Business in detail:

Sharda Cropchem Limited globally markets and distributes crop protection chemical products which include fungicides, herbicides, insecticides, and biocides.

The business was the brainchild of Mr. R. V. Bubna, a Chemical Engineer from IIT, Bombay, and with a 45 year experience of working, hands on, in the chemical industry. He together with Mrs. Sharda R. Bubna commenced business operations through their sole proprietorship concerns, namely, M/s. Sharda International in 1987 and M/s. Bubna Enterprises in 1989, respectively (together the “Sole Proprietary Concerns”). Sharda Worldwide Exports Private Limited was formed in 2004. The businesses of the Sole Proprietary Concerns consisting of manufacture and export of dyes, dye intermediates, pesticides, agrochemicals and V-Belts, were transferred to Sharda Worldwide Exports Private Limited with effect from April 1, 2004 on an “as is and where is basis”.

On September 6, 2013, the Company changed its name to Sharda Cropchem Private Limited and thereafter on September 18, 2013 it was converted into a public limited company with the name Sharda Cropchem Limited (the “Company”).

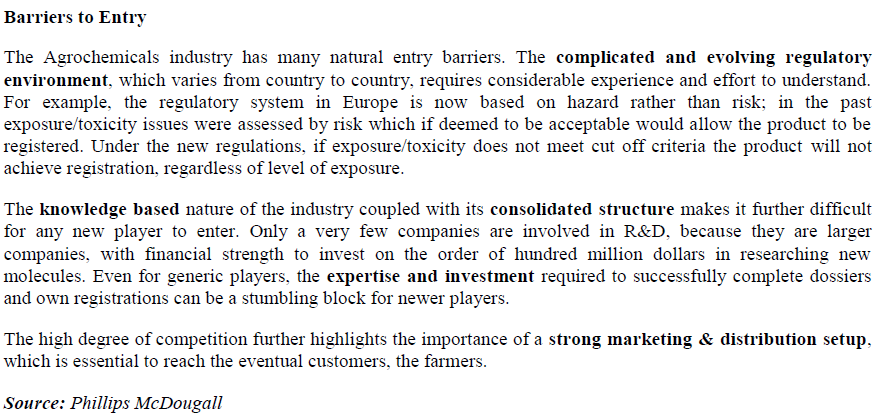

Today, the Company is a fast growing global agrochemicals company with leadership position in the generic crop protection chemicals industry. It has made deep inroads in the highly developed European and US markets which are characterized as high entry barrier markets. It also has a significant presence in other regulated markets such as LATAM and Rest of the World.

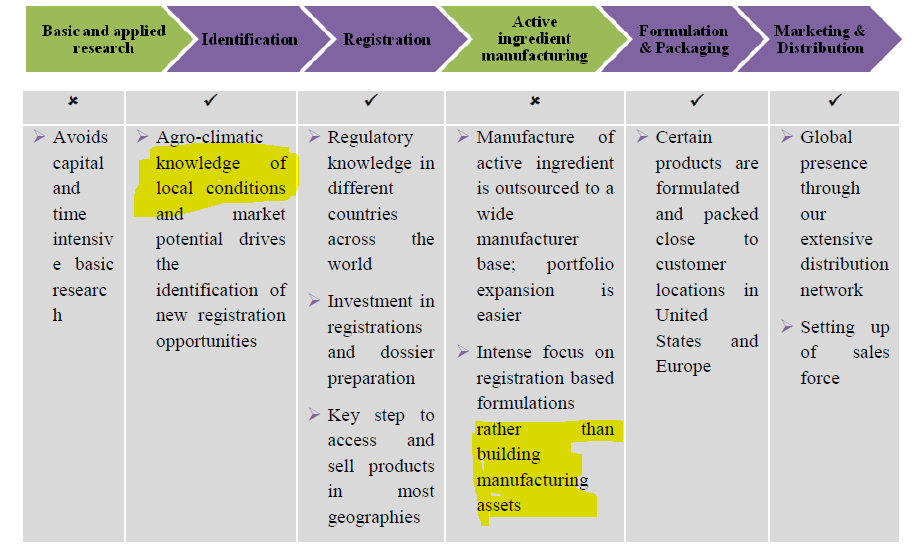

The Company has an asset-light business model whereby it focuses on identifying generic molecules, preparing dossiers, seeking registrations, marketing and distributing formulations through third party distributors or it’s own sales force. The Company’s core competence lies in developing product Dossiers and seeking product registrations in different countries. The Company not only has an extensive distribution network of third party distributors but has also setup its own sales force in various countries in Europe and in Mexico, Colombia, South Afirca and India. The Company’s strategy of sourcing through a global network of suppliers provides it with flexibility and nimbleness.

The company is capable of providing a wide bouquet of products to its customers. Its product portfolio in agrochemical business comprises of formulations and generic active ingredients in fungicide, herbicide and insecticide segments for protecting different kind of crops as well as serves turf and specialty markets and in biocide segment as disinfectants thereby allowing us to offer varied range of formulations and generic active ingredients.

The product portfolio in non-agrochemical business comprises of Belts, general chemicals, dyes and dye intermediates which enables the Company to cater to varied demands.

https://www.youtube.com/watch?v=P2s4Q5O4Iyg

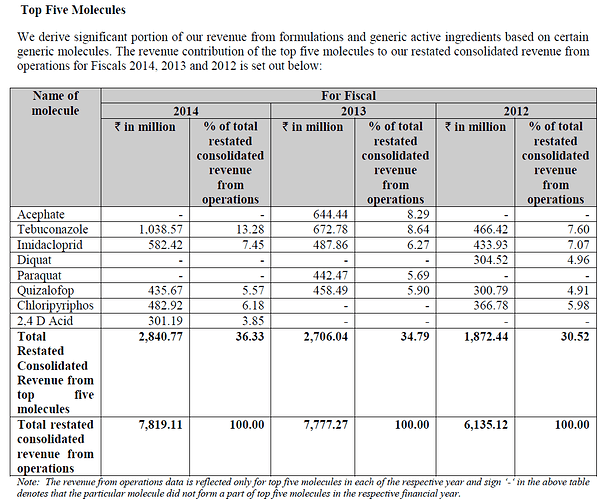

Key Products:

- Insecticides

- Fungicides

- Herbicides

- Veterinary Drugs

- Plant Growth Regulator

- Fumigants

- Regulator

- Rodenticides

- Textile Ply Conveyor Belts

- Rough Top Conveyor Belts

- Cotton Transmission Belts

- Steel Cord Conveyor Belts

- Chevron / Pattern Conveyor Belts

- Pipe Conveyor Belts

- PVC / PVG Solid Woven Conveyor Belts

- Elevator Conveyor Belts

- Sidewall Conveyor Belts

- Special Belts

- V Belts & Timing Belts

Market cap: 3,364.77 Cr

Facilities:

Pros:

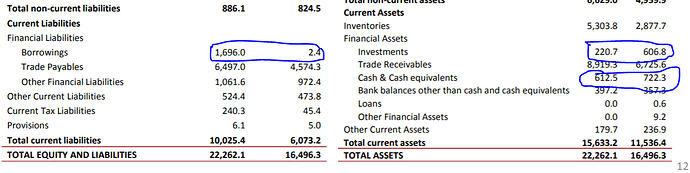

- Company is virtually debt free.

- Promoter’s stake has increased

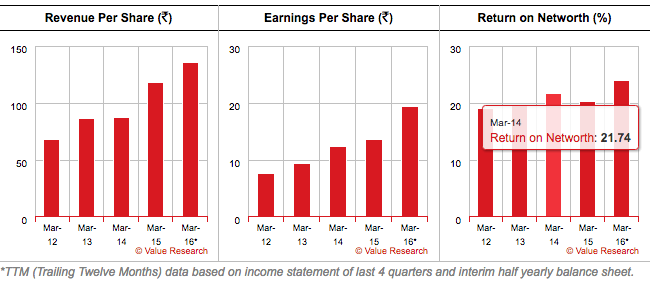

- Company has good consistent profit growth of 47.51% over 5 years

- Company has asset-light business model

Cons:

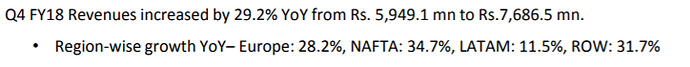

- Currency Risk

Key People:

- Ramprakash V Bubna - Chairman/Managing Director

- Conrad David Fernandes - Chief Financial Officer

- Sharda R Bubna - Executive Director

- Ashish R Bubna - Executive Director

- Manish R Bubna - Executive Director

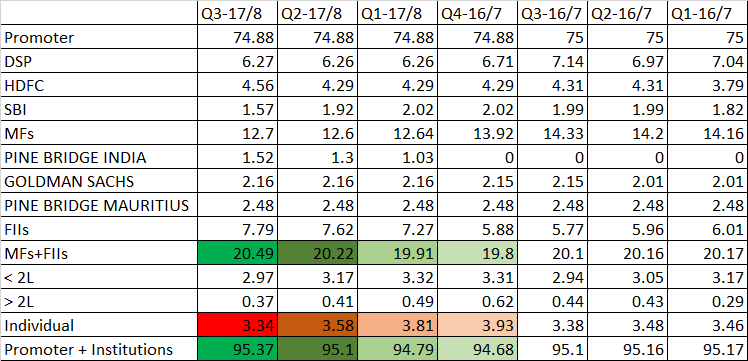

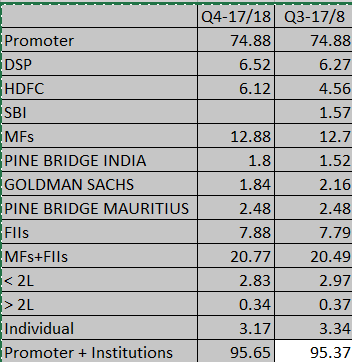

Share holdings pattern:

- Promotor: 65%

- FII: 15%

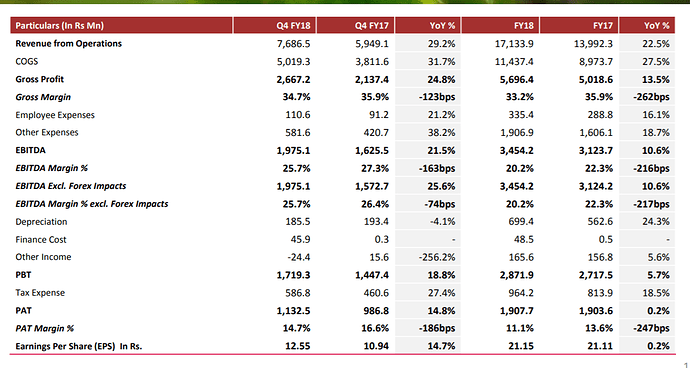

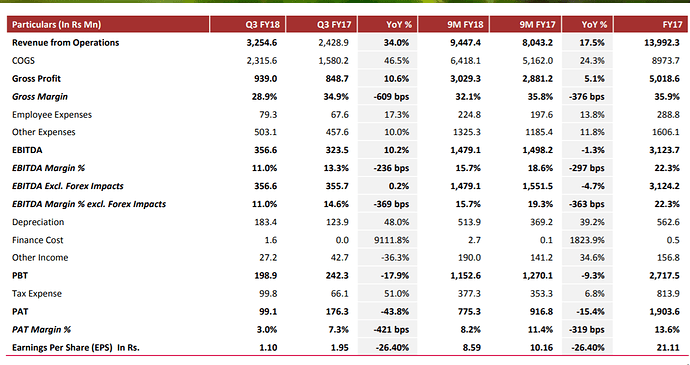

Last five years financials:

Key triggers:

- 96% Export

- 3% Indian Market

Disc: Not invested