Q4 FY24-

Guided for margin expansion from 7.3% to 8%

Guided- Top line-18-20%, Bottomline-15-20%

- Efforts to increase stud ratio by 1-3% annually to mitigate price pressure and improve gross margin and EBITDA.

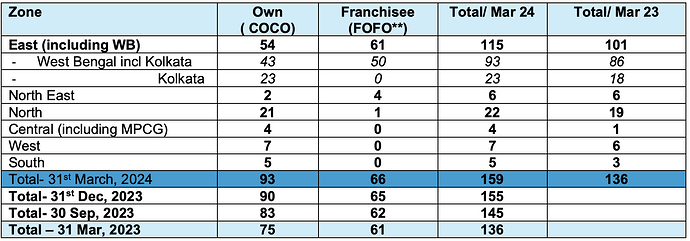

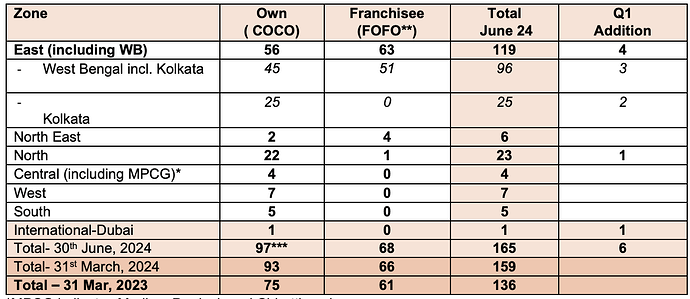

Company added 23 showrooms in FY24. Total showroom count is 159. Company guided to open 20 showrooms in FY24 and exceeded the guidance.

- Management plans to add between 15 to 20 new stores in the upcoming year.

Stud ration increased from 10.4% to 11.4%(In North- stud ratio is 17.2, higher than average). Stud ratio is less compared to Titan and Kalyan but the trajectory is upwards. Stud ratio is the % of diamonds in a gold ornament. Jewelers get more margins in diamonds. Hence, more the stud ratio better the profit margins.

- Focus on growth will be primarily in Eastern and Northern India, with a mix of West and South.

- Optimum Gold Metal Loan (GML) percentage target is around 75% to minimize borrowing costs.

- Strategic locational advantage in Kolkata helps mitigate pressure on margins compared to competitors.

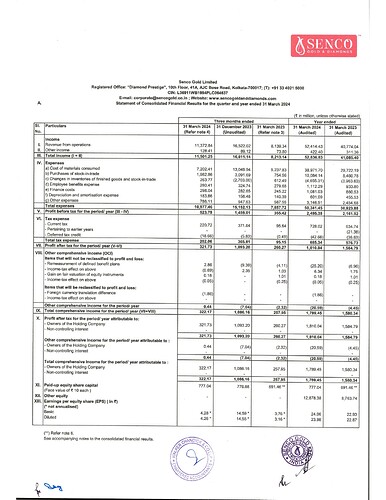

Revenue grew 40% and PAT grew 24% YoY. Senco grew faster than Titan and Kalyan in Q4. Senco exceeded the sales growth guidance of 20%.

Showroom growth of 17%, SSSG Growth of 19%, sales growth of 29%, EBITDA growth of 18.6% and PAT growth of 14.2% for the full year.

Company achieved 13% volume growth in Gold and 18% in Diamond

The Inventory value increased from 1,885Cr to 2,457Cr in anticipation of Akshaya Tritiya and higher gold price.

Inventory turnover ratio is 2.4x and inventory days is 151 days.

ROE went down from 19% last year to 15.7% due to high showroom roll-out

Key Financial Metrics:

-

Revenue growth of 28.5% in FY24

-

PAT growth of 14.2% in FY24

-

Total revenue of Rs. 5,240 crore in FY24

-

EBITDA margin at 7.3% with a target to increase to 8%

-

Average sale price (ASP) of Rs. 41,000 for the full year

-

Average ticket value (ATV) in the range of Rs. 63,000

-

Gross margin for the current year at around 15.3%

Management Commentary Highlights:

-

Senco Gold had a successful year post listing in FY24, focusing on wealth creation for shareholders and stakeholders.

-

Launched new initiatives like metaverse platform, ONDC enlistment, and tie-up with eBay for global market access.

-

Opened new stores in Central India and expanded product portfolio with 23 new collections.

-

Revenue from operations grew by 28.5% in FY24, with retail business growth at 25%.

-

PAT grew by 14.2% to Rs. 181 crore in FY24.

-

Focus on customer acquisition with 45-50% new customers and 55% repeat buyers.

-

Introduced new brand SENNES for lab-grown diamonds and leather accessories.

-

Emphasized premiumization, customer value chain, and brand positioning for ASP increase.

Insights into Business Verticals:

-

North region stores have a stud ratio of 17.2% and average sale per store of Rs. 27 crore, showing growth potential.

-

Retail growth in North at 22% with SSSG of 19%, indicating a growing business in the region.

-

Export income contributed to higher revenue growth in 4Q, with specific details on export income not provided.

Forward Guidance & Outlook:

- Focus on expanding in East and North regions, with plans to add 15-20 stores in the coming year.

Overall, Senco Gold had a successful year in FY24, with strong revenue growth, focus on customer acquisition, and strategic initiatives to drive business expansion. The company remains optimistic about future growth prospects and is committed to delivering value to shareholders.