Couldn’t find a thread about it so starting one here.

About Company

Rail Vikas Nigam Limited (RVNL), a CPSE under Ministry of Railways, was created with the twin objectives of raising extra-budgetary resources and implementation of projects relating to creation & augmentation of capacity of rail infrastructure on fast track basis. The Company, incorporated on 24.01.2003, became fully functional with the appointment of all Directors of Board by March 2005. The Company has been granted Mini-Ratna status on 19.09.2013.

RVNL is implementing projects by awarding composite contracts on turnkey basis as per the international practices and standards. As on 31.03.2017, RVNL has completed 213.82 km of New Lines, 1590 km of Gauge Conversion, 2353.32 km of Doubling and 2837.07 km of Railway Electrification i.e. 6994.21 km of project length. In addition, five Workshop Projects and one cable stayed bridge have also been completed. These projects are being executed through 36 PIUs spread across the country.

Besides Doubling and Gauge Conversion, RVNL has also diversified to:

- Railway Electrification

- Railway Workshops

- Metro Railways

- Technically challenging new Hill Railway lines, etc.

The Company generally works on a turnkey basis and undertake the full cycle of project development from conceptualization to commissioning including stages of design, preparation of estimates, calling and award of contracts, project and contract management, etc.

The projects undertaken by the company are spread all over the country and for efficient implementation of projects, 37 project implementation units (PIUs) have been established at different locations to execute projects in their geographical hinterland. They are located at Delhi, Mumbai, Kolkata (4 units), Chennai, Secunderabad (2 units), Bhubaneshwar (3 units), Bhopal (3 units), Jhansi, Kota, Jodhpur, Waltair (2 units), Bengaluru, Pune, Raipur (3 units), Lucknow (2 units), Rishikesh, Ahmedabad (2 units), Kanpur, Varanasi (2 units), Chandigarh, Mughalsarai, Ambala and Guwahati.

The company’s major client is the Indian Railways. Its other clients include various central and state government ministries, departments, and public sector undertakings. Rail Vikas Nigam Limited came out with an Initial Public Offering (IPO) of 253,457,280 equity shares of Face Value of Rs 10 each of the company through an offer for sale by the President of India, acting through the Ministry of Raliways, Govt. of India (the selling shareholder) for a cash price of Rs 19 per equity share aggregating to Rs 477.11 Crores. The face value of equity shares is Rs 10 each.

sources: https://in.linkedin.com/company/rvnl and Markets

Financials

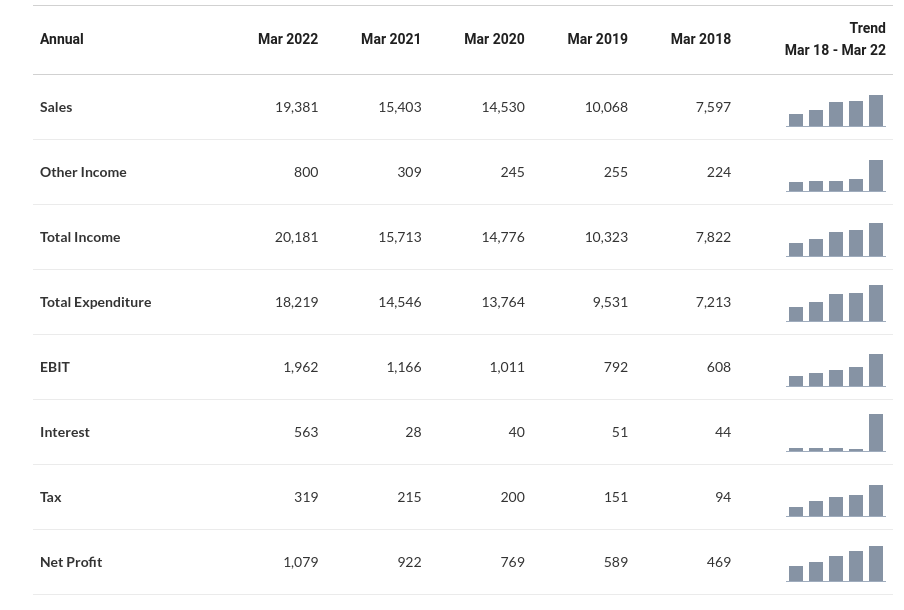

Profit and loss

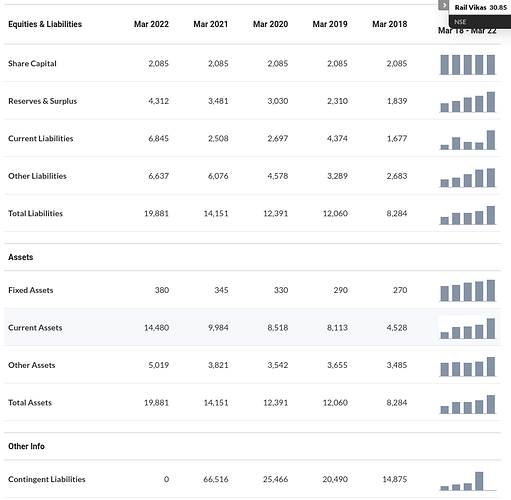

Balance Sheet

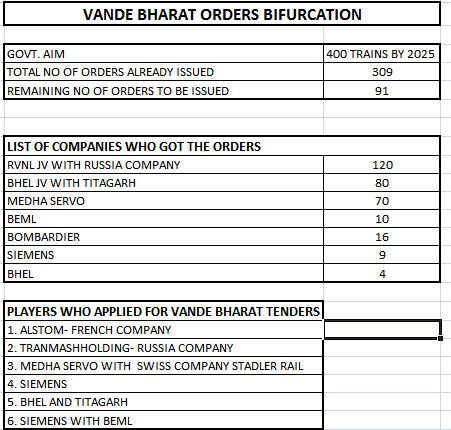

RVNL has a good order book. It has guided for order inflow of ₹15000 cr in FY23E. It has bid for orders of ₹21000 cr. Of the of opened tenders of ₹6000 cr, it has won orders of ₹2000 cr.

It is also trying to diversify from railways. Rail Vikas Nigam announced that its consortium with P Singla Constructions has been awarded the Letter of Award (LoA) by National Highways Authority of India (NHAI) on 11 July 2022 for Construction of 4 laning of NH-S from Kaithlighat to Shakral Village in Himachal Pradesh. The estimated cost of project is Rs 1844.77 crore.

Key risk is that it is almost entirely dependent on government.

Disclaimer: Invested since ipo.