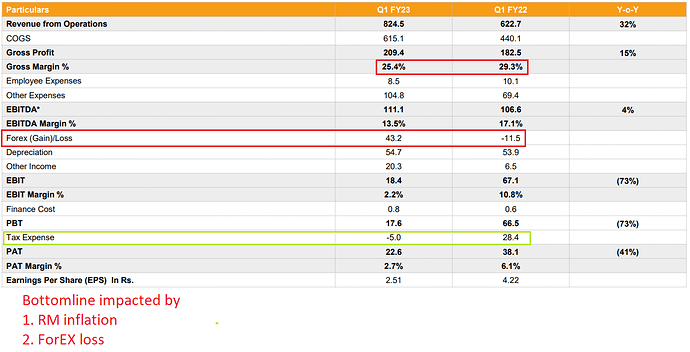

During this quarter, the miss was on gross margin which management blamed on cross currency headwinds (Euro weakening vs Dollar).

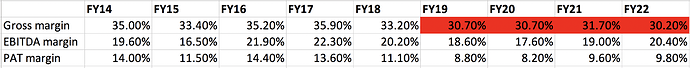

To give a bit of historical context, reduction of gross margins happened since FY18 when market derated Sharda Cropchem (from 2-3x EV/sales to 1-2x EV/sales). There were two main reasons for gross margin compression:

-

Sharda targeted USA as its next growth frontier, where they started offering products at lower realizations (thereby lower gross margins). This is a common business strategy, to sell at lower prices to break in the market, and over time establish credibility and increase prices

-

Chinese pollution issues started cropping up which meant Sharda’s suppliers demanded higher costs from Sharda

In agrochemical market, prices are set by innovators and the generic cos generally undercut these innovators. In 2019, innovators were offering ludicrous prices, which management pointed out aptly in FY19 concalls. Thus, Sharda was squeezed on both sides.

During this quarter, gross margins was at decadal lows (25%), and market has duly penalized the stock.

Future outlook

From industry perspective, Indian agchem exports have been growing very well since FY18. This is the second good cycle that this sector is witnessing (first was 2013-16 which then slowed down in 2017). So that we have had 3-4 bumper years of growth, its quite possible that growth slows down for a couple of years. Also, for a few cos, most growth has come due to realizations and they will get hit massively. This was somewhat visible in quarterly numbers of Rallis and Astec. Actually, next few quarters will help us understand which company has robust sourcing networks. Those whose margins are massively hit will likely have much higher dependence on Chinese suppliers (likes of Astec, Sharda, even Rallis to an extent). Whereas integrated players (like Meghmani, Heranba) should show lower margin pressure. As Meghmani’s numbers are out, we can clearly see that they haven’t faced margin pressures, so they actually have more indigenised sourcing of RM. Lets see what Heranba reports.

For Sharda, all this doesn’t make a lot of difference as their growth is a function of registrations. About margins, USD to Euro is still close to parity which implies Sharda’s hedge acts against it. Anyway, company has no control over currency fluctuation and I feel they shouldn’t waste a lot of time on this.

Valuation wise, I feel they can only trade at 2014-17 valuations if gross margins go back to 35% levels, which I am not sure about. The good thing with a company like Sharda is their business is becoming more diversified (both in terms of markets they sell in and the product range). Their non-agchem business has now grown past 200 cr. in quarterly revenues (just for context, the biggest belt exporter from India does lower sales). Also, Sharda was able to pass on freight cost increase in non-ag division, as a result of which margins have increased to 20%+. Lets see what the future unfolds.

Disclosure: Same as before