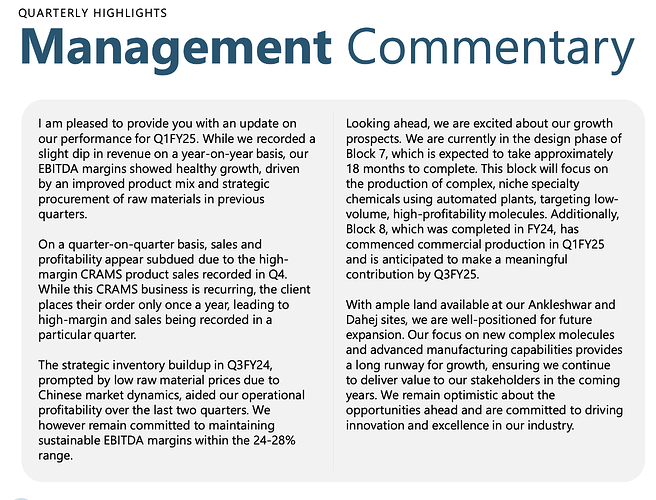

- EBITDA

- H1FY24: 17.5 crores(29%) vs H1FY23: 11 crores(28%)

- Net profit:

- H1FY24: 11.3 crores vs H1FY23 6.8 crores.

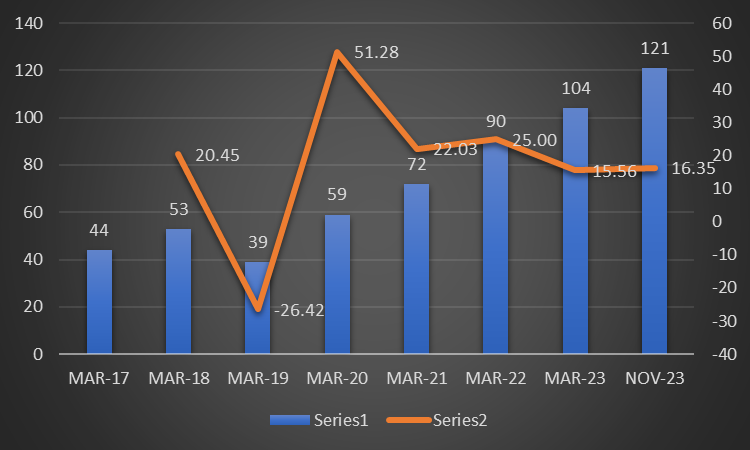

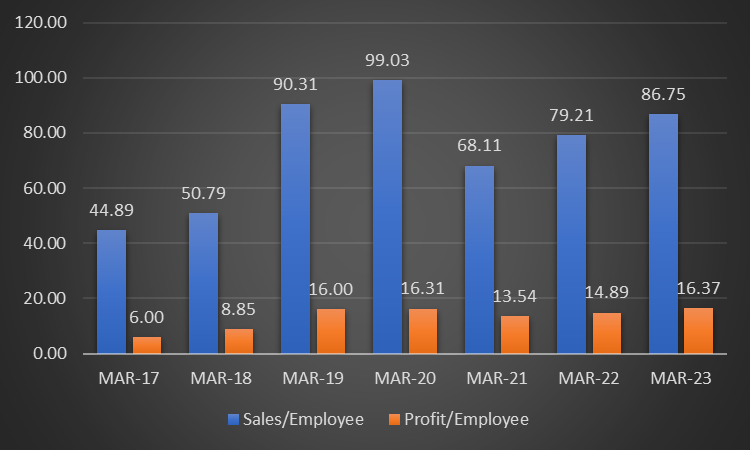

- Company has been able to increase revenues consistently over the years.

Revenue distribution:

- API intermediaries vs specialty chemicals: 59.3% vs 40.7% (FY23)

- Exports vs Domestic: 68.5% vs 31.5% (FY23)

Capex:

- Company has spent more than 40 crores in FY23 for acquiring the land adjacent to unit-1, setting up a new R & T block & pilot plant etc. This is by far the highest capex spent in the history of the company. Company expects to spend 15 crores for FY24.

Clients:

- Some of their marquee client list includes:

Management:

- Mr. Chandu Kothia who is the chairman & MD of the company has more than 30 years of industry experience. He started Ashoka pharma in early 90s and later in 2004 started Shree Ganesh Remedies to cater to international clients and to expand business further. HIs educational background is in chemistry and he started involving both of his sons into business. Both of them also pursued masters in chemicals.

- Gunjan Kothia thinks that the company has just started talked about the future prospects in the FY23 annual report (taken as is):

-

We are setting up a new GMP manufacturing block designed to cater to advanced API Intermediates, reinforcing our commitment to delivering high quality pharmaceutical solutions to our valued customers. This world-class facility is built in with the flexibility to manufacture in-house APIs which is further under strategic evaluation. We expect this facility to commence operations in the second half of FY24.

-

We have invested in an advanced manufacturing block dedicated to high-pressure reactions enhancing our pressure handling capacity up to 600 psi. This facility will allow us to widen our product range to better cater to our customers, amplifying our business horizon appreciably. With the commissioning of this facility, we will be one of the few players in our business space, with this capability placing us in a niche position in our business space.

-

We are setting up a cutting-edge Pilot Block, which will facilitate scaling up complex processes and optimization for the manufacturing processes. In addition, it will also serve as a commercial manufacturing block for small volume high-value products. When commissioned, the unit will provide the much-needed capacity and flexibility in our infrastructure to cater to high-value products. The unit should be operational in Q2 FY-24.

-

We have set up a new R&D block that houses the latest equipment and cutting-edge technology, allowing us to conduct advanced research and deliver complex, high-quality products. This investment is testimony of our commitment to fostering innovation and supporting the Pharma and Specialty Chemicals manufacturers in the US and the EU to reduce their dependence on China.

Shareholding:

- Promoters currently holding about 69.33% and total number of shareholders are also at about 7730 (relatively new listed company, came to main board in 2020).

Coverage:

-

There is not much coverage about the company in public and a handful of people in twitter talk about this company:

- https://twitter.com/theHarshFolio/status/1649009766931505152 : This is by Harsh who is very active in valuepickr. His writings has inspired me to start being active.

- https://twitter.com/raghavwadhwa/status/1724713331544526918

- Smart sync services covering this as their 5 minutes stock idea: https://twitter.com/SmartSyncServ/status/1735685176552796514

- I found a couple of videos from youtube covering this:

-

Recently Mittal analytics met the management and I don’t know if they have taken a position in it or not.

https://www.bseindia.com/xml-data/corpfiling/AttachHis/9a372c29-6cd0-47d0-a2b4-aac7355ec143.pdf -

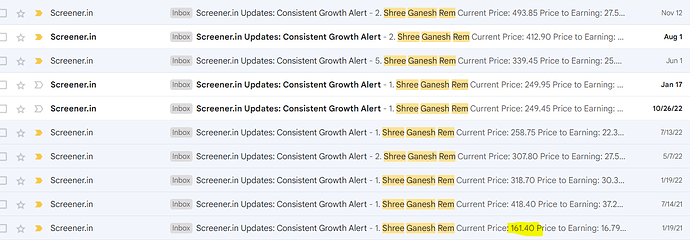

Interestingly this company came to my watchlist in one of my screeners during Jan 2021 when the price was around 160 and it continues to be part of the list multiple times since then.

What I have not covered in this:

- I haven’t gone through their chemistry processes and technologies, the company website has listed them. I am into computer science engineering and don’t have much understanding of organic chemistry.

-

I haven’t talked much on risks, I definitely feel there is a risk in raw materials procurement. It will be great if someone highlights the risks of the company.

-

I haven’t done a deep dive into financials, I would like to do it as and when I understand more about business.

-

I haven’t talked much on the management outlook and opportunities for the company, FY23 annual report covers this and I can update in the coming days about the same.

-

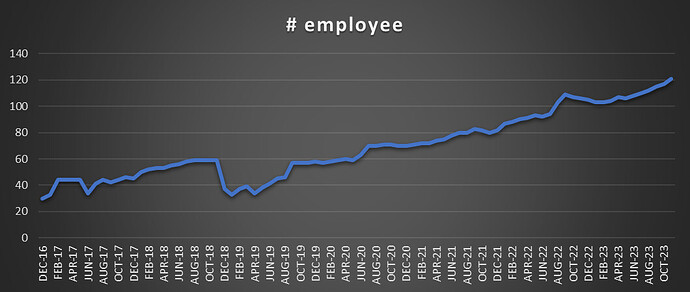

Scuttlebutt from EPFO website to get a feeling of salaries and increments, number of employee etc. I will be doing that in coming days.

References:

- FY23 Annual report: https://www.bseindia.com/xml-data/corpfiling/AttachHis/da3c26fa-3475-40b1-a0de-ecff2eb2b2b1.pdf

- FY22 Anuual report: https://www.bseindia.com/bseplus/AnnualReport/540737/76239540737.pdf

- Couple of presentations from the company to the exchange: https://www.ganeshremedies.com/investor/Q4-FY23-Investors-Presentation_revised-Final-.pdf

https://www.ganeshremedies.com/investor/INVESTORS-PRESENTATION_2020-21.pdf - About promoter1

- About promoter2

- https://www.linkedin.com/in/gunjankothia/

Disclosure:

-

After being a passive observer for several years I started being active in the forum again and started writing recently on this forum. This is my first post on the stock idea and would like to build upon the initial post by discussing with other folks and ready to learn from other people in the forum.

-

Started buying after Q2 results and will continue to buy in the upcoming days as business evolves and I get more confidence in the business.