not right to compare on the basis of YOY as the base was too low , I believe in Q1 quarter constructions are in full swing, however some of it may have delayed due to elections (management may say the same in concall). But I believe, it won’t be easy to grow multifold revenue for the company on this base. 15% to 20% revenue growth in a low margin business, so the current valuations are justified or may be stretched.

X- @amitsinghpal

considering the next quarter (Q2) remains similar to the current Quarter in terms of the numbers and profitability, the next quarter forward PE would be ~40 (at the current price). On similar assumptions, for the next to next quarter (i.e. Q3 FY 2025) the PE would be ~36.5.

Now the question is what should ideally the PE of such a company be (just trading commodities, low margins etc)?

PS: Also to estimate the above PE ratios I have assumed no growth from the current levels, if growth or margin expansion happens (somehow) then ofc the forward PEs would be lesser accordingly

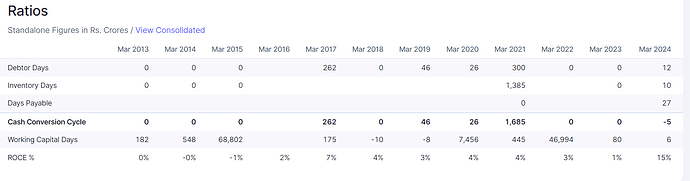

Ah okay! I wonder why this disparity would exist between screener and their presentation!!

Q1 FY25-

The business growth was slightly impacted in Q1FY25 due to general elections and plant maintenance shut down by steel producers, which impacted the raw material supply. However, we expect a strong recovery going forward, from Q2FY25.

^EBITDA of INR 247 Mn has non-recurring expense of INR 59 Mn for brand promotion

wow that’s good news!

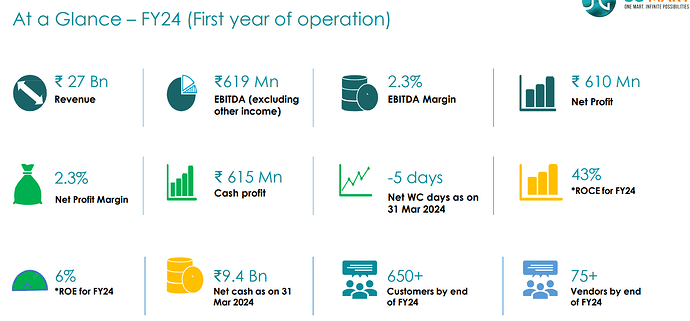

This is more of a platform based company rather than a trading one. Agreed that the margins are low and will always be low because of the nature of the business but the ROCE will always be very high. I think it is 51% right now. The cash flow should also be very good unless it gets stuck in inventory. So valuation wise I would say it is cheap at a PE of 40 if you were to think of this as a pure platform based company.

You mean like a marketplace model?

Yeah it is an online market place for construction material and its derivatives. The worrying thing for me is that in their current presentation they have specified that the no of active suppliers has gone down from 65 to 38 and the no of active customers has gone up. Customers going up is very good but why would no of suppliers go down so significantly?

I could not join the concall earlier today. If anybody was able to join then please share the details.

Has anyone actually looked into their platform? Their website doesn’t work.

Think they have uploaded the recording.

@dm88 but if you listen to their concall, they themselves describe themselves a s a trading company.

it’s a trading company only, none of the platform business works on such thin margins.

so even the heading of this topic is wrong in that sense right? It says ‘Marketplace’ whereas all they are doing is trading of infra materials.

Apl already had apl mart , why did they take the hassle of acquiring a company? And do they have a website or all the sales they have been doing is through phone calls?

it’s okay buddy, our focus is to make money not to pic the small mistakes, we all can make some. Whether you call it market place or trading company it doesn’t matter till the time you know , how much money it can make and how much money you can make from it ![]() …

…

Below are a few quick points from the 1st concall. Kindly pardon in case of any mistakes

-

Focus is to create a trading company in construction material space.

-

Three Business verticles - B2B (steel trading), B2B (service station/center) and B2C

-

B2B (steel trading): Buy steel from the big manufacturers and supply to the small businesses. Largest trader was doing business or 25K MT/month. Current SG volume 50K MT/month. Trading in HRcoils, pellets. Doing business with JSW, Sail, Tatas. Margin is 1.5-2.0%. Mostly cash and carry business

-

B2B (service station/center): Buy steel from the manufacturer and process it to make ready to use steel for users like automobile, washing machine and some construction industry. Two service station already started, planning to start 3 more incl Dubai. Plan to do 30k-40k/month steel processing. Margin is 4-5%. 15-20 days inventory. 101 service station by 2030 adding 10 per year. Capex of 20-25cr for each

-

B2C: To sell construction materials like TMT, welding rodes etc to customers which are already doing business with APL Apollo. This business will not include steel pipes for which APL will continue to use existing channels. Service centers will be used as warehouses for B2B and B2C. Volume of 13K/month already started, expected margins of margin 2-4%

-

Brand: Family has given brand to SG Mart without any cost for doing business in construction materials other than steel pipes

-

Q1 Revenue Breakup: 500cr B2B steel, 400cr B2B service station and rest B2C

-

Cash: Current cash is 1000cr+ raised last year to start the business. This fund is sufficient to reach 20k MT volume.

-

Guidance 2025: Top line 7k-8k with steel volume is 1.2mn and margins of 2.5% - don’t see any issue/risk

-

Guidance 2026: 13-14k next year

-

Guidance 2030: 50k top line, 10mn ton annual volume, 5k capital requirements, ebidta 1500 CR, ROCE of 30% by 2030

-

Competition: No current listed or unlisted competition in the market.

Not invested. Tracking closely

No listed peers, true but several unlisted companies are operating in similar markets from big names to new startups. Following are some of them