Please refer to the source footnotes.

Velocity is price vs 200DMA (%) at peak, this will give an indicator of the velocity of the price movement compared to the base (200 DMA).

Valuation is the trailing P/E at peak

Yield is the direction of bond yields in 3-6 months prior to bubble peak.

Thanks for your response. I should have been more diligent before asking.

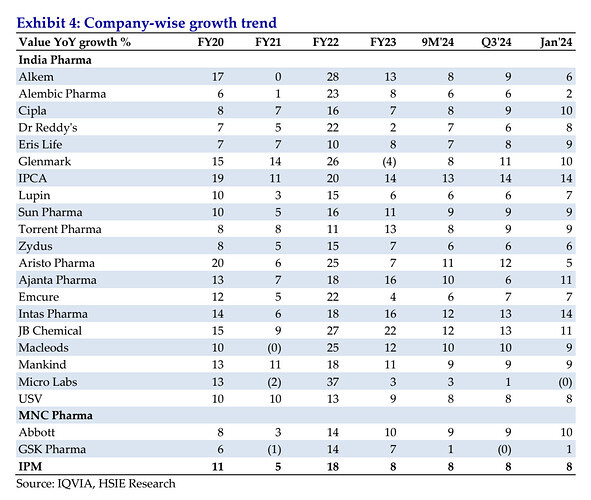

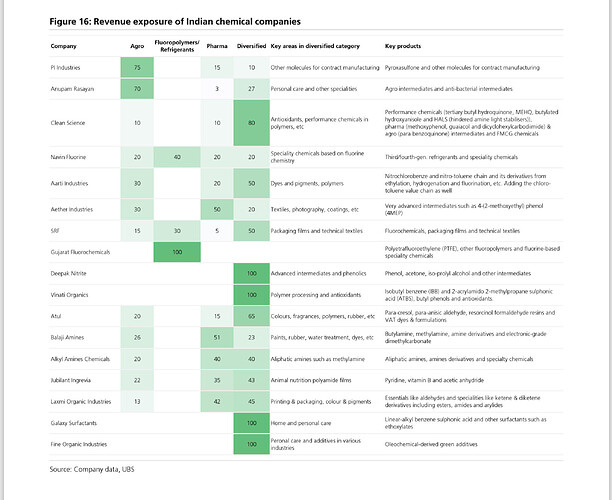

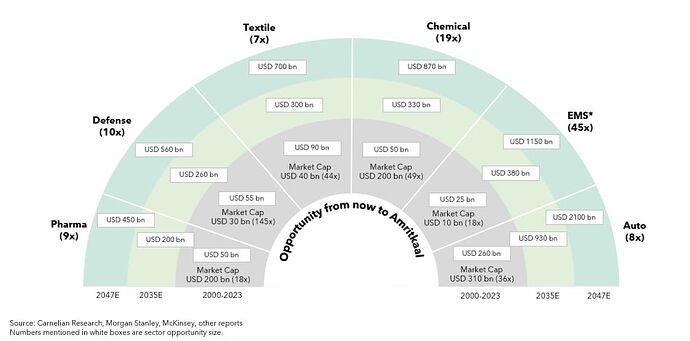

The Domestic Formulation players are very well poised for double digit growth. Pharmaceuticals could be a go to sector with stable returns in 2024 despite the regulatory overheads of price control.

Many companies have successfully tapped the inorganic route over the years

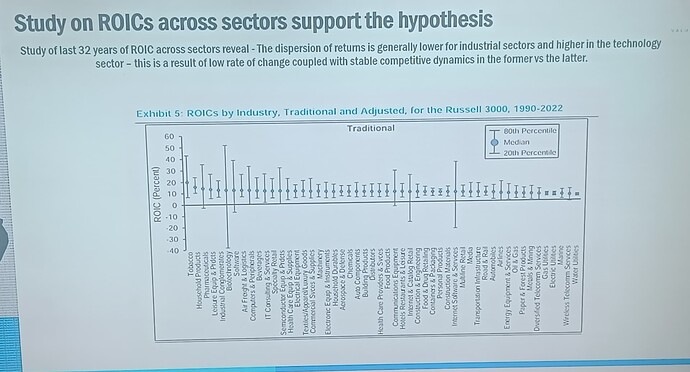

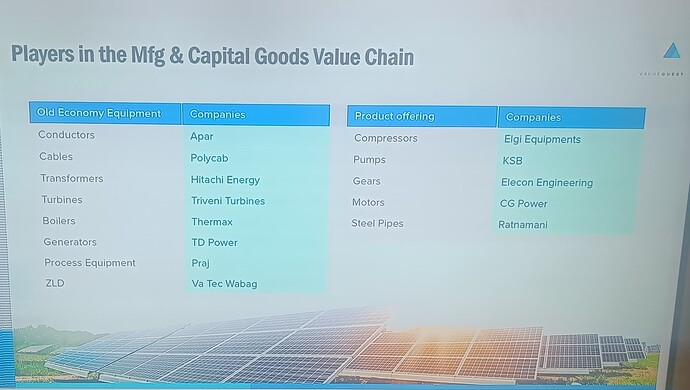

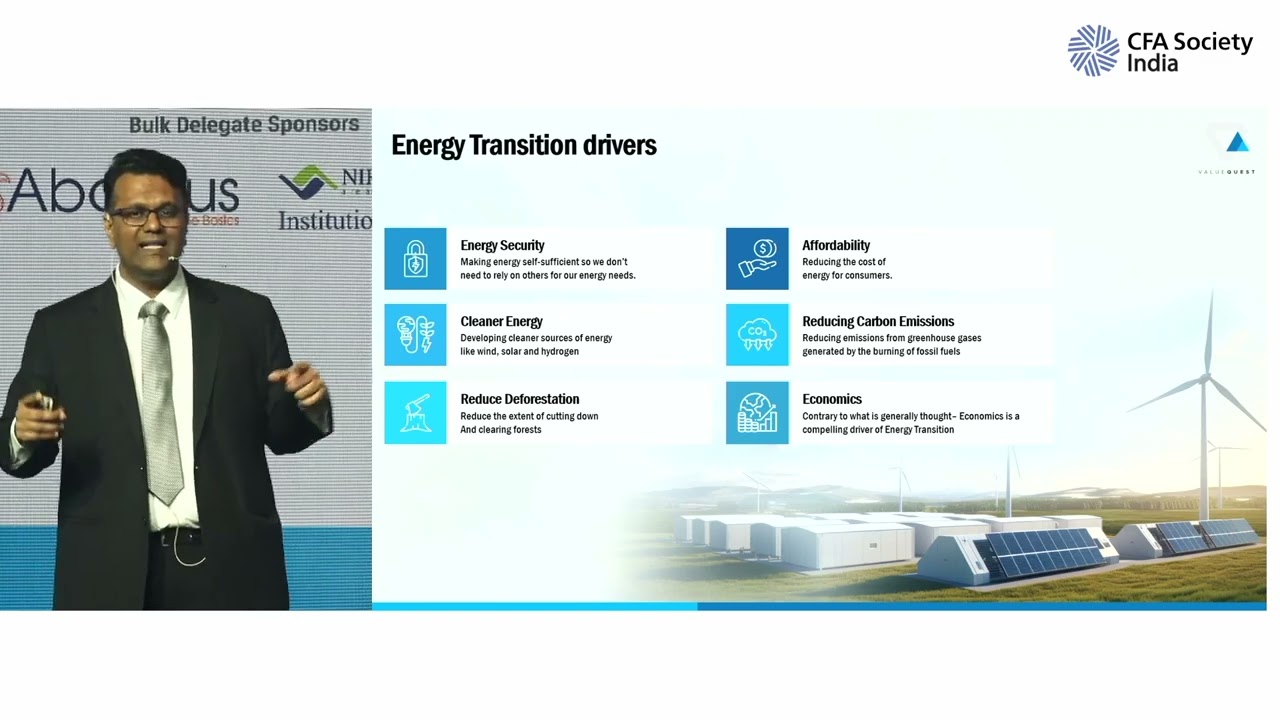

Excellent data driven presentation on investment playbook for Energy Transition (from Fossil Fuels to Renewables) by Ravi Dharamshi of ValueQuest. The key themes around Energy Generation - Energy Transmission - Energy Consumption.

Some key slides:

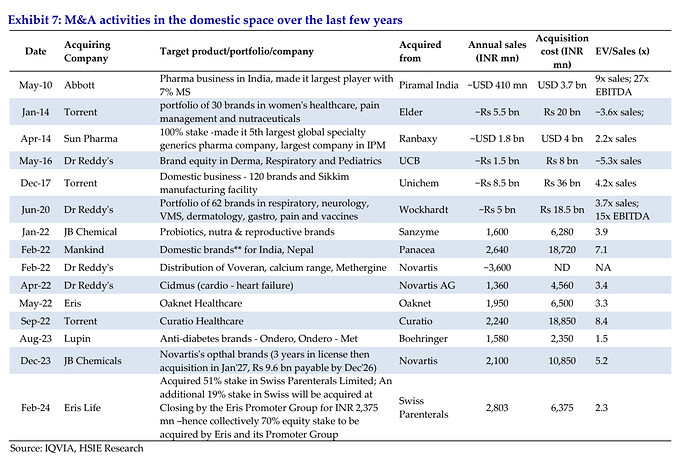

Historical ROCE has been higher for Industrials with low obsolescence and entry barriers

Relative positioning of opportunities. Targeting the ones with mature evolution and medium differentiation will be beneficial

Indicative list of opportunities from the Indian listed space

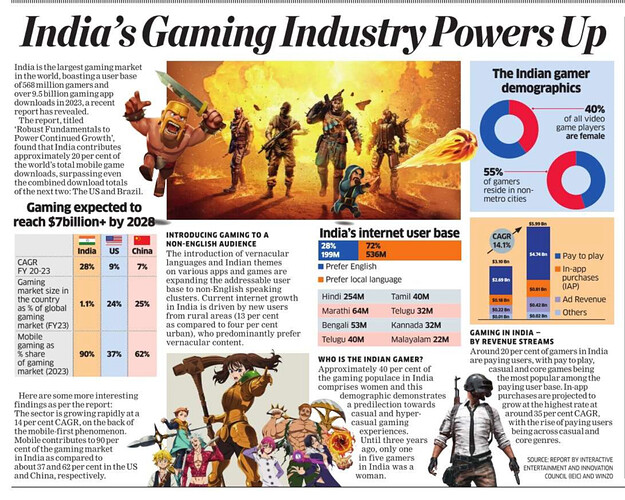

Indian Gaming Industry is at an interesting juncture and can provide many opportunities in the next decade

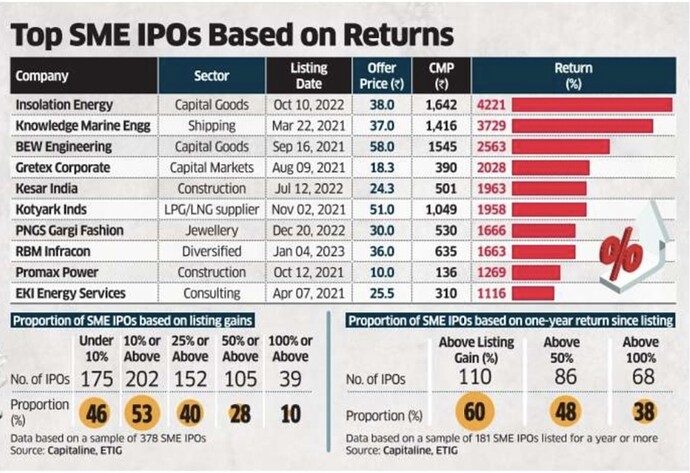

The sheer FOMo has led to humongous price appreciation in some of the SME names. Most are capitalizing this opportunity and raising further equity at these elevated valuations

#BitcoinHalving and rise of Bitcoin to its ATH

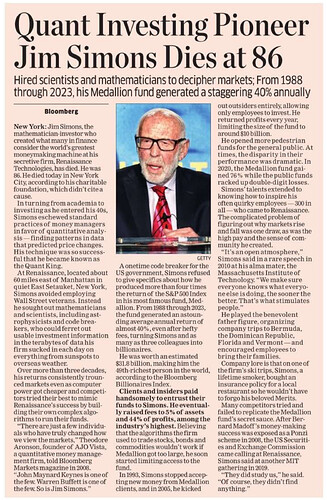

Source: Business Week 17th March, 2024 Edition

The Bitcoin halving is another event that is generating a lot of excitement. It takes place every four years when the reward for Bitcoin mining is reduced by half. The purpose is to limit supply, so when the reward decreases, it positively impacts prices. There will only be 21 million Bitcoins, and nearly 19 million have already been mined.

Historically, halvings have driven Bitcoin prices to new highs.

The first halving took place in November 2012, and in just over a year, the value of Bitcoin surged from $13 to $1,152 by December 2013.

The second halving occurred in July 2016, leading again to a significant increase in Bitcoin price—from $664 to $17,760 by December 2017.

The third halving took place in May 2020, and the price of Bitcoin rose from $9,734 to $68,789 by November 2021, reaching its peak one year and six months after the halving, explains Ryan Lee, Chief Analyst at Bitget Research, which looks at cryptocurrencies.

“The fourth halving will occur in April 2024. It is expected that the price of Bitcoin will rise and peak one year and five months after the halving. A similar trend has been observed with the previous three halvings, with prices increasing over time to hit a new all-time high,” says Lee.

“There are approximately 60 days until the Bitcoin halving in April 2024, which could potentially push the cryptocurrency market to new highs,” says Shivram Thakral, CEO of digital asset exchange BuyUcoin.

With the last trading session of FY24 behind us, it is a good time to compare the FY23 end PF to present & introspect

Reflections:

(1) Improve position sizing. Keep buying your winners without any price barriers. It is indeed difficult, and I need to do more of upward averaging in winning stocks.

(2) Don’t fight the sectoral headwinds. The bottom up approach has to be married with sectoral tailwinds, you can’t fight against the tide. Either become a fast churner or suffer underperformance when the sector is out of favor.

(3) Bull markets are good for exits. A rising tide lifts all boats, no matter how ugly. Be prudent to switch from leaky boats and don’t step into another one in the rush.

(4) Base rate and P/E at entry are critical. Once the euphoria subsides, fear of loss overpowers the fear of missing out and mean reversion becomes the norm. No matter how lucrative the pathway looks, go back to base rates, always.

This has been a phenomenal year, especially for the Midcap and Smallcap investors, to Congratulations to all who could benefit from the trends.

Unfortunately was not the best productive year for me due to the reasons mentioned above. Here’s looking forward to another year of learning & investing.

Have you compared your stock portfolio returns with your mutual.fund performance? Amy disconnect?

Hello Mudit,

I don’t invest through mutual funds. I track my portfolio returns against an weighted benchmark as mentioned above

Good summary of potential opportunities in the Data Centre space.

While the major beneficiary being Nvidia with their meteoric rise this year, if you break down the value chain a lot of ancillary players should do well.

And this is gonna be a dominant theme over the next 5-10 years as usage of Data & AI explodes

https://twitter.com/Vismaya9999/status/1773658209976279351?t=-PtQzcvIi7UpdM2J0a1fhQ&s=19

Excellent sectoral overview on waste management sector & related opportunities by @Worldlywiseinvestors

Summary of listed companies in this space:

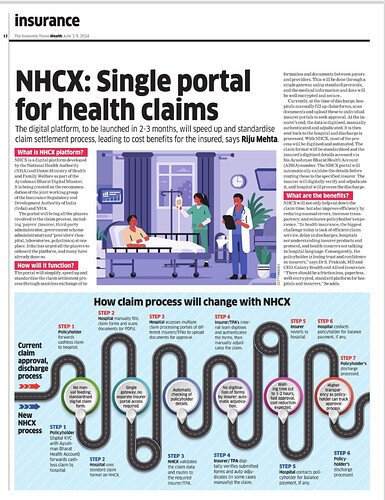

Health claims are going to be rapidly digitized with the launch of NHCX portal. Beneficial for all stakeholders

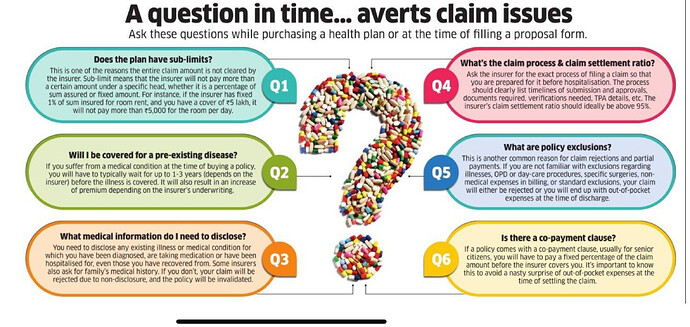

Good Cover story on ET Wealth’s 24th June ‘24 Edition on Medical Insurance claim settlement pains.

Build awareness and follow strong disclosures to avoid pain during claim settlement

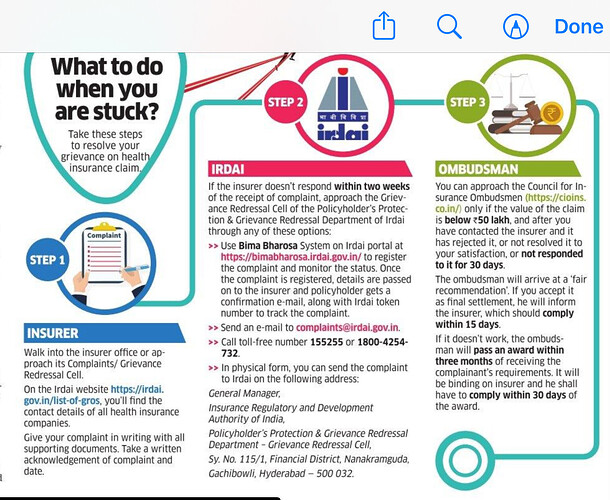

Points of escalation when your claims are not getting settled

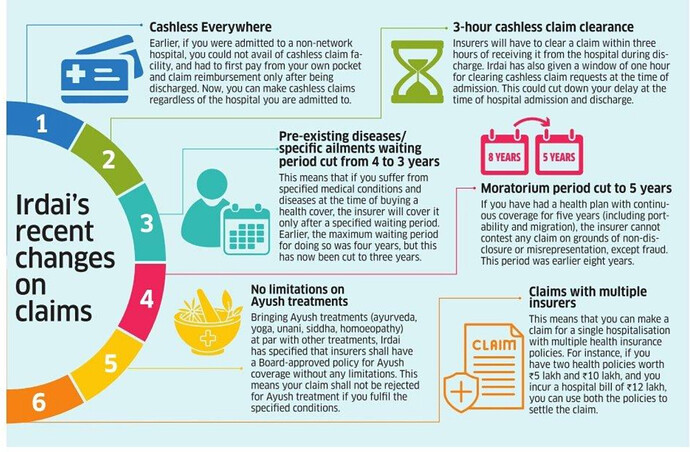

Some key recent changes introduced by IRDAI that will benefit most policyholders

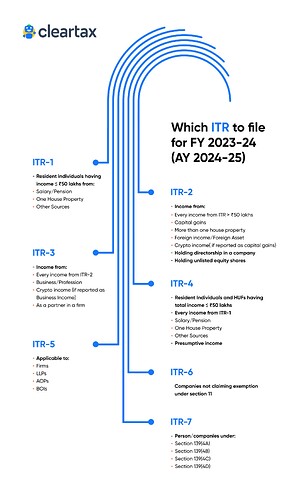

Tax filing season is on and this infographic beautifully captures all the different ITRs.

Source

For people with Intraday gains in FY24 (speculative business income) one needs to submit form 10-IEA to opt out of the “New Tax Regime” (which is the default now). It is a very complex process described here.

“Bad assets, good liabilities” from the point of view of minority shareholders of listed or unlisted companies.

X thread by Prof. Sanjay Bakshi

Bad-Assets-vs-Good-Liabilities.pdf (6.1 MB)