In my view, the possible factors are :

(1) Market discounts PM Modi to win next election and hence Govt policy continuance

(2) The Govt’s continued focus on infra capex especially for railways

(3) Again Forthcoming budget likely to allocate high budgetary provision for railways

(4) Low valuation - PSU pack as a whole were undervalued for last more than a decade. Now , market has moved up and investors find value in these stocks.

,(5) since this govt focus is to improve performance of PSU’s by capex spends, renewables, Atma Nirbhar Bharat etc and in fact the financial performance is improving in many PSU …going by last few quarters performance.

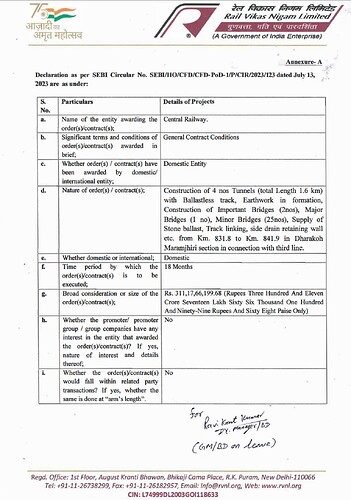

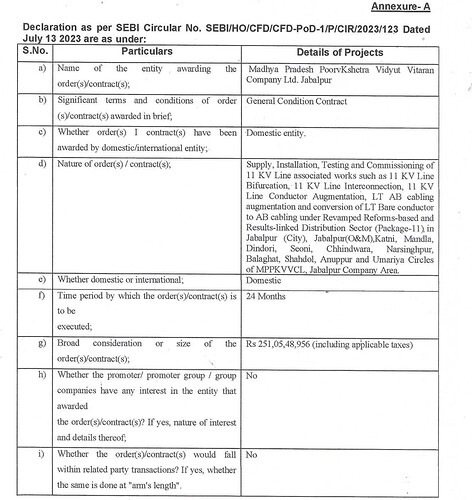

(6).Order book for these PSU’s - railway, defence , renewables are full for next 5-10 years

(7) Then there are lot of activities related to privatisation , OFS, IPO, rights issue, bonus, stock split of PSU’s where there is a lot of participation from institutional / MF/retail investors leading to increased liquidity. SIP’s get invested in these stocks. and high networth investors picking up chunks.

(8) Moreover , most of these stocks , the promoter stake is high 70-85% . So any news flow leads to heavy buying and due to low floating stock , the stock price goes up.

(9) And a lot of freedom given to PSU to improve performance , for example , REC has been recently allowed to lend for Railway though IRFC is supposed to be the sole financing arm.

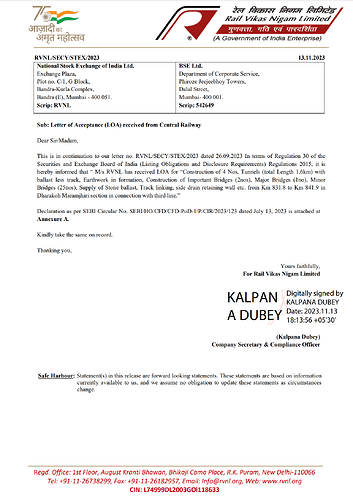

Similarly , RVNL now ventures in to Solar EPC though there are many other PSU doing similar jobs. So there is a strong competition among PSU’s.

(10) Dividend - Most of these PSU’s are mandated to give hefty dividend to the Govt and minority share holders also entitled to some mouth watering dividends regularly.

,(11) PSU stocks - no Income tax raid, No GST raid, NO CFO or CEO resigns, no other regulatory risks. CEO , CFO get transferred on job rotation on a regular basis and CEO , CFO are scared of doing any mismanagement or manipulation of balance sheet , or misappropriation of funds as they are held accountable even after retirement.

If there are any other factors left out, members are welcome for inputs.

The only Issue with these stocks are - (1) The promoters are majority share holders , so they can take decision which may not be beneficial to minority share holder (2) If there is a change in govt …then policy continuation may not be there

Finally, it will be the execution of orders and consistent performance of the PSU’s that will drive/ sustain the stock price. Since most of these orders do have long gestation period, one may not be able to judge performance by QoQ.

Discl : Invested in PSU’s from lower level in a basket of Railway , defence and renewable energy /power .

Not a buy or sell recommendation. please do your own assessment before buy sell decision.