Good Result

Q2 FY2024.pdf (1.5 MB)

PIRAMAL PHARMA Q2 results highlights -

Revenues - 1911 vs 1720 cr, up 11 pc

Revenues breakup -

CDMO - 1068 vs 940 cr, up 14 pc

Complex Hospital Generics (CHG) - 589 vs 562 cr, up 5 pc

India Consumer health (ICH) - 256 vs 227 cr, up 13 pc

Gross Margins @ 66 pc

EBITDA - 315 vs 219 cr, up 44 pc !!!

EBITDA margins @ 16 vs 13 pc ( significant improvement ). Margins in Q1 were a paltry 10 pc

PAT - 5 vs (-) 37 cr

Completed rights issue in Q2 for 1050 cr. Debt reduced by 958 cr to 3823 cr - thank GOD !!! . Need to do a lot more here in future

H2 is always better than H1 for the company. Q4 is the best

CDMO Highlights -

Have recieved 40 pc higher orders in H1 this yr vs LY. Newer orders have a good proportion of contract manufacturing of on-patent molecules

Contract manufacturing of Generic APIs - also doing well

Five of company’s CDMO facilities have successfully closed USFDA inspections since Nov 22 - Digiwal, Pithampur, Sellersville, Riverview, Lexington ( these contribute to half of CDMO revenues )

Current proportion of CDMO business involved in on-patent / NCE manufacturing / development at 44 pc vs 35 pc 2 yrs ago

CHG highlights -

Expanding capacities to meet the increasing demand for Inhalation Anesthesia products

Maintained leadership positions in Sevoflurane ( 44 pc Mkt share ) and Baclofen ( 76 pc mkt share ) in US Mkt

Have a product pipeline of 28 injectable products in various stages of development

Concluded USFDA inspection at Bethlehem facility which makes CHGs ( received 02 minor observations )

ICG -

Spent 14 pc of ICH revenues on promotions / Ads

Power brands include -

Littles - grew 19 pc in Q2

Lacto Calamine - grew 24 pc in Q2

Polycrol

Tetmosol

I-Range ( I-Pill, I- Can etc )

Power brands grew 15 pc in H1 and contributed to 42 pc of ICH sales

E- Comm grew 34 pc in Q2 and formed 14 pc of ICH sales. Have presence across 20 E-commerce platforms including own channel ( http://Wellify.in )

Have launched over 100 new products in last 3 yrs. New products launched in last 2 yrs form 20 pc of ICH business

Management comments -

Expect high teens YoY revenue growth in H2 with material EBITDA margin expansion. LY H2 EBITDA margins were around 16 odd pc !!! ( Extrapolation - suppose the revenue grows by 15 pc, EBITDA expands by 200 BPS - H2 EBITDA can be around - 810 cr. Full FY EBITDA to be around 1200 cr vs 840 cr LY - that would be a big Jump )

As innovation component increases in CDMO business going fwd, margins in CDMO business likely to expand over next 1,2,3 yrs

As ICH business crosses 1000 cr / yr revenues, margins here should grow incrementally every year. Currently, margins in single digits

Currently, road to deleveraging mapped via internal accruals. No asset monetisation lined up

Asst turns to improve substantially as revenues keep growing

Capex retirements to be also met from internal accruals

Company operates a total of 17 sites across the three businesses - helps de-risk the business. Also helps serve customer preferences

Mid 20s EBITDA margins are feasible in the medium term - Nandini Piramal

Current interest outgo @ aprox $ 44- 48 million/yr

Macro trends on biotech funding still not back to pre-COVID levels. Big Pharma spending is back

Currently, employee cost @ 27 pc of revenues. Likely to come down only when operating leverage kicks in

Medium term ROCE potential is about high teens - should be achieved as EBITDA crosses 23-24 odd pc

Innovator CDMO to outgrow generic CMO - in all probability

Disc - holding, biased, not SEBI registered

Piramal Pharma - Annual Report - 2022-23 summary -

Has 17 manufacturing locations

Distribution network spread over 100 countries

Works under 3 segments -

CDMO business

Complex Hospital Generics ( CHG )

India Consumer Healthcare ( ICH )

Has a JV with AbbVie in India ( holds 49 pc stake )- one of the Mkt leaders in Ophthalmology in India

Has a 33 pc stake in Yapan Bio - operates in biologics/ bio therapeutics and vaccines space

Revenue break up -

North America - 45 pc

Europe - 20 pc

Japan - 4 pc

India - 20 pc

Others - 11 pc

69 pc sales from regulated markets

Segment wise revenue break up -

CDMO - 56 pc

CHG - 32 pc

ICH - 12 pc

CDMO -

Offer CDMO services in High potent APIs, Antibody Drug conjugates, Peptides, sterile injectables and hormonal products

Manufacturing facilities located across India, UK, North America. Have a deep customer base across - Big Pharma, Bio-Techs and Generic Pharma majors

Have successfully cleared 36 regulatory inspections since 2022

Company also offers CRO services from its facility at Ahmedabad

Also makes 30 off patent APIs for global clients. Also makes Vitamin / Minerals ingredients and premixes for human and animal nutrition

Top 5 customers contribute 25 pc of CDMO revenues. Breakdown of revenues from Discovery:Development:Manufacturing currently at - 5:30:65 ( includes generic and on-patent manufacturing ). Currently, company is manufacturing 18 on Patent commercial molecules. Company also has 35+ molecules in Phase - 3 development phase right now

Within CDMO segment, revenue breakup is as follows -

US- 47 pc

Europe - 27 pc

Japan - 3 pc

India - 14 pc

Others - 9 pc

Among the 30 pc CDMO revenues that come from Development services, the breakdown is as follows -

Pre Clinical - 20 pc

Phase -1 - 25 pc

Phase -2 - 12 pc

Phase - 3 - 43 pc

CHG -

Has a portfolio of 35 hospital focussed products in areas of Inhalation anaesthesia, Injectable anaesthesia, pain management, Intrathecal therapy (delivering pain killers directly at spinal cord) and other injectables - sold across 6000 hospitals

PPL is 4th largest company in global Mkts for inhalation anaesthesia - Sevoflurane, Desflurane, Isoflurane and Halothane

Biggest player in Sevoflurane (inhalation product - 40 pc Mkt share ) and Baclofen ( pre-filled syringes - 78 pc mkt share ) in US mkt

Both - inhalation and intrathecal therapies are complex and capital Intensive

Vertically integrated - in inhalation products. Company to continuously intensify efforts to increase the degree of vertical integration so as to sharpen its competitive edge

Has a direct sales for in US

Product pipeline of > 25 SKUs in the CHG segment

In process of expanding capacities at Dahej and Digwal facilities. Dahej makes KSMs for inhalation anaesthesia products while Digwal facility makes the APIs

Company’s Fentanyl brand ranks No-1 in Japan, RSA and Indonesia

Sales break up of CHG sales -

US- 56 pc

Europe - 17 pc

Japan - 4 pc

India - 6 pc

Others - 17 pc

ICH -

Has over 30 different OTC products with multiple SKUs. Mainly present in categories like - analgesics, skincare, Vit/Minerals, women’s health, Digestives, Hygiene and protection. Also has manufacturing and distribution rights for Supradyn, Saridon, Becozym and Bensdon from Bayer Pharma

Own power brands include - I-Pill, I-Range, Lactocalamine, Littles, Tetmosol, Polycrol. Company has introduced Littles baby diapers. If they find traction in the Mkt, the company may end up having a huge winner at hand

Other brands include - NIXIT, Joint Flex etc

Now strengthening presence in E-Comm, Modern trade channels

Company spending / investing aggressively behind brands. Not averse to acquisitions in this space provided the financial conditions of the company allow for the same

Company Infra -

Manufacturing facilities -

US - 04

UK - 02

Canada - 01

India - 10 ( including R&D site )

Total employee count - 6200

Industry trends -

CDMO - industry snapshot - grew at 7 pc CAGR from 2016 - 21 from $100 billion to $135 billion. Did outgrow global Pharma Industry growth of 4 odd pc during this period. Likely to be a $ 180 billion + industry by 2026

The trend of outsourcing the development and manufacturing is gaining traction by the day. Its a win win for Innovators and their CDMO partners

Compex Generics ( difficult to make APIs, routes of administration, complex - drug + device combo ) Mkt snap shot -

Mkt currently valued at $ 70 billion, grew by 12 pc CAGR from 2017-22. Likely to be a & 120 billion plus industry by 2026. Complexity in manufacturing and capital intensity are key entry barriers here

Among complex generics, complex hospital generics form the bulk of the Mkt with share of 70-80 pc

Cumulative size of - Sevoflurane, Isoflurane, Desflurane and halothane is aprox $ 1.09 billion with sevoflurane constituting 84 pc of the Mkt

Due high capital intensity, requirements of backward integration, difficulty in making devices like vaporisers etc - competition is limited. AbbVie, Baxter, PPL and Lunan are the only players in the Mkt at present

Intrathecal therapy - gaining traction in recent years. Two popular products are - Morphine Sulphate, Baclofen. Baclofen’s Mkt size in US in 2022 was aprox $ 33 million

Indian OTC Industry -

Valued at $ 4 billion in FY 22, grew by 8 pc CAGR from 2017-22. Expected to be a $ 7 billion industry by 2026 due increased awareness and affordability

Company’s compliance track record -

04 USFDA inspections in FY 23. 02 inspections with zero observations. Other regulatory bodies also inspected PPL facilities ( like - MHRA, EMEA, Health Canada etc )with no major observations. Company successfully cleared 36 regulatory inspections in last FY

Disc - holding, biased, not SEBI registered

Revisiting my earlier hypothesis with subsequent developments

I subscribed to the rights issue just for kicks and also applied for more than my allocation. (20 percent more)

I got the full allocations including the extra.

Stock price has gone up 80 percent from issue price (81) to 140 presently.

Rights issue was fully subscribed and I read that the promoters applied for more than their current holding so they were able to increase their shareholding at a lower cost.

When the companies demerged into PEL and PPL i think there was a lot of bad loans on the balance sheet of the financial arm so more than proportionate debt was passed on to PPL and therefore PPL had to deleverage while PEL rebuilt it’s balance sheet with lower NPAs.

From a company strategy and promoter interest point of view this is demerger was very well executed but minority shareholders not so much.

Nandini piramal has started appearing in media interviews and the company PR will build her up to a well known well regarded business leader in the coming days.

For those who may not know the she is married to the current CEO and she handles the non core activities of the business ( QA, HR etc)

With Ajay piramals guiding hand over time this company will do well , whether that works for minority shareholders or not is a separate question

If we keep aside the 1-off misallocation of NPAs in between the 2 entities during demerger, I would like to get inputs from you all on Piramal management along the lines of 1)capital allocation, 2)business decisions(product growth, new opportunities, scaling up) & 3)ethics. Would be great to hear from anyone who might have met the management

There was no misallocation of NPAs. I am an investor from pre demerger and I did not find it unethical. Only people who played smart in picking up shorting or selling PEL and buying PPL were worried that they did not know about Loans. Promoters are ethical in my view they always inject money when business needs them.

They may make not so wise decisions but have no issues with management. They are building business slowly . The point to watch was the competition in the hospital injectible business. Gv goods prices have again hiked in Europe. The positive side they have nearshore ADCs, building consumer brands and have a emphasized textgood quality track record.

I added PPL at 80s and subscribed right issue. My understanding of business is not great but ADCs is the next good opportunity. At the low price, you don’t have to get into so much science. The more price you pay you need to be very sure of business and the performance of the future.

Disc: I am biased as Invested in PEL and PPL you can find my portfolio here

Can anyone share the latest Jefferies Report on Piramal Pharma Limited?

HDFC mutual fund has bought 8 lakh shares of piramal pharma on 15th March.

Sharing an in-depth article on the CDMO opportunity in India.

I hope you find it useful.

dr.vikas

Strong results for the quarter.

Results -

https://www.bseindia.com/xml-data/corpfiling/AttachLive/3564c28a-e817-49ca-b6ce-4f3868f0fc76.pdf

Investor presentation

Good results from PP. The innovation share of CDMO increased to 50 %, Integrated projects are now 40%, and Innovator business $116 M doubled. Piramal Pharma is back to 23% EBIDTA. Remember a year back some influencers were calling management incompetent, that was the best time to buy. In my opinion, they have the best assets to execute large orders of big pharma. Multicountry manufacturing is not easy but once you have mastered it then it benefits with big projects. Contract manufacturing esp of Pharma will go to large players and it will consolidate with few very large contract manufacturers of patent products.

Con Call Notes from Q4-FY24. CMP 154

-

EBITA Margin 17%

-

Interest cost not coming down in Q4 despite 1000 cr debt reduction in Q3-

- Overall rate has not come down

- Some interest on tax due to better outperformance (I did not get what it means, but it seems to be some sort of one-off part)

- Reduction in interest rate will contribute to lower interest rates in the future.

-

Capex of $87 million

-

Dahej capex is likely to come onstream by Q1-25

-

Investment in key starting material, debottlenecking for CHG

-

Capex will be similar to last year in FY25.

-

Innovative business 50%. Grown by 20 CAGR over last 3/4 years

-

40% of the order book is for integrated services (orders for more than one site)

-

Once biotech funding improves, growth will come back from emerging companies. This is not reflected in the current guidance

-

Visibility is higher than last year as compared to last yearly

-

Due to nature, PPL high inventory during Q1-Q3 but it goes off as proudct is shiiped to clients.

-

Peptide- Generic business is doing well and working towards getting into the on-patent business.

-

18 months back, PPL saw funding issues with Bio-tech and hence pivoted to big pharma. This pivot has helped in Fy24 with more business from big pharma.

-

PPL has been doing conjunction for over ten years

-

Biosecure has increased interest from clients in innovative patent work.

-

ADC- Number of large pharma visited in last six months. So expect to get business from them in the coming yearly

-

Most of CDMO’s capabilities are in place. So, future capabilities will be more brownfield.

-

Generic product capabilities are fungible for patent-related work if needed.

-

High fixed-cost business. Increased sales drive professionalism. CDMO and ICH will be drivers of the increase in profitability in the future.

India Consumer Business

- New products launches in e-commerce. Once they are successful then PPL will launch in general trade. They kill them if they do not meet target.

CHG (Hospital Generic)

- Incurring non-recurring expenses related to CHG, so cost - Cost of 8-9$ million

Outlook for Fy25

-

Early teen growth-

-

CDMO will be better than CHG

This is the best slide to track the company performance

My Take

As per Jan 2023 ppt

As per Jan 2023 presentation, revenue from commercial products

- FY20- $19 million

- Fy22- $56 million

- FY24- $116 million

Four-year CAGR- 55% CAGR

This shows that business can show a sharp uptick once the product becomes commercial. They have 33 manufacturers in phase 3. Even if 5-10 become commercial in the next 2-4 years, they could add 50-100 million in revenue. Due to the nature of the business, even one successful manufacturer could add that much business.

I get the impression the company is keen on expanding on patient businesses. Last year, two companies announced the commercialisation of two products. I think their business would have been a major driver of the increase in revenue for the patent business. As they launch their product in the market, and as the product gets better accepted, it is likely that these two recently launched products will give more business. I think the CDMO on-patent business shall be higher significantly again in FY25, even if there is no more product commercialisation in FY25.

Note- Invested

Piramal Pharma -

Q1 results and Concall highlights -

Revenues - 1971 vs 1787 cr, up 10 pc

EBITDA - 224 vs 171 cr , up 31 pc

Share of profit of associates - 22 vs 14 cr, up 56 pc

PAT - (-) 89 vs (-) 99 cr ( due heavy depreciation and finance costs )

Segment wise revenues -

CDMO - 1057 cr, up 18 pc ( seeing signs of revival in biotech funding. Also seeing steady inflow of orders for commercial manufacturing of on-patent molecules - a key positive ). Also seeing uptick in generic API business

CHG ( complex hospital generics ) - 631 cr, up 2 pc ( anesthesia products reported healthy volume growth in US and EMs - offset by price erosion in US ) Aim to keep expanding portfolio offerings and signing new in-licensing deals. Robust demand seen for Sevofluranne and Isoflurane

ICH ( India Consumer Health ) - 264 cr, up 10 pc ( launched 7 new products, power brands grew @ a strong 19 pc YoY ). New product launches include -

Littles - Baby Diapers

Littles - Baby Detergent

I-Active - Period panties

I-Feel - Intimate women wash

Bohem - men’s hair removal spray

Tri-Active - mosquito nets

Company’s power brands portfolio includes - Littles, I-Range, Tetmosol ( anti-fungal soaps and dusting powder ), Lactocalamine and Polycyrol ( antacids )

In general, 35 pc of company’s EBITDA comes from H1 and 65 pc comes from H2

**50 pc of company’s CDMO work is now innovation related ( ie related to on patent molecule manufacturing + Clinical trials of new molecules ) vs 35 pc in FY 20. Split between Development : On patent Commercial manufacturing is aprox 70:30. That means, on an annual basis - company is generating an aprox revenue of 700 cr from on Patent manufacturing on an annual basis **

19 pc of ICH segment sales come from E-Commerce. The E-comm channel grew by 37 pc YoY

Continue to maintain early teens guidance of growth in Topline and EBITDA and meaningful growth in PAT

Most of company’s sales promotion, advertising efforts in the ICH business are directed towards power brands. Other brands are likely to be in sustain mode

The Bio Secure Act passed in US should act as a tailwind for the company. However, the uptick in business should take some time

Q1 is always the weakest for the company. Business usually picks up from Q2. Expecting the same in FY 25 as well

If the interest rates start to trend downwards, the same will get reflected as savings on interest costs for the company

Company has a product pipeline of 17 products in the CHG business in US. Out of these, 05 are already approved

No of molecules in Phase - 1, 2, 3 development stages @ 68, 38, 33 - as on 31 Mar 24. This looks like a very healthy pipeline. Even if 10-15 molecules from the 33 molecules in phase 3 go into commercial production, company’s revenues from on patent manufacturing can potentially double in 2-3 yrs ( or go up by even higher percentage ) from 700 to > 1400 cr / yr

Disc: holding from lower levels, biased, not SEBI registered, not a buy/sell recommendation

HDFC Mutual Fund raise its stake from 5% to 7% on 29th July

Company Profile: The company has 17 manufacturing sites with presence in 100+ countries, 500 CDMO customers, 6000+ CHG hospitals and 180k ICH hospitals. As of FY24, the geographical revenue diversification is as follows: North America-41%, Europe-25%, India-20%, Japan-4%, Others-10%.

a) Q1 FY25 results: The company’s Q1 FY25 revenue from operations stood at Rs 1951 crores, up 12% YoY. EBITDA stood at Rs 224 crores, up 31% YoY, whereas EBITDA margins stood at 11% versus 10% YoY driven by operating leverage, cost optimization, and superior revenue mix… Net loss stood at Rs 89 crores versus 99 crores YoY. The company successfully closed the USFDA inspection at the Lexington facility with zero observations. As per CARE ratings, the company’s business intensity (revenue from operations divided by sum of net worth and debt) is expected to improve to 0.85x in FY26 versus 0.6-0.65x in the last three years.

B) Segmental Performance: Following is the detailed segmental performance overview of the company’s business:

CDMO Business (54% of revenues):

-

This segment’s revenues grew 18% YoY.

-

The business continues to witness steady order inflow momentum, particularly for on-patent commercial manufacturing. Management is also seeing early signs of a pick-up in biotech funding with increase in customer enquiries and visits, especially for differentiated offerings.

-

Profitability improved due to healthy revenue growth, better business mix and cost optimization initiatives. The company is also seeing YoY improvement in demand for its generic APIs.

-

Future investments will be geared towards differentiated offerings in ADC, peptides, and on-patent API development and manufacturing.

-

CDMO segment EBITDA margins have improved from 10% in FY23 to 15% in FY24. With around 34% of development revenue from phase III molecules, there is a high probability of these transitioning to product registration and commercial production. Also, 50% of the revenues came from innovation-related work and 64% revenues come from big pharma and emerging pharma. This provides visibility and stability on sales increasing by 10-15% in the near term and improvement in EBITDA margins by 100-200 bps.

-

In FY24, five of the company’s manufacturing facilities which contribute to over half of the CDMO revenues successfully cleared the USFDA inspection.

Complex Hospital Generics (32.3% of revenues):

-

This segment’s revenues grew 2% YoY.

-

The company saw robust demand for Sevoflurance (80% of the global IA market) and Isoflurane in emerging markets like Asia, Europe and RoW, which was partly offset by lower pricing in Sevoflurane in the US. 67% of FY24 CHG revenues came from inhalation anesthesia products and 51% came from the USA.

-

The company is undertaking capacity expansion in the inhalation anesthesia to meet the growing demand. The expected commercialization is in FY26.

-

The growth in the intrathecal portfolio (15% of FY24 CHG revenues) is led by new customer conversion. The company continues to command a 70% market share in intrathecal baclofen in the USA.

-

The company is also investing in portfolio expansion by developing specialty products and signing-in new licensing deals. It has a current pipeline of 24 new products which are at various stages of development and have an addressable market of $2 billion.

India Consumer Healthcare (13.5% of revenues):

-

This segment’s revenue grew 10% YoY.

-

The company added 7 new products and 10 new SKUs in its portfolio in Q1 FY25.

-

Power brands grew 19% YoY in Q1 FY25 and contributed 48% of ICH sales.

-

The company looks to widen its reach across general trade and is also strengthening its presence in alternate channels of distribution.

-

Profitability margins in this segment are in the low single digits. With the increase in sales, CARE ratings expect profitability margins to improve going forward.

C) Debt & Capex: The company’s capex plans for FY25 stand to the tune of Rs 650-750 crores, which would be majorly debt funded. The debt obligations for FY25 stand at Rs 900 crores and the company has prepaid Rs 200 crores worth of NCDs in Q1 FY25. The company has cash and liquid balances of Rs 500-600 crores as of FY24. The company’s net debt-to-EBITDA stood at 2.8x versus 2.9x QoQ.

D) Management Commentary: The following is the management commentary post its Q1 FY25 results:

-

With respect to the profitability in the CDMO business, the management intends to increase it over the medium term through increased capacity utilization and higher contribution from differentiated offerings and innovation-related work.

-

Recent changes in regulations, along with the needs of supply chain diversification are expected to provide medium- to long-term growth opportunities for the CDMO business.

-

In the CHG segment, the company is looking to build a pipeline of limited competition specialty products through investments in R&D and in-house product development capabilities.

-

For FY25, the management has guided for early teens increase in revenue and EBITDA with a meaningful improvement in PAT.

-

The management is seeing early signs of customer enquiries due to the effect of the US BioSecure Act, which aims to source low-cost generic medicines from companies maintaining high quality standards and also encourage R&D on new innovator drugs.

-

With regards to cashflows, the Indian Consumer Healthcare business funds itself, whereas investments in the CDMO and Complex Hospital Generics segment will be managed through internal accruals.

-

In the Complex Hospital Generics business, the company has 5 products approved and 17 are under various stages of approval.

E) Monitorable risks: Here are the key monitorable with respect to the company:

-

Although the company has a clear track record with respect to successfully clearing USFDA inspections, regulatory risk in this industry remains.

-

The company only hedges 45% of its net foreign currency exposures through forward contracts as a part of its hedging policy.

-

Raw material pricing remains a risk which was witnessed in FY22 and FY23 financials leading to moderation in operating margins.

-

The company’s revenues and EBITDA still remain skewed towards H2 of the year. In FY24, 55% of the revenue and 65% of the EBITDA for the full year was earned in H2 FY24.

-

In the CHG business, Sevoflurance constitutes 67% of the total segmental revenues. However, the company is working on reducing this dependence.

Piramal Pharma was discussed by Sajal Kapoor in the recent Twitter space.

Please watch from 24 minutes on the timeline.

Piramal Pharma would be one of the company to watch out for in this bio secure angle.

Sitting on large asset base, with multiple site locations across the world 3 years back it was a drawback on account of cost, now it has become a edge point.

Innovator business pie also increasing as per latest concall.

If biosecure act happens or not, but it’s just a mindset, but directional companies will be shifting from China to India.

How Indian CDMOs Like Piramal Pharma Stand to Benefit from the BIOSECURE Act

The pharmaceutical industry is on the brink of a major transformation as geopolitical shifts and new legislation reshape global supply chains.

The recent passage of the BIOSECURE Act in the United States has created ripples across the biopharma landscape, particularly for Indian pharmaceutical companies.

With US drug companies compelled to diversify their supplier base and reduce reliance on certain Chinese biotech firms within eight years, the stage is set for Indian CDMOs (Contract Development and Manufacturing Organizations) to emerge as key players in the global market.

Piramal Pharma Limited, a leader in the CDMO space, appears uniquely positioned to capitalize on this paradigm shift. As the company leverages its integrated global manufacturing network and focuses on high-value offerings like high-potency APIs, antibody-drug conjugates (ADC), and peptides, the tailwinds for its CDMO business are undeniable.

But how sustainable is this growth trajectory, and what does the future hold for its other business segments, including complex hospital generics and consumer healthcare?

Decoding Piramal Pharma’s Growth Drivers

1. CDMO Segment (54% of revenue):

- Growth fueled by robust order inflows, particularly for on-patent API development.

- Increased customer engagement and a surge in inquiries and site visits.

- Strategic focus on innovative, differentiated services and capacity expansion through targeted capex investments.

2. Consumer Healthcare Segment (13.5% of revenue):

- Significant growth driven by new product launches and expanding e-commerce channels.

- Strong double-digit growth (37% YoY in Q1FY25) highlights the potential of this segment.

3. Complex Hospital Generics (32% of revenue):

- Moderate growth amidst pricing pressures in the US market, with ongoing efforts to enhance margins through cost optimization.

Quarterly Performance Snapshot (Q2FY25)

Piramal Pharma showcased strong growth in its latest quarterly results. Net sales rose by 15.2% YoY to ₹2,241.75 crore, while operating profit margins improved to 15.24% from 13.90% a year ago, indicating better cost management and business mix.

We can also see common size % from the image above.

Interest costs slightly declined as a percentage of sales, supporting profitability. Profit Before Tax (PBT) surged to ₹102.86 crore (4.59% of sales), reflecting improved operational efficiency.

This performance highlights the company’s recovery momentum, driven by robust order inflows in the CDMO segment and growth in consumer healthcare. However, pricing pressures in complex hospital generics remain a challenge.

Moving forward, Piramal Pharma’s focus on high-margin offerings and cost optimization will be key to sustaining growth.

Macro Tailwinds for CDMO Growth

The global CDMO market is not just growing—it’s outpacing the broader pharmaceutical sector. With an estimated valuation of ₹18,800 crore in 2024, the market is projected to nearly double by 2029, achieving a CAGR of 14.67%.

Indian CDMOs enjoy a distinct advantage due to cost efficiencies and government support, such as the Production-Linked Incentive (PLI) scheme. This, coupled with rising demand from biopharma companies lacking manufacturing capabilities, underscores the sector’s long-term growth potential.

Questions for Further Discussion

- Can Indian CDMOs effectively address capacity and regulatory challenges to fully capitalize on the shifting supply chain dynamics?

- How might geopolitical factors, beyond the BIOSECURE Act, shape the global pharmaceutical supply chain in the next decade?

- With pricing pressures in the US market affecting the complex generics segment, how should Piramal Pharma balance its portfolio to sustain margins?

This evolving narrative invites us to explore the resilience and adaptability of Indian pharmaceutical players like Piramal Pharma. Will they seize the opportunity to redefine their role in the global pharma ecosystem?

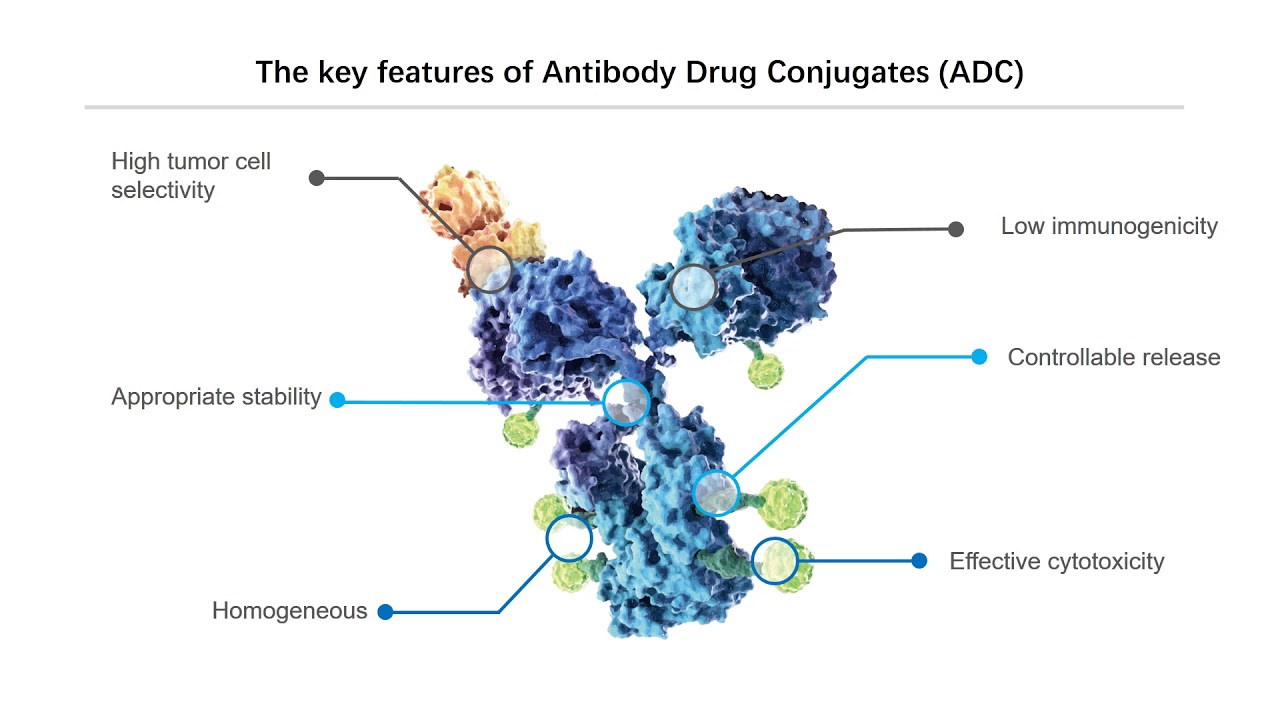

PPL Antibody-Drug Conjugate (ADC) overview.

PPL has a significant presence in ADC, in fact, they were one of the earlier players in the ADC market (working with ADC for the last 15 years as per the Q4-24 call). They were the first CDMO to manufacture commercial ADCs in 2011 and have been continuously doing so since then (Piramal Pharma Solutions). I think this is one of the jewels in PPL’s hand. However, it is yet to see full potential as they have expanded UK capabilities this year and are coming up with fill to finish facility in the US.

Here is a brief about ADC in general along with PPL capabilities.

Suven has just acquired 4 year old company and has given a good PPT about ADC. I think Suven is talking a lot about the ADC market hence it is good information about ADC.

What is ADC

Antibody-Drug Conjugates (ADCs) are highly targeted biopharmaceutical drugs that combine the specificity of monoclonal antibodies with the potent cell-killing ability of cytotoxic agents13. These innovative therapeutics have emerged as a promising class of treatments in the fight against cancer and potentially other diseases

More detail in the video.

Essentially ADC is a technology that identifies cancer-producing cells and attaches the Monoclonal antibodies to it (artificial protein having similar capabilities produced in the body’s antigen) using Linker. The linker attaches mAB to cancer cells and delivers a payload to the cells. This payload contains chemicals that eventually destroy the rouge cell and help cure cancer (or prevent the growth). During this process the normal body cells are not impacted hence ADC significantly reduced the side effects (like hair loss due to Chemotherapy) is gaining and has a lot of promise.

Market Size/Potential of ADC

ADC Segments and PPL’s capacities

PPL can offer fully integrated ADC development programs that include MAB, conjugation, linker payload, and fill/finish services.

PPL ADC capabilities have historically been focused on conjugation at their Grangemouth facility. However, within the last three years PPL invested in Yapan Biopharmaceuticals, which allows them to provide monoclonal antibody (MAB) development services. PPL can also provide fill/finish services for ADCs through their Lexington facility. The company also has linker payload capabilities at its Michigan facility.

PPL has expanded (investment of $45 millions)the conjugation capacity at their Grangemouth facility by 70%-80%. The facility expansion included two large commercially-oriented suites and a customer experience center.

PPL is making investments to expand their sterile fill-finish facility at Lexington with $80 million expansion). The sterile fill-finish facility expansion will more than double the facility’s capacity and is expected to be commercially available by the end of fiscal year 2027. Multiple customers are planning to commercialise their products following the expansion. The expansion is expected to help PPL meet the growing demand in the injectables market.

SO overall, PPL is expanding heavily into promising areas. PPL will be key player in ADC CDMO and likely to reap rich rewards from this segment.