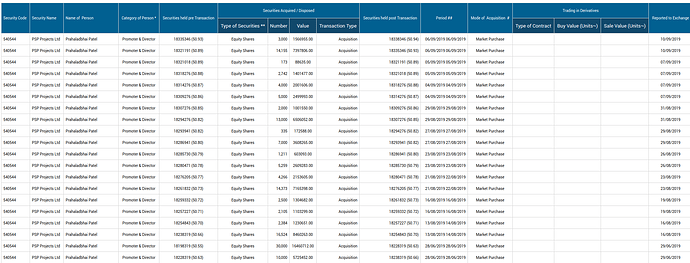

Received orders worth Rs.572.17 crores

PSP came out with very good Q3 numbers. Detailed investor presentation below.

Does the stock appear reasonably priced at 387? Its about 17 PE for FY’19 estimated earnings.

Pretty good Numbers from PSP

Regarding Valuations , i think market will rate it on Order Book basis. Currently a large part of book is for Surat Diamond Bourse and thus risks of limited geographic and revenue diversity.

Current Order book around 2700 Cr and thus good visibility for 2-3 Years.

Need to monitor New Orders closely. In my view , Markets does not give premium if long term visibility is uncertain.

Thanks Bharat! The way I see it - Because of opportunity size and good reputation of PSP with corporates, order book is most likely to be taken care. I came across a report from Edelweiss which quotes “RoCE of 33 per cent and RoE of 25 per cent in FY20E” . This sort of metric appear quite impressive

Read more at:

//economictimes.indiatimes.com/articleshow/67621920.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

surat daimond project will be finished by this year end. If company wants to show more revenue, then winning projects > 1000 crs is a must. Until there is a visibility on orders market will not give premium.

they have guided to get orders above 1200 cr in 1819 which is in line …regrading big orders , after Surat diamond project they will be formally eligible to bid for higher order

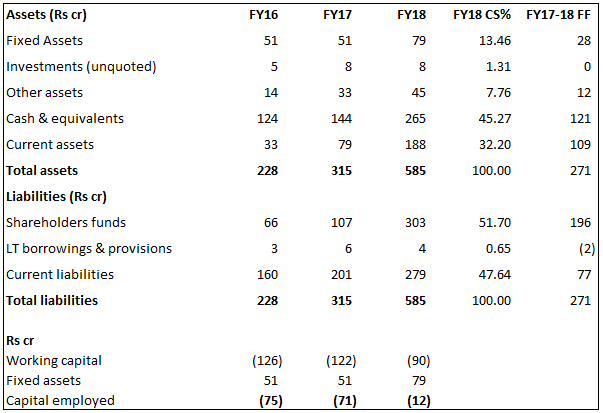

Was just going through the annual report and noticed something interesting. Il just put the balance sheets of the Company here:

Note that I have re-classified certain certain amounts to reflect what I think is the correct way to analyse Current Assets/Liabilities. For example, the balance sheet would classify the current portion of long term debt (i.e. due in the next 12 months), but I would not include that in current liabilities due to nature of the loan being long term. Working capital loan will remain part of current liabilities.

If you view the fixed assets of a company as its engine, then working capital of the company is its fuel. The total of fixed assets and working capital of the company is actually negative for PSP. This is primarily because of Mobilisation money and other advances received from clients. In effect the company is generating a nearly Rs1000 crore turnover on other peoples money.

It is also testament to Company’s value proposition to its clients that allows it to command this kind of a premium in the market.

Another good results from PSP need to listen to concall for future guidance

Latest research report by HDFC

company has received letter of intent (LOI) of work worth i 601.40 crores (excluding GST) for Planning, Designing and Construction of Flat Type High Rise Buildings cum Commercial units including on site development with all infrastructure Services for 6348 Economical Weaker Section (EWS) Housing Units under Pradhan Mantri Awas Yojana (PMAY) at site no. 124A Chavindra/Pogaon Bhiwandi, Maharashtra.

PS Patel, CMD, PSP Projects says Rs 607 cr orders to be completed over 36 mths; Margin on new orders to be in range of 12-13%, 85% of the co’s orderbook is from Gujarat & expect Rs 700-750 cr rev fm Diamond Bourse proj in FY20

PSP Projects AGM 2019 notes.

Currently capable of 45-50 projects

Current Avg Ticket 25Cr+ for Ahmedabad, 50Cr+ Outside Ahmedabad, 200cr+ Outside Gujarat

Aim to bring outgoing projects down to 25-30 with average ticket-size 100cr in the long run

Would not bid for low margin projects in Govt, focused on Marquee govt projects.

Would remain pure building contractor, no plans to get into infrastructure space

Current skew is towards pvt/institutional projects, but going forward they see 40% contribution from Housing & Govt projects, so if required term loans (working capital) would be taken

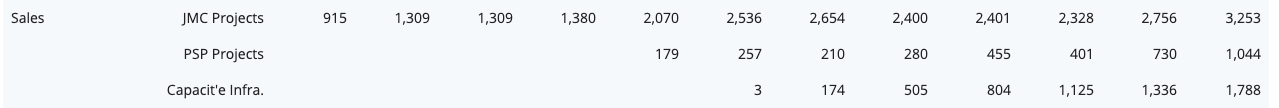

Major competitors for 100-500cr ticket size projects: shapoorji pallonji, JMC, Capacite etc…

Always looking for new technology adoption

Management seems very proud of MRF project and repeat order

Currently 11% revenue is from outside Gujarat, going forward plan to increase this to 30%

Currently qualified to bid for projects upto around 700cr, after SDB handover would be qualified for projects worth 2000 crs

They expect growth to be around 30-35%

One site is fully managed by Females

There is RM & Labour price escalation/passthru clause in pvt projects, but in Govt projects no such clause. But the company chooses and bid selectively. they never bid if margins are below a certain threshold

There has been some delay (6-8months) in SDB project, they expect the project to be completed by Dec 2020 (or was it 2019, forgot the year)

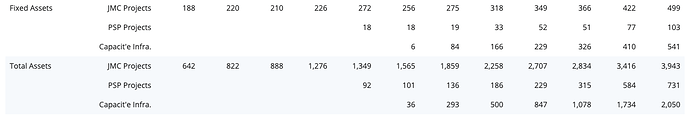

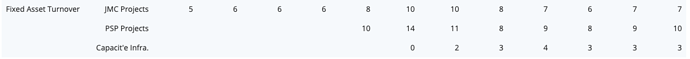

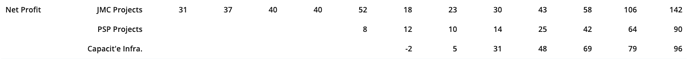

Thank you for sharing the notes. Apart from Shapoorji Pallonji, was stuck trying to figure out who the other competition was. Thanks for clarifying that. One thing that struck me was the FAT and ROCE in comparison with the competition.

What does the company do differently to maintain such ROCE and FAT? Is it just because of a different kind of revenue mix (JMC Projects also seems to be present in the Infra space and Capacite seems to be focussed on building high-rises)? Or does the geographical concentration allow the company to sweat its assets better and a thing to be monitored as the company expands outside Gujarat more?

Would love to hear some insights on this from @Vivek_6954 and other experienced forum members tracking this story.

Disc: Invested.

So far the co focus on pvt sector clients from where it generated good advance and also has RM pass through clause enabling ito come out with such good nos. Stellar reputation for high quality and timely completion of projects attracted lot of pvt sector clients,

There is a lot of hullabaloo about the high cost of the SBD project from buyers (reported in various Gujarati newspapers). Apparently the cost has ballooned to around 8k instead of the 6k that people were expecting / guided for. Don’t know if PSP is in any way responsible, or will be affected by the uproar.

As per my understanding, PSP is an EPC player who executes on cost plus basis and not a developer. Therefore, extra cost is borne by the project owner and not PSP.

That may be true, but questions are being raised as to why the cost is so high. What led to such a huge increase?

I am not sure whether it’s the pure construction cost that’s increased or something else related to the project though.

If it’s the construction cost itself, it’s definitely a negative for PSP, for me. Either they are inefficient, or there is something else going on that is not above board.

After looking at this company, I concluded the same - winning big projects is must if they have to grow well for the next 5/10 years.

The competition in 1000 crore space would be from stronger players across India. To conquer this space, management must have bandwidth, depth, integrity, and diversity (ability to recruit top talents across India). This is probably where many <5000 Crore Market Cap companies get stuck. Even if opportunities are plenty, only very few become 1,00,000 crore Market Cap.

Disc: Investigating. No conviction to invest at that time. Main concern is managements ability to scale and execute multiple, geographically spread out, large projects well.

Views Invited.

Results https://www.bseindia.com/xml-data/corpfiling/AttachLive/68732423-39de-4c4c-8af3-ddc21d72c4a7.pdf

Although P&L look good the balance sheet and cashflow seem to be deteriorating.