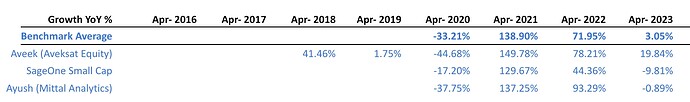

Portfolio Benchmarking to discover your true opportunity cost.

The objective of portfolio benchmarking is to compare with an investment mandate that invests in a similar set of companies and with a similar set of objectives. Hence instead of benchmarking against the Nifty or NSE500 which is the common practice, an ideal option is to compare with the leading PMS’ with consistent long-term compounding, who match your investment style and gestation. Your true opportunity cost lies there as you are unlikely to simply pick a Nifty index fund/ETF if not investing on your own.

As discussed on another thread, I use an average returns index from the 3 funds

-

SageOne Small Cap

SEBI | Portfolio Manager Monthly Report

PMS: Sageone Investment Managers LLP -

@aveekmitra’s Aveksat Equity

Aveksat Financial Advisory -

@ayushmit’s Mittal Analytics

SEBI | Portfolio Manager Monthly Report

PMS: Mittal Analytics Private Limited

Since many have requested sources to track these, I am providing the links here as well.