yes - that’s an unorganized sector.

Do they have a website? Or do they take orders only through WhatsApp and phone calls? Basically, how are they taking orders, And does anyone know their customers?

Website - https://sgmart.co.in

Here is some key point from recent concall -

-

Business Model and Strategy:

-

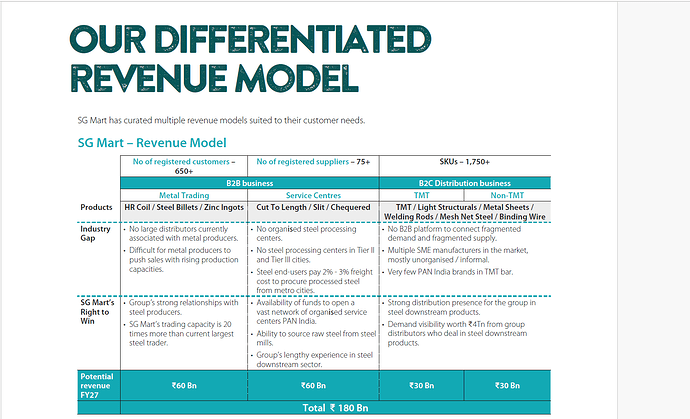

SG Mart Limited aims to become India’s largest steel and metal trader. The company’s strategy includes buying raw materials in bulk from steel and zinc producers and distributing them to smaller retailers and dealers.

-

SG Mart serves as a large distributor, relieving steel producers from managing small dealers directly.

-

They are also focusing on setting up high-tech service centers to process steel for industries like consumer durables, automotive, and construction, offering better quality and timely delivery compared to traditional small-scale processors .

-

Acquisition and Financial Strategy:

-

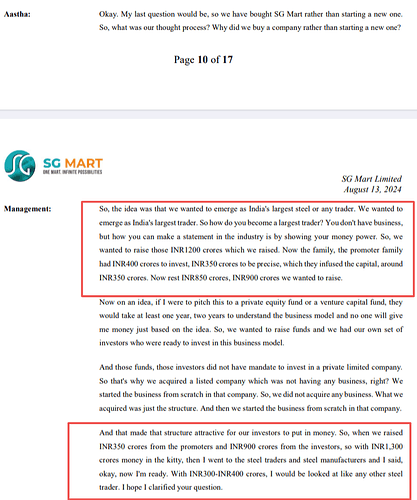

SG Mart was acquired as a listed company to attract investors, as they needed a public structure to raise funds efficiently. The acquisition was not for existing business but for the corporate structure, allowing the company to raise approximately INR 1300 crores .

-

Customer and Market Insights:

-

SG Mart’s customers include OEMs (Original Equipment Manufacturers) in industries such as consumer durables and automotive, who require processed steel. By setting up service centers close to major manufacturing hubs, SG Mart reduces logistics costs and improves service quality for these large manufacturers .

-

Market Opportunities and Challenges:

-

SG Mart is positioning itself as a significant player capable of handling the increasing steel production in India, as the country aims to expand its steel capacity significantly by 2030. The company believes that small traders cannot keep up with this growth, providing a business opportunity for larger distributors like SG Mart .

thanks for the insights. Even I had the same question as @prashant_Singh2 about the website. i have already visited the website and know that there exists one but I didn’t seem to find any way to place an order or something. Infact the website still says that ‘it is still under development’. So how do they take orders exactly?

Q1 FY25- First Concall

OPM will be - 2.5 - 3%

What we have to look is keeping our working capital requirement low, churns 15-20 times in a year, zero creditors, zero debtors, and make 35% ROC, maybe higher. If we are able to do that, then my business model will be very, very sustainable. And then we will replicate this in the other industries once we are able to create this full model.

We have enough money to take this revenue to INR20,000 crores in next two to three years. So, a lot of funds are lying in the fixed deposit, which gives us the interest income. So, that’s why my PAT may appear higher than the EBITDA. But as we start investing into service centers, as my volume ramps up from INR7,000-INR8,000 crores to INR12,000-INR13,000 crores this year and next year, and then eventually INR17,000-INR18,000 crores in FY27, and then INR50,000 crores by FY30.

So just to mention that, the basic concept of this company is trading. Connecting the manufacturer with the distributor. So, we act like an intermediary between the manufacturer and a wholesaler.

And once we establish this business for steel, we create a proof of concept for the steel sector, then we are confident that the other industries will also come to support, to take support from SG Mart. By that time, we will be able to move to other sectors.

But if you look at the countries outside India like China, South Korea, Japan, which are actually the manufacturing hubs in the world, they have very large trading giants who are lifting material in bulk from the manufacturers and then distributing those products, whether in the same countries or at the global platform . This is what we always miss as manufacturers, whether it’s in steel tubes or plumbing pipes.

Then the idea came that how do we start? How do we create India’s largest trading company? Which product we should start with? Whether it should be metals, non-metals, construction materials, agri-commodities, cement, etc. So, then we realized that our strength has been steel. We have spent four decades of manufacturing and buying and selling of steel, upstream, downstream products. So, let’s start with steel as the product and then we fully establish ourselves in steel trading, and then we move to other products into whether it could be agricommodities or other construction material products.

when India is going to see massive increase in the upstream steel capacity because last five years, we have not seen any new capacity addition in steel. What has happened is the consolidation of the steel sector. But if you see from December 2023 till December 2025, India’s steel capacity is going to go up by 50%. So, it’s the right time to start a venture which is into steel trading to take material from steel companies and then distribute for them and create a business model out of it.

I mean you will be surprised to know that we have become India’s largest zinc trader as we speak today

And then we will distribute the product in the downstream sector. So today we are doing business with JSW Steel, NMDC Steel, Jindal Steel and Power, Steel Authority as well, and some imports which we are doing in SG Mart.

Second business in B2B is service centers. Now here if you look at the industry like auto sector, consumer durables, construction industry, they don’t buy raw steel like in coil form or long steel form. They need processed steel, which acts as an input to their factories and then they make washing machines, refrigerators. It is used in automobile bodies, in construction, in bridges, etc.

So here the business model is that in metro cities as we are talking, two of our service centers are operational, doing business of 10,000-12,000 ton a month. Two new service centers in India will be starting in next two to three months. The construction work is underway and we will be starting those service centers in the next two to three months.

And then we have identified 15 new locations, which we will start operations over the next 12 months. So, the vision here is that by 2030 we should be having 101 service centers, maybe 102 outside India and 99 in India.

So, the idea is that every year we keep on adding 10, 20 service centers and by 2030 we should have a network of 101 service centers. Here the capex per service center should be like INR20-25 crores and the working capital requirement would be another INR10-15 crores at gross level. At net level it will be like INR5 crores. So doing 5,000-ton average volumes should give us ROC of again 30-35% with the capex and working capital combined under capital employment.

Now if you look at our group dealers who are doing business in steel pipes, steel pipes are 28% of their total business. Rest 80% they do rebars, angle channels, welding rod, mesh, wires. This is massive consumption but almost like INR3-4 trillion for non-tube products which these distributors buy from small manufacturers.

Steel Tubes as an industry became formalized. Apollo played a pioneer role in formalizing the steel tube industry but for other products like angle channels, rebars, welding rods, this industry is still highly unorganized. There are multiple, n number of small manufacturers who manufacture these products in an inefficient way and then they sell to the distributors in downstream sector.

So, family has given rights to SG Mart to use APL Apollo brand for non-steel pipe products at free of charge.

So, we are not going to spend extra money on creating more warehouses. My service centers will act like warehouses plus the processing unit. So, my capex is limited, which is like say INR25 crores per service center.

We are reaching directly to the contractors and real estate developers and we are doing the B2B business. That segment is small, but it is ramping up pretty quickly.

So, other competitions like O-Business. I would say our nearest competitor is unorganized sector.

So, after FY27, we will speed up the process of entering into other industries, other sectors. But till FY27, we have a laser-sharp focus that all the energy, all the resources must be put to build the steel franchise first and then, we will move to other sectors.

So, then the steel mill will say, okay, I will stop servicing 5,000-ton dealer on my own, why doesn’t that small dealer buy from SG Mart? Okay, so that’s the segment in metal trading.

Plus, what happens is that, a factory in Ludhiana, Ludhiana is a big manufacturing hub, they need processed steel. Now they have to buy from Ghaziabad, for which you have to pay INR1,000 per ton freight. Now the steel which comes, HR coil which comes, whether it comes in Ghaziabad railway siding or Ludhiana railway siding, the freight is the same, the handling cost is the same. But from Ghaziabad to Ludhiana, the processed steel will carry freight of INR1,000 a ton. If I open a center in Ludhiana, my raw metal cost will be the same and my customer will be able to save Rs.1000 per ton freight from Ghaziabad. So that’s how we will acquire customers in service centers.

And thirdly, on distribution side, the B2C business, there the customers are same. What I will do is I will replace a small inefficient manufacturer with a more capable manufacturer who has tie-up with me, and I will push his product under my brand to my dealer.

Then the risk comes on the debtor write-off or inventory write-off. So, we are going to do cashand-carry. We are talking with banks for providing channel financing services to our SG Mart’s customers. We have all the national banks with us. We have our own group in NBFC with us. So, I will not be having debtors more than 3-4 days. So, my risk on debtor write-off is also taken care of by having channel financing services for my clients.

Then the inventory write-off. Now, steel is a volatile commodity. It carries a lot of risk and with such a low margin, our risk management has to be very strong, which it is.

So again, all the three verticals, Alisha, the first vertical, which is metal trading, here we are doing back-to-back sale, like purchase and sale. So, the risk what we carry is from 0 to 10 days. Which is very limited. Steel prices in India normally are reviewed like once in a month. On first day of every month, all the steel producers come out with a new revised pricing policy. So, if you are doing business within 10 days, there is no risk as such to carry to your balance sheet.

Second is service centers. Now, service centers, yes, here the inventory days will be 20-25 days, but then here the margin is high. So even if there are some write-offs, you have to take some write-off, but your high margin does take care of that.

Then third is distribution business. Distribution business, B2C, is mainly secondary steel, right? Whether it is rebars, secondary, angles and channels, welding rod, which is not a very volatile product anyways . They are sold more as product. And here also, like the inventory days in the system will not be more than 20. So, the fluctuation is manageable easily.

Just to give one example, you can look at the financials of Shankara. Shankara is a retailer. They carry more inventory than what we will be having on our books at any given day. Now, if you look at their quarterly EBITDA margin, you can look at 20 quarters, like 5 years, you see. Their EBITDA margin has always remained stable between 2.5% to 3.5%, right? The swing is not like they will erode the profitability and they will close the balance sheet with zero profit or at a loss.

So Shankara can be our customer, right? Because Shankara is a retailer. We are like wholesalers.

And this is a concept which is not unique in the world. You look at Japan, South Korea, China, there are players like Marubeni, Mitsubishi Trading Corporation, Sumitomo Trading Corporation, ITOCHU, Hanwha, JFE Shoji all these players are there who buy raw material from steel producers or other metal producers in bulk and then they distribute further.

We are hiring right people at right place. We are already a team of 100 people which will increase to say not more than 200-250 when we touch INR18,000 crores top line by FY27

I think they are using the APL group network. And most probably doing business on calls. Theres no functional website yet…

On a lighter note, Platform companies dont make profits! Maybe that’s why they call themselves a trading company ![]()

Promoter holding decreased significantly compared to last quarter!!!

Refer to these discussions SG Mart- Can it successfully create a marketplace? - #11 by antson_m

me too business being created by most large conglomerates (tata, birla, jindal) , alongside existing players like ofbusiness, infra.market etc etc - dont really understand whether there EVER will be any edge that SG Mart can achieve…plus the heady valuations it is already getting it just make it a no go

Company held it’s first con call. Some of the risks are now non-risks based on the explanation from Mgmt.

-

“valuation is steep, 65 PE”. PE won’t be appropriate measure at this stage because major part of the earning is from interest out of 1200 odd cr. in the bank. This money and what they make next few years will get utilized in the service centers which they want to setup. A back of the envelop calculation of their core earning for FY25 would be (going by their guidance) 7000-8000 cr. topline and 2.5% EBITDA margins. So, 175-200 Cr. EBITDA, They plan to spend about 400-500 cr. in setting up these service centers per year @ 25Cr. per center and 20-30 centers per year. So some appropriate depreciation and the most of the EBITDA + interest income should should go to PBT. 3400 cr. of EV for 175-200 cr. of EBITDA looks decent ?

-

With a call behind us, the 2nd risk is now taken care.

-

Risk to expansion and question on business model - This should be monitored.

-

Risk of dilution : Mgmt. clarified this point in the call. They don’t need much additional money for nearly 20x growth in next 5 years. In fact that’s what makes this an exciting opportunity.

-

Thin Margins : Most often inventory losses & operating deleverage are the enemy of thin margin business. Mgmt. tried to argue against the possibility of inventory losses in this business. It will be a very interesting battle to learn form.

Disc: Invested after the concall.

The calculations in point 1 are correct but didn’t quite understand the logic behind why you said that the steep valuation of 65 PE is an invalid argument at this stage (Even though after the results from the current quarter it is ~50 now and is only going to reduce further but still??). If the interest income is a significant component of the earnings currently, then it is only going to reduce with time (The interest income as percentage of the OP is going to decrease and even the absolute value of the interest income is also going to reduce due to utilization of the funds, which is going to lead to an even greater drop to the contriubution of the int income to the PAT, so it is only going to reduce with time). So just curious did I miss something in that argument?

PS: Ofc there are massive expansion plans etc but by the above logic how can we say that the PE of 65 won’t be an appropriate measure

The company started a new business from ground zero in Q1 FY24. Even then, it always gave positive EBITDA nos. That it self is a big deal, most business will fail this criteria at that stage. As it scaled over next 3 qtrs. it slowly got very close to it’s desired margins. Normally Since PE is a historical measure it will make sense to use it when history is normal. Clearly it isn’t the case when a business is just born. That’s reason no.1.

2nd like you also mentioned, since interest income is a BIG part of the PAT and we know that the cash that’s giving that income is going to get used, then no point including that in eps and getting to PE. EV/EBITDA helps to get over this problem. and forward looking EV/EBITDA ratio is a better measure to see if it makes a case for investment or not. These are MHO, others can help more in theoretical concepts. I am not a purist when it comes to valuation and investment theory related topics ![]()

Thin margin can be a moat if they manage it. But what I understood from concall is they don’t hold inventories long enough. So just like a sabji wala as long as you are selling your inventories fast you are safe. Falling comodity price can be bad thing for the manufacturers. Just like a farmer if vegitable price goes up it’s good for them and vice versa. For a trader falling price will work against the top line growth but margin will remain same.

Here they have explained about how they can tackle against inventory losses

For this kind of business, key is inventory management, If they are able to actually manage inventory turnaround max 10 days, its really amazing! The price fluctuations will be averaged out and chances of maintaining margins improve.

What I think is the name of APL Apollo will stand out here, as we have known this group and the management is also looking clean and as they are maintaining such healthy EV/EBITDA growth then I guess the PE will shrink down. Here we should look for Forward PE according to their guidance like FY25 is projected at ₹7,000-8,000 Cr, with expectations to ramp up to ₹13,000-14,000 Cr in FY26 and ₹18,000-20,000 Cr in FY27. This guidance will shrink down their PE and one concern about is their OPM which I think a good management knows how to handle.

I read the S Mart concall. It’s very fantastic, but didn’t understand few part of the concall. Can anyone elaborate this.

Their business model is to dwarf any steel trader in the Indian Market.

They needed money. As promoters of APL Appolo, they had goodwill in the investor community for their execution prowess. They bought out a non-active or zero-revenue old listed company valued at almost so that they could do a primary capital raise.

Why do u need that much capital. Simple u can do Pan India trading and Value added services. Steel Trading is high value low margins with the largest city based or regional based players at 400 Cr Turnover and 8-10 Cr profits.

Scale has benefits on operational performance, buying price and logistics. But all this is still at embryo stage. Can they execute will be multi billion dollar MCap question.

Update:

I’m pretty bullish about the prospects. For a trading company at the end I believe FY27 it’s available at forward 8 EV/EBITDA, so not completely cheap. But a potential distribution market leader is available at 4000 crs EV. It technically is a market leader already however I would consider a company market leader when they gain meaningful % of market share.

And if things go right they should make 4000 crs Cumulative EBITDA in the next 7-10 years

As upstream steel capacity comes up, steel itself market will grow 14% annually for next couple of years.

Execution is not the problem here, and WC is also not a problem which is generally the issue with distribution companies. Margins however will remain paper thin.

Value proposition comes from consistent pricing for small players as well as larger ones.