COncall

I wish I could attend the concall to hear the father-son duo live! In any case, I went through the transcript that was uploaded recently. @nikhil_chowdhary & @sahil_vi have done full justice in highlighting key insights from the concall. I will just post my two cents on my key takeaways-

-

Amazing execution and scale up over the years in terms of customer wins, projects, new vehicle segments, and even components.

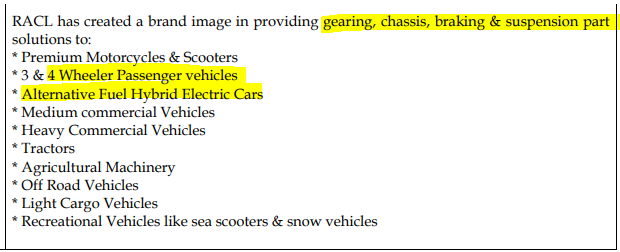

- They mentioned in the opening remarks that they do chassis, braking & suspension components apart from gears. Gears is what we know the company for.

- They mentioned in the opening remarks that they do chassis, braking & suspension components apart from gears. Gears is what we know the company for.

-

EV risk is definitely there but look at the insights they have provided on ZF and BMW.

-

On ZF- this product that they are doing wasn’t there in the market till 2015 and they want to be “big” in this. This product is vehicle agnostic.

-

A new, EV/ICE agnostic, product in which they want to be big and have taken BMW as the first customer and have “2-3 more projects” for a different end customer, with ZF in place. Discussions with other customer

also going on. This says a lot!

-

A new, EV/ICE agnostic, product in which they want to be big and have taken BMW as the first customer and have “2-3 more projects” for a different end customer, with ZF in place. Discussions with other customer

-

E-Scooter- They worked with ‘a European major’ for the last two and a half years and have developed this with them.

- And now they are saying that value addition in this product is higher than the fuel.

- A contract for 10 years that too single source is massive. This highlights the OEM’s trust in RACL’s quality and supply reliability.

-

These are futuristic projects with the world’s largest and best OEM’s. They are making themselves EV immune brilliantly.

-

Associating with such OEMs and a company like ZF, they should remain ahead in the curve. These product developments with ZF for BMW and “a European major” are a testimony to that.

-

-

5-7 years back they were doing loose component and now they are doing sub-assemblies and assemblies. They have moved up the value chain and I don’t think that is highlighted enough

-

Moving from ‘Build to Print’ to ‘Concurrent Engineering’ is another key takeaway for me. This way, they remain close to their customers and get to participate in their latest developments.

I want to think about the risks as well. After reading the transcript, for me, the biggest risk is not EV but the fact that companies like BMW and other large traditional OEMs don’t succeed in this EV revolution and are unable to compete with the likes of Tesla and several other companies coming up. Their “futuristic” projects fail completely and they become irrelevant in this world. Putting any probability to this outcome is futile and I am not capable of doing that.

Disc: Invested and Biased. Have a high allocation at low rates.

In terms of risks, is it possible that a company like Motherson Sumi might acquire RACL Geartech? If yes, what could be the potential implications for minority shareholders?

EV risk management was made clear in this concall

1 ) Delay 2) Diversify

-

Delay impact through

a) Right customer segment selection : Premium bikes , off-roaders , Heavy Commercial etc

b) Relentless reduction in cost to ensure RACL is last man standing even in declining industry -

Diversify into product segment which are fuel neutral

a) New/ incremental capital allocation to Chassis and Suspension system - ZF

b) E- axle drive for scooters - beyond Transmission system to motor and power electronics ?? - A bit surprised as this is very R&D intensive

Now as RACL shifts from traditional engine timing and transmission segment to new world and more promising of chassis and suspension system and possible e Axle system - how does one value this firm

Typically one values tier 1 and Tier 2/3 auto ancillaries are EV to sales ( as auto is cyclical industry and profit margins may vary a lot depending on operating leverage )

Normally Tier 1 supplier with good growth and product patents is valued at 2

to 5 times EV to sales

and Tier 2 /3 supplier depending upon value addition will be valued at 0.5 to 1 times EV to sales and level of major transformation needed to be relevant.

Now with my doubts cleared … I will wait for right price ( < Rs 120 )

This is the reply I have received from Investor Relations on the Cash Flow and Direct Tax added back query.

Strange. I thought companies do not follow this practice of adding Taxes. If you are going through PAT route, no need to subtract taxes and if you are going through PBT route, subtract taxes to arrive at OCF. This is what I knew

issue is not about exact price , but what is right valuation metric for buying tier 2/3 auto ancillaries …

It is between 0.5X to 1X EV sales for decent Tier 2/3 companies with products which will not get disrupted by technology atleast for next 5 odd years …

This is more or else how Indian auto ancillaries companies buy their Peer firms

.

This seems like great news for the electric scooter sector in India.

Per the con-call summary Sahil had added earlier, RACL are investing into producing electric scooter drive trains for their European clients. While their client base is mainly international, having the knowhow to manufacture these drive trains could later prove to be useful should they expand to have Indian clients.

Article is behind the paywall. Most of the points mentioned in the article are already very well covered by @sahil_vi and some others. New thing I noticed is that company has surplus 25 Acres of land for future expansion.

Disclosure - invested for last 3 months, added more post Q4 FY21 concall

Since most of the major clients of RACL has published their June Qtr numbers, its time to review their performances:

Piaggio and Moto Guzzi

https://www.piaggiogroup.com/en/archive/press/piaggio-group-first-half-2021

https://www.piaggiogroup.com/sites/piaggiocorpd7/files/doc/conference_call_q2_2021_results.pdf

Piaggio group continued showing their strong performance in Q2 as well along with best first-half result since 2007, with 50.3% YoY half-yearly revenue growth, and 74% YoY half-yearly EBITDA growth.

Piaggio group reported 49% YoY volume growth for 2 wheeler, whereas The Moto Guzzi brand achieved a record first half, with its highest-ever sales volumes and net sales, notably for the Moto Guzzi V7 and V85TT.

BMW Motorrad

-

BMW Group sales +39.1 percent higher year-on-year; 1,339,080 vehicles sold in first six months

-

Deliveries of electrified vehicles more than doubled (153,267 vehicles, +148.5%)

-

Sales up +7.1 percent from pre-crisis year 2019

-

Pieter Nota: “Strong sales for first half-year – continuing on growth track with decisive expansion of electrification”

-

Sales increase for all brands and regions

BMW Group sales in Q2/YTD June 2021 at a glance

| 2nd Quarter 2021 | Compared with previous year % | 1st Half 2021 | Compared with previous year % | |

|---|---|---|---|---|

| BMW Group Automotive | 702,474 | +44.6% | 1,339,080 | +39.1% |

| BMW | 617,749 | +43.5% | 1,178,292 | +39.9% |

| MINI | 83,116 | +52.2% | 157,799 | +32.6% |

| BMW Group electrified* | 83,060 | +166.9% | 153,267 | +148.5% |

| Rolls-Royce | 1,609 | +127.6% | 2,989 | +91.6% |

| BMW Motorrad | 65,018 | +55.1% | 107,610 | +40.3% |

BMW Motorrad increased sales 55.1% from 42,592 in Q1 to 65,018 in Q2.

Kubota

For the six months ended June 30, 2021, revenue of Kubota Corporation and its subsidiaries increased by ¥217.2 billion [ 24.6% ] from the same period in the prior year to ¥1,101.4 billion. However Farm & Industrial Machinery including Tractors (accounted for 85.5% of consolidated revenue) witnessed much better growth (30.9% YoY). Operating profit in this segment increased by 65.1% YoY.

The company has made strong forecast for the next 2 qtrs as well.

(3) Forecasts for the year ending December 31, 2021

The Company revised its forecasts for revenue for the year ending December 31, 2021 upward to ¥2,150.0 billion, an increase of ¥100.0 billion from the previous forecasts, which were announced on February 15, 2021. This revision was made because overseas revenue is expected to increase due to a significant increase in sales of farm equipment in Asia outside Japan and more favorable exchange rates for the yen than forecast, in addition to strong sales of tractors and agricultural-related products in domestic market.

Overall, it is clearly evident that all the major customers of RACL has witnessed strong qtr that just gone by and RACL also might well keep the growth momentum intact.

Disc: Holding RACL from much lower levels and this is not any recommendation to buy/sell.

Thanks for sharing details. This is useful hard work.

However, i think, RACL would have supplied atleast 3-4 months before the sales to have happened. So one can’t do direct co-relation…rather RACL would be the early indicator…lol.

What is more important to focus on these is - 1. How are these large cos evolving given the EV adoption 2. Are these cos able to grow ICE business along with EV?

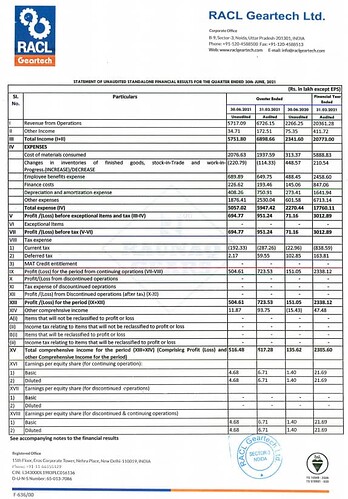

Results not bad

152.27% increase YoY

57.17cr Q1FY22 vs 22.66cr Q1FY21

(Q1FY21 was impacted due to Covid)

15% decline in Revenue Sequentially

Q4FY21 (67.25cr) vs Q1FY21 (57.17cr)

Should do 250cr in sales this year

I think its Fairly Valued at 2.3x FY22 Sales

The company hasn’t done ~58cr in sales in any Q before Dec’20

Dec’20 and Mar’21 were extraordinary as previous two Qs demand shifted

Should do EPS of ~20 this yr as well

New Independent Director joining the company seems well qualified

Results Release: https://www.bseindia.com/xml-data/corpfiling/AttachLive/61bb347c-02f1-4f25-ab6b-8829d0cd92de.pdf

@Tar and @sahil_vi

What’s your view on OPM and sales growth if we compared it to Q1 2019 instead of Q1 2020 ?

Company is meeting Prashant Khemka’s White Oak. Probably the first institutional meeting for the company.

Recent pullback has given a window of opportunity of entry for folks who felt left out ![]()

Some great work in thread by VPers, impressive to see how business evolved in last 2 years( esp last few quarters transformation is visible)

Some qualitative aspects by looking at recent Qtr concalls

-

Entry and positioning of promoter 's son - Prabh IMO is not only a solid succession( a key issue in small/micro caps) but also a strategic driver with clear roadmap for future - interesting to see Finance and Business Development being driven by same person as this provides a unique driving force - those driving P&L will relate with it better.

-

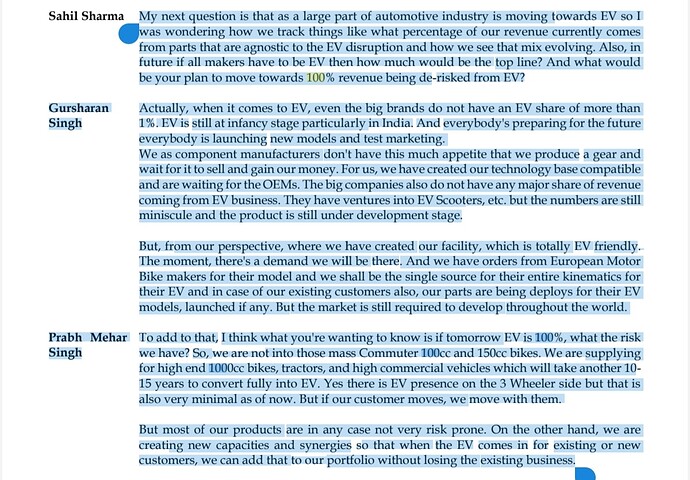

EV threat and preparedness- Given their focus is non mass and premium/niche segment - EV transformation will not be immediate threat, mgmt response for Q from @sahil_vi

-

Margin drivers and sustainability - Increasing Export mix , Outsourcing of capital intensive jobs( heat treatment, forging press etc), reducing reject and wastages - looking at concall these initiatives seems brainchild of Prabh Mehar - when one looks at both business dev and finance ops - these initiatives are driven frictionless.

-

Ambitions - They have called out for 500 cr revenue by 2025.

-

Moat/competitive advantage - OEM Relationship which takes years to build, Domain experience gathered over years ( people, tools, processes experience) - large OEMs prefer small vendors for niche works which has a R&D flavor, requires flexibility from vendor, quality ( having long term Japanese customers itself is a testimony). Difficult to imagine a Foxconn for Auto industry, niche players will survive and thrive.

Risks ( a lot has been covered in thread on other aspects )

- Industry order shuffle- Next decade Auto leaders may be very different from last decade with EV and tech disruption playing out. See Ola Setting up world’s largest 2W factory - Relationship into newer players is key. I may be wrong here but they seem to be counting on Current customer base to successfully transition to EV as and when it happens.

- Technology - It is no surprise that future of mobility will be more around software, hardware than mechanical - understanding that disruption and having access to talent pool is imp.

- PE money backed players vs others - Great customer line up today is an asset, knowing their competitors and deep pockets backing them is equally imp - like other industries winners are likely to be different one’s

- Customer concentration - while they haven’t specifically called out, 2W being their largest segment, premium bikes will be a large focus and rev portion - Given RACL size they are prone to any demand disruption in top customer base.

All in all a strong niche mfg player with marquee customer base and bright future ahead, though susceptible to industry disruption

Valuation - Given solid performance over last few Qtrs, a rerating may sustain, no MoS at present valuations Given industry risks. Given their 25% CAGR growth ambitions, 2X sales/TTM PE of 20 seems a fair valuation( used to have 3/5/10 yr PE ratio of single digit but last year+ has been solid, as they contnue to deliver in future, likely to rerate provided they navigate industry disruption well and there is consistency in performance

Disc - Tracking position in recent pullback. Excited about possibilities.

Anyone has link to Q1’22 concall details? Thanks in advance

Please have a look at screener.

Go to documents and you will find confcalls.

https://www.screener.in/company/520073/

Last concall was for q4. No Q1 con-call

Global auto industry output expected to fall sharply amid acute chip shortage.

The acute shortage of semiconductor chips will negatively impact global vehicle production in 2021 and the following year, leading to huge losses for the auto industry.

The global auto industry may produce 6.3-7.1 million fewer vehicles this year due to the shortage and vehicle manufacturers may face difficulties till the second half of next year due to ongoing supply disruptions.

Global auto industry output expected to fall sharply amid acute chip shortage (msn.com)

=============

What will be the extent of impact for RACL Geartech in view of the acute Chip shortage which is expected to ease somewhere in middle of next calender year?