SGMART is a B2B one-stop shop that provides a wide range of construction-related solutions from top brands under one roof. The company aims to establish itself as the trusted and preferred platform for all infrastructural and building material needs in India.

History:

The company used to be Kintech Renewables. The company was earlier engaged in activities relating to the renewable energy sector. The promoters then were Aditya Singhal, Saurav Singhal, Ambala Patel and Jigar Shah.

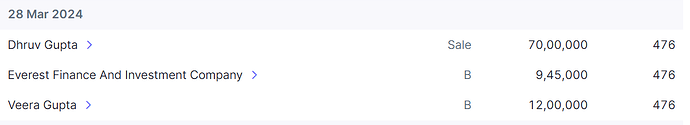

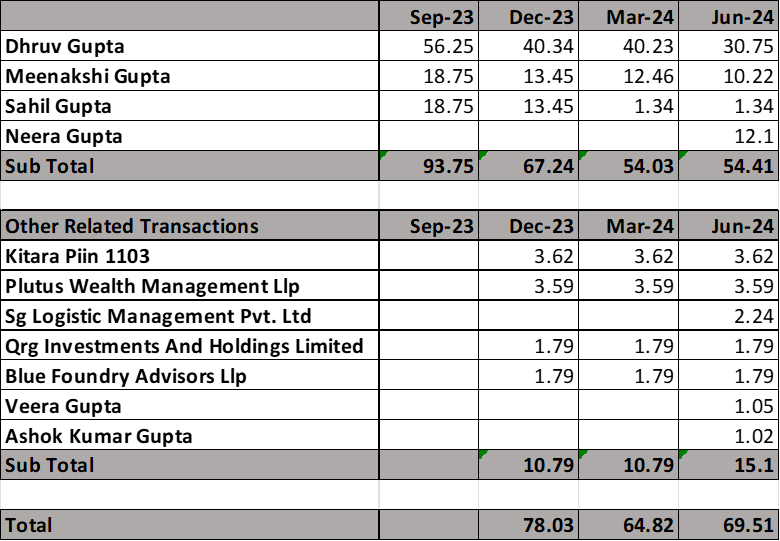

In April-23, New promoters Meenakshi Gupta and Dhruv Gupta bought out the company for INR 22 crs. The promoters belong to the APL Apollo group family.

Products:

TMT Bar, MESH NET, Binding Wire, Welding Rod, Steel Tube, Sanitaryware, Bath fittings, Laminates, Galvanised Sheet, HR Coil & Sheet, All Ceramic Range of Tiles, Premium Tiles Adhesive & Grouts, Double Charge Tiles division, Home appliances, Lighting for Domestic, Commercial & Industrial applications, LED Lighting, Fans, Modular Switches & Wiring Accessories, Water Heaters, Industrial & Domestic Circuit Protection Switchgear, and Industrial & Domestic Cables and Wires. Looking ahead, the company plans to expand its product line, adding Barbed Wire, MS Bar, Angle, ISMC Channel, ISMB Beam, and Patti Flat.

Brands being sold:

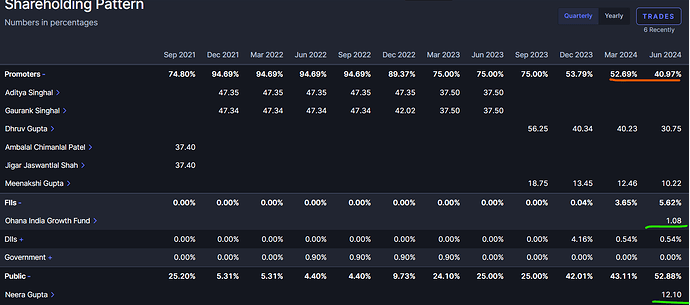

4 large brands- APL Apollo TMT bars, Kajaria Tiles, Havells electricals, SG premium

Other Brand partners- NMDC, JSW Steel, Jindal Steel and Power, Hindustan Zinc, Godawari Power and ISPAT, Triveni Enterprises, etc.

Industry dynamics:

- India is the 7th largest manufacturing hub and the 5th largest retail distribution market globally for construction materials.

- This sector is yet to be disrupted by technology, with the penetration of B2B marketplaces at under 1% today v./s China and USA, where digital adoption is as high as 20%.

- 100-300% annual growth in leading B2B marketplaces since COVID – sustained shift in adoption

Industry issues:

- Fragmented supplier base

- Limited vertical integration between different stages of material transformation and its final usage

- SMEs often have a problem in buying good quality steel due to minimum amount of steel which the manufacturer sells is more than the SME requires

- Long lead time for delivery to distributors

- No standardized prices

Industry size:

| Segment Product | Market Size, FY24 | FY2027E | |

|---|---|---|---|

| Downstream Steel | 4.1 Trillion | 5.6 Trillion | |

| Fixtures & Fittings (Bath fittings, Electrical fittings) | 1.3 Trillion | 1.8 Trillion | |

| Tiles industry | 0.4 Trillion | 0.6 Trillion | |

| Total | 5.8 | 8 |

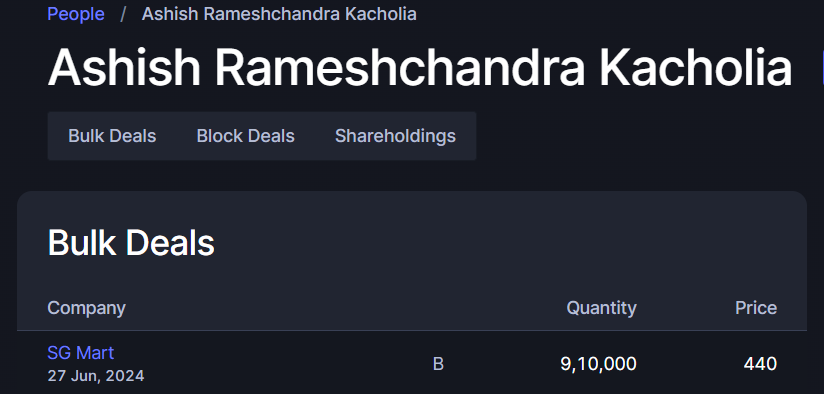

Other Investors and fund raising:

In Nov-23, The company raised equity shares worth 878 crs, at Rs 5000 per share, Rs. 10 face value. The top allotees from this were:

| Allottees | No of equity shares | Value (in crs) |

|---|---|---|

| Kitara PIIN 1103 | 202,000 | 101 |

| Plutus Wealth Management LLP | 200,000 | 100 |

| QRG investments and Holdings Ltd | 100,000 | 50 |

| Blue Foundry Advisors LLP | 100,000 | 50 |

| Vallabh Bhanshali | 50,000 | 25 |

| SageOne-Multiple | 50,000 | 25 |

| Turnaround opportunities fund | 40,000 | 20 |

| Abbakus | 80,000 | 40 |

| Rikeen P Dalal | 30,000 | 15 |

| 360 One special Opp Fund | 30,000 | 15 |

| Mukul Mahavir Agarwal | 30,000 | 15 |

| Ashok Goel Trust | 24,000 | 12 |

| High Conviction Fund | 20,000 | 10 |

| Madhuri Madhusudhan kela | 20,000 | 10 |

| Top allottes | 976000 | 488 |

The company also issued warrants at the time, at Rs 5000 per share to non-promoter category:

| Particulars | No of shares | Value (in crs) |

|---|---|---|

| Rohan Gupta | 382,000 | 191 |

| Marigold Partners | 90,000 | 45 |

| Shivkumar Bansal | 75,000 | 37.5 |

| Rohit Gupta | 50,000 | 25 |

| Deepak Kumar | 25,000 | 12.5 |

| Anubhav Gupta | 25,000 | 12.5 |

| Kanhaiya Sharma | 10,000 | 5 |

| Anjana Bansal | 10,000 | 5 |

| Arun Agarwal | 10,000 | 5 |

| Payal Jain | 10,000 | 5 |

| Ravindra Kumar | 10,000 | 5 |

| Chakram Singh | 5,000 | 2.5 |

| Amit Kapoor | 5,000 | 2.5 |

| Bhanu Singh | 5,000 | 2.5 |

| Utkarsh Dwivedi | 5,000 | 2.5 |

| Ankit Jain | 3,000 | 1.5 |

| Atul Jain | 3,000 | 1.5 |

| Total | 723,000 | 361.5 |

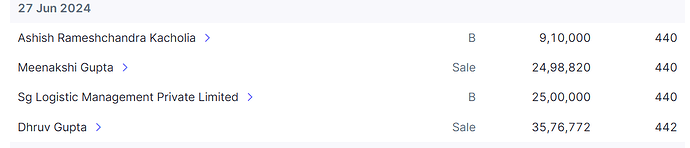

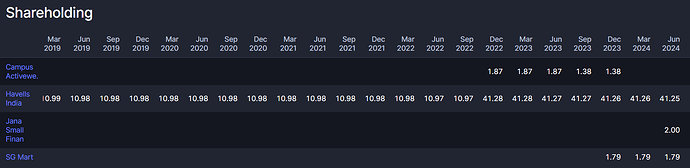

In February 2024, the company split the stock 10:1, and issued bonus shares on the same.

Financials:

The new company started operations in June 2023, and since has had 4 quarters of operation.

| Particulars | Q1FY24 | Q2FY24 | Q3FY24 | Q4FY24 | FY24 |

|---|---|---|---|---|---|

| No. of customers | 170 | 315 | 426 | 444 | |

| Net Revenue | 150 | 506 | 748 | 1277 | 2681 |

| Raw Material cost | 147 | 493 | 728 | 1238 | 2606 |

| % of rev | 98.00% | 97.43% | 97.33% | 96.95% | 97.20% |

| Gross profit | 3 | 13 | 20 | 39 | 75 |

| GP Margin | 2.00% | 2.57% | 2.67% | 3.05% | 2.80% |

| Employee cost | 0.5 | 0.9 | 0.15 | 0.21 | 1.76 |

| Other expenses | 0.7 | 0.2 | 0.1 | 0.52 | 1.52 |

| EBITDA | 1.8 | 11.9 | 19.75 | 38.27 | 71.72 |

| EBITDA Margin | 1.20% | 2.35% | 2.64% | 3.00% | 2.68% |

| Other income | 0 | 1.1 | 9.6 | 20.9 | 31.6 |

| Interest Cost | 0.1 | 0.3 | 3.4 | 7.9 | 11.7 |

| Depreciation | 0 | 0.1 | 0.1 | 0.3 | 0.5 |

| PBT | 1.7 | 12.6 | 25.85 | 50.97 | 91.12 |

| Tax | 0.4 | 3 | 6 | 10.9 | 20.3 |

| Tax rate | 23.53% | 23.81% | 23.21% | 21.39% | 22.28% |

| Net Profit | 1.3 | 9.6 | 19.85 | 40.07 | 70.82 |

The company has given a guidance of reaching INR 18,000 crs of revenue in FY27.

In typical APL Apollo group company fashion, it works on negative working capital (-5 days)

Thesis:

- Creating a marketplace for construction materials has a larger purpose to also standardise the industry and move the players to a more organised supply chain.

- The pedigree of the group is certainly to its advantage.

- Creating one more supply channel should also be beneficial to other brands wanting to diversify their supply chains.

- Current valuations although steep, can be justified at the expected 60-80% topline and bottomline CAGR for the next 3 years.

Risks:

- The company’s current valuation is steep, 65 PE. However with the assumed growth it may reach a comfortable level.

- There is not enough information out in the open, with the company not conducting concalls so far.

- The company has achieved proof of concept in the last few quarters, however to drive deeper penetration and creating a category is fairly untested.

- Risk of dilution of shares via either warrants or more fund raising.

- Trading business has a lot of competition and thin margins, company may have to go even lower to sustain topline momentum.

Disclosure- Invested