Its been quite long that I have not posted any updates in my Portfolio

Its been a tough past 2 year to weather the storm - but somehow survived the market with having almost no returns.

The main mistake that I did

-

Believing the story : LAURUS LABS invested around 480 (prior bonus) made a good run uphill to 1300 but had not booked profits and management commentary of 1 billion dollars made me all ears - nothing to just make loss eventually burning the profit and capital too.

What’s the most interesting aspect it that - it was not just me, many retailers that I spoke off had no idea about the cost aspects of the company. The company had projected to the moon but the rocket fuel was leaking somewhere in the engine room.

*** Recency bias** : Believing in the story that’s coming ahead in next year or six quarters - made me blinded by two flaps on the side of the eye

PRAJ : Still holding on to stock for past 2 year with 40%

-

Am still not mature to understand the cycles of the sectoral returns, however each experience of seeing the unseen is everyone’s cup of learning something new : but I wanna do learn quickly

-

Recently I am following a approach of CORE Portfolio & SECTORAL turns Portfolio.

SECTORAL Portfolio : Identify sectoral triggers and ride on the leaders/winners.

CORE Portfolio : Long Term only when there clear triggers based on management commentary on concall or on numbers.

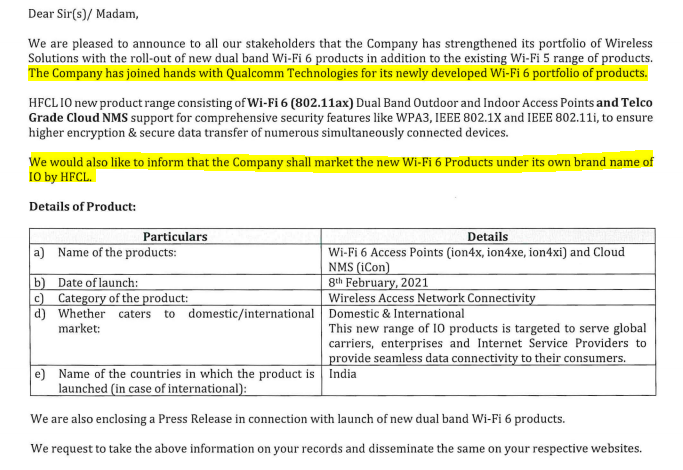

CORE :

| Instrument |

Price |

Current Price |

Returns |

Allocation |

| NEULANDLAB |

2100.01 |

3445.65 |

64% |

29% |

| SBCL |

146.02 |

697.15 |

377% |

15% |

| SYNGENE |

669.5 |

807.05 |

21% |

14% |

| PRAJIND |

296.41 |

415.9 |

40% |

9% |

| SYRMA |

346.72 |

473 |

36% |

7% |

| ORCHIDPHAR |

550.82 |

588.1 |

7% |

6% |

| NEWGEN |

499.57 |

825.75 |

65% |

6% |

| AXISCADES |

440.73 |

482 |

9% |

5% |

| HBLPOWER |

121 |

176.6 |

46% |

3% |

| KOPRAN |

121.33 |

187.75 |

55% |

3% |

| E2E-BE |

274 |

270.75 |

-1% |

2% |

NEULAND : Is into API | CMS | SPECIALITY API - recently the main trigger for me was the CMS business wherein they have 4 blockbuster molecule and one is live.

SBCL : Holding this gem for more than 2.5 years thanks to Ayush Mittal this fell onto my radar, the company makes shunts and its quite widely used in all electrical appliances, EV, Power Meter and much more - the company is expected to complete the capex by 24 and will continue to work over 2-3 shifts - with new capex coming live the company can clock in 1600 crores revenue at full capacity

SYNGENE : CRO | CRAMS and now a CDMO company with 360 degree science - recent trigger was Zoetis contract and new acquisition of Stelis bio plant - the company was expecting development in next 2-3 years however due to STELIS acquisition the time has turned short and recent development were Mangalore API plant US FDA approval, Bangalore Biotech plant US FDA. Next items - The stelis plant needs to go regulatory, client approvals, with talent hiring and then the commercial production of CDMO begins however the Mangalore API plant will be ready to supply small molecule and they will continue to source out more clients/contracts - the biggest hurdle is development and phase approval of molecule - neither less the company will make recurring revenue due to CRO/CRAMS

PRAJ : Next gen technology of (bio mobility) : sustainable fuels for aviation, bio diesel, cbg gas, (bio prism) - renewable chemicals, praj hi purity : biotech companies, semi conductor industries, brewers & beverages, with order book of 3000+ crores - next set of developments - setting up indian oil cbg stations in differnent locations for 5 stations - end to end implementation and further there are about 30 stations that government is planning to do - praj needs to bid, recent order win with indian oil for sustainable fuel, they have orders from USA as well for SAF.

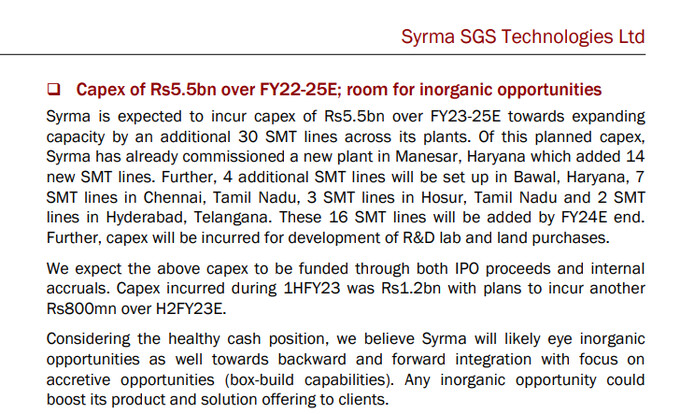

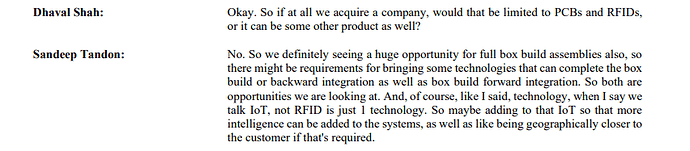

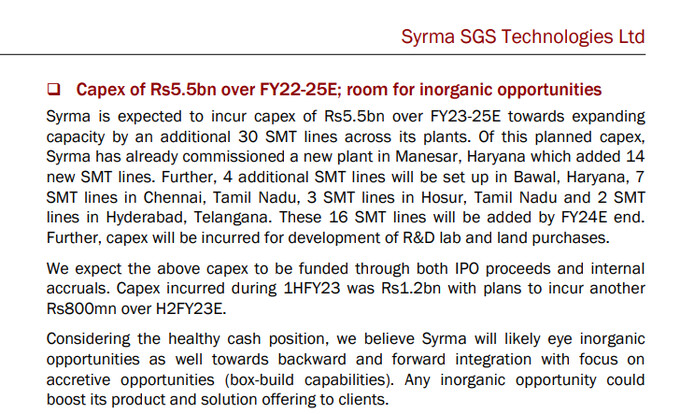

SYRMA. : EMS company they plan to forward integrate in BOX BUILD PRODUCT where as they already manufacturing PCBA which goes into it. BOX BUILD is low margin(just RM pass),they may not be interested(depending on application) Focus is on PCBA and HIGH MARGIN RFIDs.

They catered to 200+ customers, out of which 16 customers have been associated for 10+ years, contributing 262.8 cr. of FY22 revenues. Co’s clients include TVS Motor Co Ltd, A. O. Smith India Water Products Pvt. Ltd, Robert Bosch Engineering & Business Solution Pvt Ltd, Eureka Forbes Ltd Limited, CyanConnode Ltd, Atomberg Technologies Pvt Ltd, Hindustan Unilever Ltd, Total Power Europe B.V. Co’s products are sold in 25+ countries, including USA, Germany, Austria & the UK. In FY22, exports contributed 55% of the revenue.

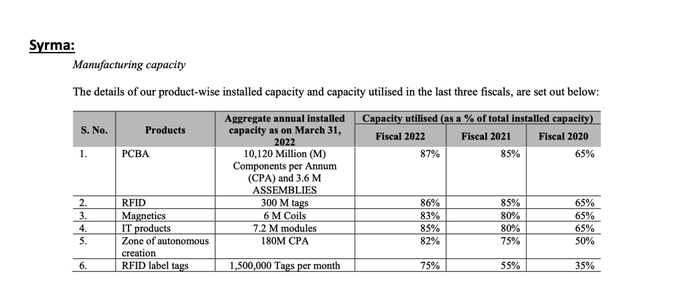

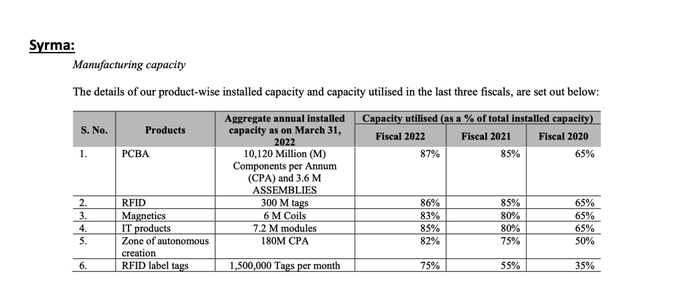

Syrma Capacity & utilisation% FY22 - Achieved 80-85% utilisation

Asset Turnover ratio: measures the efficiency with which a company uses its assets to produce sales

For the period ending FY22

Kaynes 4.79x

Syrma 4.43x

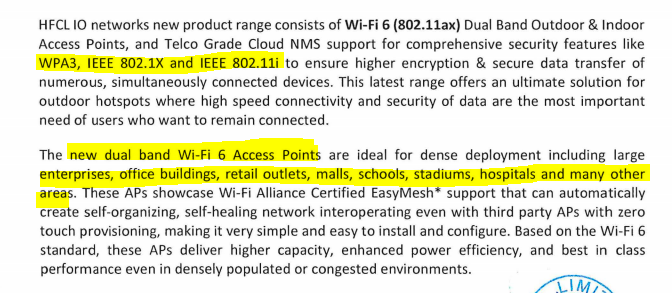

| Per Q3 FY23 Concall |

|

Kaynes |

Syrma |

| Order Book |

|

Rs. 2500 cr |

Rs. 2100 cr. |

| Net Working Capital Days |

|

135 Days |

83 Days |

| EBITDA margins |

|

14.7% |

10% |

| ODM % |

(IP/designing is developed in-house) |

5% |

11% |

| Box Build % |

Generally high margins but depends on type & segment |

24% |

15% |

| Exports % |

Exports are higher margin |

20% |

26% (34% earlier) |

| Top Verticals |

|

Automotive (39%) |

Industrial (44%) |

|

|

Industrial (26%) |

Consumer (24%) |

|

|

Railways (13.5%) |

Automotive (15%) |

| Capex |

|

Rs. 250 cr. |

Rs. 200-250 Cr. |

| PLI |

|

1. Telecom |

1. Telecom |

|

|

2. Air conditioning & |

2. Air conditioning & |

|

|

white goods |

white goods |

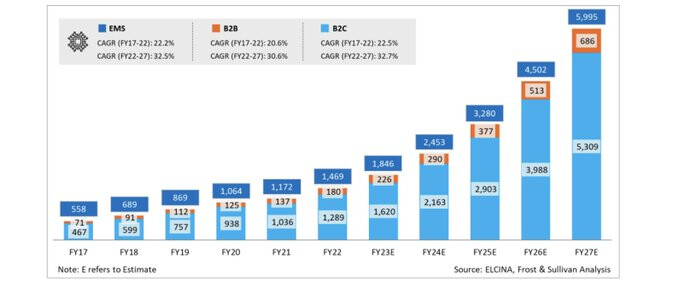

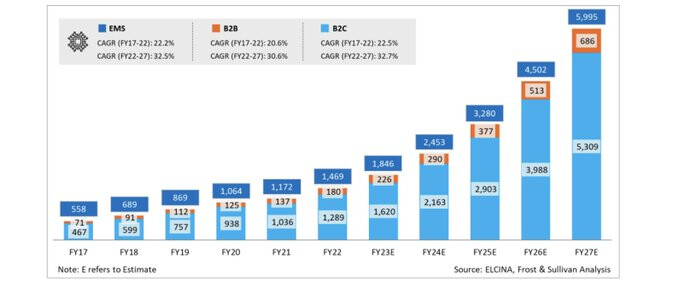

EMS market is set to grow at +30% CAGR for at least next 5 years from ₹1,469Bn to 6,000Bn by FY27.

ORCHIDPHAR : Leader in producing ANTIBIOTICS especially cephalosporins acquired in by Dhanuka Agritech - the promoters of Dhanuka agritech

The Co has a multi-therapeutic presence. Product portfolio constitute of API - Cephalosporins - Orals, Cephalosporins - Injectables, Veterinary Products & Non-Antibiotics

Clientele:

Clientele includes Sanofi, Sun Pharma, Pfizer, Mylan etc. Top 10 clients of Orchid contribute to 57% of the total revenues geographically.

Capex :

It has announced a capex of 50 crores for establishing a manufacturing facility of the Company at Alathur (Kerala).

Orchid Pharma signed a technology agreement with an international biotech company having expertise in fermentation technology to set up the 7-ACA plant, a step towards backward integration

The NCE product Enmetazobactum is expected to take away market share from Piperacilin Tazobactum, Ceftriaxone, and Carbapenems.

Enjoys much less competition in the US for injectables and Cephalosporins, and it is gaining traction.

Ceftazidime Avibactam : It’s a very complex product, number and is a lifesaving drug. When all of the bacteria have resistance, this only works. Orchid is in

a leadership position in Ceftazidime Avibactam. In the Indian market they have already launched and they are planning now to file for the ANDA in the US market also. hoping to be leader in the US as well.

Enmetazobactum : To be launched in EUROPE this year.

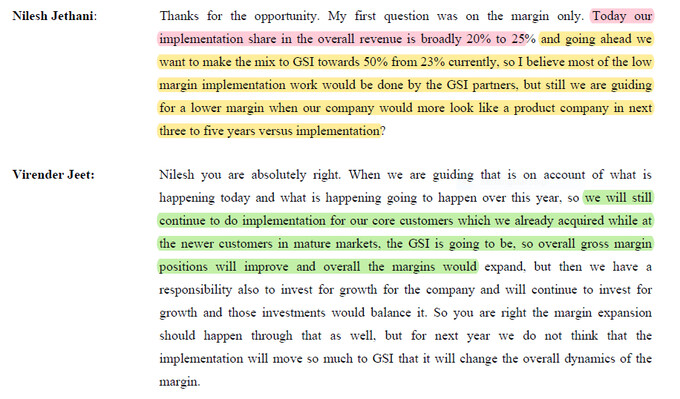

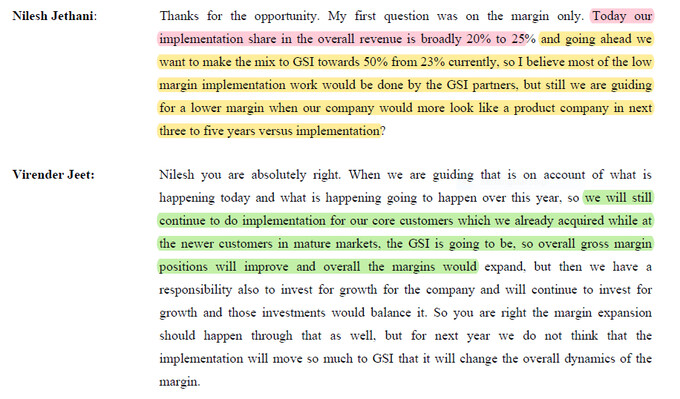

NEWGEN : Marked as a NICHE Player in the GARTNER MAGIC QUADRANT

• Newgen Software has a direct sales strategy for Tier 2 and Tier 3 banks and a GSI strategy for Tier 1 accounts and larger accounts in the US.

The company is looking to localize in UAE and Saudi and is not impacted by corporate tax as it is in a tax-free zone

Strong growth in emerging markets, with India and Middle East leading the way.

Aspires to reach $500 million in the next 5-7 years, with strategies including building a strong ecosystem with GSI and expanding into mature markets.

Newgen announced partnership with GSI’s to SAAS Revenues

GSI coming in the SAAS revenue should help in shooting up the margins

1.Implementation services will be done by GSI(Low Margin)

2.Product based SAAS Revenue will accrue to Newgen(High Margin)

AXISCADES : Recent acquisition of GERMAN automobile company (Add Solution GMBH) will help in entering into GERMANY will help them deliver their product solutions in GERMANY

DEFENSE : They will soon starting production of DRONES, ANTI DRONES for defense

HBL POWER Anti Collision systems, energy storage batteries etc - proxy to railways

KOPRAN : Antibiotics, Nitroxoline, Carbapenems

SECTORAL PORTFOLIO

INVESTED:

NATCO - Majorly for PARA IV opportunities

CIPLA - Recently clocked in good revenues especially from USA

INOX WIND - Sectoral trigger - couldn’t find any other best - than this because of merger

SW SOLAR - Sectoral solar wind power triggers

PRICOL - Should do well based on lot of management commentaries across auto - lastly it was CV vehicles who did well - from STERLING TOOLS management heard that 2 wheeler is coming with growth starting in this or next

SJS : Decent result + acquisition

PFC : Couple of twitter folks that i follow

GUFIC BIO : Gufic BioSciences Ltd - #72 by nithin_Shenoy

TRACKING:

DREAMFOLKS : June quarter is the best quarter for them

BRAND CONCEPTS : New royalty of united colors of Benetton + new stores opening + management guidance of 30% cagr with June result to be best - lets wait and watch

TEGA : Dyna Prime will be huge Opportunity in an OLIGOPOLISTIC Market

How big is Dynaprime Market ?.

MS : $900 Mn

Tega is gaining MARKET SHARE & Opened a NEW MARKET(Other than Rubber& PM Market)

CSB BANK : Nothing special has good set of ratios + gold returns but only limited for Kerala however banks as a whole doing well

RBL BANK : Same banks doing well

Recent Exit :

LAURUS LABS : Was Biased dont know if this exit is the right one at this juncture as the next quarter Chava has mentioned its bound to be good, which is true given the correct very low numbers - however giving the market time for correction, dont know if that happens too or not as am not good a technical - any suggestions welcome

@Worldlywiseinvestors, @vikas_sinha, @Akshada_Deo, @hitesh2710 : please do share your thoughts  open to constructive criticism

open to constructive criticism