Copying all the discussions and data points related to Pokarna from the WA group and continuing the discussion here.

[7:05 PM, 12/23/2020] Amit Rupani: I have captured their last 4-5 years of US exports data and have closely followed their recent legal battle in the US.

I can contribute in these couple of areas.

If you guys need any help in these areas, holler me.

[9:21 PM, 12/23/2020] Anant Jain: Have you looked at their products and the competition in USA?

[9:22 PM, 12/23/2020] Anant Jain: Also in terms of distribution anything that you have discovered?

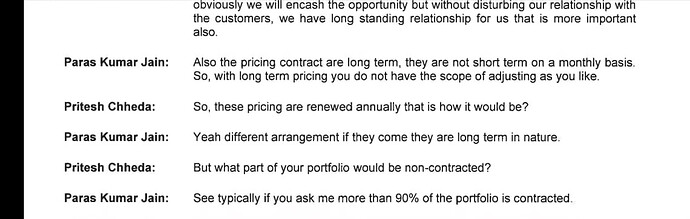

[9:23 PM, 12/23/2020] Anant Jain: What is very evident to me is the growth of Pokarna is strongly tied to how Wilsonart grows in US. Wilsonart is Pokarnas largest client and the two had same legal counsel during the litigation

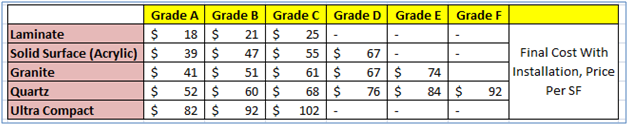

[9:48 PM, 12/23/2020] Rupesh Tatiya: Another thing you can find out is final cost to customer on per sqft basis. Granite vs Quartz. Cambria, Caesorstone vs rest.

Based on conf calls, cost of installation comes to 75-150$ per sqft but Pokarna makes only 6-8$ per sqft.

All the money is in fabrication, distribution and installation.

Are customers continue to likely to choose Quartz, that js the end goal?

[9:48 PM, 12/23/2020] Rupesh Tatiya: Can more manufacturing move out of US and to Pokarna?

[9:49 PM, 12/23/2020] Rupesh Tatiya: Also the price delta between plain vanilla slab vs pre fabricated slab

[9:52 PM, 12/23/2020] Anant Jain: This will also establish that price of Quartz from Bretonston which is expensive as compared to Chinese quartz ($10 vs $5) does not matter.

[9:52 PM, 12/23/2020] Anant Jain: Cambria I heard is around $30

[9:52 PM, 12/23/2020] Anant Jain: and in a different league

[10:00 PM, 12/23/2020] Amit Rupani: I’ve personal experience with selecting between Quartz and Granite for my home when we were building it 4 years back. Away from my PC. Will share details soon.

[10:02 PM, 12/23/2020] Anant Jain: Personal experience details will be superb. Can you also find out how the market is? Quartz in US was growing at 25% to 30% from 2014 to 2019 replacing granite. Now that growth is expected to come down to 5%

[9:13 AM, 12/24/2020] Amit Rupani: I went and visited 3-4 biggest stone wholesalers in Charlotte for our kitchen countertop. These 3-4 biggest stone wholesalers were contracted by my builder. So I had option to pick slab from any of them. They had huge warehouses with good options for both Quartz and Granite.

Salesmen just knew about which country stone came from. Nothing more. They don’t know if its Cambria, Ceaserstone, or Quantra. My belief is that these were regional wholesalers. Main wholesalers like WilsonArt would be able to tell whether its Pokarna’s product or not.

Most of the Quartz options were from Italy and Brazil. Whereas, most Granite options were from India. Indian granite was standing out among all with many exotic designs.

Sales people don’t sell based on brand. They s…

[9:15 AM, 12/24/2020] Amit Rupani: True. Wilsonart is number 1 by big margin for Quartz. Pokarna does good business with Dal Tile for Granite.

[9:18 AM, 12/24/2020] Rupesh Tatiya: WilsonArt is #1 of Pokarna or #1 in US market ?

[9:20 AM, 12/24/2020] Amit Rupani: Last mile installer makes good chunk of all. Then fabricator.

Remember labor is very expensive in the US. And specialized labor is even more expensive.

Quartz will cost almost 50%-60% more than Granite. In some cases even double.

[9:22 AM, 12/24/2020] Amit Rupani: sorry not getting your question

[9:23 AM, 12/24/2020] Amit Rupani: don’t have exact number but I can find out…i know that more bigger slabs command higher price for both granite and quartz

[9:27 AM, 12/24/2020] Rupesh Tatiya: Manufacturing and product cost is very small in the entire value chain. I see - no motivation for US players to put manufacturing plants in US.

[9:31 AM, 12/24/2020] Amit Rupani: We have to look at it from 3 angles; Enterprise (hospitals, sports stadiums, business buildings, etc), New Home Constructions, Renovation.

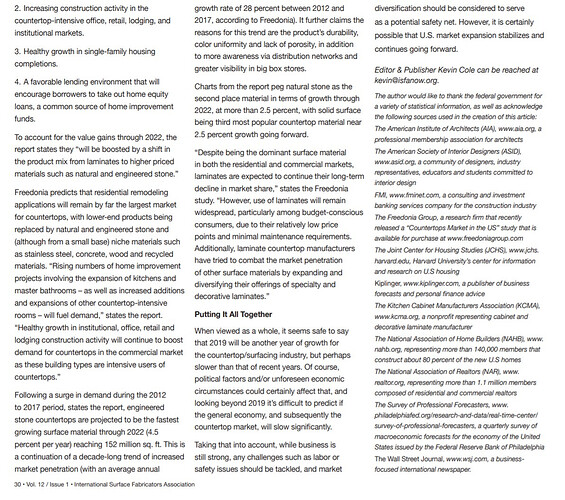

New Home Construction and Renovation businesses are probably seeing best boom time of their lives. And 2021 should be even better for new home construction. This market is red hot man.

Enterprise will be slow.

Where are you hearing/reading that Quartz will grow only at 5%?

After Christmas I will stop by few local mom&pop fabricators and installers near my home and check what their order book is looking like.

[9:32 AM, 12/24/2020] Amit Rupani: #1 for Pokarna…not sure about #1 in US

[9:35 AM, 12/24/2020] Amit Rupani: I don’t think new capacity will come over here, especially for a commodity product for which China and India will always undercut them.

Labor cost is their biggest challenge.

[9:43 AM, 12/24/2020] Anant Jain: From a research report.

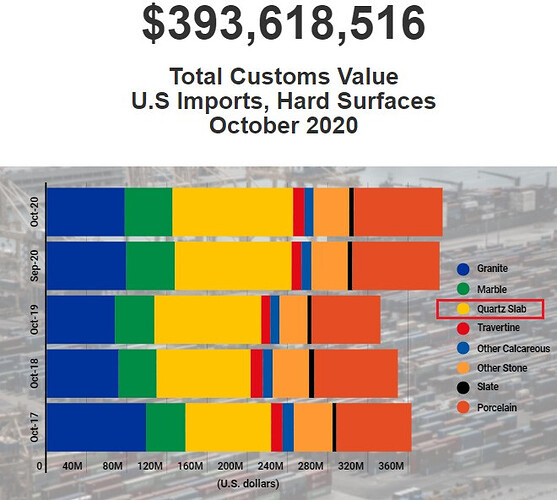

[9:44 AM, 12/24/2020] Anant Jain: The reason for quartz high growth was it was replacing granite very fast. Now quartz is like 85% to 90% of the market

[9:50 AM, 12/24/2020] Amit Rupani: The number of new houses that will be built in 2021 will be significantly higher than last 3-4 years…2021 shall break many new construction records…we will see…but there is lots of immediate demand potential there

80-85% for new construction homes in last 5-6 years…80-85% not in ALL homes…remember there are many old homes that will be renovated and existing countertops with granite that will be replaced with Quartz in future…there is no math to account for this demand

For next 1-2 years demand should be robust and 5% looks very conservative number given the way wind is blowing in housing market here

[9:50 AM, 12/24/2020] Anant Jain: makes sense

10:13 AM, 12/24/2020] Amit Rupani:

I wanted a 10’x1’ stone for a small project in our basement area. I was lucky to find a beautiful remnant Quartz piece at the fabricator’s place. I paid ~$400 for stone + fabrication + installation. It costed me about $40 per sqft. But it was a remnant piece which perfectly fit my requirements.

If this piece was fabricated from a regular slab of quartz stone, it would have easily costed me $1800 to $2000.

There are also $200-$250 per sq ft granite pieces but they are super exotic with amazing natural designs. Ultra wealthy go for granite than quartz because of its natural variation and aesthetics.

Quartz is your “tikau” but little more pricey than granite…an average middle class can afford Quartz here and is willing to pay-up a little for its superiority and hence its in-demand than Granite.

The story of Pokarna is really simple - capex coming online, normalization of earnings post USITC investigation episode and re-rating supported by decent tailwinds in terms of end industry demand.

Capex

Pokarna is undertaking capex of ~350-400cr which was supposed to come online in Dec 2020 as per AR20. (Originally supposed to come online in Mar 2020, delayed by 9 months).

This project would increase the Quartz capacity by 130% of existing capacity. Original capacity is ~ 6-7mn. New capacity would be 8-9mn taking total capacity to 15mn. This would be 10% of total US demand of 150mn.

Existing revenue from Quartz is ~316cr, revenue from new plant would be ~400cr as peak capacity utilization. Quartz has consistently had EBITDA margins of 40%, so new capacity would add ~160cr in EBITDA thus taking the EBITDA from ~150cr to 300cr. The company is available at EV of ~780cr as of today.

Assuming additional depreciation of ~40cr and interest cost of ~40cr, PAT would be ~60cr after taxes. So PAT can go from ~80cr to ~140cr once capex comes online. Current MCap is ~527cr.

If one goes through older conf calls, the new plant would be latest and greatest from Bretton and it would have more efficiency and more capability to do new designs. Management has hinted that margins from new plant can go to 45-50% in past conf calls.

Normalization

In FY20, whatever could go wrong for the company has gone wrong. Cambria filed petition against India for anti-dumping and for brief period Indian producers had very high duties. Due to this, company suffered in Q3/Q4 FY20 and Q1 FY21 - where quarterly PAT run rate of ~20cr went down to ~5cr. The case is now settled and Pokarna has total duties of ~5%. Q2 FY21 has already shown some normalization with PAT run rate going back to ~20cr.

Demand

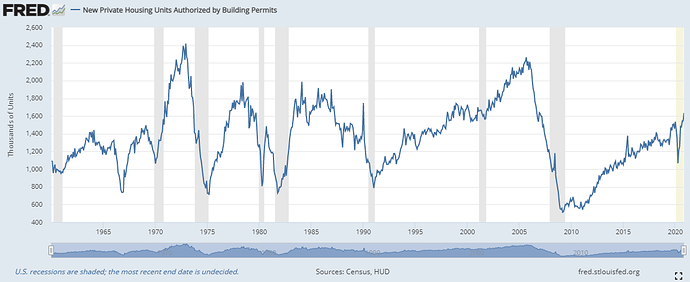

If one goes through the commentaries of US based surface players (Caersarstone, Select Interior Concepts - SIC) and also home players (Home Depot, Toll Brothers, Pulte) - there is a very strong demand for new construction as well as renovation. There is also shift from Granite/Laminates to Quartz.

Duty on Chinese Products

Chinese producers face 100%+ import duties in the US and Chinese supply has gone down significantly. Some of this supply seems to be captured by Vietnam, Turkey etc. Coming to Pokarna, the benefit from this China supply shortage would not be very high. Pokarna plays into mid mass segment and not in low value entry segment. Also all of its products are from Bretton. China has no Bretton products. Aro Industries is a small company which might be a play on China supply captured by Indian players. Aro only does Chinese equipment and no Bretton.

Granite

Granite side business is suffering due to over capacity from Brazil and currency depreciation. Granite business would perform as per currency movements and demand pattern - whether demand is more for Indian colors or Brazilian colors. Even in Granite - company is trying to do cut-to-size slabs which have higher margins and more complex designs.

Quantra

Company has ambition to scale up Quantra brand Indian market and some decent hiring has happened. This is medium to long term story and need to see how Indian market adopts to it.

Stanza

The textile business - Stanza - is still with the company and they have talked over the years about selling it. Looking at promoter family history (largest distributor of Raymond, fashion focus), it might not happen. Investors have to live with this. If this gets sold/demerged - that would be a great thing.

Debt

Debt is THE serious risk to the whole story. The company has also hinted about doing equity dilution to reduce debt in the past conf calls. But this is a chicken and egg problem - that until they get good valuation they would not want to dilute and without PAT numbers valuation would not increase.

If we are able to get a meeting with Promoters (Gautam Chand/Paras), the only real thing I want to know is - are they ready to get their act together and ready to create MCAP?

Will add more finer things later …

I will share some key monitorable items to assess private residential demand scenario in the US:

- New Private Housing Units Authorized by Building Permits: Building permits represent the number of new privately-owned housing units authorized by building permits in the United States. As of Nov 2020 data the ongoing rate is 1.635mn units issued which is seasonally adjusted annual rate. This dipped around 1mn in April but has bounced back strongly and now above Feb levels. 2005 peak was at 2.2mn and we are far away from it. However, trend for last 10 years is clearly in uptrend.

Source: New Privately-Owned Housing Units Authorized in Permit-Issuing Places: Total Units (PERMIT) | FRED | St. Louis Fed

- Existing Home Sales: The data reflect the number of homes that have previously been constructed and are now being resold. There are two reasons to monitor it. Firstly, lower existing home inventory will push demand higher for building new homes needed more countertops. Secondly, people buying existing home are more likely to upgrade their kitchens and bathrooms to their likings pushing demand for countertops. Its trajectory is same as building permits issued. It’s been in uptrend for last decade but plummeted heavily in March/April and now back above Feb levels.

Source: United States Existing Home Sales - April 2022 Data - 1968-2021 Historical

Interest Rates are historic low and it should keep existing housing momentum going for next 6-12 months.

@rupeshtatiya - thank you for the write-up and kicking-off the discussion.

Any idea when exactly is their new quartz capacity going into utilization?

My biggest worry here is for any delay in new production ramp-up becoming spoilsport to the story. Back in 2010 things were different with launching brand new line of business of Quartz, but it took them a while to ramp it up to ~40-50% utilization levels by 2015. Now as their Quartz business is a decade old, hopefully, it shouldn’t take them so long to utilize the capacity to decent levels.

China impact: This is one story where I see no China impact. Since the price of quartz/granite slab is less than 20% of the total cost of installation a lower priced cost will not have significant impact. Basically the price of the material is almost immaterial. Pokarna grew very strongly along with the Chinese until the time duties came.

Granite: granite market is shrinking and is eaten away by Quartz along with Brazil impact.

Quantra: One key monitorable in US market is whether the Quantra brand has any traction.

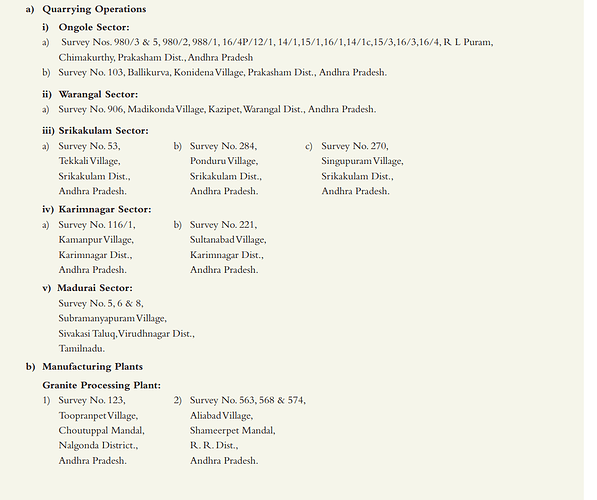

Risks: I would not say that debt is an issue given the ability of the business to generate FCF going ahead. The company at optimum capacity utilization can generate cash flow in excess of 300 cr. The key monitorable IMO are the ramping up of operations from the newer facility. The other thing to understand would be that the growth is not linear and requires large capex. So how the company plans its next phase of growth. Along with this the management has a track record of over promise and under delivery consistently. The current capex was expected to come on stream some where in 2018. The company had also announced demerger of Stanza but rolled it back. What is also interesting is that Paras Jain who runs the key subsidiary Pokarna Engineered Stone and a KMP is not from family and some how gives the impression that the next generation is either not considered competent or is there a discord in the family.

The interesting thing is - in one of the old conf calls management management had said that they expect 60% capacity utilization in first full year of operation. They also talk about trying to do some very difficult products and innovation - which would lead to better margins.

The company expects the breakeven to happen at 50-60% utilization.

Some comments from management on competitive advantages - proprietary modifications to the line, best quality Quartz available in India.

Some more comments on competitive advantage w.r.t. Caesarstone - captive Quartz deposits in India.

Advantage against Chinese players - Look and performance of the product is a lot better with Bretton.

90% of the Quartz revenue comes from contracts.

Since management has stopped communication, we don’t get any updates. Following is one article published in Stone World in Oct 2020.

Few salient points from the article -

- Have 100 designs that respond to various customer demands and trends

- Launched 8 new designs in Calacatta, raising the bar

- Aggressive plans for 2021, more launches

- New production facility would be used for Jumbo (330 x 165) and Super Jumbo (346 x 200) slabs

- Vizag Quartz - installing most advanced slab trimming, calibration and polishing machines from Bretton. Reorganization of floor to improve efficiency.

The point of all this circus is to show that Pokarna business quality in itself is pretty good. How the heck did management allow business to get to these valuation is a question to ponder?

They have high margins, several designs/innovations, proprietary processes, 90% contracted revenues, not playing in commodity/lower end of the market, focus on efficiency, optionality with domestic business - Quantra and Ikea.

Will the intrinsic value of the business come out and get converted into MCAP?

I have set-up an in-person appointment this Monday with Home Depot kitchen associate. I will inquire for a dummy project and get a quote of different stones and brands to get an idea of what the popular category is and the ongoing rate and what their ongoing project turnaround time is.

Below is the list of questions so far:

- What is the ongoing popular countertop category is?

- Get introduction of their popular brands for quartz vs granite of different origins.

- Get quote for starting/mid-range/top-range of each stone options, and their fabrication and installation. Make sure to include quote for Cambria and Caesarstone.

- Any quartz availability that is made in China?

If you can think of any questions, please let me know.

Above scuttle-but will give us an idea of what things look like from renovation standpoint. I will visit few some other mom&pop places as well to get an idea of current renovation demand in my area.

And in first week of Jan will visit 3-4 regional wholesalers in my city to get an idea of what things look like at their end for new housing construction demand.

Another thing to establish is why Pokarna sells. The story earlier was Bretonstone but now that there is competition coming out with Breton one needs to understand and establish why would people be interested in Pokarna. I was in Aro granite conf. call and as per them the quality difference between Bretona and Chinese has reduced significantly. The other explanation we got was that Pokarna’s designs are superior when compared to competition an it takes a lot of effort to come up with the designs, @rupaniamit would be helpful if you can take a look/feel of how it is different.

Also if possible from WilsonArt. I dont know how it works in US but can you ask about the origin of stone from India/China etc.

Let us also list what all data we would want to get our hands on. To start with some basic market data:

a) Quartz vs Granite market share over the years in countertop markets.

b) Pokarna sales in different segments as pointed out by Amit

c) Pokarna clients

d) Price differential for various products:

-

Quartz vs Granite vs Porcelain

-

Cambria/Ceaserstone/WilsonArt/Others

-

Chinese vs Bretonstone (for similar designs)

-

Any data on domestic Quartz sales

-

US import data for quartz/granite

Pokarna Specific:

- Quartz vs Granite exports value and volume

You guys can keep adding to the list.

Thanks @Anant for above questions. I will make an edit to my question list and add them appropriately.

Good news is that I found few local sellers of Wilsonart in my city. I will head to some of them soon to cover for Wilsonart questions.

Ceaserstone latest presentation. Covers a lot of data point, would be easy to derive Quartz volume sales/Quartz vs Granite and other info.

Pokarna Scuttlebut Notes

Date: 28th Dec, 2020

Location: Home Depot, Rock Hill, South Carolina

• Counter-top Home Depot Quote. Quote includes Material + Fabrication + Installation.

• Brands available in Home Depot:

o Solid Surface: WilsonArt, HI-MACS, Corian

o Granite: Cambria, Stonemark,

o Quartz: Cambria, Caeserstone, Silestone, Viatera

o Ultra Compact: Dekton

(HI-MACS and Viatera are brands of LG Hausys. Sileston and Dekton are brands of Cosentino Group)

• Ultra Compact stone is a new premium stone that has been recently introduced under Dekton brand. Its composition is same but its UV rays and scratch proof. It’s considered even more durable stone than Quartz.

• Most of Stonemark’s granite was from India and Brazil.

• Most of Quartz stones were from Spain, Italy, and USA.

• Ultra Compact stones were from Spain.

• Designer mentioned that she has never seen Cambria brand on sale compared to other competitor brands.

• Cambria also had a huge display right at the entrance of Home Depot to promote their products.

• Quartz is the most popular category in countertops among buyers

• Turnaround time from start to finish is 5 weeks. Fabricators are running at turnaround time of 3 weeks due to Covid issues.

• They did not have any stone countertop category that was Made in China

• At this moment they didn’t have countertop options under Porcelain material

Personal Observations:

• Quartz and Granite have gotten about 20%-30% cheaper than what they were 4 years back when I was in the market looking for countertop options. This means Quartz should be more affordable now for even larger audience.

• Quartz designs that are available now are much better. The natural variation like Granite stone was visible in high-end Quartz stone. This was missing 4 years back. Looks like there has been technological advances to make Quartz designs better.

Bottom-line: Brand doesn’t matter to an end customer. All that matters is exclusive and exotic design in a stone.

Next Steps: Next week I will visit Wilsonart dealer and couple of large regional wholesaler/fabricators in my area.

Guys,

Thanks for the excellent summary from Rupesh, and the questions bank/scuttlebutt from Amit and Anant.

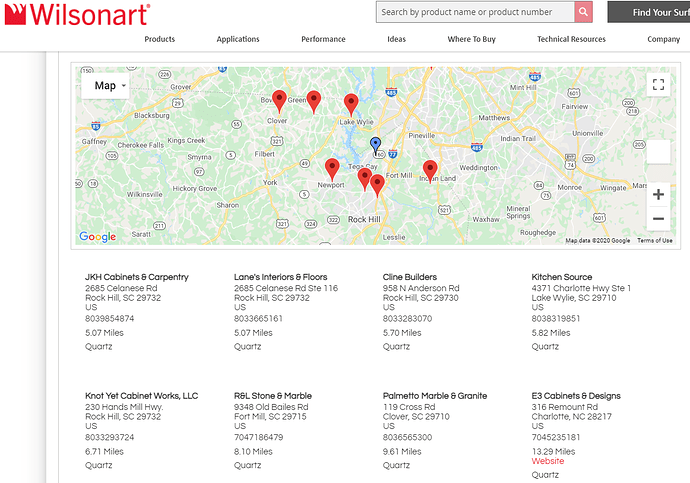

I had a question on their captive 10+ captive quarries mentioned.

Do we have any further granular details on them, leases, competition, environmental, risks, if any.

Are the factories located close to the captive quarries.

From FY20 AR,

The lease period is 15/20 years depending upon the state. The renewals to the same owner happens two times after the lease period expires without any competitive auction process. In general there are no major environment/competitive risks.