I am unable to find annual report for FY23. Their website seems to have FY22’s AR only. Anyone has been able to find the AR for FY23?

with many regional/local players and several large chains, is this segment getting crowded or there is still a large addressable market?

A shift from unorganized to organized is the main play and thesis here

Company has received an Order on February 3, 2024, from The Principal Commissioner, CGST & CX, Kolkata North Commissionerate bearing a demand of excise duty amounting to 1,59,31, 470/- (Rupees One crore Fifty Nine Lakhs, Thirty One Thousand, Four Hundred and Seventy Only) plus interest at applicable rate and a penalty of Rs. 8,95,76,460/- (Rupees Eight Crore Ninety five Lakhs Seventy Six Thousand Four Hundred Sixty Only). The said demand pertains to inappropriate availment of CENVAT credit during the Financial Year 2016-17.

Company is in the process of preferring an appeal against the said Order.

I don’t think Market doesn’t take this order seriously today as price moved to 4% nearly with good volumes

This case was an overhang since long time. There will be no material impact on the financials. It would have been better if they just pay up instead of appealing but the response seems to be that some payment has already been done.

Management response:

"The Company will challenge the Order and file an appeal before CESTAT, Kolkata within due course.

So far as the penalty amounting to Rs. 6,88,52,876/- under section 11AC(1)(c ) of CEA 1944 is concerned, since the duty and interest was paid prior to issuance of Show Cause Notice, which was duly acknowledged in the Order in Original, penalty under any provision of excise is not applicable.

With regard to the duty demand for reversal of credit, the entire demand is barred by limitation of time as well as weak on merits as well and hence there is no suppression, mis statement or intent to evade payment of duty and the entire demand will be dropped at the subsequent stage.

Further, this case from the inception was duly disclosed in DRHP (Page No 33 to 34 and 343 to 344) and in RHP (Page No 34-35 and 367) as well and the same was evaluated by statutory auditor for contingent liability purposes from time to time.

Further, there is no impact on the financial operation or other activities of the Company due to this Order."

Senco posted a robust topline growth in Q3 FY24 yoy and 9M FY24 yoy. Whereas bottom line was down due to reduction in margins. Not an expert of this, can someone let me know is the margins hit due to increase in gold prices? I can see the cost of materials consumed is 79% of total sales against 67% last year same quarter.

| Q3 FY24 | Q3 FY23 | YOY | Q2 FY24 | QOQ | 9M FY24 | 9M FY23 | YOY | |

|---|---|---|---|---|---|---|---|---|

| Revenue | 1651.24 | 1344.47 | 22.82% | 1144.4 | 44.29% | 4099.73 | 3262.78 | 25.65% |

| EBITDA | 190.01 | 172.34 | 10.25% | 50.52 | 276.11% | 317.18 | 273.66 | 15.90% |

| EBITDA % | 11.51% | 12.82% | -10.23% | 4.41% | 160.66% | 7.74% | 8.39% | -7.76% |

| PAT | 108.62 | 103.11 | 5.34% | 10.69 | 916.09% | 146.73 | 132.24 | 10.96% |

| PAT % | 6.58% | 7.67% | -14.23% | 0.93% | 604.21% | 3.58% | 4.05% | -11.69% |

COGS increased because gold prices increased and the same is reflected in topline with 16-17% Value growth,…Margins are down because company had to roll out new offers and schemes to attract the customers during the festive days as the gold prices were increasing. And also they have mentioned Advertising costs were higher as the company’s new stores in T4/T3 cities required higher spends for reach…

But for the full year, they have maintained their margin guidance at 14% GM and 7% EBITDA and Topline CAGR at 18-20%…i guess these are inline with the consensus…

meaning of Stud ratio plz explean

Stud are jewellery which are kind of fast fashion and light in size like light earrings.

Studs generally has higher margin.

Stud is short of studded jewelry (i.e. fixed into the gold) which includes diamond and precious stone jewelry. The margin is higher is higher in it versus pure gold jewelry. Ratio of stud to gold jewelry is known as stud ratio.

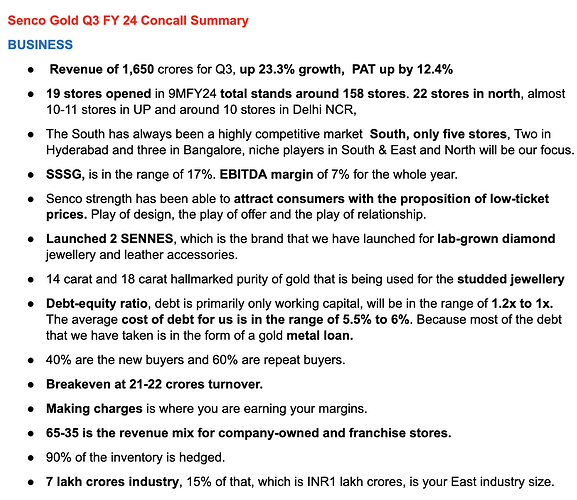

Senco Gold -

Q3 FY 24 results and concall highlights -

Revenues - 1652 vs 1339 cr ( up 23 pc. Out of this, 920 cr of sales were clocked in a single day on Dhanteras )

EBITDA - 181 vs 162 cr ( up 11 pc, noteworthy margin compression due higher employee and other expenses - due higher investments in newer stores )

PAT - 109 vs 103 cr ( up 6 pc due higher depreciation, interest costs )

Revenue growth led by - higher gold prices - up 15 pc, higher stud ratio and new store openings @ 19 additional stores vs LY ( out of these, 04 are franchisee stores )

Q3 volume growth @ 9 pc in gold and 27 pc in Diamond jewellery

Current number of showrooms - 155. Company operated stores @ 90, franchise stores @ 65

Stores present across 105 towns and cities

Last 3 yr - revenue CAGR @ 19 pc, ROCE @ 14.2 pc, ROE @ 19 pc

Dec 23 stud ratio at 11.6 pc vs 9 pc in FY 21

Avg transaction value @ 65k vs 57k in FY 21

Share of organised player in the Jewellery industry @ 40 pc vs 15 pc in 2001

Segment wise industry break up -

Bridal - 50-55 pc

Daily wear - 35-40 pc

Fashion - 5-10 pc

Geography wise industry break up -

Urban India - 40 pc

Rural India - 60 pc

As urbanisation improves, this may change

Company’s geographical spread -

WB + Kolkata - 90 + 21

North - 22

Central - 4

West - 7

South - 5

Almost all of franchise stores ( except 1 ) are in WB

About 33 pc of company’s revenues come from Franchise stores

Brand ambassadors - Kaira Advani, Vidya Balan, Saurav Ganguly, Madhumita Sarcar, Diptipriya Roy, Ishaa Saha

Company has strong digital presence by the name - Sencoverse to attract Gen Z customers

Company has launched new product ranges under the Sennes brand -

Laptop Bags

Backpacks

Men’s Wallets

Leather Bags

Other accessories

Company has enrolled itself on the ONDC platform as well

Aim to open 18-20 stores/yr for the foreseeable future

Company’s same store growth in Q3 is healthy @ 17 pc

Company seeing good demand trends in Q4 as well. Company guiding for 23-24 pc growth for full FY 24

Company seeing better growth rates and better stud ratios in the North. For the time being, North - including UP, Chandigarh, and NCR are focus areas for the company

Aiming to maintain full FY’s EBITDA margins at around 7 pc

South is a hyper competitive mkt for Jewellery. Hence the company’s focus remains to be North and East. Company will continue to be a niche player in South. Company’s stores in South are already profitable

On an avg, 60 pc of company’s buyers are repeat and 40 pc are new buyers

Capex plan for next FY at around 60 cr - mostly for new store openings

Company believes, it can open another 12-15 stores in WB in next 2-3 yrs in tier - 2,3 cities

Disc: holding, biased, not SEBI registered

In case someone has experienced or have observed.

I have a general question related to fundamentally strong gold jewellary stocks.do they have specific trajectories in bull & bear markets ?

Gold stocks don’t normally follow the general stock market trend. Rather, it is linked to Gold price movement and Dollar appreciation, which is what I believe

Why does Senco Gold trade half of the P/E and P/B value of Titan and Kalayan, can we expect rating match as Senco Gold is also growing at 20% -25% like its competitors.

Both Titan and Kalyan are PAN India players. Senco gold on the other hand is currently present mostly in East. They are trying to expand their operations in the North. If they successfully manage to grow in the north, there is a great possibility of PE rerating.

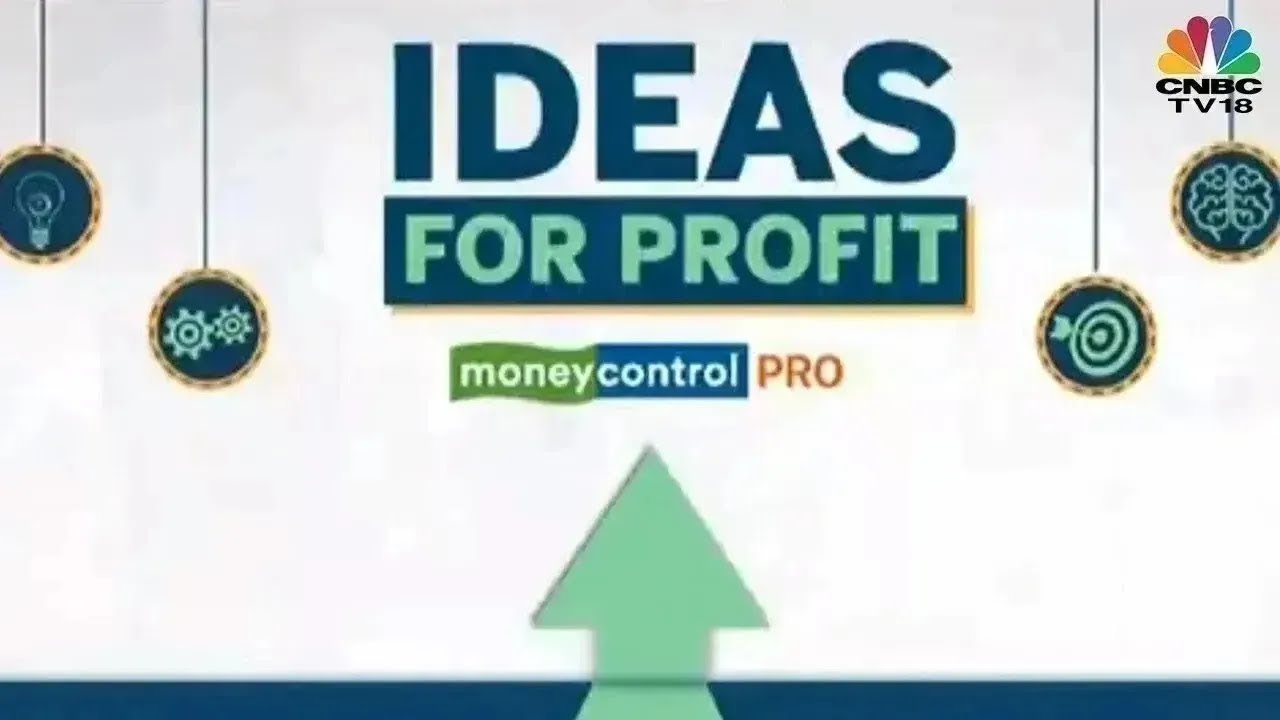

This is my financial model regarding the business

Here is my thesis

Disc: Bought in the last 30 days. No buy or sell recommendation.

Thesis

For FY24, H1 growth has been around 27% which is really great, however i want ti be a bit conservative because of the fact that Q3 base is quite large. Hence, The overall growth I have assumed for the year is around 25%, which sounds great but still could be conservative.

Now for the rest of the years, the company wants to increase the store count by around 25 something each year and reach about 250 stores which seems possible. Current store count is 153 and 10 should be added by FY24 so around 163. With an SSG of double digits, and 15%+ growth in number of stores, even 20% growth in revenue seems very conservative.

Regarding EBITDA,

This FY24 there seems to be inventory losses due to Diamonds, and hence i expect the margins to decline a bit, however we can assume this problem to solve and revert back to mean. Even though the studded ratio is increasing, the company mentioned that it will probably get offset by entering into new markets and more competition, as mentioned in Q1 concall. Another point, the margins were on the higher side last year due to diamond prices and hence we shouldn’t expect increasing margins, mostly stable or even around 7% because of franchise additions and growth phases of the company. I have opted for 8% but I think( could be wrong so correct me whenever) 7% too is a reasonable assumption

Interest costs and depreciation

During the H1 balance sheet, lease liabilities increased by around 10% and hence assuming a 10% increase is possible in depreciation and Interest costs. With the own store additions of our 10%. Its safe to assume these two ill increase by the same range.

PBT

I do have a problem with PBT for FY 26-27. The PBT is more than 5% which seems a bit hard to believe because it’s difficult to achieve a PBT of 5%+. It’s probably possible if operating leverage plays out, which is a thesis pointer.

Valuations

I would not wanna assign the valuations of Titan and Kalyan, since i haven’t studied titan i can’t say much about it but Kalyan does look overvalued. It should command a higher multiple than now, but it does depend on its ability to become a Pan India player. Secondly, Senco has a very strong presence in the east but not much in other regions and that becomes a big risk. If anything goes wrong in West Bengal, any financial model we make will go for a toss. So that’s why, I think 1.5x PEG makes some sense to me. However, upon talking to other investors, it does make sense to me that consumption businesses get a 50x PE.

Personal opinion

There is a strong shift from unorganized players to Organized players and hence I do believe that there are strong tailwinds in the sector. I think Senco can deeply penetrate areas due to their lower average ticket size and business model, which just gives me a sense of relief that they have a lot of growth possibilities in new geographies.

However, not a lot of big pan India players have a strong presence in the east and hence it will be interesting to see how Senco tackles the big boys in other regions.