In this segment anyone can be a market leader.it’s a steel distribution company don’t have any pricing power or any advantage of ,if I sell jsw and tata steel in my areas anyone can do that also so I’d think they’ve any advantage.its not a value adding like steel tube business.if u want seen same thing plz rent a car a go AURANGABAD TO JALNA HIGHWAY you can seen maybe 10 big warehouse shop just selling steel and sheet.i think it’s a bull market stock.if margins are volatile than …

Steel service centre are like big retailer, they slit and supply as per customized requirement.

Highly unorganised industry with only local players i.e not even state level players. The bigger you are the better terms you get from manufacturer.

With a highly capitalized company with experience in steel there definitely is a case.

The growth in 1 yr is testament to their model.

Answer is already in your question.

For rent a car , where we have to go? I will go to Ola or Uber because it is easy and convenient. Ola or Uber is a brand and we know it. Similarly, APL Apollo is a brand and SG Mart is going to do same thing like Ola or Uber in its field.

I tend to agree with Ajij that this business does not have any moat and a serious risk on margin front.

APL trademark and liquidity can help to grow in the beginning but things can change rapidly considering wafer thin margins.

Reviewing this stock for some time but unable to invest at current PE levels of 57.

I will prefer to wait on sidelines as market already valuing the company based on management commentary and APL management

It is true that a trading company has no moat.So, as per my view, wafer thin margin is the actual moat. Low margin keeps away the competitors to enter in the business. High margin attract competitors and competition erodes margin.Best way to value this business through analysing ROCE and Growth in earnings.

Apl Apolo buy steel and makes value addition pipe and tubes .but what are need in steel distribution company does they add value or they can ? I didn’t think so , it’s not a brand related things.you don’t need any brand for steel distribution. So it’s not make any sense

Wafers thin margins are there moat are you kidding me! Did you know who is there real competitors the local traders are more cheap than sg mart.cause i am working in civil construction business so our clients never paid full amount of steel or others material or they relying on local traders so they used their black money also.or something I can’t tell you in …

Have you read the entire thread ? The person who has set up the business has much more pedigree in his field than we have . Surely ,he can also see with his eyes that the sector is unorganised and margins are thin . He is trying to do something that has not been done at this scale and apparently many canny investors and industrialists have faith in the business model to put in money when there was no business at all . While it’s true that they did so at 250 per share , it’s also true they did it based on even less data to go on . While the business can run and be profitable consistently in future is something that no one knows , it’s surely foolish to look for moat in a business that’s only taking baby steps . It surely won’t pass the Buffet copycats scrutiny but there are many ways to invest and make money .Only thing is that one must not not expect to hear opera music in a rock concert .

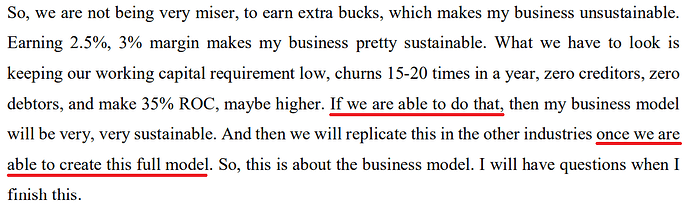

It’s a completely new business model which only time will tell, if the management is able to walk the talk. Although the management seems confident to fill the gap due to their decades of experience in the industry, but they are still being humble and confirmed in the last con-call that this business model is yet to be proven (even after doing 85cr of EBITDA from just a 1-1.5 year old business). Below please see the humble lines underlined:

We all will have our opinions based on our past experience and mental models. I can see that the story of SG Mart can go either way as I can put up enough points supporting both bull and bear thesis. We are not helping this thread by simply sharing our one-line opinion without backing it with concrete facts and data. Story is currently half baked with lot to prove and huge execution risk ahead of it.

But I felt good after listening to the first concall and lean towards the bull camp to get my foot in the door. Current gaps that management shared on the concall seem to be big enough for a capable player to create a business and benefit out of it. Similar pitch has already gotten support from some of the respected investors and family offices (that doesn’t mean we don’t need to do our due diligence). While the company’s ambitious plans for a futuristic moat are intriguing, it remains to be seen whether decades of industry experience and Rs.1300cr kitty will yield a competitive advantage or simply become a costly folly.

I fully understand that we don’t need to have all the answers today (unless one is deploying 50% of their portfolio in SG Mart). Such stories with huge size of opportunity can have long run way of growth (many times very lumpy and bumpy along the way) and one can scale up along with the successful quarterly execution of the business and as confidence increases. In fact, I would feel much safer to average up at appropriate valuation in SG Mart 3 years down if they do Rs. 15000cr topline with 2.5-3% EBITDA.

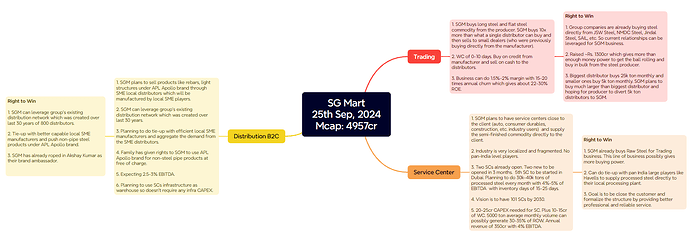

Below I am sharing my understanding of each line of business and its “right to win” as shared by the management.

Disc: invested in last 7 days and managing execution risk with appropriate starting position size which will be kept on a very tight leash. Not a recommendation and do your own due diligence.

Did anyone attend the AGM? Can you please share notes?

Summarization and interpretation of Nature and Business model of SG Mart, compiled from Concall, Investors Presentation and Annual Report.

Which types of problems SG Mart is going to solve for the industry?

As you all know that, we have been running two manufacturing companies for many years now. One is APL Apollo Steel Tubes, and the second is Apollo Pipes, which is in the plumbing segment. What happens is that as manufacturers, we always struggle to push our material with the large distributors. The countries outside India like China, South Korea, Japan, which are actually the manufacturing hubs in the world, they have very large trading giants who are lifting material in bulk from the manufacturers and then distributing those products. This is what we always miss as manufacturers, whether it’s in steel tubes or plumbing pipes. So, we thought let’s start a trading company.

The business version of a contrarian question: what valuable company is nobody building? Every correct answer is necessarily a secret: something important and unknown, something hard to do but doable. If there are many secrets left, there are probably many great companies yet to be started. The best place to look for secrets is where no one else is looking. If you find a secret, your face a choice: Do you tell anyone? Or do you keep it to yourself? Answer is: whoever you need to, and no more. In practice, there’s always a golden mean between telling nobody and telling everybody- and that’s a company. The best entrepreneurs know this: every great business is built around a secret that’s hidden from the outside —Peter Thiel.

(Peter Thiel is an entrepreneur and investor. He co- founded PayPal and Palantir, made the first outside investment in Facebook, funded companies like SpaceX and LinkedIn).

Is it the right time to start the business?

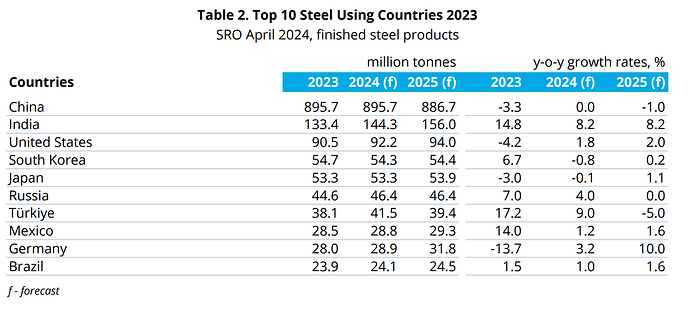

When India is taking a leap forward to become the world’s manufacturing hub, China plus one policy actually being played out in the minds of global consumers, we thought it’s the right time that we should support the manufacturing sector by becoming one of the largest traders in the country. From December 2023 till December 2025, India’s steel capacity is going to go up by 50%. So, it’s the right time to start a venture which is into steel trading to take material from steel companies and then distribute for them and create a business model out of it.

Which products to start with?

We have spent four decades of manufacturing and buying and selling of steel, upstream, downstream products. So, let’s start with steel as the product and then we fully establish ourselves in steel trading, and then we move to other products into whether it could be Agri commodities or other construction material product.

Example: - Amazon shows how it can be done. Jeff Bezos’s founding vision was to dominate all of online retail, but he very deliberately started with books.

What is the business model?

SG Mart comprises three business models:

• First - B2B Trading of long and flat steel products, buying directly from the steel producers and then distributing it in the market.

• Second - Creation of a vast network of service centres, where upstream steel is processed and sold in semi-finished shape to various steel user industries.

• Third - B2C Distribution of products like TMT, Light Structures, Metal Sheets, Welding Rods, Mesh Net Steel etc. which are sold as branded products.

What gap the company has identified?

In B2B metal trading:

The industry gap that we identified here was that steel mills are dependent on very small size distributors and dealers who lift material directly from steel mills and then distribute it to their customers who are like user industries down the line. The largest distributor which we could identify in the industry was doing a volume of 25,000 ton a month. Now, that’s like ridiculously low if you look at India sitting at 120 million tons of steel capacity today, and we are talking about a 300-million-ton capacity by 2030. So, there is no way that this incremental capacity can be consumed or can be absorbed by these small SME traders.

In B2B is service centers:

Now here if you look at the industry like auto sector, consumer durables, construction industry, they don’t buy raw steel like in coil form or long steel form. They need processed steel, which acts as an input to their factories and then they make washing machines, refrigerators. It is used in automobile bodies, in construction, in bridges, etc. So, there are small service centers, very unorganized service centers, which are run like mom-and-pop stores. There is no Pan-India national level organized chain of service centers which can ensure the quality steel availability to the user industry. So, this is a gap we thought we should work upon. And anyways, the steel, the input for these service centers will be the raw steel, which I’m buying anyways, for my trading business. So, I can divert some of the steel to my service centers and I can process it and earn extra profit on that.

In B2C

Here we want to leverage the distribution network in the downstream sector which the group created for the steel tubes over the last 30 years. Now if you look at our group dealers who are doing business in steel pipes, steel pipes are 20% of their total business. Rest 80% they do rebars, angle channels, welding rod, mesh, wires. This is massive consumption but almost like INR3-4 trillion for non-tube products which these distributors buy from small manufacturers. Apollo played a pioneer role in formalizing the steel tube industry but for other products like angle channels, rebars, welding rods, this industry is still highly unorganized. we have a visibility of demand for INR3-4 lakh crores in multiple products. We aggregate the demand from our distributors and against that we do tie-ups with efficient, good quality manufacturers and we bridge the gap between the SME manufacturer and an SME trader.

Benefits of service centers cum warehouse:

The network of service centers which we are creating can act as a warehouse for either metal trading or for B2C distribution products. So, we are not going to spend extra money on creating more warehouses. My service centers will act like warehouses plus the processing unit.

Diversification:

Once we establish this business for steel, we create a proof of concept for the steel sector, then we are confident that the other industries will also come to support and to take support from SG Mart. By that time, we will be able to move to other sectors. we have already started seeding some of the non-steel products like we have done tie-ups with industry leaders in tile segment, in electrical fitting segment, in bath fitting segment, in branded rebars to support the construction sector. We are reaching directly to the contractors and real estate developers and we are doing the B2B business.

Win-win situation for everyone:

What I have to offer is the power to buy in bulk, right, multiple products, offer the same product at much lower cost than what that trader would be getting from the manufacturer. And we are only looking for 2.5%, 3% EBITDA spread, which is not very high for my services. And this also I will be generating by two sources, one is improving the efficiency in the manufacturing process, right? Because if I am doing a business with a manufacturer who is doing, say, 50% utilization rate as of now, and I take his utilization rate to 70-80%, so his cost of production will come down and he will pass on that benefit to me, which I will keep 50% myself and 50% I will share with my customer. Plus, I will use APL Apollo brand, right, to get the premium from the market, from the customer, that will add to my EBITDA.

All good companies make profit by solving a unique problem. Creative product means new products that benefit everybody and sustainable profits for the creator.

Sustainability of Earnings:

Earning 2.5%, 3% margin makes my business pretty sustainable. What we have to look is keeping our working capital requirement low, churns 15-20 times in a year, zero creditors, zero debtors, and make 35% ROC, maybe higher. If we are able to do that, then my business model will be very, very sustainable. And then we will replicate this in the other industries once we are able to create this full model.

Sequencing markets correctly need discipline to expand gradually. The most successful companies make the core progression - to first dominate a specific niche and then scale to adjacent markets.

Focused approached:

See, as a group, we always like to work on our core strengths first. Our strength or right to win was in steel sector. That is why we started with steel sector. Unless we see this company making INR500 crores EBITDA. We don’t want to invest into sectors where we don’t have much expertise.

Competition:

If you see, there is no national level player, who has a network of service centers. They are all, like I said, mom-and-pop stores. Steel traders, the distributors who are attached with the steel producers, there are also SMEs, multiple end number of unorganized players. And any unique company which has access to downstream traders in the steel sector who are doing these steel pipes, rebars, angles and channels, that also no one has except our group. So, in that way, I mean, difficult to name anyone who could be our nearest competitor. I would say our nearest competitor is unorganized sector.

*There is a sweet spot when any industry migrates from unorganised to organised and India is going through a classic phase of unorganised to organised. If you find the companies in that sweet spot, the time to buy is now. I don’t care timing. — Ramesh Damani.

Solving problems:

For steel mills to focus on production:

Steel Mills like to work with large distributors. So, SG Mart comes in and acts like a large distributor, so they sell the material to us and then that metal, we either sell to the retailers or their own small dealers. Because like I said, the largest one was doing 25,000-ton monthly volume. But the smallest one was doing 5,000 ton as well. So, then the steel mill will say, okay, I will stop servicing 5,000-ton dealer on my own, why doesn’t that small dealer buy from SG Mart? Okay, so that’s the segment in metal trading.

For OEM industries:

In our service centers the customers are OEM industries like consumer durable companies, automobile companies, construction companies who are buying processed steel. Earlier, what happened is that a small mom-and-pop processing center. They don’t have enough steel supply from behind and the quality of machinery what they have installed like cutters and slitters, etc., that also is likely outdated. So here we are trying to address the problem that, I am a service center with high-tech machinery. My quality of my processed steel will be better. For example, Havells. at head office level, I do a tie up with Havells that for all your factories, we will be supplying from my service center near to your factory. Right now, they don’t have any national level players. So, each of the factories is buying steel from the local mom-and-pop processor. So that’s the value proposition I’m going to offer to large manufacturers.

Risk of bad Debts:

we are going to do cash-and-carry. We are talking with banks for providing channel financing services to our SG Mart’s customers. We have our own group in NBFC with us. So, I will not be having debtors more than 3-4 days. So, my risk on debtor write-off is also taken care of by having channel financing services for my clients.

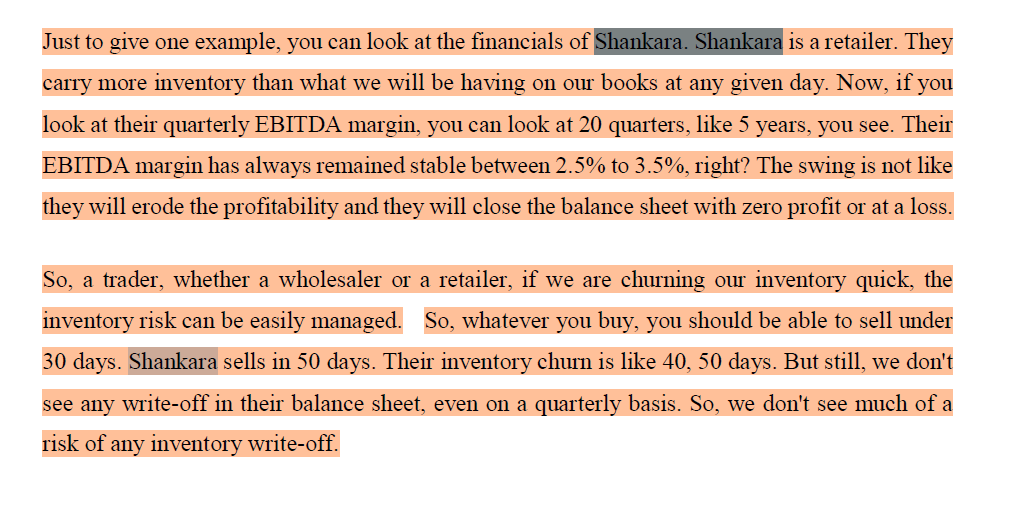

Risk of inventory loss:

first vertical, which is metal trading, here we are doing back-to-back sale, like purchase and sale. So, the risk what we carry is from 0 to 10 days. Which is very limited. Steel prices in India normally are reviewed like once in a month. On first day of every month, all the steel producers come out with a new revised pricing policy. So, if you are doing business within 10 days, there is no risk as such to carry to your balance sheet.

Second is service centers. Now, service centers, yes, here the inventory days will be 20-25 days, but then here the margin is high. So even if there are some write-offs, you have to take some write-off, but your high margin does take care of that.

Then third is distribution business. Distribution business, B2C, is mainly secondary steel, right? Whether it is rebars, secondary, angles and channels, welding rod, which is not a very volatile product anyways. They are sold more as product. And here also, like the inventory days in the system will not be more than 20. So, the fluctuation is manageable easily.

Strength:

The Group has long experience in the steel downstream sector. Its strong relationships with steel producers strengthen the Company’s ability to source raw steel from steel mills. The Company has a strong distribution presence for downstream steel products. Its trading capacity is 20 times more than the current largest steel trader. Moreover, the availability of funds allows it to make strategic investments for business growth. SG Mart offers a one-stop solution for all construction needs, making it convenient for builders to source materials from a single platform. Solving the problem of minimum purchase requirements allows small builders to procure necessary materials without the burden of bulk buying. Offering standardised quality and prices ensures reliability and trust among customers, helping to build a strong brand reputation.

Management should have great competencies, passion for growth and above all unquestionable integrity. When you find a top-class business run by top class management, you get a top-quality company. —Ramdeo Agarwal.

Opportunity:

The addressable market for the B2B construction material industry alone is huge – it is currently estimated at INR 6 trillion, moving to about INR 8 trillion in three years. The bottom-line is that even if a fraction of these estimates transforms into reality, demand for building products will remain robust.

Weakness:

Being a new player in the field, awareness of the Company’s presence and operating model will need to be achieved to generate growth. Economic downturns can affect the construction industry, reducing demand for construction materials. Also ensuring timely delivery to remote or hard-to-reach areas can be challenging and may affect customer satisfaction if not managed efficiently.

Disclosure: - took small position after reading concall and willing to add more in future if management walk the talk. It is not a buy or sell recommendation.

The group NBFC they are talking about, is that SG Finserv?

Arihant Bharat Connect call…many of the points reiterated and some new points clarified. Overall good call to hear https://www.youtube.com/watch?v=iDJ4kDjuqiY

The YouTube link is not working. Can you repost it

Seems like Arihant has removed the video. We have to wait. hopefully they will upload again.

I have tried to compare the scale that the management is claiming to achieve by 2030 to other trading giants from Japan and EU.

Japan is especially renown for having a trading dependent economy because it lacks many raw materials needed for industry and energy such as oil, coal, iron ore, copper, aluminum and wood. Japan must import most of these goods.

| Peers | Country | Latest Sales (in Cr) | EBITDA (in Cr) | EBITDA Margin | PE (TTM) | Remarks |

|---|---|---|---|---|---|---|

| Stemcor | UK | 16,600 | 423 | 2.6% | NA | steel trading |

| Marubeni (metals and minerals) | JP | 29,880 | 4,150 | 13.9% | 8.09 | not like for like |

| Mitsubishi (Materials) annualised | JP | 58,696 | 3,337 | 5.7% | 4.29 | not like for like. Gross profit in place of OP profit |

| JFE Shoji | JP | 84,531 | 2,806 | 3.3% | 7.71 | steel trading |

Most of these trading companies especially Japanese ones are decades old and are fairly large with buying offices in a large number of countries. This is what helps them with scale.

From glancing through their financials, a few questions come to my mind:

- How come SG Mart would be able to achieve 30,000 Cr in sales when half of these giant companies barely reach that number. Even if their growth trajectory sustains, some competition would inevitably enter the market like Japan. Having 1000-1500 Cr capital is not that big of a moat

- Sales realizations of a lot of these companies fluctuate along with steel prices year-on-year even though they have the advantage of having much larger reach and hedging capabilities. Once SG reaches a certain scale, it would be much harder for them to sustain their 5-10 day working capital cycle and their margins might also fluctuate.

Another question I have with investing in SG Mart is with respect to valuations. Here, you’re clearly paying for insane sales growth but since there’s no big moat, what is the exit multiple you would consider and how much of that is currently account for in the current stock price.

Shankara Building Products is also in trading business (more white label one compared to SG) and is in a sector with tailwinds (infra) but it hardly gets a PE of 16.

The valuations make sense if company is able to reach its 2030 vision and then it can give some outsized returns.

| FY24 | Jun-25 | TTM | FY25 (E) | FY26 (E) | FY27 (E) | FY30 (E) | |

|---|---|---|---|---|---|---|---|

| Sales | 2,683 | 1137 | 3,669 | 7000 | 12,000 | 18000 | 50,000 |

| Growth YoY | 161% | 71% | 50% | 41% | |||

| EBITDA | 62 | 24 | 85 | ||||

| % | 2.3% | 2.1% | 2.3% | 2.1% | 2.1% | 2.1% | |

| PAT | 61 | 27 | 87 | 140 | 240 | 360 | 1000 |

| % | 2.3% | 2.4% | 2.4% | 2% | 2% | 2% | 2% |

| Mcap | 4400 | 4400 | 4400 | 4400 | 4400 | 4400 | 4400 |

| PE | 72.1 | 50.6 | 31.4 | 18.3 | 12.2 | 4.4 |

I know that their business is so fast growing.but i want to know that how much they are able earn money.what is their ROE -5.6 just.you can earn 7% if you do bank fixed deposit .if your growth is high and ROE is low then you have to raise capital every time for your business.and margins are very low but their assets turnover is good .

So guys did I miss anything.plz tell me if I am wrong.

Nice points, but to compare a company’s potential in India (where no such big aggregator like SG Mart currently exists) to those of Japan and Eu where this has been a norm since a long-long time now in such a simple and straight-forward way would not be the most accurate thing to do, in my opinion.

Both the countries are at much different stages of growth and development in terms of infrastructure. Even the mere sizes of both countries are vastly different (both in terms of land area and population).

So to answer your 1st question: How come SG Mart would be able to achieve 30,000 Cr in sales when half of these giant companies barely reach that number?

1. Growth in India’s Infrastructure Market:

India’s infrastructure market is growing at a significant pace compared to developed nations like Japan and the EU. According to the National Infrastructure Pipeline (NIP), the Indian government plans to invest ₹111 lakh crore (~1.5 trillion USD) by 2025. This massive investment spans sectors such as energy, railways, roads, urban infrastructure, and water supply.

- Construction & Steel Industry Demand: India is expected to become the second-largest steel consumer in the world after China by 2025, thanks to rapid urbanization, industrialization, and government projects such as Bharatmala (road construction), Sagarmala (port development), and the Smart Cities Mission.

- GDP Growth & Market Potential: India’s GDP is projected to grow at a rate of 6-7% annually, while Japan and the EU are expected to have lower growth rates (Japan’s GDP growth has been stagnant at 1% or lower).

2. Scale of Indian Companies vs Global Competitors:

Indian companies, especially infrastructure-focused entities, have room for significant scale-up. For example, the Indian steel industry is growing steadily, with companies like JSW Steel and Tata Steel seeing substantial growth in production and exports. JSW Steel’s revenue crossed ₹1.46 lakh crore in FY23, showcasing that Indian firms can indeed achieve a scale of 30,000 Cr or more in sales.

- Japanese companies like Mitsubishi and Marubeni operate in mature, saturated markets, which explains their relatively lower growth rates. SG Mart, operating in a fast-growing market like India, has a competitive advantage in capitalizing on the infrastructure boom.

3. Competitive Landscape in India vs Japan:

While competition would inevitably enter the market, India’s infrastructure needs are massive and still evolving, offering much more headroom for growth compared to Japan, where growth is limited by market saturation. New entrants or competitors in India would face high barriers to entry, including large capital investments and government approvals. On the other hand, India’s infrastructure growth plans suggest that existing companies can still absorb significant growth before market saturation occurs.

Question 2: Sales realizations and fluctuating margins (especially with steel prices) – how can SG Mart sustain its working capital cycle?

1. Steel Price Fluctuations:

Steel prices are inherently volatile and are influenced by global supply-demand dynamics. In the case of India, though, this fluctuation can be mitigated by:

- India’s Hedging Mechanisms: Indian companies are increasingly adopting hedging strategies to protect against the volatility of steel prices and global market fluctuations. The Indian government has also been imposing tariffs and anti-dumping measures to stabilize the domestic market.

- Internal Market Demand: Domestic demand for steel and other raw materials is expected to grow substantially, driven by the urbanization and infrastructure boom. The internal consumption buffer means that Indian companies like SG Mart would not be solely dependent on export markets or fluctuating global prices.

2. Efficient Supply Chain Management & Capex Spending:

Many Indian infrastructure companies have optimized their working capital cycle by leveraging better supply chain management, cutting lead times, and improving logistics. SG Mart can also take advantage of this by streamlining its operations and reducing unnecessary costs. Moreover, as infrastructure projects get prioritized (e.g., dedicated freight corridors), companies will benefit from faster project completions, reducing the strain on working capital.

3. Infrastructure Improvement Opportunities in India:

India’s underdeveloped logistics and transportation sectors provide a strong case for improvements in efficiency. For example, investments in roadways, ports, and airports are expected to reduce transportation costs significantly, which is currently much higher in India than in developed countries.

Scope of Improvement in India vs Developed Nations:

- India: Huge opportunities exist in building new infrastructure (transportation, energy, etc.), creating room for significant sales growth in construction materials, including steel. With a younger population, economic growth, and substantial government support, India’s infrastructure needs are far from being met.

- Japan and EU: These regions are in a stage of infrastructure renewal and maintenance rather than new development. This leads to lower growth potential in the construction materials sector, which is why companies like Marubeni and Mitsubishi have slower revenue growth.

So, long story short:

- SG Mart’s 30,000 Cr target is achievable, given the growth trajectory of India’s infrastructure market and the increasing demand for materials like steel.

- Sustaining margins will require strong hedging strategies, improved supply chains, and benefiting from India’s internal market, which provides resilience against global price fluctuations.

India’s underdeveloped infrastructure presents far more opportunities for growth than the saturated markets in Japan and the EU, giving SG Mart a solid base for scaling up.

- To some extent I agree that Indian steel demand is greater than Japan and will outpace it easily. The core problem is that any company can enter into this sector and cause competitive margin erosion. I disagree with the company’s claim that there’s little to no competition - see Ofbusiness, Infra.market, Shankara, etc who have the money and can easily enter into this market

- Japan trading companies are the biggest customers for steel manufacturers. SG suddenly doesn’t become the biggest client. They’re hoping that being an Indian player would give them bargaining power since Marubeni (biggest steel trader) for example has the luxury to buy in 50 countries and buy from the lowest priced provider

- There’s no govt approval needed for trading in steel. I hope you’re not just copy pasting from chatGPT

- Even biggest steel manufacturers aren’t safe from steel fluctuations. Any issues in credit lines, working capital shortage will lead to inventory costs. India has become a net importer of steel, even with tariffs imports are cheaper - https://www.reuters.com/markets/commodities/indian-steelmakers-seek-higher-tariffs-chinese-imports-surge-2024-09-26/

- Demand is definitely there in India and SG can grab a huge chunk of the pie and I am bullish on their prospects. My major concern is valuations here → no margin of safety and no barriers to entry.

Mgmt. keeps saying that they are into 3 diff. lines of business. Yet most discussions keep gravitating towards the segment (metal trading) which they claim will only give them 1/3rd of their goals.

Even in metal trading, is the infra.market , for instance, really a competitor ?

Infra.market claims to be a house of brand. But it has (taken from it’s corporate video on it’s site)

- 10 Milion cubic meters of RMC mfg. capacity - worth 4k-6k cr.

- 2.5 Million AAC Block capacity - Again 1k cr. worth of

- MDF and laminate plants.

- Has it’s own brand of plastic pipes and fittings.

- Operates the shalimar paints brand and owns 24% of it.

- has a electrical and appliance vertical and manufactures them.

- Tiles Mfg… unit

- Modular kitchen mfg. unit etc etc…

Even with all this, it had a ~12k cr. topline and ~150 cr. PAT in FY23. Take a look at their corporate video. Do you still feel SGMart is competing with them ?

Should we compare this with SGMart just because there is online connection ?

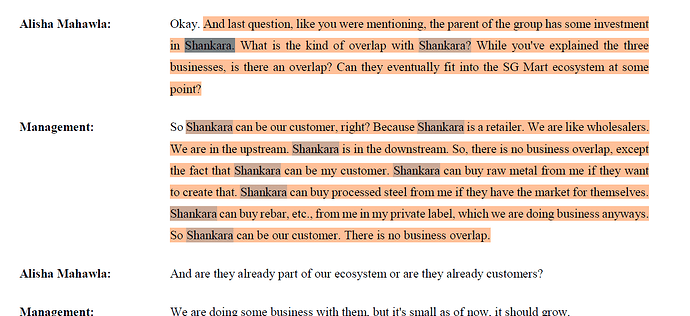

Comparison with Shankara is already addressed by Mgmt. in the call

mgmt. has given their logic of how they are playing to their strength by entering the specified segments.

OfBusiness operates in a market which offers 7.5% EBITDA margins. I doubt steel trading can give this kind of margins.

Also can we try and find some competitor in the rest 66% segment which SG is targeting ?

Can you help to give more clarity on this point. Do the Japanese trading company(like Marubeni) operate in India ? In the sense that they buy from Indian manufacturers and sell them to Indian distributors, like what SG is aiming to do ? If not then how is relevant to SGM ? They are not competing with Marubeni’s of the world in the world market, right ?